India Fresh Cream Market Size, Share, Trends and Forecast by Application, Sales Channel, and Region, 2025-2033

India Fresh Cream Market Size and Share:

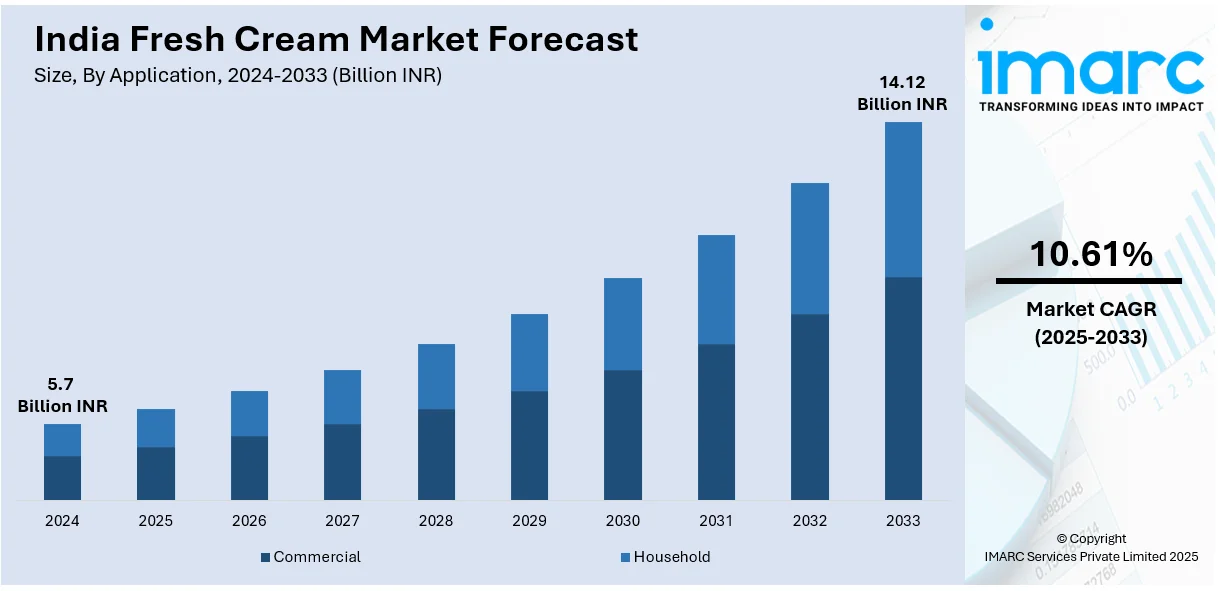

The India fresh cream market size was valued at 5.7 Billion INR in 2024. Looking forward, IMARC Group estimates the market to reach 14.12 Billion INR by 2033, exhibiting a CAGR of 10.61% from 2025-2033. The market is experiencing steady growth driven by an increasing demand from both household and commercial sectors. Expanding foodservice industries, innovative product offerings, and improved distribution networks further support market expansion, thus making fresh cream a staple in Indian culinary applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 5.7 Billion |

| Market Forecast in 2033 | INR 14.12 Billion |

| Market Growth Rate (2025-2033) | 10.61% |

Some of the key India fresh cream market trends include the increasing inclination toward convenience foods and changing dietary preferences among the urban consumers. Rising popularity of home baking and cooking have significantly enhanced the use of fresh cream in many culinary applications, such as desserts, gravies, and sauces. Western food trends are acting as another growth-inducing factor as they are intensifying the popularity of fresh cream within Indian households. This, coupled with the expanding foodservice industry comprising restaurants, cafes, and bakeries is also a significant driver in the fresh cream market in India. Premium dairy products continue to increase the India fresh cream market share supported by rising disposable incomes among urban consumers. For example, in 2023, the Union Minister of India projected that by 2050 India will have 850-900 million residents living in urban areas with 20-30 people migrating every minute. This rapid expansion in the urban population base is expected to drive the market growth further.

To get more information on this market, Request Sample

According to industry reports, in 2024, India has more than 500,000 different varieties of restaurants operating in the country. The entire number comprises stand-alone as well as chain store restaurants. Increasing requirement for quality high-grade dairy inputs for preparation of haute cuisine food items and also for confectionery products drives the market further. Increased distribution of fresh cream in smaller units and at affordable pricing and penetration towards rural markets broadened the client base. Manufacturers' efforts to innovate flavors and shelf life also contribute to market expansion.

India Fresh Cream Market Trends:

Expansion of Retail and E-Commerce Channels

The expansion of the retail and e-commerce channels has increased the access and availability of fresh cream all over India especially in tier-2 and tier-3 cities. Supermarkets and hypermarkets now allocate greater shelf space for fresh dairy products attracting diverse consumers with different options and shopping convenience. The ecommerce platforms have transformed distribution by offering doorstep delivery, attractive discounts, and subscription models to make fresh cream more accessible to households and foodservice businesses. According to industry reports, India's ecommerce market is projected to reach $325 billion by 2030 with 250 million online shoppers and 969 million internet users as of June 2024 and the global cross-border e-commerce is expected to grow to $800 billion by 2025. Improved cold-chain logistics have also enhanced the freshness of the products and the digital marketing campaigns by brands have increased awareness and demand in regions previously underserved. This multi-channel approach ensures consistent India fresh cream market growth.

Growth in Food Service and HoReCa Sector

The growth of the foodservice and HoReCa (Hotels, Restaurants and Catering) sector has significantly increased the demand for fresh cream driven by its versatile use in a variety of culinary and dessert applications. The rising demand for premium-quality ingredients and processed foods in the HoReCa sector has prompted significant investments by industry players. For instance, in January 2025, Food Service India Pvt. Ltd. announced its plans to invest up to ₹100 crore by 2028 to meet the growing demand for ready-to-cook and processed food in the HoReCa sector. As the hospitality industry expands, fueled by rising disposable incomes, urbanization and increased tourism the need for high-quality ingredients like fresh cream has surged. Fresh cream is essential in preparing soups, sauces, curries, and desserts, such as cakes, pastries, and mousses, making it a staple in HoReCa kitchens. The trend of premium dining experiences and innovative menu offerings has further boosted the consistent use of fresh cream. These developments are creating a positive India fresh cream market outlook by driving consistent demand across the HoReCa sector.

Growing Adoption of Western Cuisine

The increasing popularity of Western food in India has increased the use of fresh cream in everyday cooking. Pasta, soups, salads and baked products like cakes and pastries have become a common feature in many Indian homes due to the exposure of people to global food trends through social media, travel and food shows. Fresh cream is a versatile ingredient that adds texture and flavor to these dishes making it a favorite for home cooks and professional chefs alike. The proliferation of restaurants serving Western cuisine and the growth of ready-to-cook meal kits have also popularized fresh cream in Indian kitchens. According to the India fresh cream market forecast, the increasing adoption of Western culinary practices will continue to drive the demand for fresh cream with significant growth expected in both household and commercial applications further fueled by urbanization and evolving food preferences.

India Fresh Cream Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India fresh cream market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and sales channels.

Analysis by Application:

- Commercial

- Household

The commercial segment accounts for the largest share in the India fresh cream market primarily due to its wide usage in the foodservice industry such as restaurants, bakeries, cafes, and catering services. Fresh cream is an essential ingredient in the preparation of a wide range of gourmet dishes, desserts and beverages making it indispensable for commercial kitchens. The increasing popularity of dining out along with the growth of the foodservice sector has increased the India fresh cream market demand. The trend of including superior ingredients to improve the quality and also the presentation of the served dishes supports the dominance of this segment.

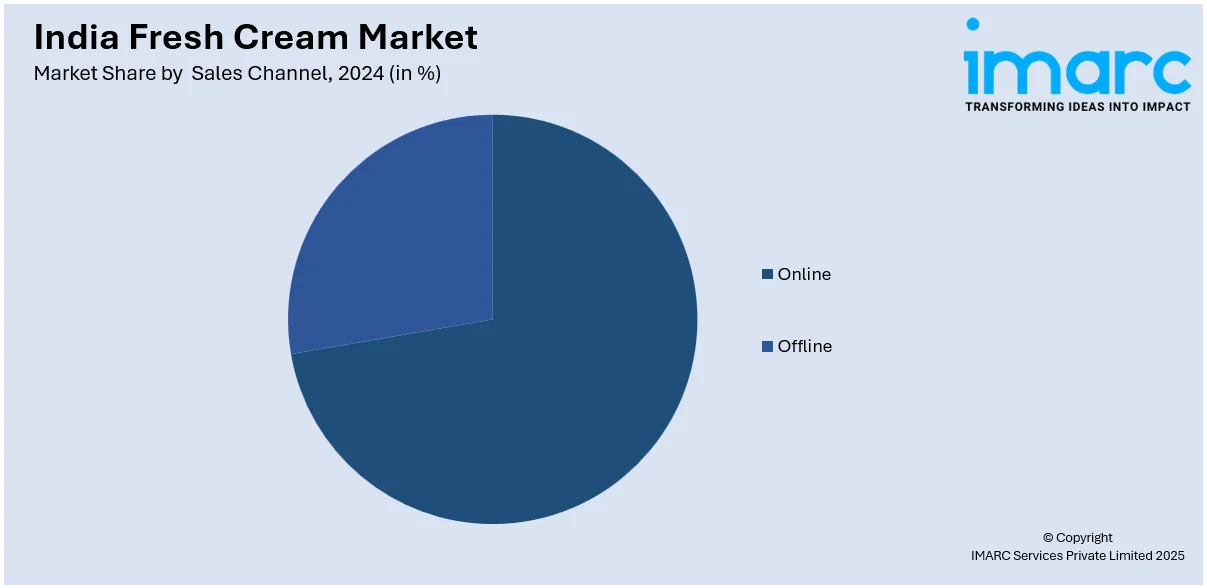

Analysis by Sales Channel:

- Online

- Offline

The offline segment held the largest market share in the India fresh cream market primarily due to the high presence of supermarkets, hypermarkets, and local retail stores. These outlets provide customers with the advantage of direct purchase and the opportunity to evaluate the quality of the product which increases consumer trust. The availability of fresh cream in most offline stores even in smaller towns and rural areas further sustains its market share. In-store sampling, discounts and promotions help to attract customers. Offline sales continue to remain more prominent due to easy access and existing networks for distributing products throughout India.

Regional Analysis:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Maharashtra emerged as the largest market for fresh cream in India due to its high population density and strong urbanization. The state is home to major metropolitan cities like Mumbai and Pune where the demand for fresh cream is boosted by a thriving foodservice industry of restaurants, cafes, and bakeries. Growing trends of home baking and an increasing demand for Western cuisines in urban households have further contributed to the market growth. Maharashtra has a well-established dairy industry and an effective distribution set-up to ensure the availability and consumption of fresh cream.

Competitive Landscape:

The India fresh cream market is highly competitive with numerous players vying for market share through product innovation, quality enhancement and strategic distribution. Companies are focusing on introducing diverse packaging sizes to cater to both household and commercial needs. The growing demand for premium and flavored fresh cream has encouraged innovation with players emphasizing improved shelf life and nutritional content. The proliferation of distribution channels such as offline retail stores and ecommerce platforms has increased competition. Advertisements and promotional activities are used to promote brands and create consumer loyalty. With changing consumer preferences market players are also spending more on research and development to develop products in line with new trends thus increasing competition further.

The report provides a comprehensive analysis of the competitive landscape in the India fresh cream market with detailed profiles of all major companies, including:

- G.K. Dairy & Milk Products Pvt. Ltd.

- GCMMF

- Kwality Limited

- Milky Mist Dairy Food Private Limited

- Parag Milk Foods Limited

- Shubham Foods Pvt. Ltd.

Latest News and Developments:

- In January 2025, Heritage Foods announced its plans to expand beyond South India. As a part of this expansion plan, it intends to add more value-added dairy products to its portfolio.

- In November 2024, the Ministry of Cooperation, Government of India (GoI) announced the launch of the White Revolution 2.0 initiative. This scheme aims to build upon the legacy of Operation Flood (India’s original White Revolution) while focusing on modernizing, expanding, and enhancing dairy cooperatives across the nation.

- In November 2024, the Ministry of Cooperation, Government of India (GoI) announced the launch of White Revolution 2.0 initiative. This scheme aims to build upon the legacy of Operation Flood (India’s original White Revolution) while focusing on modernizing, expanding, and enhancing dairy cooperatives across the nation.

- In October 2024, Kisanserv, a retail company dealing with fresh fruits and vegetables, announced its plans to expand its product line through a strategic partnership with Milky Mist, a dairy brand. This partnership allows Kisanserv to offer more than 200 stock-keeping units (SKUs) of premium dairy products, made from 100% cow’s milk, at its convenience retail stores in Mumbai and Pune.

- In September 2024, Amul Dairy announced its plans to invest Rs 1,000 crore in new plants at Chittoor (Andhra Pradesh), Pune, and Punjab. The Chittoor facility will process milk for southern states Pune will focus on ice-cream while Punjab will expand its dairy product range.

- In August 2023, the Punjab Chief Minister announced the launch of Verka Fruit Yogurt, One Litre Packing of Fresh Cream and Extended Shelf Life UHT milk, continuing with the commitment to strengthen the Cooperative Entities of the state. He further highlighted that to ensure safe and high-quality products for consumers, state-of-the-art infrastructure is being developed at Verka Dairy Mohali with an investment of Rs. 325 crore under JICA. This includes the establishment of a new milk processing unit with a capacity of 5 LLPD, along with facilities for value-added products such as 50 MTPD for curd, 4 MPTD for ghee, and 10 MPTD for butter.

India Fresh Cream Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Commercial, Household |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | G.K. Dairy & Milk Products Pvt. Ltd., GCMMF, Kwality Limited, Milky Mist Dairy Food Private Limited, Parag Milk Foods Limited, Shubham Foods Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fresh cream market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India fresh cream market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fresh cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fresh cream market was valued at 5.7 Billion INR in 2024.

Key drivers include the increasing demand from households and the HoReCa sector, the popularity of Western cuisine, rising disposable incomes, innovative product offerings, and the expansion of retail and e-commerce channels.

IMARC estimates the india fresh cream market to exhibit a CAGR of 10.61% during 2025-2033, reaching a value of USD 14.12 Billion INR by 2033.

The commercial segment accounted for the largest market share by application driven by the extensive use of fresh cream in restaurants, bakeries, cafes, and catering services.

Some of the kye players in the India fresh cream market include G.K. Dairy & Milk Products Pvt. Ltd., GCMMF, Kwality Limited, Milky Mist Dairy Food Private Limited, Parag Milk Foods Limited, Shubham Foods Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)