India Gear Oil Market Size, Share, Trends and Forecast by Product Type, End-User Industry, and Region, 2025-2033

India Gear Oil Market Overview:

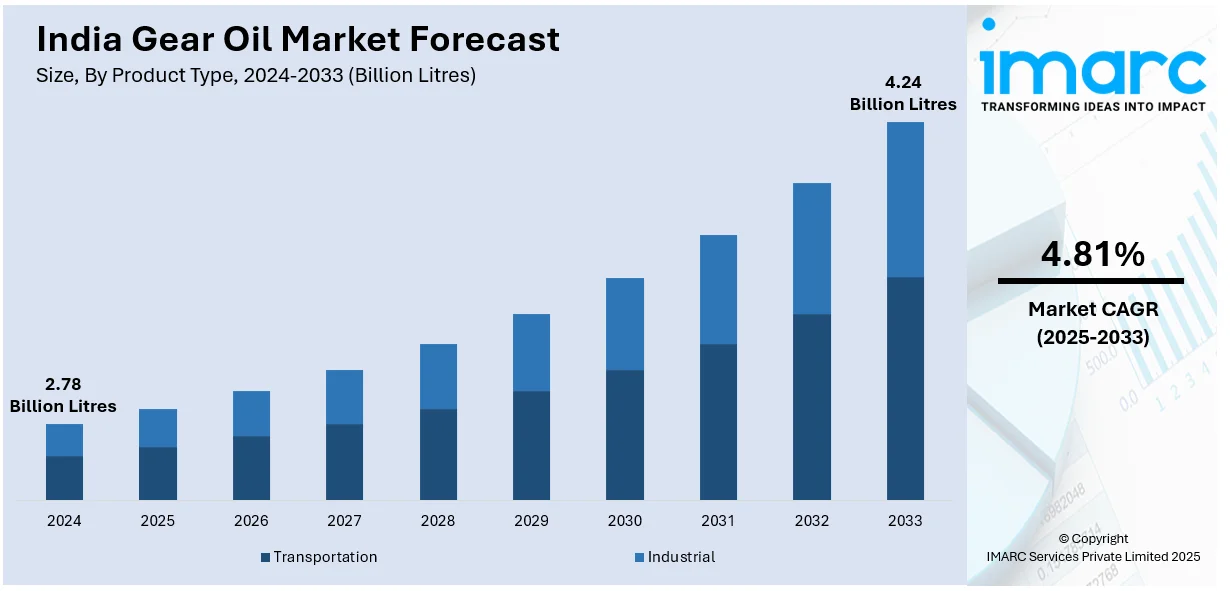

The India gear oil market size reached 2.78 Billion Litres in 2024. Looking forward, IMARC Group expects the market to reach 4.24 Billion Litres by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The market is growing due to expanding automotive and industrial sectors, rising infrastructure development, ongoing technological advancements, stricter emission regulations, and increasing demand for high-performance, synthetic, and eco-friendly lubricants.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.78 Billion Litres |

| Market Forecast in 2033 | 4.24 Billion Litres |

| Market Growth Rate (2025-2033) | 4.81% |

India Gear Oil Market Trends:

Growing Adoption of Synthetic and High-Performance Gear Oils

The growing adoption of synthetic and high-performance gear oils is boosting the India gear oil market share. This demand is primarily driven by the rising industry needs for lubricants, which deliver enhanced thermal stability alongside better oxidation resistance and longer drain intervals. For instance, in December 2024, Russia's Rosneft agreed to supply nearly 500,000 barrels per day of crude oil to India's Reliance Industries under a 10-year agreement. This deal ensures a steady supply of raw materials for manufacturing synthetic lubricants, bolstering the gear oil market. Synthetic lubricants represent an ideal selection for gear oils used in automotive and manufacturing and construction sectors because they show resistance to extreme temperatures and heavy operational loads. Additionally, manufacturers now face environmental sustainability requirements and emission standards which drive them to create biodegradable and eco-friendly gear oils. Moreover, fuel efficiency improves as the synthetic gear oils minimize friction and wear, thus generating savings from maintenance costs and reduced downtime. Furthermore, major businesses support research activities to introduce innovative oil formulations with enhanced additive technologies into the market. As a result, the market for premium long-lasting gear oils is experiencing substantial growth since consumers and industries are becoming more aware of their requirements.

To get more information on this market, Request Sample

Expansion of the Automotive and Industrial Sectors

The expanding automotive and industrial sectors function as fundamental market drivers fostering the India gear oil market growth. In line with this, transmission and differential fluid demand keeps rising because of the expanding automobile manufacturing and an expanding fleet of vehicles. Moreover, the government’s focus on building infrastructure such as roads, railways, and smart cities fuels the increased requirement for specialized gear oils because of expanding heavy-duty construction and mining equipment deployment. For example, in October 2024, the Indian government approved a 101 billion rupee ($1.2 billion) program to double edible oil production within seven years. This initiative aims to reduce dependence on imports and increase the availability of raw materials for producing biodegradable lubricants. Besides this, the industrial sector comprises manufacturing and power generation, together with metallurgy operations, which depend on effective gear systems for smooth operations to increase lubricant consumption. Concurrently, electric vehicles (EVs) need specialized lubricants for their transmissions as they are widely being adopted by many consumers. Apart from this, supportive industrial policies and ongoing technological developments, alongside foreign investment, serve multiple applications throughout the automotive sectors, heavy machinery operations, and industrial equipment usage, thereby enhancing the India gear oil market outlook.

India Gear Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and end-user industry.

Product Type Insights:

- Transportation

- Manual Gearbox

- Automatic Gearbox

- CVT

- DCT

- Axle Oil

- Industrial

The report has provided a detailed breakup and analysis of the market based on the product type. This includes transportation (manual gearbox, automotive gearbox (CVT, DCT), and axle oil), and industrial.

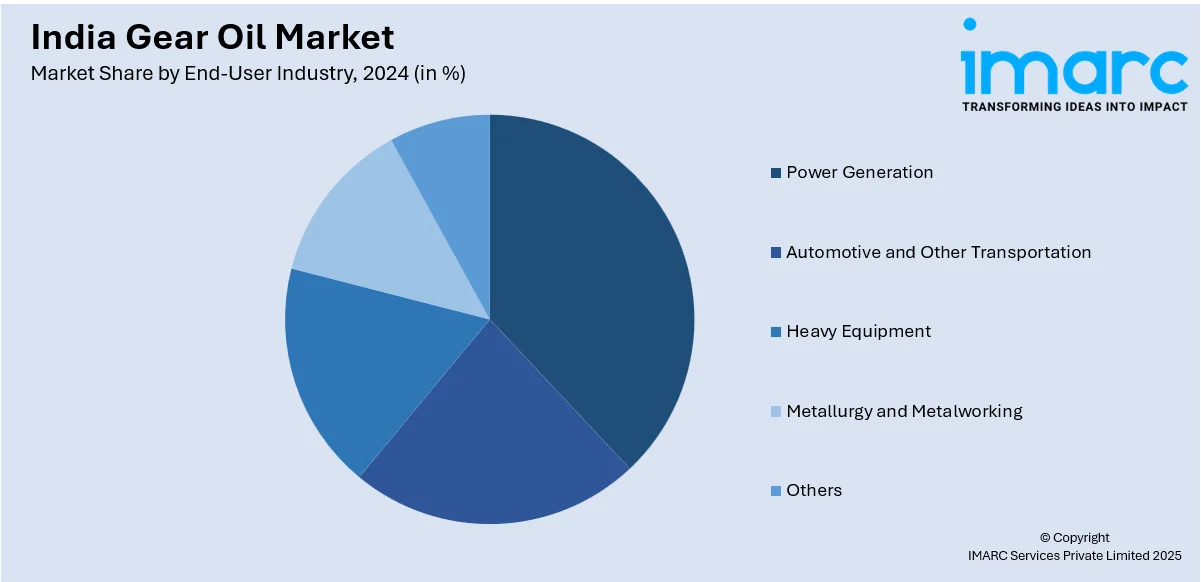

End-User Industry Insights:

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Metallurgy and Metalworking

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes power generation, automotive and other transportation, heavy equipment, metallurgy and metalworking, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gear Oil Market News:

- In May 2024, Enso Oils & Lubricants, a subsidiary of the Enso Group, entered into a distribution agreement with Russia's Gazpromneft-Lubricants. This partnership ensures a steady supply of high-quality base, motor, hydraulic, and gearbox oils to the Indian market, addressing the growing demand for superior lubricants in both industrial and automotive sectors.

- In April 2024, Savsol Lubricants introduced Savsol Ester 5, a biodegradable lubricant derived from edible oil fatty acids. This product caters to high-end applications in the automotive and railway sectors, reflecting a shift towards environmentally friendly lubricants in the Indian market.

India Gear Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-User Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Metallurgy and Metalworking, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gear oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gear oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gear oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gear oil market registered a volume of 2.78 Billion Litres in 2024.

The India gear oil market is projected to exhibit a CAGR of 4.81% during 2025-2033, reaching a volume of 4.24 Billion Litres by 2033.

The market is growing due to the expansion of the automotive and industrial sectors, infrastructure development, and rising vehicle production. Additionally, demand for synthetic, eco-friendly, and high-performance gear oils is increasing, driven by stricter emission standards, technological advancements, and the need for greater efficiency and durability in machinery and vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)