India Gems and Jewelry Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Gems and Jewelry Market Overview:

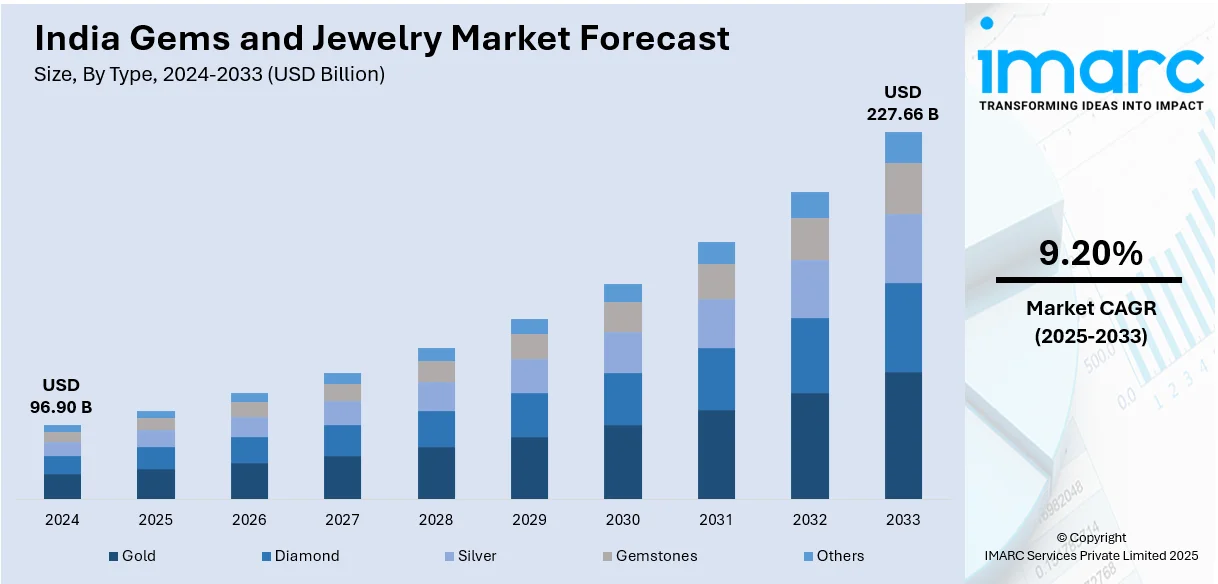

The India gems and jewelry market size reached USD 96.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 227.66 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is driven by rising disposable incomes, increasing consumer preference for gold and diamond investments, and growing demand for customized and heritage designs. Digitalization, e-commerce expansion, and lab-grown diamonds are reshaping purchasing trends, while government initiatives and export opportunities further fuel the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 96.90 Billion |

| Market Forecast in 2033 | USD 227.66 Billion |

| Market Growth Rate 2025-2033 | 9.20% |

India Gems and Jewelry Market Trends:

Rising Demand for Lab-Grown Diamonds

The India gems and jewelry market is witnessing a growing shift toward lab-grown diamonds, driven by affordability and ethical sourcing. These diamonds, identical to mined ones in physical and chemical properties, offer a sustainable alternative appealing to eco-conscious consumers. Strict regulations on natural diamond sourcing and advancements in technology have enhanced quality and scalability, making lab-grown diamonds more accessible. Leading jewelry brands are expanding their collections with lab-grown options to attract younger buyers seeking premium yet cost-effective jewelry. Supporting this trend, the government in India allocated a five-year research grant in the Union Budget 2023 to an IIT for advancing indigenous production of lab-grown diamond machinery, seeds, and recipes. Additionally, government incentives for manufacturing are strengthening India’s position as a global hub for sustainable diamond production.

To get more information on this market, Request Sample

Digitalization and E-Commerce Growth

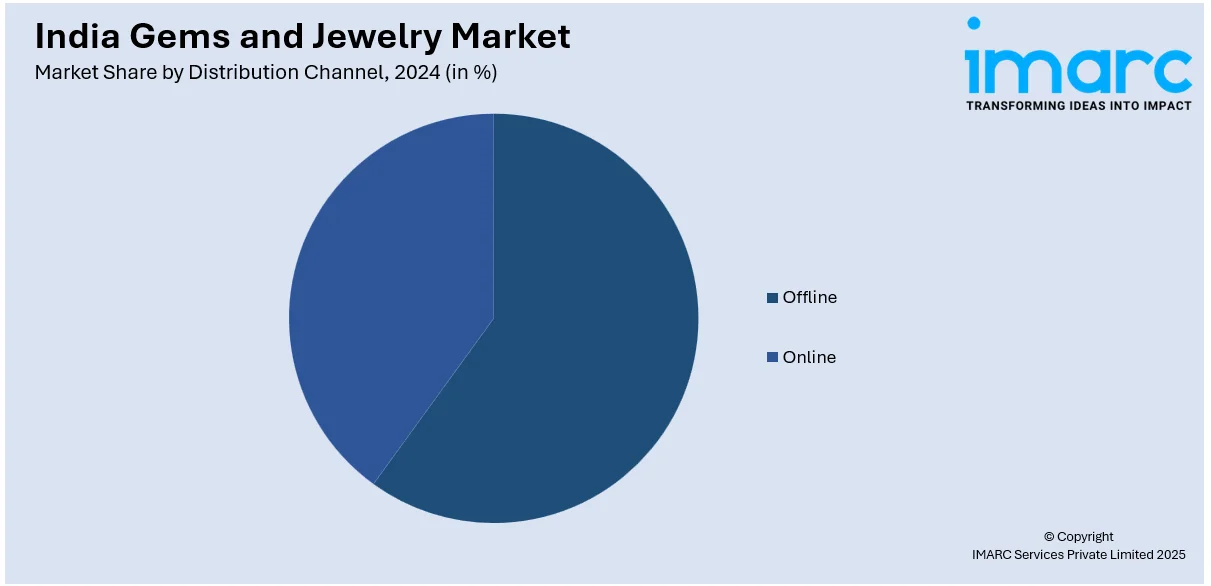

The India gems and jewelry industry is quickly adopting digital platforms to reach more consumers and increase engagement. Online marketplaces, social media advertising, and virtual try-on technology are transforming the way people shop for jewelry, with companies using AI-powered suggestions, secure payment options, and engaging experiences. Web sales are booming, especially among consumers between 18 and 45 years, who account for 70-80% of digital purchases. The COVID-19 pandemic hastened the shift, furthering the popularity of online shopping for jewelry. The ticket size for buying gold jewelry online averages between INR 25,000 and INR 30,000, with the products usually purchased for everyday use or special festivals. Omnichannel strategies, which meld physical stores and digital channels, are helping brands establish stronger connections with customers. Millennials and Gen Z are leading this revolution, choosing personalized and hassle-free jewelry shopping experiences on the web.

Growing Popularity of Heritage and Customized Jewelry

Consumers in India are shifting towards heritage-inspired and customized jewelry, which is a blend of tradition and customization. The demand for intricate craftsmanship, temple jewelry, and vintage pieces with cultural significance is on the rise. Additionally, there is growing interest in customization services, including personalized engravings, modular jewelry, and bespoke bridal collections. The trend is fueled by an increasing appreciation for regional craftsmanship and a need for unique jewelry that reflects individual style. Jewelers are combining regional themes and hand-crafting methods to meet niche consumer demand. The trend towards bespoke jewelry also indicates increasing disposable income and shifting consumer aspirations, including propelling design creativity and material choice.

India Gems and Jewelry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Gold

- Diamond

- Silver

- Gemstones

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes gold, diamond, silver, gemstones, and others.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline, and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gems and Jewelry Market News:

- In August 2024, Uday Jewellery Industries Limited agreed to acquire Narbada Gems and Jewellery Limited for INR 1.6 billion on August 31, 2024. Under the deal, Uday Jewellery will issue 4,623 equity shares for every 10,000 shares of Narbada Gems. The merger is subject to approvals from BSE, SEBI, NCLT, shareholders, and creditors. A fairness opinion from Corporate Professionals Capital Pvt. Ltd. has validated the share exchange ratio.

- In February 2024, The India Jewellery Park Mumbai (IJPM) project took a major step forward on February 22, 2024, as MIDC handed over a 43,026.50 sq. m. plot. The project, backed by GJEPC, aims to establish a world-class gems and jewellery hub, attracting 50,000 crores in investment and creating 100,000 jobs. With construction set to begin soon, IJPM is poised for significant industry impact.

India Gems and Jewelry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gold, Diamond, Silver, Gemstones, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gems and jewelry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gems and jewelry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gems and jewelry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gems and jewelry market in India was valued at USD 96.90 Billion in 2024.

The gems and jewelry market in India is projected to reach USD 227.66 Billion by 2033, exhibiting a CAGR of 9.20% during 2025-2033.

The India gems and jewelry market is driven by rising disposable incomes, a strong cultural preference for gold and diamond assets, and growing interest in custom-made and heritage designs. The market is also benefiting from rapid digital adoption, the rise of lab-grown diamonds, and a shift toward e-commerce and omnichannel retail. Government support, export incentives, and increased demand during weddings and festivals continue to sustain high consumer engagement and industry growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)