India Fuel Cards Market Size, Share, Trends and Forecast by Type, Technology, Application, End User, and Region, 2026-2034

India Fuel Cards Market Summary:

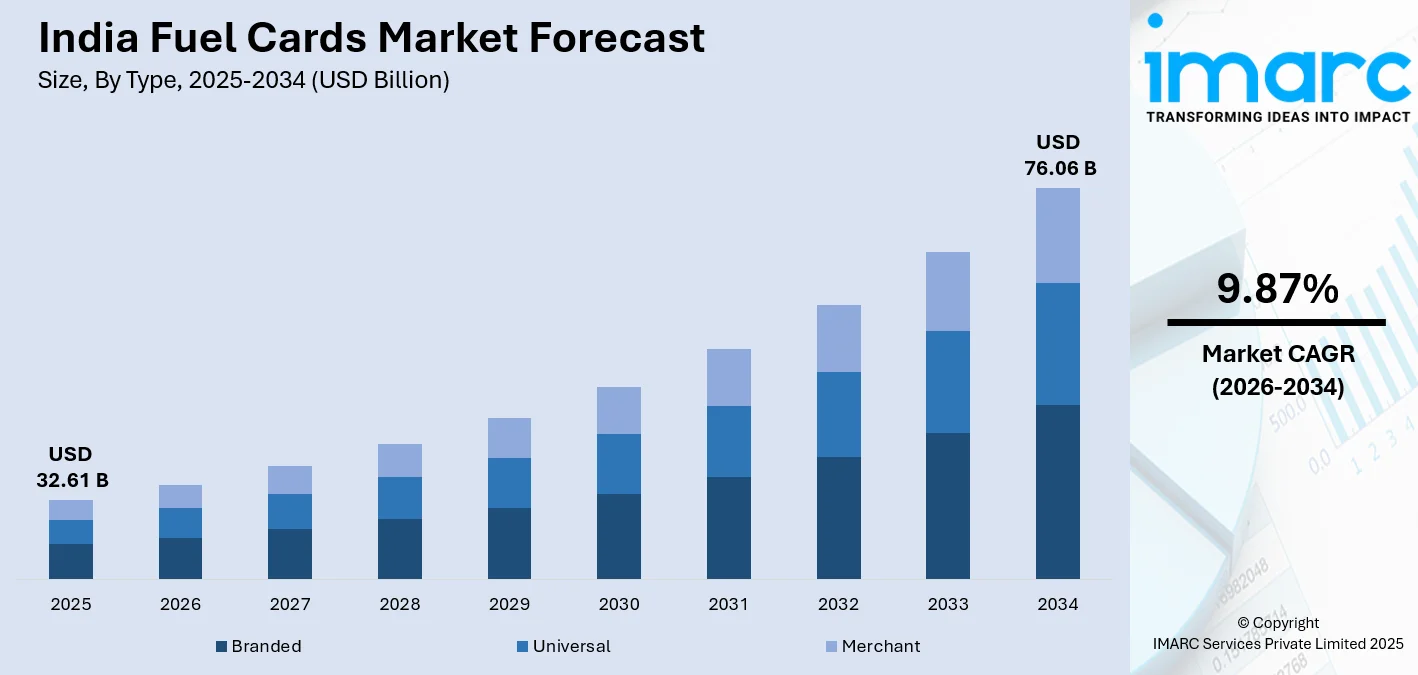

The India fuel cards market size was valued at USD 32.61 Billion in 2025 and is projected to reach USD 76.06 Billion by 2034, growing at a compound annual growth rate of 9.87% from 2026-2034.

The market demonstrates robust growth driven by fleet digitization imperatives, corporate expense management optimization, and regulatory frameworks promoting cashless fuel transactions. Apart from this, the sector benefits from accelerating commercial vehicle adoption, logistics infrastructure modernization, and increasing preference for automated payment solutions that enhance operational transparency and reduce administrative burdens across transportation-dependent industries, thereby expanding the India fuel cards market share.

Key Takeaways and Insights:

- By Type: Universal dominates the market with a share of 43.2% in 2025, offering cross-brand acceptance that maximizes convenience for fleet operators managing diverse vehicle portfolios across multiple fuel retail networks.

- By Technology: Smart cards lead the market with a share of 64.3% in 2025, enabling advanced transaction monitoring, real-time fraud detection, and integrated telematics capabilities that enhance security and operational control.

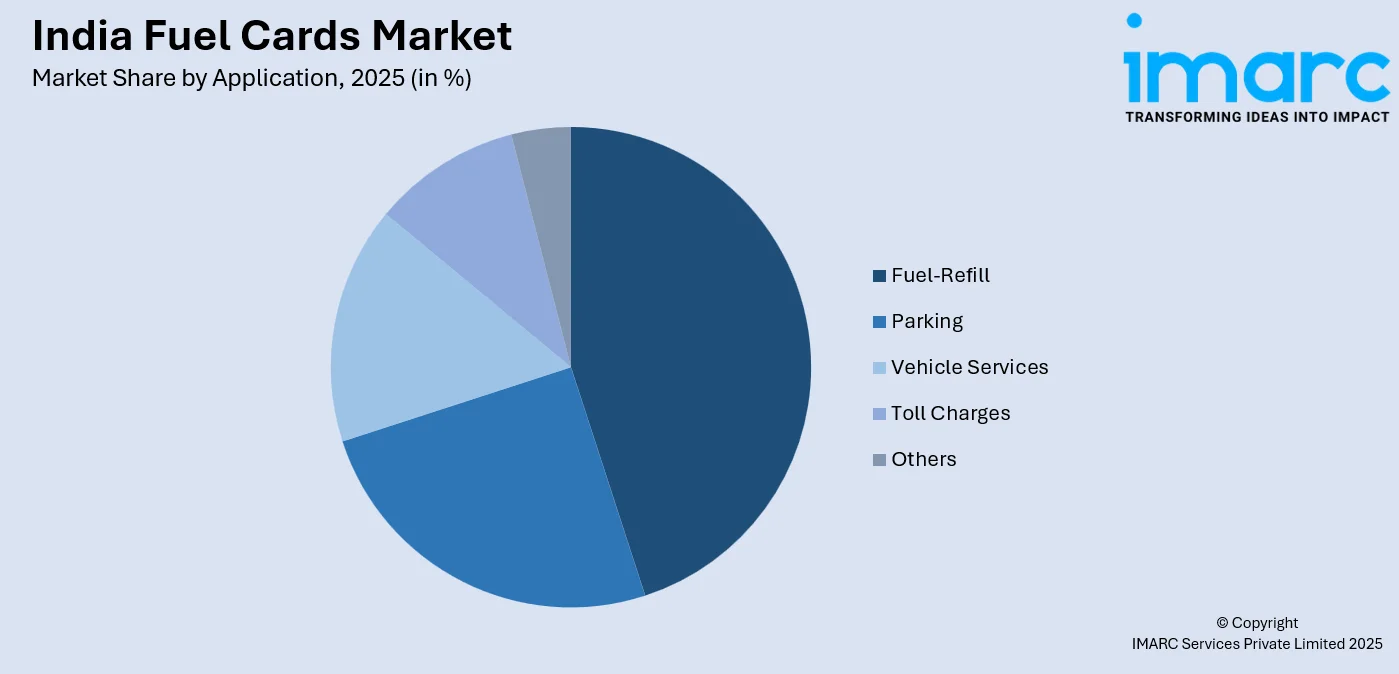

- By Application: Fuel-refill represents the largest segment with a market share of 41.6% in 2025, reflecting the core function of fuel cards in streamlining petroleum procurement and expense tracking for commercial fleets.

- By End User: Corporate segment leads the market with a share of 61.4% share in 2025, driven by large-scale fleet management requirements and institutional adoption of digital payment infrastructures.

- By Region: South India represents the largest segment with a market share of 31% in 2025, supported by concentrated logistics hubs, automotive manufacturing clusters, and high commercial vehicle density in metropolitan corridors.

- Key Players: The India fuel cards market features moderate competitive intensity with petroleum marketing companies, financial institutions, and specialized fleet management providers competing across technological sophistication levels and network coverage breadth.

To get more information on this market Request Sample

The Indian fuel cards ecosystem has evolved from basic prepaid solutions into sophisticated fleet management platforms integrating GPS tracking, driver behavior analytics, and comprehensive reporting capabilities. Commercial transport operators increasingly recognize fuel cards as essential infrastructure for controlling operational costs, preventing fuel pilferage, and ensuring regulatory compliance. The Government of India's digital payment initiatives, including the promotion of FASTag-integrated solutions and mandates for electronic invoicing in fuel transactions, have accelerated market formalization. In 2025, Gro Digital Platforms, a collaboration between Ashok Leyland and Hinduja Leyland Finance, entered into a Memorandum of Understanding with IDFC FIRST Bank to introduce FASTag services intended to deliver comprehensive mobility solutions for fleet operators and transporters throughout India. According to the agreement, Gro Digital Platforms will market IDFC FIRST Bank's FASTag services via Ashok Leyland dealers. The collaboration will provide fleet managers with a digital toll payment system aimed at enhancing efficiency, transparency, and convenience in their activities. Major oil marketing companies have expanded their fuel card networks while fintech players introduce innovative features such as dynamic pricing alerts, route optimization tools, and carbon footprint tracking. The logistics boom driven by e-commerce expansion, combined with GST implementation streamlining interstate transportation, creates sustained demand for centralized fuel expense management solutions across small transport businesses and large corporate fleets.

India Fuel Cards Market Trends:

Integration of Telematics and IoT-Enabled Fleet Intelligence

Fuel card providers increasingly embed telematics connectivity and IoT sensor integration, transforming traditional payment cards into comprehensive fleet management platforms. These advanced systems enable real-time vehicle location tracking, fuel consumption pattern analysis, driver performance monitoring, and predictive maintenance scheduling through unified digital interfaces. Major petroleum retailers now offer fuel cards that automatically capture odometer readings, detect unauthorized transactions, and generate actionable insights on fuel efficiency optimization. The convergence accelerates as commercial fleet operators demand holistic solutions that combine payment automation with operational intelligence, reducing the need for multiple disparate systems and enabling data-driven decision-making across transportation operations. As per IMARC Group, the India IoT market is projected to attain USD 3.62 Billion by 2034.

Expansion of Multi-Application Card Functionalities

The fuel card value proposition extends beyond petroleum procurement to encompass parking fees, toll payments, vehicle servicing, and other transportation-related expenses through single-card solutions. This functional expansion addresses fleet operators' requirements for consolidated expense tracking and simplified accounting processes across diverse operational categories. Petroleum marketing companies collaborate with parking operators, toll collection authorities, and automotive service networks to create interoperable payment ecosystems. The trend gains momentum as National Electronic Toll Collection integration enables seamless highway transit, while urban parking aggregators accept fuel cards as valid payment instruments, enhancing convenience for commercial vehicle operators navigating India's complex transportation infrastructure. In 2025, IndusInd Bank introduced a co-branded credit card in collaboration with Jio-bp, which represents the lender’s inaugural fuel-linked card and the fuel retailer’s initial partnership, according to a statement from the companies. The ‘IndusInd Bank Jio-bp Mobility+’ credit card, backed by RuPay, provides enhanced rewards on fuel buys across Jio-bp’s network of over 2,050 Mobility Stations, as well as lifestyle perks and UPI-integrated payments.

Rise of Customizable Spend Controls and Fraud Prevention Mechanisms

Advanced fuel card platforms now incorporate granular transaction controls allowing fleet managers to set vehicle-specific spending limits, restrict purchase categories, mandate PIN authentication, and establish time-based usage parameters. These customization capabilities address persistent concerns regarding fuel theft, unauthorized purchases, and employee misuse that historically plagued commercial fleet operations. Moreover, the increase in cybersecurity cases in India from 10.29 lakh in 2022 to 22.68 lakh in 2024 demonstrates the expanding scale and intricacy of digital dangers in India. Real-time alert systems notify administrators of anomalous transactions, while biometric authentication pilots introduce additional security layers for high-value fleet accounts. The sophistication reflects growing enterprise emphasis on financial governance and risk mitigation as fuel expenses represent significant operational cost components requiring rigorous monitoring and control frameworks.

Market Outlook 2026-2034:

India's fuel cards market trajectory benefits from structural economic shifts favoring organized logistics, regulatory emphasis on transaction transparency, and technological advancements enabling sophisticated fleet management capabilities. The continued expansion of organized retail fuel networks, coupled with increasing smartphone penetration facilitating mobile card management applications, positions fuel cards as essential infrastructure for India's evolving transportation ecosystem. The market generated a revenue of USD 32.61 Billion in 2025 and is projected to reach a revenue of USD 76.06 Billion by 2034, growing at a compound annual growth rate of 9.87% from 2026-2034. Government initiatives promoting digital payments and reducing cash transactions further reinforce adoption across commercial vehicle segments.

India Fuel Cards Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Universal |

43.2% |

|

Technology |

Smart Cards |

64.3% |

|

Application |

Fuel-Refill |

41.6% |

|

End User |

Corporate |

61.4% |

|

Region |

South India |

31% |

Type Insights:

- Branded

- Universal

- Merchant

Universal dominates with a market share of 43.2% of the total India fuel cards market in 2025.

Universal fuel cards capture market leadership by offering fleet operators unrestricted access to multiple petroleum brand networks, eliminating geographical constraints and brand-specific limitations that complicate route planning and fuel procurement logistics. This cross-compatibility proves particularly valuable for long-haul transportation businesses operating across diverse regions where single-brand fuel station availability varies significantly. Fleet managers prioritize universal cards to ensure drivers can refuel at nearest available stations regardless of brand affiliation, optimizing operational efficiency and preventing costly detours.

The segment's dominance reflects India's fragmented fuel retail landscape where operators like Indian Oil, Bharat Petroleum, and Hindustan Petroleum maintain separate station networks with varying geographical concentrations. Universal cards negotiated through specialized fleet management companies often secure competitive pricing across multiple fuel brands while maintaining centralized billing and reporting capabilities. Small and medium transport enterprises particularly favor universal solutions as they lack the fleet scale to negotiate individual agreements with multiple oil marketing companies, making universal cards an economically rational choice that balances convenience with cost management.

Technology Insights:

- Smart Cards

- Standard Cards

Smart cards lead with a share of 64.3% of the total India fuel cards market in 2025.

Smart card technology dominates through embedded microprocessors enabling encrypted data storage, real-time transaction authentication, and advanced security protocols that significantly reduce fraud vulnerabilities compared to magnetic stripe alternatives. These sophisticated cards support multiple applications on single platforms, store detailed transaction histories, and facilitate offline transaction processing in areas with limited connectivity. Corporate fleet managers increasingly mandate smart card adoption to leverage features like driver identification through PIN codes, vehicle-specific spending restrictions, and automated exception reporting that enhance financial controls.

The technology segment's leadership position strengthens as petroleum marketing companies invest in point-of-sale infrastructure supporting EMV chip card standards and contactless payment protocols. Smart cards enable integration with enterprise resource planning systems, allowing seamless data flow from fuel transactions into accounting platforms and fleet management software. The growing availability of mobile applications for remote card management, transaction monitoring, and instant alert notifications further amplifies smart card appeal among technologically sophisticated fleet operators seeking comprehensive digital solutions for transportation expense management and operational oversight.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel-Refill

- Parking

- Vehicle Services

- Toll Charges

- Others

Fuel-refill exhibits a clear dominance with a 41.6% share of the total India fuel cards market in 2025.

Fuel-refill represents the foundational application driving fuel card adoption as petroleum procurement constitutes the largest recurring operational expense for commercial vehicle fleets. The application segment's dominance stems from universal applicability across all vehicle types, high transaction frequency generating substantial card usage volumes, and critical importance of fuel expense control for fleet profitability. Operators prioritize fuel cards primarily for streamlining diesel and petrol purchases, automating expense documentation, and eliminating cash handling risks associated with traditional fuel procurement methods.

Fuel-refill applications benefit from comprehensive acceptance networks as virtually all organized fuel retail outlets support card-based payments, ensuring transaction convenience regardless of vehicle location or operational route. The segment captures additional value through integration with fuel management systems that track consumption patterns, identify fuel efficiency anomalies, and detect potential pilferage or unauthorized usage. Digital fuel receipts generated through card transactions facilitate GST input credit claims and simplify regulatory compliance for transportation businesses, reinforcing Fuel-refill's position as the primary application justifying fuel card investment for most commercial fleet operators.

End User Insights:

- Individual

- Corporate

Corporate leads with a share of 61.4% of the total India fuel cards market in 2025.

Corporate end-users drive fuel card market growth through large-scale fleet operations requiring centralized expense management, standardized procurement protocols, and comprehensive reporting capabilities that fuel cards uniquely provide. Enterprises managing dozens to thousands of vehicles across geographically dispersed operations rely on fuel cards to enforce spending policies, prevent unauthorized purchases, and generate consolidated financial statements simplifying accounting processes. The segment encompasses logistics companies, manufacturing firms with captive fleets, public sector undertakings, and organized retail chains operating delivery vehicle networks.

Corporate adoption accelerates as organizations recognize fuel cards as essential components of broader digital transformation initiatives targeting operational efficiency and financial transparency. Large fleet operators negotiate volume-based pricing discounts and customized reporting formats with fuel card providers, extracting additional value beyond basic payment automation. The corporate segment benefits from dedicated account management support, specialized software integrations connecting fuel card data with enterprise systems, and scalable solutions accommodating fleet expansion without proportional administrative overhead increases, making fuel cards indispensable infrastructure for professional fleet management operations.

Regional Insights:

- North India

- South India

- East India

- West India

South India exhibits a clear dominance with a 31% share of the total India fuel cards market in 2025.

South India's market leadership reflects concentrated automotive manufacturing ecosystems in Tamil Nadu, Karnataka, and Andhra Pradesh generating substantial commercial vehicle deployment and associated fuel consumption requirements. The region hosts major logistics hubs serving port cities like Chennai, Visakhapatnam, and Kochi, creating dense transportation networks where organized fleet management solutions demonstrate maximum utility. Technology adoption rates exceeding national averages, combined with higher urbanization levels and stronger corporate governance practices, accelerate fuel card penetration among South Indian fleet operators.

The region benefits from well-developed fuel retail infrastructure with dense petroleum outlet networks ensuring fuel card acceptance across urban centers and highway corridors. South India's prominence in information technology and business process outsourcing sectors generates significant corporate fleet requirements for employee transportation services that increasingly adopt fuel card solutions for expense control and accountability. The region's manufacturing clusters, particularly automotive component suppliers and electronics assembly operations, maintain substantial captive logistics capabilities that represent prime fuel card adoption targets, reinforcing South India's position as the dominant regional market for fleet payment automation solutions.

Market Dynamics:

Growth Drivers:

Why is the India Fuel Cards Market Growing?

Rapid Expansion of Organized Logistics and E-Commerce Transportation Networks

India's e-commerce boom drives exponential growth in last-mile delivery infrastructure, with companies deploying thousands of delivery vehicles across urban and semi-urban markets requiring sophisticated fuel expense management solutions. As per the International Trade Administration, in 2020, Indian e-commerce was valued at $46.2 billion and is projected to expand at a rate of 18.29 percent, reaching $136.47 billion by 2026. The logistics sector's formalization accelerates as businesses transition from fragmented, cash-based operations toward organized fleet management practices emphasizing transparency and cost optimization. Fuel cards emerge as critical enablers facilitating this transformation by providing automated transaction recording, centralized billing, and detailed consumption analytics. Major logistics providers increasingly mandate fuel card adoption across vendor networks to ensure standardized expense documentation and prevent revenue leakage, creating sustained market expansion as organized logistics penetrates deeper into India's geographic and economic landscape.

Government Digital Payment Initiatives and Cashless Transaction Mandates

The Government of India's sustained emphasis on digital payment adoption, formalized through initiatives promoting cashless transactions and reducing currency circulation, creates favorable regulatory environments for fuel card proliferation. The Union Cabinet has endorsed a ₹1,500 crores incentive scheme for FY 2024–25 aimed at boosting low-value BHIM-UPI (P2M) transactions and promoting digital payments among small vendors. Policies encouraging electronic payment instruments in commercial transactions, combined with GST implementation requiring detailed expense documentation for input credit claims, amplify fuel card value propositions for businesses seeking regulatory compliance with minimal administrative burden. Petroleum marketing companies align with governmental digitization objectives by expanding fuel card acceptance networks and introducing features supporting e-invoicing requirements. The convergence of regulatory push and technological enablement positions fuel cards as preferred fuel procurement mechanisms for compliance-conscious commercial operators navigating India's evolving business regulation landscape.

Increasing Corporate Focus on Fleet Cost Optimization and Operational Efficiency

Rising petroleum prices and competitive business environments intensify corporate emphasis on controlling fuel expenses, which often represent 30 to 40% of total fleet operating costs for transportation-dependent businesses. India’s petrol usage experienced a strong 7.03 percent year-on-year (Y-o-Y) increase in October, propelled by festive demand, as reported by initial oil ministry statistics. In October, domestic petrol usage was 3.65 million tonnes, in contrast to 3.41 million tonnes one year earlier. Fuel cards provide granular visibility into consumption patterns, enable data-driven efficiency improvements, and eliminate cash handling costs associated with traditional fuel procurement methods. Companies increasingly recognize fuel cards not merely as payment instruments but as strategic tools for identifying fuel wastage, detecting unauthorized usage, and benchmarking driver performance across fleet populations. The growing sophistication of fuel card analytics platforms, offering insights on optimal refueling locations, consumption trend forecasting, and vehicle-specific efficiency metrics, reinforces adoption among organizations pursuing operational excellence and competitive cost structures in transport-intensive industries.

Market Restraints:

What Challenges the India Fuel Cards Market is Facing?

Limited Penetration Among Small Fleet Operators and Individual Vehicle Owners

Fuel card adoption remains concentrated within medium and large corporate fleets, with small transport businesses and individual commercial vehicle owners exhibiting resistance due to perceived complexity, annual fee concerns, and preference for traditional cash transactions. Many small operators lack technological literacy or administrative infrastructure to effectively utilize fuel card features, viewing them as unnecessary complications rather than value-adding tools. The fragmented nature of India's commercial vehicle ownership, where millions of individual truck owners operate independently, creates market penetration challenges requiring extensive education and simplified product offerings tailored to unsophisticated users with limited digital familiarity.

Infrastructure Gaps in Rural and Remote Geographic Markets

Fuel card acceptance networks concentrate in urban centers and major highway corridors, leaving significant coverage gaps in rural areas and remote regions where commercial vehicles frequently operate. Many independent fuel retailers, particularly in smaller towns and villages, lack point-of-sale infrastructure supporting card transactions or prefer cash payments to avoid transaction processing fees. This geographic limitation constrains fuel card utility for operators whose routes extend beyond organized fuel retail networks, forcing dual payment systems that diminish card convenience benefits and complicate expense reconciliation processes for businesses serving underserved markets.

Security Concerns and Fraud Vulnerabilities in Card-Based Systems

Despite technological advances, fuel cards remain susceptible to theft, cloning, and unauthorized usage scenarios that create financial losses and administrative burdens for fleet operators. Incidents involving stolen cards, employee collusion with fuel station personnel, and unauthorized fuel purchases for personal vehicles erode confidence in card-based systems among security-conscious fleet managers. The challenge intensifies in environments with weak enforcement mechanisms and limited digital surveillance capabilities, where fraudulent transactions may escape detection until substantial damages accumulate. Addressing these vulnerabilities requires continuous investment in security technologies and monitoring systems that increase overall fuel card program costs and complexity.

Competitive Landscape:

India's fuel cards market exhibits moderate competitive intensity characterized by petroleum marketing companies leveraging captive fuel retail networks, financial institutions introducing co-branded card solutions, and specialized fleet management providers offering technology-differentiated platforms. The sector witnesses strategic partnerships between fuel retailers and payment processors to expand acceptance networks and enhance value-added services. Competition increasingly centers on technology capabilities, with providers differentiating through mobile application sophistication, analytics platform robustness, and integration capabilities with enterprise fleet management systems. Price competition remains constrained by petroleum pricing regulations, shifting competitive dynamics toward service quality, network coverage, and feature richness. The market demonstrates consolidation tendencies as larger players acquire niche providers to expand technological capabilities and customer segments, while new entrants introduce digital-first solutions targeting tech-savvy fleet operators seeking modern alternatives to traditional fuel card offerings.

India Fuel Cards Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Branded, Universal, Merchant |

| Technologies Covered | Smart Cards, Standard Cards |

| Applications Covered | Fuel-Refill, Parking, Vehicle Services, Toll Charges, Others |

| End Users Covered | Individual, Corporate |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India fuel cards market size was valued at USD 32.61 Billion in 2025.

The India fuel cards market is expected to grow at a compound annual growth rate of 9.87% from 2026-2034 to reach USD 76.06 Billion by 2034.

Universal dominated the market with a 43.2% share in 2025, driven by their cross-brand acceptance capabilities that maximize operational flexibility for fleet operators managing vehicles across diverse geographic regions and multiple petroleum retail networks.

Key factors driving the India fuel cards market include rapid expansion of organized logistics driven by e-commerce growth, government digital payment initiatives promoting cashless transactions, and increasing corporate focus on fleet cost optimization through automated expense management and data-driven efficiency improvements.

Major challenges include limited penetration among small fleet operators and individual vehicle owners due to perceived complexity, infrastructure gaps in rural and remote geographic markets restricting acceptance networks, and persistent security concerns regarding card theft and fraudulent transactions that erode user confidence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)