India Generator Market Size, Share, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2025-2033

India Generator Market Overview:

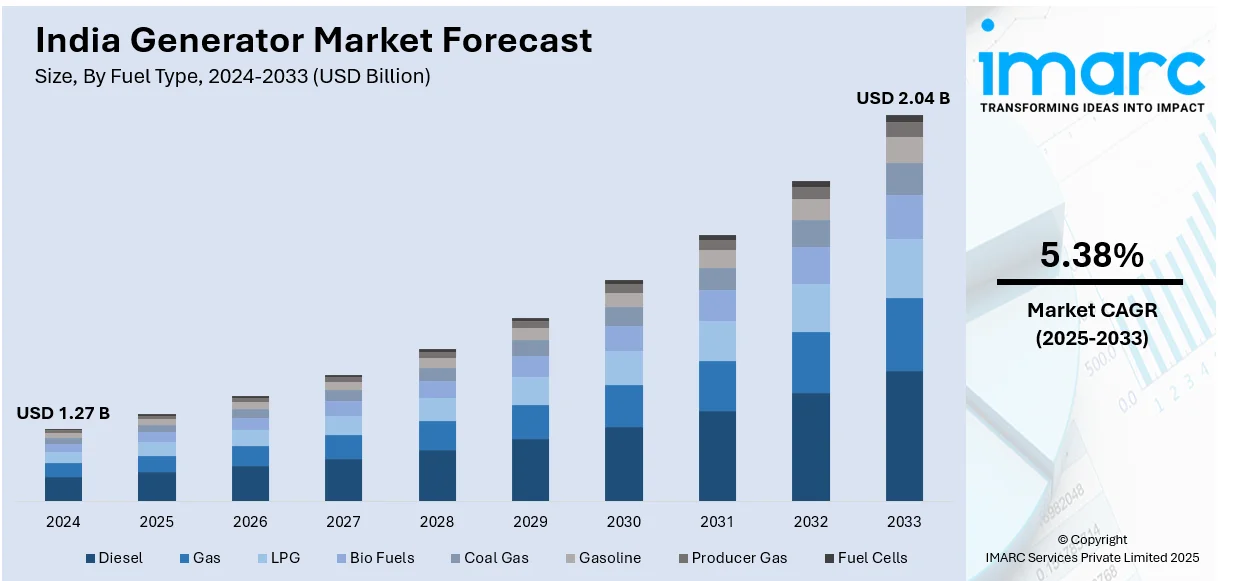

The India generator market size reached USD 1.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.04 Billion by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033. The market is growing amid increasing demand for green, quiet, and hybrid power solutions. Due to growing urbanization, more stringent environmental laws, and awareness towards sustainability, businesses and customers are moving towards cleaner and more efficient energy solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.27 Billion |

| Market Forecast in 2033 | USD 2.04 Billion |

| Market Growth Rate (2025-2033) | 5.38% |

India Generator Market Trends:

Growing Demand for Eco-Friendly Generators

As India emphasizes sustainability more and more, demand for green generators is growing. Growing awareness about the environment and regulations to reduce emissions are fueling the growth. Green generators usually operate on alternative energy sources such as natural gas, LPG, and biofuels, emitting lesser harmful gases than conventional diesel-powered generators. The move towards clean energy alternatives is also driven by government initiatives offering incentives to consume renewable energy. These options not only reduce emissions but also support the nation's energy objectives in the long run. Moreover, with boosting numbers of urban cities focusing on clean energy, residential users as well as companies are looking for greener options for backup power requirements. The heightened emphasis on lowering carbon footprint and reducing environmental side effects is driving demand for more sustainable and power-efficient solutions. This trend is likely to persist with eco-aware consumers seeking cleaner technologies in every industry, from domestic houses to industry. For example, in December 2024, Greenzo Energy collaborates with EODev to bring Toyota-powered hydrogen fuel cell generators to India and Nepal. This tie-up seeks to displace diesel generators, promoting sustainability and local assembly, and adding to the green technology ecosystem of India.

To get more information on this market, Request Sample

Increasing Adoption of Silent Generators

In urban India, the growing use of silent generators is emerging as a major trend, fueled by the requirement to minimize noise pollution. Conventional generators are recognized for their high decibel usage, which may disturb communities, particularly in residential and commercial neighborhoods. Silent generators are made using cutting-edge technology to reduce noise, providing quieter usage without diminishing performance. This makes them perfect for being used in places like hospitals, schools, and homes, where noise has to be regulated. The demand has increased as concerns about the detrimental effects of noise pollution on human health have spread. Many Indian cities also enforce stricter regulations over noise pollution, further promoting quieter alternatives. Quiet generators are also becoming more affordable, with better fuel economy and noise suppressors. This transition to quiet power sources will continue as urbanization progresses and the demand for noiseless environments grows

Rise of Hybrid and Solar-Powered Generators

Hybrid and solar-powered generators are one trend that India is adopting with a shift toward cleaner energy sources. These are essentially generators that run on traditional fuels blended with green energy like solar power, resulting in a constant and clean power supply. Moreover, solar-powered generators especially find use where sunlight is ample, and these are cost-friendly and green as well. Hybrid generators, using diesel or gas along with solar power, give the advantage of utilizing both conventional fuels and green energy. It is fueled by India's desire for cleaner technology and increasing accessibility of solar infrastructure. Hybrid generators are best suited for off-grid areas, rural regions, building sites, and distant industries, where power supply is not assured. They have the added advantage of curbing fossil fuel dependence and offering constant power supply. With advancing solar and hybrid technologies, their usage is bound to amplify by leaps and bounds, leading towards a greener energy future for India.

India Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on fuel type, power rating, sales channel, design, application, and end user.

Fuel Type Insights:

- Diesel

- Gas

- LPG

- Bio Fuels

- Coal Gas

- Gasoline

- Producer Gas

- Fuel Cells

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, gas, LPG, bio fuels, coal gas, gasoline, producer gas, and fuel cells.

Power Rating Insights:

- Up To 50 Kw

- 51–280 Kw

- 281–500 Kw

- 501–2,000 Kw

- 2,001–3,500 Kw

- Above 3,500 Kw

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes up to 50 kw, 51–280 kw, 281–500 kw, 501–2,000 kw, 2,001–3,500 kw, and above 3,500 kw.

Sales Channel Insights:

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct, and indirect.

Design Insights:

- Stationary

- Portable

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes stationary, and portable.

Application Insights:

.webp)

- Standby

- Prime and Continuous

- Peak Shaving

The report has provided a detailed breakup and analysis of the market based on the application. This includes standby, prime and continuous, and peak shaving.

End User Insights:

- Utilities/Power Generation

- Oil and Gas

- Chemicals And Petrochemicals

- Mining and Metals

- Manufacturing

- Marine

- Construction

- Others

- Residential

- Commercial

- Healthcare

- It and Telecommunications

- Data Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities/power generation, (oil and gas, chemicals and petrochemicals, mining and metals, manufacturing, marine, construction, others), residential, commercial, (healthcare, it and telecommunications, data centers, others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Generator Market News:

- In October 2024, Power Engineering India Pvt Ltd launched its Glass Reinforced Polymer (GRP) Diesel Generators, with the latest technology for increased durability, corrosion protection, and environmental friendliness. The product has been designed to exceed industry standards for strength, UV stability, and serviceability.

- In April 2024, Pune Gas introduced India's first LPG-fueled backup generator, targeting the hospitality industry. The green solution overcomes space and maintenance issues and minimizes carbon footprints, providing a reliable, efficient backup to diesel generators. The innovation is perfectly compatible with the LPGenius Smart system, maximizing LPG consumption.

India Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gas, LPG, Bio Fuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells |

| Power Ratings Covered | Up To 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, Above 3,500 Kw |

| Sales Channels Covered | Direct, Indirect |

| Designs Covered | Stationary, Portable |

| Applications Covered | Standby, Prime and Continuous, Peak Shaving |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generator market in India was valued at USD 1.27 Billion in 2024.

The India generator market is projected to exhibit a CAGR of 5.38% during 2025-2033, reaching a value of USD 2.04 Billion by 2033.

The market is driven by the need for reliable backup power, particularly in areas with unstable supply. Expanding commercial operations, construction activity, and rural electrification gaps contribute to growing demand. Users across sectors are adopting generators to ensure operational continuity, while awareness of product efficiency and maintenance ease supports sustained equipment adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)