India Green Packaging Market Size, Share, Trends and Forecast by Packaging Type, End Use Industry, and Region, 2025-2033

India Green Packaging Market Size and Share:

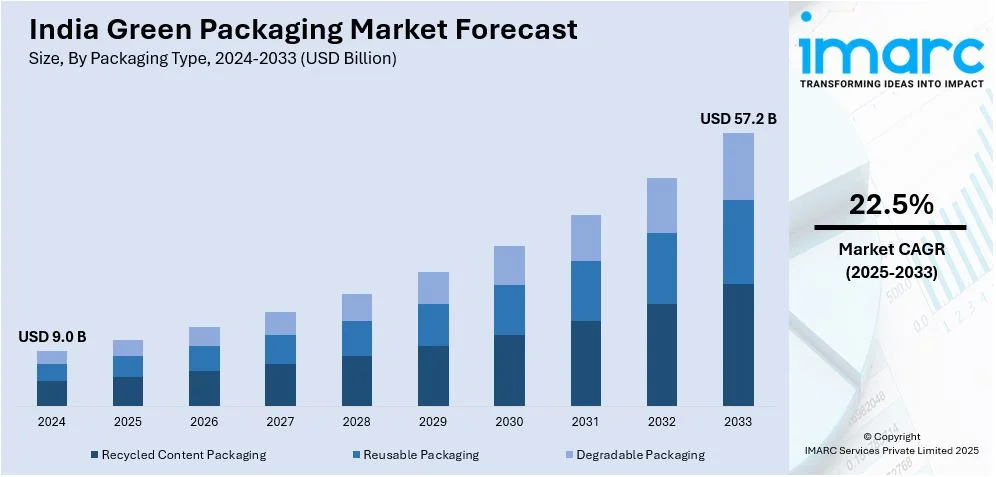

The India green packaging market size was valued at USD 9.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 57.2 Billion by 2033, exhibiting a CAGR of 22.5% from 2025-2033. The market share is expanding, driven by the growing implementation of government policies that encourage companies to adopt eco-friendly packaging solutions for better management of waste, along with the increasing consumption of beverages, which is creating the need for sustainable packaging, with brands adopting recyclable bottles, paper cartons, and biodegradable alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.0 Billion |

| Market Forecast in 2033 | USD 57.2 Billion |

| Market Growth Rate (2025-2033) | 22.5% |

The rising environmental awareness among the masses is impelling the market growth in India. People have become more conscious about environmental issues like plastic pollution and climate change. They favor sustainable packaging options crafted from biodegradable, recyclable, and compostable materials instead of harmful plastics. Besides this, social media platforms, educational campaigns, and government initiatives promote the usage of sustainable choices. As a result, individuals demand greener packaging, encouraging brands to employ environment friendly alternatives to stay competitive. Businesses that utilize green packaging gain customer trust and improve their brand image. Apart from this, people are willing to pay more for sustainable packaging, enabling firms to wager on better materials.

To get more information on this market, Request Sample

Technological advancements are offering a favorable India green packaging market outlook. New innovations make eco-friendly packaging more affordable, durable, and efficient. Companies employ biodegradable plastics and plant-based materials to replace traditional packaging. These items break down easily, reducing waste and pollution. Better recycling technology also helps. Besides this, advanced sorting and processing methods make it easier to recycle and reuse packaging materials, cutting down on landfill waste. Smart packaging solutions, such as water-based coatings and compostable films, are enhancing the quality and shelf life of packaged goods. As technology keeps improving, green packaging is becoming more practical for businesses.

India Green Packaging Market Trends:

Rise in the number of government initiatives

An increase in the number of government initiatives for sustainable packaging is fueling the market growth. In July 2024, the Council of Scientific and Industrial Research (CSIR), an Indian national research and development (R&D) organization, introduced the national mission on sustainable packaging solutions initiative. This project aims for a net-zero future by utilizing domestic, advanced, and integrated innovations derived from the joint expertise of eight collaborating CSIR laboratories and industry stakeholders. Government agencies are implementing stringent regulations to reduce plastic waste, including prohibitions on single-use plastics and promoting the use of biodegradable and recyclable materials. Regulations are holding businesses accountable for handling their packaging waste, allowing them to embrace sustainable options. Incentives and subsidies for eco-friendly materials also encourage companies to adopt more sustainable packaging options. This change also creates the need for packaging made from paper, bioplastics, and plant fibers. With various sectors, ranging from food to e-commerce, adopting eco-friendly practices, the demand for sustainable packaging in India continues to grow, establishing it as a significant trend in the packaging sector.

Increasing consumption of beverages

The increasing consumption of beverages is impelling the India green packaging market growth. With a high number of consumers purchasing packaged beverages, such as juices, soft drinks, and ready-to-drink tea and coffee, the demand for eco-friendly packaging grows. Individuals favor environment friendly choices instead of plastic bottles and non-recyclable packaging products. Major brands are also transitioning to eco-friendly options like biodegradable bottles, paper cartons, and recycled plastics to comply with government regulations and user expectations. In December 2024, Ball Corporation, a leading provider of eco-friendly aluminum packaging solutions, collaborated with Dabur India Limited to expand their real juice offerings by launching new real bites in fully recyclable aluminum cans throughout India. The product range addresses the demand for longer shelf life and green packaging options.

Growing implementation of eco-labeling schemes

The rising implementation of eco-labeling schemes in India is positively influencing the market. In October 2024, the Ministry of Environment, Forest and Climate Change, India introduced the 'Ecomark Regulations' under the 'Lifestyle for Environment initiative' to promote eco-friendly adoption and sustainable production through strict environmental standards. This initiative will be executed by the Central Pollution Control Board (CPCB) in alliance with the Bureau of Indian Standards (BIS). This effort aims to guarantee correct labeling and avoid deceptive information regarding products. These labels assist individuals in recognizing sustainable items, increasing the likelihood that they will opt for eco-friendly packaging. When people notice a reliable eco-label, they feel assured that the packaging is environment friendly. Companies also gain advantages from these programs. Businesses that use green packaging can receive certification, enhancing their brand reputation and appealing to environmentally aware people.

India Green Packaging Industry Segmentation:

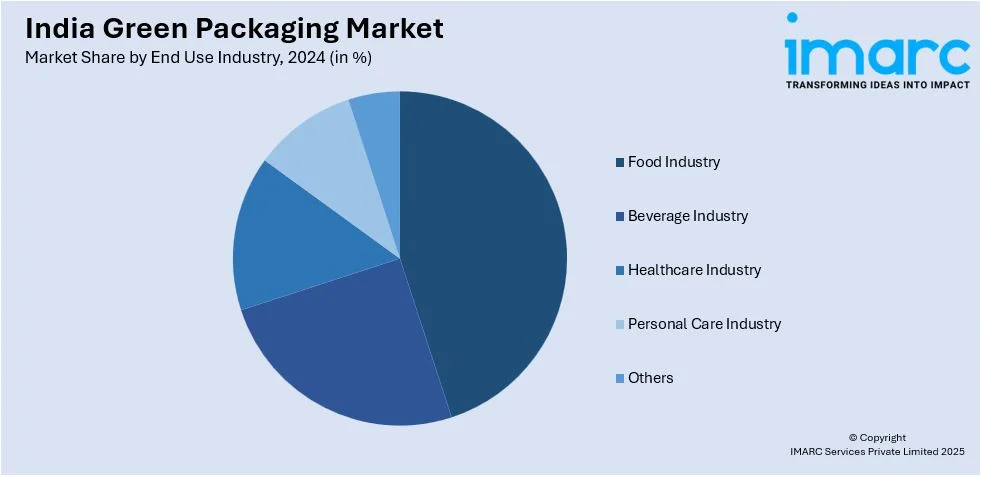

IMARC Group provides an analysis of the key trends in each segment of the India green packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on packaging type and end use industry.

Analysis by Packaging Type:

- Recycled Content Packaging

- Paper

- Plastic

- Metal

- Glass

- Others

- Reusable Packaging

- Drum

- Plastic Container

- Others

- Degradable Packaging

Recycled content packaging (paper) leads the market. It is readily accessible, economical, and simple to recycle. Numerous companies choose paper packaging over plastic because it is biodegradable and complies with government regulations aimed at minimizing plastic waste. As e-commerce, food delivery, and retail channels expand, businesses utilize recycled paper for their packaging, bags, and boxes to reduce their environmental footprint. Individuals tend to favor paper packaging, as it is safer for food products and more eco-friendly. The government's promotion of sustainability and prohibition of single-use plastics are increasing the popularity of paper-based alternatives. Moreover, brands invest in sturdy and visually appealing recycled paper packaging that is also eco-friendly. The recycling system is getting better, facilitating the reuse of paper products and fostering a circular economy. Since paper is lightweight and adaptable for different industries, it remains a top choice for green packaging in India.

Analysis by End Use Industry:

- Food Industry

- Beverage Industry

- Healthcare Industry

- Personal Care Industry

- Others

The food industry represents the largest segment in India. It drives a huge demand for packaging solutions and faces strict regulations on plastic use. With the rise of food product delivery services, restaurants, and packaged food brands, companies are looking for eco-friendly alternatives, such as biodegradable containers, paper-based wraps, and compostable cutlery. People are also becoming more health-conscious and prefer food packed in safe, non-toxic, and sustainable materials. The Government has banned certain plastic items and is promoting greener solutions, motivating food businesses to adopt green packaging. Besides this, big brands and startups spend resources on innovative materials that keep food fresh while lowering waste. Supermarkets and online grocery stores are also switching to recyclable and reusable packaging to attract eco-conscious buyers. As more companies focus on reducing their carbon footprint, the food industry is setting an example for other sectors.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and Central India enjoy the leading position in the market. They have strong industrial hubs, big consumer goods markets, and strict government policies on sustainability. Cities like Mumbai, Pune, Ahmedabad, and Indore are home to major manufacturing units, food processing companies, and e-commerce warehouses that need eco-friendly packaging. Many startups and established companies in these regions are wagering on sustainable packaging solutions, such as biodegradable materials and recycled paper. Government regulations in states like Maharashtra and Madhya Pradesh, including bans on single-use plastics, encourage firms to adopt green packaging. People in urban areas have also become aware about sustainability and prefer items with eco-responsible packaging. The presence of major ports and good transportation networks helps companies to source and distribute green packaging materials easily. With strong support from industries and awareness conferences, West and Central India continue to fuel the market growth. In May 2024, the Foundation for Innovative Packaging and Sustainability (FIPS) announced that the third edition of the Respack conference was set to take place on June 13 and 14, 2024, at the Lalit, Majestic Hall in Mumbai. The two-day event aimed to bring together the top figures of the packaging sector to partake in a vibrant discourse with other stakeholders to promote responsible packaging. Respack was the sole conference in the country that focused on all varieties of packaging materials, not limited to plastics, and also discussed associated technologies.

Competitive Landscape:

Key players work on developing sustainable solutions to meet the high India green packaging market demand. Major producers are developing environment friendly products, including paper-based substitutes and recyclable packaging. Government policies and regulations like prohibitions on single-use plastics and subsidies for eco-friendly packaging motivate companies to implement sustainable practices. In addition, consumer goods firms utilize recyclable and compostable packaging to appeal to environmentally aware customers. Startups and research organizations are likewise developing new materials and affordable solutions. Furthermore, retailers are encouraging eco-friendly packaging by providing reusable bags and minimizing plastic waste. With growing awareness, partnerships among these key players are aiding India in transitioning to sustainable packaging, reducing environmental impact. For instance, in August 2024, Khyber Agro Pvt Ltd, a leading firm in Kashmir's dairy sector, launched a new 1 kg curd product in sustainable bucket packaging. The innovative curd item, contained in a biodegradable "IML Bucket," marked a noteworthy advancement in sustainable packaging, supporting the ‘Eat Right India’ initiative's objectives of encouraging environment friendly practices.

The report provides a comprehensive analysis of the competitive landscape in the India green packaging market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Syntegon, a well-known supplier of processing and packaging products, introduced sustainable packaging items at Pack-Ex India. It developed a solution for sandwich cookies that featured an automated packaging line designed for speed, flexibility, and efficiency. The FGCT high-speed count feeder gathers cookies and places them into trays, reducing damage and waste while considering sustainability principles.

- October 2024: SIG’s Ahmedabad facility intended to commence sustainable packaging operations in the Western Indian city before the year's end. Samuel Sigrist, CEO of SIG Group revealed the company’s strategic goals for India and the firm’s dedication to advancing sustainable packaging. SIG aimed to allocate €100 Million for the production plant.

- September 2024: Pakka, a prominent producer of compostable packaging options, released a fresh line of flexible compostable packaging solutions. The selection featured enhanced barrier characteristics and heat/cold sealing ability. Flexible packaging is essential in India's consumer goods market, transforming item packaging, distribution, and usage across multiple sectors.

- May 2024: Huhtamaki India's Khopoli facility achieved the respected ‘International Sustainability and Carbon Certification (ISCC). This marked the inaugural ISCC Plus certification for any Huhtamaki India location, making it the fourth flexible packaging manufacturing facility in the country to achieve this milestone. The certification highlighted the firm’s dedication to sustainability, particularly concerning environmental preservation. It provided worldwide acknowledgment for contributing to the creation of an eco-friendly supply chain.

- August 2023: Amcor, a global leader in creating and manufacturing sustainable packaging solutions, revealed the purchase of Phoenix Flexibles, enhancing Amcor's capabilities in a scalable flexible packaging plant within the rapidly growing Indian Market. This agreement also incorporated machine-direction oriented film technology, facilitating local manufacturing of a wider variety of more sustainable packaging options.

- March 2023: Parason, a prominent manufacturer and supplier of pulp and paper machinery, teamed up with ABB in India to enhance and automate the production of eco-friendly and compostable packaging solutions. The partnership was formed to assist the firm’s clients in decreasing their dependence on single-use plastics and Styrofoam containers.

India Green Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered |

|

| End Use Industries Covered | Food Industry, Beverage Industry, Healthcare Industry, Personal Care Industry, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India green packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India green packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India green packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green packaging market in India was valued at USD 9.0 Billion in 2024.

With rising concerns about plastic pollution and waste management, businesses are adopting eco-friendly materials like biodegradable plastics, paper-based packaging, and reusable alternatives. Government policies, such as bans on single-use plastics and incentives for sustainable packaging, are encouraging companies to switch to greener options. Moreover, the expansion of e-commerce platforms and food product delivery services is creating the need for green packaging solutions.

The India green packaging market is projected to exhibit a CAGR of 22.5% during 2025-2033, reaching a value of USD 57.2 Billion by 2033.

Recycled content packaging (paper) accounted for the largest India green packaging type market share, due to its affordability, easy availability, and recyclability. Businesses prefer it as a sustainable alternative to plastic, driven by government regulations and user demand for eco-friendly packaging, especially in e-commerce, food delivery, and retail industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)