India Green Coffee Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, End User, and Region, 2025-2033

Market Overview:

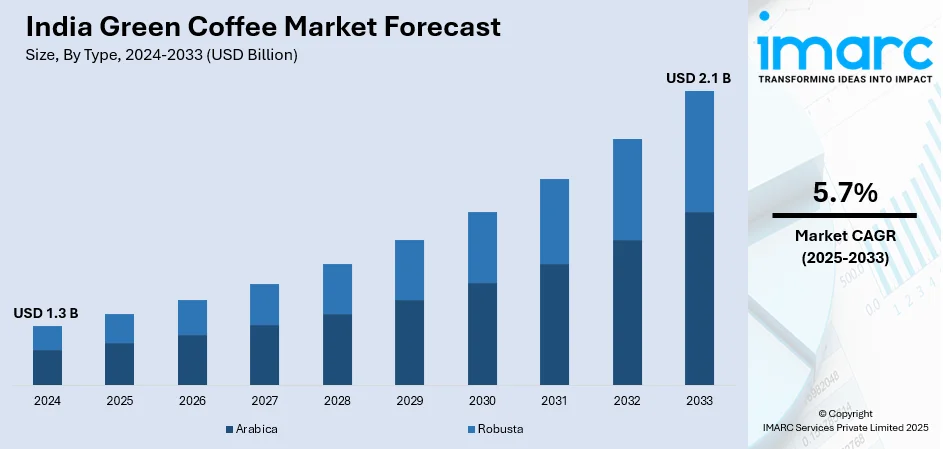

India green coffee market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. The increasing advances in agricultural practices, processing technologies, and logistics that can enhance the efficiency and quality of green coffee production, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Market Growth Rate (2025-2033) | 5.7% |

Green coffee refers to raw, unroasted coffee beans derived from the Coffea plant. Unlike the familiar brown coffee beans, green coffee retains its natural color and contains higher levels of chlorogenic acid a compound believed to have potential health benefits. Harvested from coffee plants, the beans are processed to remove the outer layers, revealing the green seeds inside. These raw beans have a grassy, herbal aroma and a more astringent taste compared to their roasted counterparts. Green coffee has gained popularity in recent years due to its association with potential weight loss benefits attributed to chlorogenic acid, believed to help regulate blood sugar levels and boost metabolism. Although the taste of green coffee is not as appealing as roasted coffee, its growing popularity is driven by health-conscious consumers seeking alternative wellness options. As an unroasted alternative, green coffee has found its place in the market, often consumed in the form of supplements or specialty beverages.

To get more information on this market, Request Sample

India Green Coffee Market Trends:

The green coffee market in India is experiencing significant growth, driven by several key factors. Firstly, an increasing awareness of the health benefits associated with green coffee consumption has spurred demand. Consumers are drawn to the rich presence of chlorogenic acid, known for its antioxidant properties and potential to support weight management. Additionally, the growing trend towards organic and natural products has propelled the market forward, as green coffee is perceived as a minimally processed, natural alternative. Moreover, the regional rise in coffee culture has not only heightened consumer interest but has also led to a surge in specialty and artisanal coffee consumption. This has created a niche for high-quality, sustainably sourced green coffee beans, emphasizing the importance of origin and ethical production practices. Furthermore, the impact of climate change on traditional coffee-growing regions has prompted a shift in cultivation practices, with more regions exploring the viability of green coffee production. In the context of economic factors, the escalating demand for green coffee has stimulated job creation and income generation in coffee-producing regions, fostering economic development. As consumer preferences evolve and health-conscious choices become more prevalent, the green coffee market in India is poised to thrive, supported by these interconnected drivers.

India Green Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, distribution channel, and end user.

Type Insights:

- Arabica

- Robusta

The report has provided a detailed breakup and analysis of the market based on the type. This includes arabica and robusta.

Product Insights:

- Roasted Coffee

- Instant/Soluble Coffee

- Green Coffee Bean Extract

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes roasted coffee, instant/soluble coffee, and green coffee bean extract.

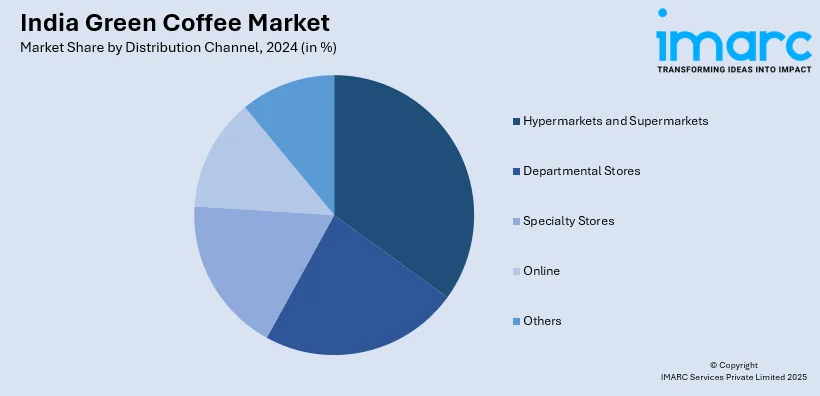

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Departmental Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, departmental stores, specialty stores, online, and others.

End User Insights:

- Retail

- Coffee Cafes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes retail, coffee cafes, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Green Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Arabica, Robusta |

| Products Covered | Roasted Coffee, Instant/Soluble Coffee, Green Coffee Bean Extract |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Departmental Stores, Specialty Stores, Online, Others |

| End Users Covered | Retail, Coffee Cafes, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India green coffee market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India green coffee market?

- What is the breakup of the India green coffee market on the basis of type?

- What is the breakup of the India green coffee market on the basis of product?

- What is the breakup of the India green coffee market on the basis of distribution channel?

- What is the breakup of the India green coffee market on the basis of end user?

- What are the various stages in the value chain of the India green coffee market?

- What are the key driving factors and challenges in the India green coffee?

- What is the structure of the India green coffee market and who are the key players?

- What is the degree of competition in the India green coffee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India green coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India green coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India green coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)