India Fuel Cell Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Market Overview:

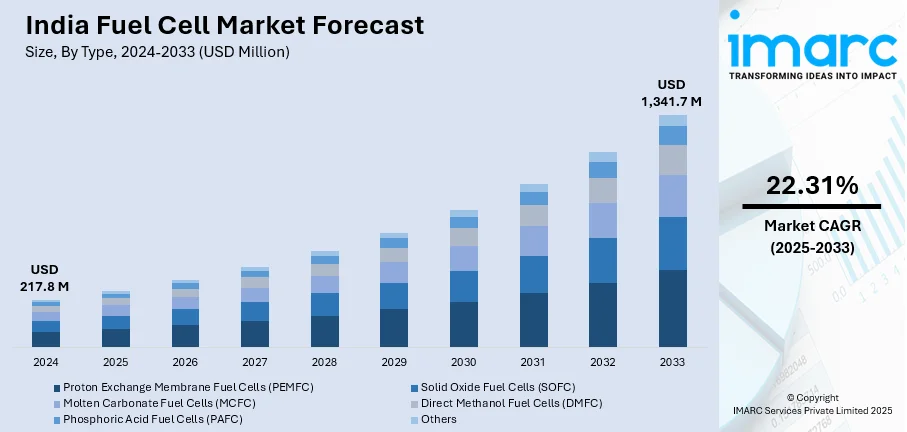

India fuel cell market size reached USD 217.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,341.7 Million by 2033, exhibiting a growth rate (CAGR) of 22.31% during 2025-2033. The increasing demand for clean and efficient power sources in both urban and remote areas across the country is primarily propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.8 Million |

| Market Forecast in 2033 | USD 1,341.7 Million |

| Market Growth Rate (2025-2033) | 22.31% |

A fuel cell is an electrochemical device that transforms chemical potential energy into electrical energy. It is composed of a cathode, anode, and electrolyte, facilitating the movement of electrically charged particles between electrodes. Primarily employed as a secondary power source in commercial, industrial, and residential structures, as well as in remote or hard-to-reach locations, fuel cells also serve as a propulsion system for various vehicles such as forklifts, cars, buses, trains, boats, motorcycles, and submarines. Fuel cells are recognized for their heightened efficiency, flexibility, extended operational duration, improved dependability, and cost-effectiveness. In comparison to conventional power generation methods, they generate electricity without combustion, leading to reduced greenhouse gas emissions and diminished environmental pollution.

To get more information on this market, Request Sample

India Fuel Cell Market Trends:

The fuel cell market in India is emerging as a promising sector driven by the country's growing focus on sustainable energy solutions and a desire to reduce dependence on traditional fossil fuels. In India, fuel cells are being utilized as backup power systems in commercial, industrial, and residential buildings, addressing the need for reliable and sustainable energy solutions. The environmental benefits of fuel cells, such as reduced greenhouse gas emissions and lower pollution levels compared to traditional combustion-based power generation, align with India's commitment to sustainable development and environmental conservation. Moreover, government initiatives and policies supporting the adoption of green technologies further contribute to the growth of the fuel cell market in India. Incentives, subsidies, and research and development programs encourage businesses and industries to explore and implement fuel cell technologies. Additionally, collaborations between public and private entities aim to advance research and development efforts, fostering innovation in the fuel cell sector. Besides this, as the demand for clean energy solutions continues to rise, the India fuel cell market is poised for expansion. Apart from this, the technology's ability to provide reliable power, especially in off-grid and remote areas, positions fuel cells as a significant contributor to India's energy landscape, offering sustainable and environmentally friendly alternatives for power generation and transportation, which is expected to fuel the market growth in the coming years.

India Fuel Cell Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Molten Carbonate Fuel Cells (MCFC)

- Direct Methanol Fuel Cells (DMFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes proton exchange membrane fuel cells (PEMFC), solid oxide fuel cells (SOFC), molten carbonate fuel cells (MCFC), direct methanol fuel cells (DMFC), phosphoric acid fuel cells (PAFC), and others.

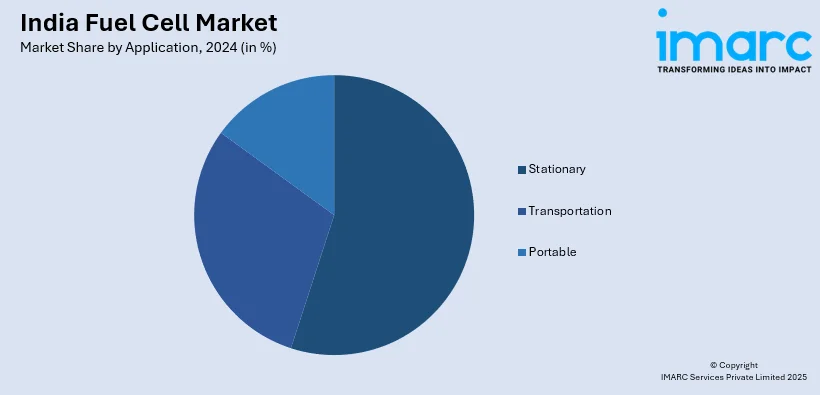

Application Insights:

- Stationary

- Transportation

- Portable

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stationary, transportation, and portable.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fuel Cell Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC), Others |

| Applications Covered | Stationary, Transportation, Portable |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fuel cell market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fuel cell market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fuel cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fuel cell market in India was valued at USD 217.8 Million in 2024.

The fuel cell market in India is projected to exhibit a CAGR of 22.31% during 2025-2033, reaching a value of USD 1,341.7 Million by 2033.

The fuel cell market in India is growing due to increasing focus on clean energy, government support, and rising demand for sustainable power solutions. Key drivers are favorable policies encouraging green technologies, interest in reducing fossil fuel dependence, and the necessity for high-efficiency energy sources. Increased awareness of environmental concerns coupled with improvements in fuel cell technology are also influencing industries and transportation sectors to seek fuel cell applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)