India Generic Injectables Market Size, Share, Trends and Forecast by Therapeutic Area, Container, Distribution Channel, and Region, 2025-2033

Market Overview:

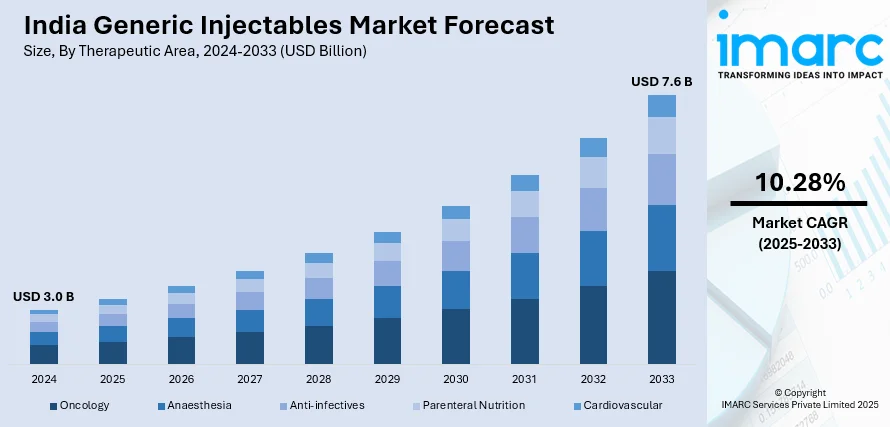

The India generic injectables market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.28% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.0 Billion |

|

Market Forecast in 2033

|

USD 7.6 Billion |

| Market Growth Rate 2025-2033 | 10.28% |

Generic injectables refer to alternative drugs that are bio-equivalent of their branded counterparts in terms of active ingredients, strength, quality, effectiveness, intended use, and dosage. They are used to treat various life-threatening and chronic diseases, such as cancer, diabetes, rheumatoid arthritis, cardiovascular ailments, and respiratory infections. As compared to innovator drugs, generic injectables offer maximized patient compliance, reduced frequency of drug delivery, limited price erosion, and higher profitability for manufacturers.

To get more information on this market, Request Sample

The increasing prevalence of chronic diseases in India, due to the rising pollution levels and unhealthy lifestyle of the population are the major factors driving the generic injectables market growth. This, in turn, has led to a rise in the expenditure on innovation in generic injectables for effective drug administration and faster recovery of patients. Additionally, an expansion in the life science industry and rapid technological advancements in drug delivery systems, such as the development of self-injection devices, are contributing to the market growth. Moreover, rising economic development in India has resulted in improved healthcare facilities, which is acting as another growth-inducing factor. Apart from this, the increasing shortage of branded medicines and expiry of patents of branded items, are further creating a positive outlook for the market in the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India generic injectables market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on therapeutic area, container and distribution channel.

Breakup by Therapeutic Area:

- Oncology

- Anaesthesia

- Anti-infectives

- Parenteral Nutrition

- Cardiovascular

Breakup by Container:

- Vials

- Ampoules

- Premix

- Prefilled Syringes

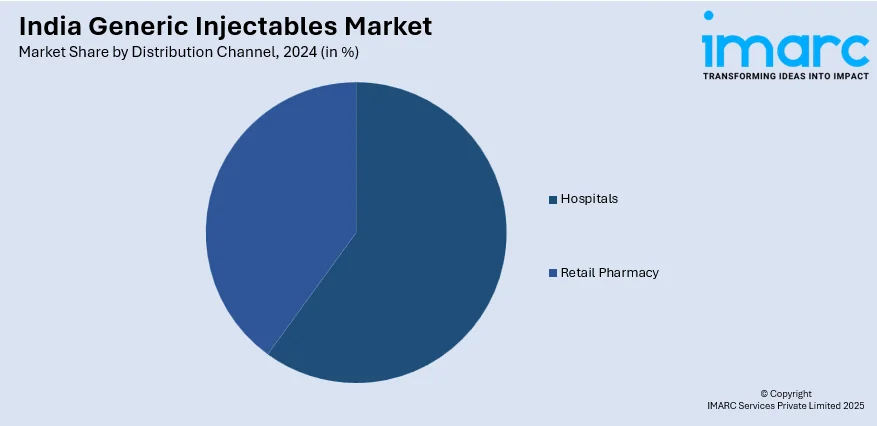

Breakup by Distribution Channel:

- Hospitals

- Retail Pharmacy

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Therapeutic Area, Container, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India generic injectables market was valued at USD 3.0 Billion in 2024.

We expect the India generic injectables market to exhibit a CAGR of 10.28% during 2025-2033.

The rising prevalence of various chronic diseases, such as cancer, diabetes, osteoporosis, rheumatoid arthritis, etc., along with the increasing adoption of generic injectables as they are cost-effective and offer enhanced patient outcomes, is primarily driving the India generic injectables market.

The sudden outbreak of the COVID-19 pandemic has led to the growing demand for generic injectables owing to the introduction of self-injection devices to reduce the risk of the coronavirus infection upon hospital visits or interaction with healthcare professionals.

Based on the therapeutic area, the India generic injectables market can be divided into oncology, anesthesia, anti-infectives, parenteral nutrition, and cardiovascular. Among these, oncology currently holds the majority of the total market share.

Based on the container, the India generic injectables market has been segmented into vials, ampoules, premix, and prefilled syringes, where vials currently exhibit a clear dominance in the market.

Based on the distribution channel, the India generic injectables market can be segregated into hospitals and retail pharmacy. Currently, hospitals account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India generic injectables market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)