India Glass Packaging Market Size, Share, Trends and Forecast by Type, End Use Vertical, and Region, 2025-2033

Market Overview:

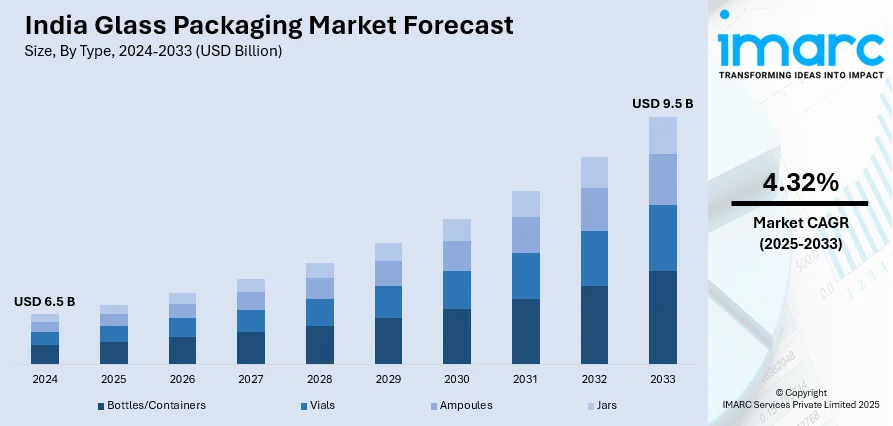

India glass packaging market size reached USD 6.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The expanding beverage industry, including alcoholic and non-alcoholic beverages, which relies heavily on glass packaging to protect the contents from external factors, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.5 Billion |

|

Market Forecast in 2033

|

USD 9.5 Billion |

| Market Growth Rate 2025-2033 | 4.32% |

Glass packaging refers to the use of glass containers for storing and transporting various products, ranging from beverages to food items. Glass is a versatile and eco-friendly material that offers several advantages. It is impermeable, ensuring the preservation of the product's quality by preventing any interaction with external elements. Glass is also recyclable, promoting sustainability and reducing environmental impact. The transparency of glass allows consumers to visually assess the contents, fostering trust and quality assurance. Moreover, glass is non-reactive, preserving the taste and purity of the stored items. Despite being heavier than some alternative materials, the durability and inert nature of glass make it an ideal choice for preserving the integrity of diverse products, contributing to a circular economy and minimizing waste.

To get more information on this market, Request Sample

India Glass Packaging Market Trends:

The glass packaging market in India is thriving due to various key drivers linking sustainability with consumer preferences. Firstly, the increasing regional awareness of environmental issues has propelled the demand for eco-friendly packaging solutions, positioning glass as a frontrunner. Moreover, consumers are increasingly gravitating towards products that offer a premium and high-quality image, and glass packaging aligns seamlessly with this trend, establishing itself as a symbol of sophistication and purity. Additionally, the health and safety aspects associated with glass packaging contribute significantly to its market growth. Glass is inert and non-reactive, ensuring the preservation of the product's integrity without any risk of chemical contamination. This feature resonates particularly well in the pharmaceutical and food industries, where maintaining product purity is paramount. Furthermore, the regulatory landscape advocating for sustainable practices and reduced carbon footprints has spurred industries to opt for recyclable materials, further boosting the glass packaging market. As regional initiatives intensify to reduce single-use plastics, glass emerges as a sustainable alternative, gaining favor in diverse sectors. In conclusion, the confluence of environmental consciousness, consumer preferences, health considerations, and regulatory mandates act as cohesive drivers propelling the glass packaging market forward in India.

India Glass Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use vertical.

Type Insights:

- Bottles/Containers

- Vials

- Ampoules

- Jars

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottles/containers, vials, ampoules, and jars.

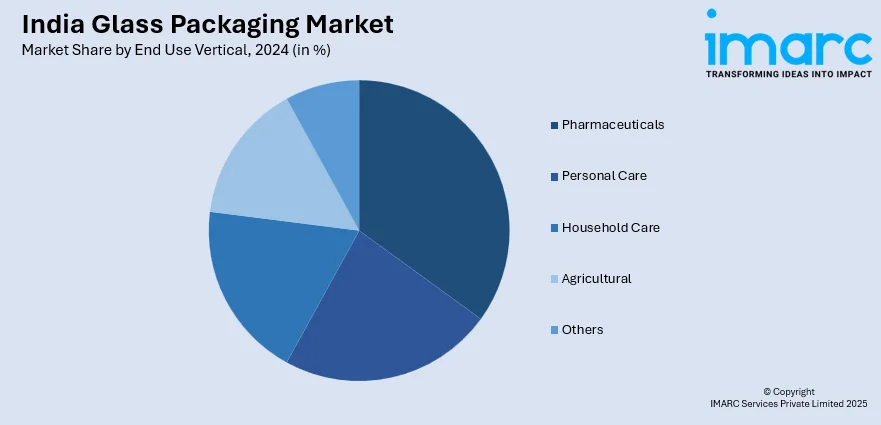

End Use Vertical Insights:

- Pharmaceuticals

- Personal Care

- Household Care

- Agricultural

- Others

A detailed breakup and analysis of the market based on the end use vertical have also been provided in the report. This includes pharmaceuticals, personal care, household care, agricultural, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Glass Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottles/Containers, Vials, Ampoules, Jars |

| End Use Verticals Covered | Pharmaceuticals, Personal Care, Household Care, Agricultural, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India glass packaging market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India glass packaging market?

- What is the breakup of the India glass packaging market on the basis of type?

- What is the breakup of the India glass packaging market on the basis of end use vertical?

- What are the various stages in the value chain of the India glass packaging market?

- What are the key driving factors and challenges in the India glass packaging?

- What is the structure of the India glass packaging market and who are the key players?

- What is the degree of competition in the India glass packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India glass packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India glass packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India glass packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)