India Frozen Dessert Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

India Frozen Dessert Market Summary:

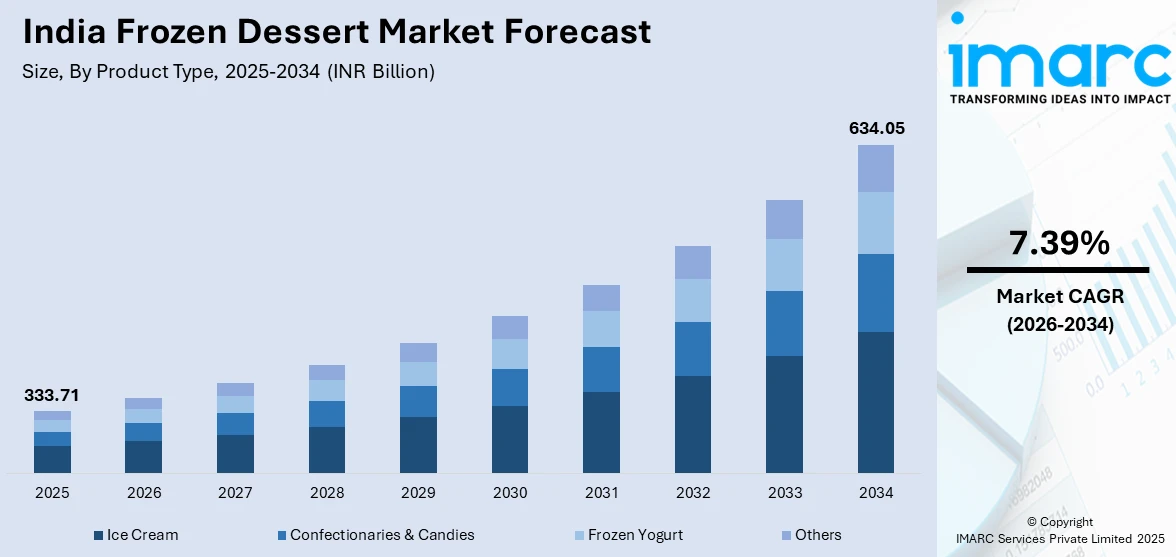

The India frozen dessert market size was valued at INR 333.71 Billion in 2025 and is projected to reach INR 634.05 Billion by 2034, growing at a compound annual growth rate of 7.39% from 2026-2034.

The India frozen dessert market is witnessing robust expansion driven by shifting consumer preferences toward indulgent yet convenient dessert options. Rising disposable incomes across urban and semi-urban regions have empowered middle-class households to allocate greater discretionary spending toward premium food experiences. The proliferation of organized retail outlets and changing dietary preferences influenced by exposure to global food trends through social media and travel have accelerated demand for western-style frozen treats.

Key Takeaways and Insights:

- By Product Type: Ice cream dominates the market with a share of 58% in 2025, owing to its widespread popularity across all demographic segments, affordability of impulse formats, and continuous flavor innovation by established brands. Rising demand for premium and artisanal variants is further accelerating segment growth.

- By Category: Conventional leads the market with a share of 80% in 2025, driven by strong consumer preference for traditional dairy-based formulations and familiar taste profiles. Cost-effective pricing and established brand loyalty among mass-market consumers reinforce the dominance of conventional frozen desserts.

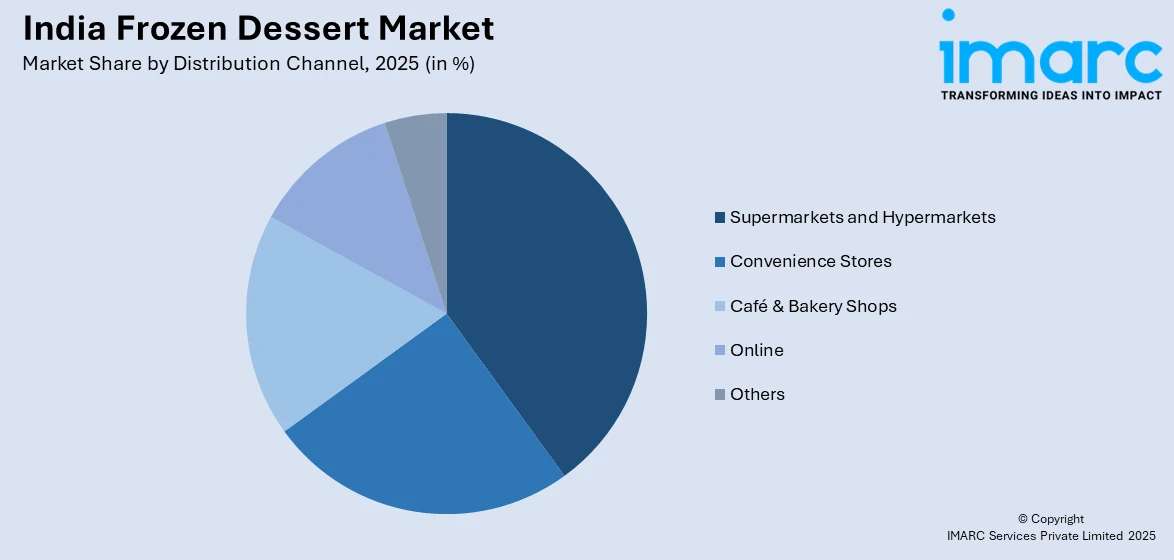

- By Distribution Channel: Supermarkets and hypermarkets hold the largest segment with a market share of 39% in 2025, reflecting the expansion of organized retail infrastructure that ensures product visibility, refrigeration facilities, and promotional campaigns that attract price-conscious consumers seeking variety.

- By Region: Maharashtra represents the largest region with 15% share in 2025, driven by high urbanization levels in Mumbai, Pune, and Nagpur, cosmopolitan lifestyle preferences, rising disposable incomes, and robust cold chain infrastructure supporting seamless distribution.

- Key Players: Key players drive the India frozen dessert market by expanding production capacities, innovating with regional and health-focused flavors, and strengthening distribution networks across organized retail and quick commerce platforms. Some of the key players operating in the market are Creambell (RJ Corp.), Gelato Vinto, Hindustan Unilever Limited, Keventer Group, Lazza Ice Cream, Menchie’s India and Vadilal Industries Limited.

To get more information on this market Request Sample

The India frozen dessert market is experiencing robust expansion driven by rising urbanization, increasing disposable incomes, and evolving consumer preferences toward premium indulgence options. The market encompasses diverse product categories including ice cream, frozen yogurt, confectionaries, and innovative plant-based alternatives that cater to health-conscious consumers seeking guilt-free indulgence. Rapid modernization of cold chain infrastructure and the proliferation of quick commerce platforms have transformed distribution dynamics, enabling year-round consumption beyond traditional seasonal patterns. Urban millennials and Gen Z consumers demonstrate strong appetite for artisanal offerings, regional flavor innovations, and internationally inspired variants that command premium price points. The organized retail sector's expansion alongside e-commerce penetration has significantly enhanced product accessibility across metropolitan and tier-two cities. Additionally, manufacturers are responding to health-conscious consumers by introducing low-sugar, dairy-free, and protein-enriched variants that cater to diverse dietary requirements while maintaining India frozen dessert market share.

India Frozen Dessert Market Trends:

Premiumization and Artisanal Offerings

The India frozen dessert market is experiencing a significant shift toward premium and artisanal products as consumers increasingly seek distinctive, high-quality dessert experiences. Urban millennials and Gen Z consumers demonstrate willingness to pay higher prices for small-batch ice creams featuring organic ingredients, exotic flavor combinations, and authentic regional specialties. Brands are launching preservative-free formulations, handcrafted gelatos, and innovative presentations that deliver Instagram-worthy experiences, thereby elevating frozen desserts from everyday treats to premium indulgences that command higher price points. In May 2025, premium ice cream brand Hocco raised USD 10 million in Series B funding from Sauce.vc at a valuation of INR 600 Crore, subsequently launching its premium sub-brand Huber & Holly featuring indulgent flavors such as Salted Caramel Popcorn, Pondicherry Vanilla, and Sicilian Pistachio.

Health-Conscious Frozen Dessert Innovation

Growing health awareness among Indian consumers is reshaping product development strategies across the frozen dessert industry. Manufacturers are introducing low-sugar, low-fat, protein-enriched, and plant-based alternatives that cater to fitness enthusiasts, diabetic consumers, and those following specific dietary regimens. Frozen yogurt has gained substantial traction among health-conscious urban populations seeking probiotic-rich, lower-calorie dessert options. The emergence of vegan ice creams using coconut, almond, and oat milk bases addresses lactose intolerance concerns while appealing to environmentally conscious consumers. In March 2025, guilt-free ice cream brand Go Zero raised INR 30 Crore in Series A funding from DSG Consumer Partners, Saama Capital, and V3 Ventures, with participation from Shark Tank India investors Aman Gupta and Namita Thapar, highlighting the growing investor confidence in healthier dessert alternatives.

Quick Commerce Transformation

The proliferation of quick commerce platforms is fundamentally transforming frozen dessert consumption patterns in India. Rapid delivery services offering ten to twenty-minute delivery windows have converted ice cream from a seasonal treat into an impulse purchase available year-round. These platforms leverage advanced cold chain logistics and last-mile delivery infrastructure to ensure product quality. The convenience factor particularly resonates with urban consumers seeking instant gratification, enabling brands to reach customers beyond traditional retail footprints and expand consumption occasions significantly.

Market Outlook 2026-2034:

The India frozen dessert market has bright growth opportunities due to the favorable demographic trends, development of cold chain infrastructure, and changing consumer behavior towards high-end indulgence. Government programs such as the Pradhan Mantri Kisan Sampada Yojana and the Integrated Cold Chain and Value Addition Infrastructure scheme are facilitating the development of infrastructure required for the growth of the market. The growing penetration of organized retail, the increasing reach of quick commerce services, and the changing consumer behavior towards trying new international flavor profiles are set to fuel the growth of the market. Companies focusing on innovations in health-oriented products and local flavor offerings are poised to reap the benefits in tier-two and tier-three cities. The market generated a revenue of INR 333.71 Billion in 2025 and is projected to reach a revenue of INR 634.05 Billion by 2034, growing at a compound annual growth rate of 7.39% from 2026-2034.

India Frozen Dessert Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Ice Cream | 58% |

| Category | Conventional | 80% |

| Distribution Channel | Supermarkets and Hypermarkets | 39% |

| Region | Maharashtra | 15% |

Product Type Insights:

- Confectionaries & Candies

- Ice Cream

- Frozen Yogurt

- Others

Ice cream dominates with a market share of 58% of the total India frozen dessert market in 2025.

Ice cream continues to hold the leading market position in the India frozen dessert market due to its broad appeal across all age groups and all socioeconomic classes. The product's flexibility in terms of packaging options such as sticks, cups, cones, tubs, and sundaes make it accessible at different price points ranging from impulse buys to family packs. The tropical climate in India, with extended summer seasons in the main consumption areas, drives demand for cooling dessert products year-round.

Some of the well-established brands have continued to lead the segment with innovations in regional flavors such as kesar pista, mango, and gulkand, which have a strong appeal to the Indian palate. The established brands have been able to capitalize on the strong brand recall and consumer trust built over the years, while at the same time keeping up with the changing demands of the market. The segment has strong distribution channels, including organized retail and general trade, as well as the emerging quick commerce business.

Category Insights:

- Conventional

- Sugar-free

Conventional leads with a share of 80% of the total India frozen dessert market in 2025.

Conventional frozen desserts hold the leading market share, as there is a strong consumer preference for traditional dairy-based conventional frozen desserts in India. Consumers in the general trade channel, especially in semi-urban and rural areas, remain loyal to brands of established market players, who provide competitively priced products through their extensive general trade distribution channels. This market is also supported by the fact that India is the largest producer of milk in the world.

Manufacturers continue expanding conventional product portfolios with innovative flavor combinations that blend western indulgence with regional preferences, thereby attracting broader consumer demographics seeking familiar yet exciting dessert experiences. Traditional dairy-based formulations maintain strong appeal among consumers who prioritize authentic taste profiles and trusted ingredient compositions. The affordability and accessibility of conventional frozen desserts through multiple distribution channels including pushcarts, convenience stores, and modern retail formats reinforce segment dominance across diverse market tiers, ensuring consistent product availability throughout metropolitan and semi-urban regions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Café & Bakery Shops

- Online

- Others

The supermarkets and hypermarkets exhibit a clear dominance with a 39% share of the total India frozen dessert market in 2025.

Supermarkets and hypermarkets maintain their leading position by providing extensive product assortments, reliable refrigeration infrastructure, and compelling promotional campaigns that attract price-conscious consumers seeking value and variety. These organized retail formats enable consumers to compare multiple brands, evaluate nutritional information, and discover new product launches within single shopping destinations. Modern trade outlets in urban centers offer enhanced shopping experiences through air-conditioned environments, product sampling opportunities, and dedicated frozen food sections that facilitate impulse purchases and encourage experimentation with premium offerings.

Major retail chains in India are expanding their footprint across tier-two and tier-three cities, bringing organized frozen dessert retail to previously underserved markets. These outlets benefit from established partnerships with leading frozen dessert brands ensuring consistent supply chains and exclusive product launches. The channel's capacity to accommodate bulk purchases and family pack formats makes supermarkets and hypermarkets the preferred destination for planned frozen dessert purchases during festivals and special occasions.

Regional Insights:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Maharashtra represents the leading segment with a 15% share of the total India frozen dessert market in 2025.

Maharashtra's leadership in the India frozen dessert market stems from its combination of high population density, extensive urbanization, and robust economic development concentrated in metropolitan hubs including Mumbai, Pune, and Nagpur. These cities feature higher concentrations of consumers with elevated purchasing power who demonstrate strong appetite for both premium artisanal offerings and impulse frozen dessert purchases. The state's cosmopolitan culture and exposure to international food trends through travel and media accelerate adoption of innovative frozen dessert formats.

Maharashtra benefits from advanced cold chain infrastructure including organized retail networks and modern cold storage facilities ensuring seamless distribution across urban, semi-urban, and rural markets. In October 2024, Frozen Fun Café launched its new concept, La Dolce Vita, in Bandra, Mumbai, celebrating Indo-Italian culture and offering authentic gelato experiences beyond traditional offerings. The state's tropical climate generates consistent year-round demand for frozen desserts, while the presence of numerous regional and national brand headquarters facilitates rapid product innovation and market responsiveness.

Market Dynamics:

Growth Drivers:

Why is the India Frozen Dessert Market Growing?

Rapid Urbanization and Rising Disposable Incomes

India's accelerating urbanization trajectory is fundamentally reshaping frozen dessert consumption patterns across the nation. Urban populations demonstrate higher purchasing power, greater exposure to global food trends, and easier access to modern retail outlets that collectively drive demand for premium and innovative frozen dessert products. The expansion of nuclear families and dual-income households creates favorable conditions for convenient, ready-to-eat dessert options that align with time-constrained modern lifestyles. Metropolitan cities function as consumption hubs where consumers willingly experiment with gourmet ice creams, handcrafted artisanal variants, and indulgent international flavors previously unavailable in traditional markets. Rising aspirational spending among the growing middle class positions frozen desserts as accessible luxury treats that enhance everyday consumption occasions without requiring substantial financial commitment. Urban infrastructure improvements including reliable electricity supply and expanding cold storage networks further enable consistent frozen dessert availability across diverse retail touchpoints. According to a July 2025 World Bank report titled "Towards Resilient and Prosperous Cities in India," the nation's urban population is expected to almost double by 2050 to 951 million, with seventy percent of new jobs coming from cities by 2030.

Expansion of Cold Chain Infrastructure and Distribution Networks

Substantial improvements in India's cold chain infrastructure are enabling market expansion into previously underserved regions while ensuring product quality throughout distribution channels. Government initiatives through schemes such as the Pradhan Mantri Kisan Sampada Yojana and Integrated Cold Chain and Value Addition Infrastructure program have catalyzed infrastructure development essential for perishable food distribution. Enhanced cold storage facilities, refrigerated transportation fleets, and efficient logistics networks have significantly increased product availability across both urban and rural locations. The penetration of organized retail formats including supermarkets, hypermarkets, and convenience stores continues accelerating, providing freezer sections capable of showcasing diverse frozen dessert assortments. Parallelly, quick commerce platforms have revolutionized frozen food logistics through improved freezer technology and optimized last-mile delivery systems. These developments collectively reduce distribution barriers that previously constrained market growth in secondary and tertiary markets. According to industry report, India has over 8,689 cold storage facilities with a total capacity of 39.6 Million Metric Tons as of August 2024, while the Ministry of Food Processing Industries has approved 400 cold chain projects under PMKSY as of August 2024.

Product Innovation and Health-Conscious Offerings

The manufacturers are increasing their innovation in products to meet the changing consumer preferences across various demographics, thus significantly increasing the addressable market. The launch of health-conscious variants such as low sugar, low fat, protein, and plant-based variants is a response to the increasing consumer awareness about the nutritional content and needs. Vegan ice cream variants made from coconut, almond, and oat milk cater to lactose-intolerant consumers as well as those who are concerned about environmentally sustainable products without compromising on the taste and texture. Regional innovations in flavors using indigenous ingredients such as saffron, cardamom, mango, and rose help brands differentiate their products while aligning with the taste preferences of the local market. The launch of preservative-free, artisanal variants with organic ingredients by premium brands commands a higher price and appeals to quality-conscious urban consumers.

Market Restraints:

What Challenges the India Frozen Dessert Market is Facing?

Inadequate Cold Storage Infrastructure in Rural Regions

India's cold chain infrastructure remains underdeveloped in rural and semi-urban areas, presenting significant challenges for frozen dessert distribution beyond metropolitan centers. Existing cold storage facilities are heavily concentrated in major urban areas, creating logistical hurdles for brands seeking to expand into remote regions where frozen dessert demand is gradually increasing. The inadequate refrigeration infrastructure increases product spoilage risks, reduces shelf life, and limits market reach, ultimately constraining seamless distribution throughout the country and hindering potential rural market penetration.

High Transportation and Operational Costs

The cost of refrigerated transport in India has increased substantially due to rising fuel prices and specialized equipment requirements for temperature-controlled vehicles. Transportation of frozen goods demands consistent refrigeration throughout transit, with high costs associated with fuel consumption and cooling systems significantly impacting pricing strategies for frozen dessert manufacturers. These elevated operational expenses compress profit margins, particularly for brands targeting price-sensitive mass-market segments, and create barriers for smaller regional players attempting to compete against established national brands.

Regulatory Complexity and Product Classification Challenges

The Indian frozen dessert industry faces ongoing regulatory challenges regarding product classification and permissible ingredients that complicate market operations. The Food Safety and Standards Authority of India mandates clear labeling to differentiate dairy-based ice creams from products manufactured using vegetable oils or non-dairy fats, which must be labeled as frozen desserts. This distinction affects consumer perception, with frozen desserts often associated with lower quality compared to traditional ice creams, creating marketing challenges for manufacturers utilizing cost-effective formulations.

Competitive Landscape:

The India frozen dessert market is found to be highly competitive, with the presence of established dairy cooperatives, global companies, and new-age premium brands competing across various product categories and price points. Market leaders have been using their distribution networks, established brands, and innovative flavors to create a competitive edge, while new entrants are using health-centric formulations, artisanal positioning, and online marketing approaches to differentiate themselves. Strategic investments in capacity expansion, cold chain development, and quick commerce partnerships are helping brands tap new opportunities in tier-two and tier-three cities, where organized frozen dessert retail is gaining traction.

Some of the key players operative in the industry include:

- Creambell (RJ Corp.)

- Gelato Vinto

- Hindustan Unilever Limited

- Keventer Group

- Lazza Ice Cream

- Menchie’s India

- Vadilal Industries Limited

Recent Developments:

- In September 2025, MyFroyoLand launched India's first Acai Frozen Yogurt, introducing the superfood acai to the country. Known for its antioxidant-rich, immune-boosting, and energy-enhancing properties, this frozen yogurt combines the benefits of acai with creamy yogurt, offering a nutritious and delicious treat aligned with India's growing demand for health-conscious frozen desserts.

- In March 2024, Kedaara Capital invested in Dairy Classic Ice Creams Private Limited (Dairy Day), South India's leading ice cream brand, to accelerate growth. Operating in multiple states and serving over 50,000 retailers with diverse ice cream offerings, the strategic partnership will boost production capabilities while expanding retail distribution channels and improving brand recognition.

India Frozen Dessert Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Confectionaries & Candies, Ice Cream, Frozen Yogurt, Others |

| Categories Covered | Conventional, Sugar-free |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Café & Bakery Shops, Online, Others |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | Creambell (RJ Corp.), Gelato Vinto, Hindustan Unilever Limited, Keventer Group, Lazza Ice Cream, Menchie’s India, Vadilal Industries Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India frozen dessert market size was valued at INR 333.71 Billion in 2025.

The India frozen dessert market is expected to grow at a compound annual growth rate of 7.39% from 2026-2034 to reach INR 634.05 Billion by 2034.

Ice cream dominated the market with a share of 58%, owing to its widespread popularity across demographic segments, diverse format availability, and continuous flavor innovation by established domestic and international brands.

Key factors driving the India frozen dessert market include rapid urbanization and rising disposable incomes, expansion of cold chain infrastructure and organized retail networks, and increasing product innovation featuring health-conscious and premium offerings.

Major challenges include inadequate cold storage infrastructure in rural regions, high refrigerated transportation and operational costs, regulatory complexity regarding product classification, intense price competition from regional brands, and seasonal demand fluctuations affecting production planning.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)