India Grain Analysis Market Size, Share, Trends and Forecast by Grain Type, Component, Technology, Target Tested, End Use, and Region, 2025-2033

India Grain Analysis Market Size and Share:

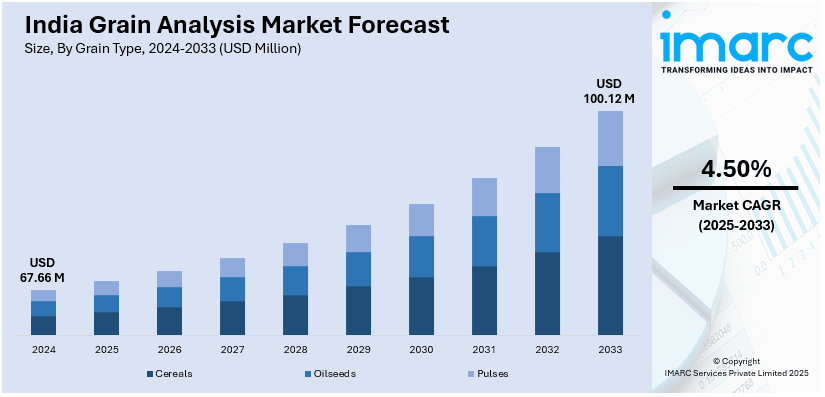

The India grain analysis market size reached USD 67.66 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 100.12 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The rising implementation of stringent food safety regulations, artificial intelligence (AI) adoption in grain analysis, and stricter export standards are driving the market growth. Moreover, advanced testing technologies, automation, and compliance requirements ensure higher quality, safety, and efficiency in India’s grain sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67.66 Million |

| Market Forecast in 2033 | USD 100.12 Million |

| Market Growth Rate (2025-2033) | 4.50% |

India Grain Analysis Market Trends:

Growing Adoption of Artificial Intelligence (AI) in Grain Quality Assessment

The increasing deployment of AI for grain quality analysis is having a positive impact on the India grain analysis market outlook. AI-based solutions are improving accuracy in detecting adulterants, moisture content, and nutritional values in grains. Computerized grain analysis eliminates human errors, providing consistent assessment of quality from batch to batch of grains. AI-based imaging and spectroscopy methods facilitate quick, non-destructive testing, enhancing efficiency of quality evaluation. Machine learning (ML) algorithms scan huge sets of data, detecting grain quality parameter patterns and anomalies. AI-powered grain sorting systems assist in removing impurities, improving the general quality of final processed food products. AI implementation is simplifying regulatory compliance by guaranteeing compliance with national and international food safety regulations. AI-based real-time monitoring assists in early mycotoxin, pesticide residue, and other contaminant detection. The combination of AI with internet of things (IoT) equipment allows remote monitoring, enhancing decision-making in grain storage operations. Predictive analytics powered by AI assist farmers and traders in foreseeing quality problems, reducing losses from spoilage. Acknowledging these advantages, the Food Corporation of India (FCI) in January 2024 announced the installation of 50 AI-powered automatic grain analyzers at its depots. These systems would decrease human discretion, increase efficiency, and make grain assessment more transparent. Automatic analysis of grain decreases dependency on laboratory testing, which decreases operation expenses for food processors and solidifies India's food security defenses.

To get more information on this market, Request Sample

Rising Food Safety Regulations

Laws pertaining to food safety are expanding the India grain analysis market share by guaranteeing stringent quality control. Strict guidelines for testing pollutants, residues, and adulterants are enforced by the Food Safety and Standards Authority of India (FSSAI). Grain farmers are being forced to use cutting-edge testing methods in order to comply with these standards and ensure accurate quality evaluation. The need for trustworthy grain analysis solutions in agricultural supply chains is rising as a result of routine inspections and certification requirements. Tighter export laws require premium grains, which incentivizes growers to spend money on testing facilities and sophisticated analytical equipment. For the protection of consumer health, food safety regulations place a strong emphasis on mycotoxin identification, pesticide residue analysis, and microbiological contamination testing. Under the Draft Food Safety and Standards (Contaminants, Toxins, and Residues) Amendment Regulations, 2024 , FSSAI has recommended revisions to improve regulatory compliance and guarantee acceptable levels of pesticide residues in food. In order to comply with international food safety standards, India has also revised its list of prohibited and restricted pesticides. To improve food safety regulations across the country, the government is also encouraging the construction of accredited testing facilities. Grain suppliers are being urged to give quality evaluation priority by regulatory agencies who are enforcing severe fines for non-compliance. India grain analysis market growth is further fueled by mandatory labeling requirements that demand comprehensive nutritional information. Grain analysis technology is developing as a result of these changing rules, increasing the accuracy and efficiency of quality evaluation.

India Grain Analysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on grain type, component, technology, target tested, and end use.

Grain Type Insights:

- Cereals

- Oilseeds

- Pulses

The report has provided a detailed breakup and analysis of the market based on the grain type. This includes cereals, oilseeds, and pulses.

Component Insights:

- Instruments

- Reagents and Consumables

- Reference Materials

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes instruments, reagents and consumables, and reference materials.

Technology Insights:

- Traditional Technology

- Rapid Technology

The report has provided a detailed breakup and analysis of the market based on the technology. This includes traditional technology and rapid technology.

Target Tested Insights:

- Pathogens

- Pesticides

- GMO

- Mycotoxins

- Others

A detailed breakup and analysis of the market based on the target tested have also been provided in the report. This includes pathogens, pesticides, GMO, mycotoxins, and others.

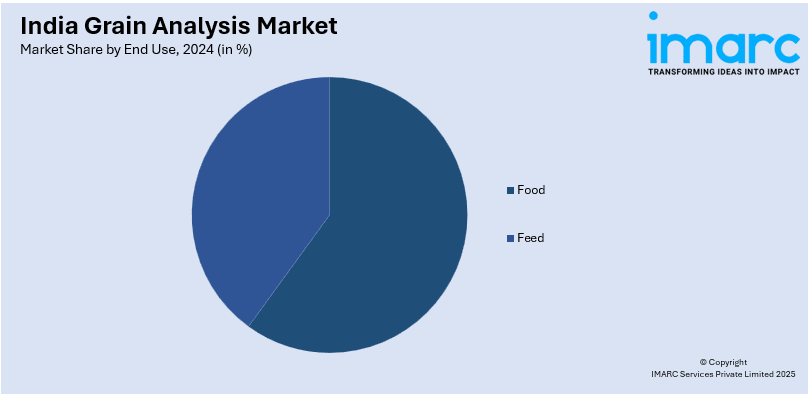

End Use Insights:

- Food

- Feed

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food and feed.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Grain Analysis Market News:

- In March 2024, Syngenta Vegetable Seeds launched India’s first and the world’s third Vegetable Seed Health Lab in Hyderabad. This state-of-the-art facility enhanced seed testing, quality assurance, and export capabilities, supporting the Make in India initiative. The lab strengthened India’s role in the global seed market, ensuring disease-free, high-quality vegetable seeds.

- In January 2024, Sohan Lal Commodity Management (SLCM) launched AI and ML-powered grain testing through Krishi Quality Janch Kendra and the Agri Reach app. With 31 centers already set up and plans for 600 nationwide, these innovations aimed to enhance accuracy, reduce turnaround time, and improve efficiency in India's grain analysis market.

India Grain Analysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grain Types Covered | Cereals, Oilseeds, Pulses |

| Components Covered | Instruments, Reagents and Consumables, Reference Materials |

| Technologies Covered | Traditional Technology, Rapid Technology |

| Target Tested Covered | Pathogens, Pesticides, GMO, Mycotoxins, Others |

| End Uses Covered | Food, Feed |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India grain analysis market performed so far and how will it perform in the coming years?

- What is the breakup of the India grain analysis market on the basis of grain type?

- What is the breakup of the India grain analysis market on the basis of component?

- What is the breakup of the India grain analysis market on the basis of technology?

- What is the breakup of the India grain analysis market on the basis of target tested?

- What is the breakup of the India grain analysis market on the basis of end use?

- What are the various stages in the value chain of the India grain analysis market?

- What are the key driving factors and challenges in the India grain analysis market?

- What is the structure of the India grain analysis market and who are the key players?

- What is the degree of competition in the India grain analysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India grain analysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India grain analysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India grain analysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)