India Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End User, and Region, 2025-2033

Market Overview:

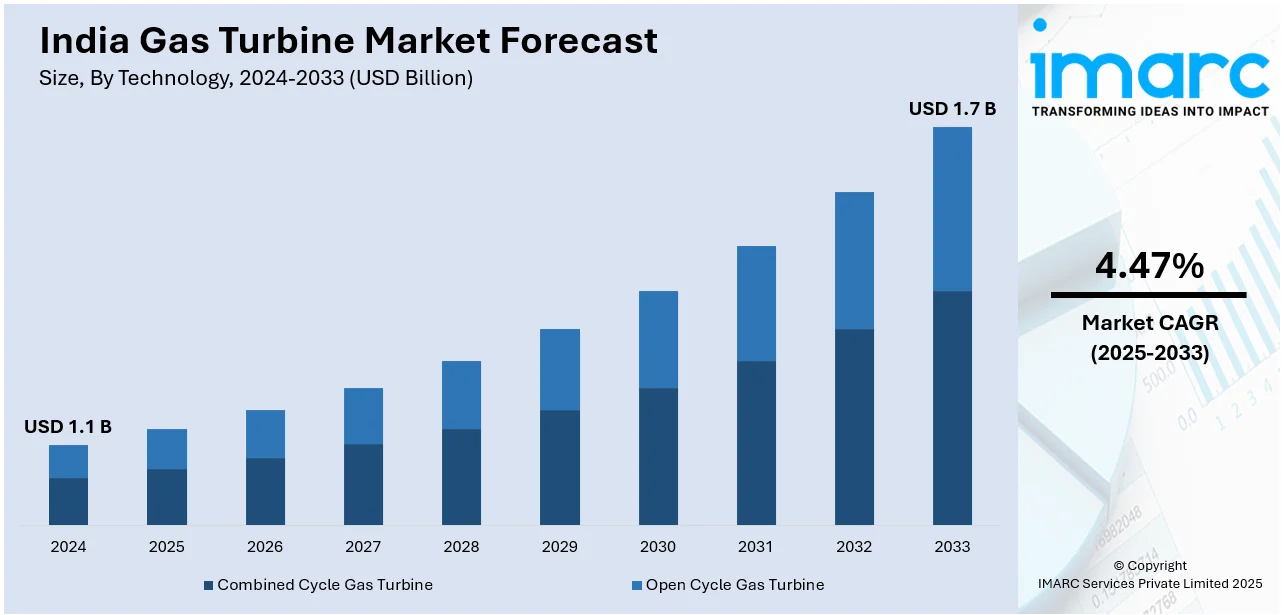

India gas turbine market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. The rising focus of government bodies on energy efficiency, along with the inflating need for reliable sources of power, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.1 Billion |

|

Market Forecast in 2033

|

USD 1.7 Billion |

| Market Growth Rate 2025-2033 | 4.47% |

A gas turbine is an internal combustion engine specifically designed to convert thermal energy generated from liquid fuels and natural gases into mechanical energy. Its components include an upstream rotating compressor, a downstream turbine, and a combustion chamber responsible for compressing atmospheric air. Manufactured from diverse materials like steel, titanium alloys, and superalloys, the gas turbine relies on various fuels, including synthetic fuels and natural gas, for efficient operation. Its versatility extends across different industries, such as automotive, marine, aerospace, mining, and oil and gas, making it a utilized technology. Beyond its functional capabilities, the gas turbine plays a crucial role in cost-effectiveness throughout its lifecycle, contributing to enhanced profitability for organizations involved in these industries.

To get more information on this market, Request Sample

India Gas Turbine Market Trends:

The gas turbine market in India is experiencing substantial growth and playing a pivotal role in the country's energy and industrial landscape. In this country's evolving energy sector, gas turbines are extensively employed to generate electricity, providing a reliable and efficient source of power. Their application extends to industries such as aerospace, automotive, marine, mining, and oil and gas, where these turbines are instrumental in various processes requiring mechanical energy. Additionally, the materials used in manufacturing gas turbines, including steel, titanium alloys, and superalloys, highlight the technological advancements incorporated into their design. Beyond the intrinsic functionality, gas turbines in the Indian market are recognized for their ability to contribute to cost reduction throughout their lifecycle. Moreover, this cost-effectiveness enhances the profitability of organizations involved in these industries, making gas turbines a valuable investment. Furthermore, as India continues to expand its industrial and energy infrastructure, the demand for gas turbines is expected to rise. Their efficiency, versatility, and contribution to cleaner energy align with India's goals for sustainable development, positioning gas turbines as a crucial technology in the country's pursuit of reliable and efficient power generation. This, in turn, is expected to fuel the market growth over the forecasted period.

India Gas Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, design type, rated capacity, and end user.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

The report has provided a detailed breakup and analysis of the market based on the technology. This includes combined cycle gas turbine and open cycle gas turbine.

Design Type Insights:

- Heavy Duty (Frame) Type

- Aeroderivative Type

A detailed breakup and analysis of the market based on the design type have also been provided in the report. This includes heavy duty (frame) type and aeroderivative type.

Rated Capacity Insights:

- Above 300 MW

- 120-300 MW

- 40-120 MW

- Less Than 40 MW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes above 300 MW, 120-300 MW, 40-120 MW, and less than 40 MW.

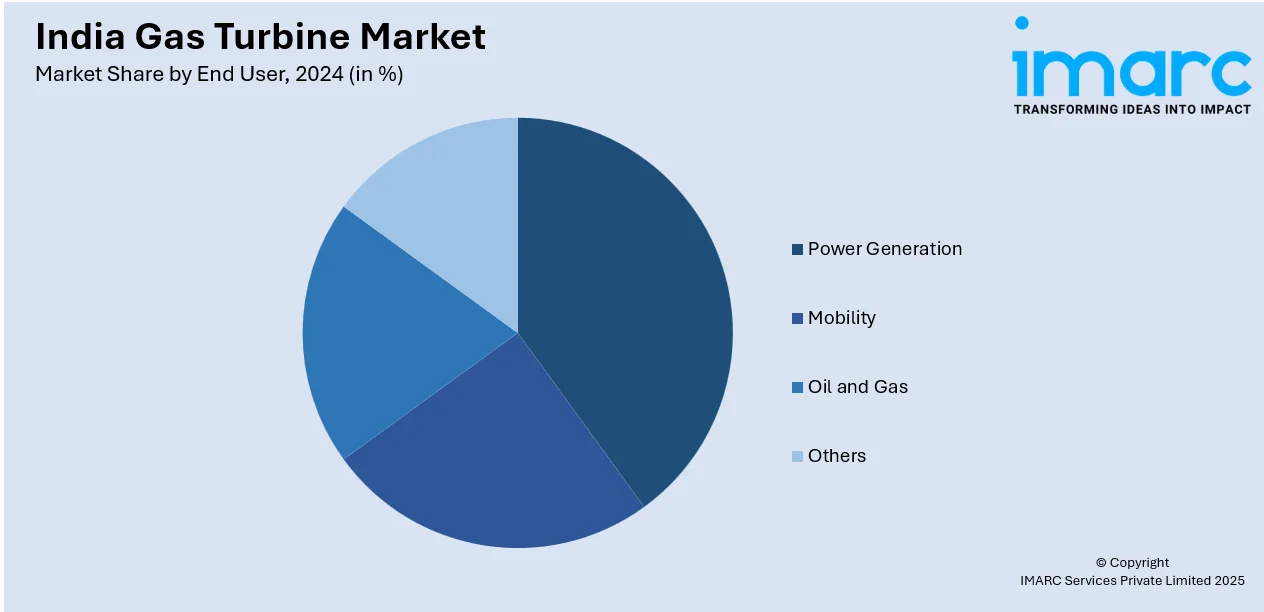

End User Insights:

- Power Generation

- Mobility

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes power generation, mobility, oil and gas, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gas Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gas turbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gas turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gas turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas turbine market in India was valued at USD 1.1 Billion in 2024.

The India gas turbine market is projected to exhibit a (CAGR) of 4.47% during 2025-2033, reaching a value of USD 1.7 Billion by 2033.

The market is characterized by increasing energy consumption, escalating investments in power plants, and emphasis on cleaner energy sources. Industrialization, growth in oil & gas industries, and use of combined-cycle and high-efficient turbines favor market advancement. Moreover, efforts by the government to minimize carbon emission and upgrade energy infrastructure are causing expanded gas turbine deployment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)