India Freight Transportation Market Size, Share, Trends and Forecast by Offering, Transport, End Use, and Region, 2025-2033

India Freight Transportation Market Overview:

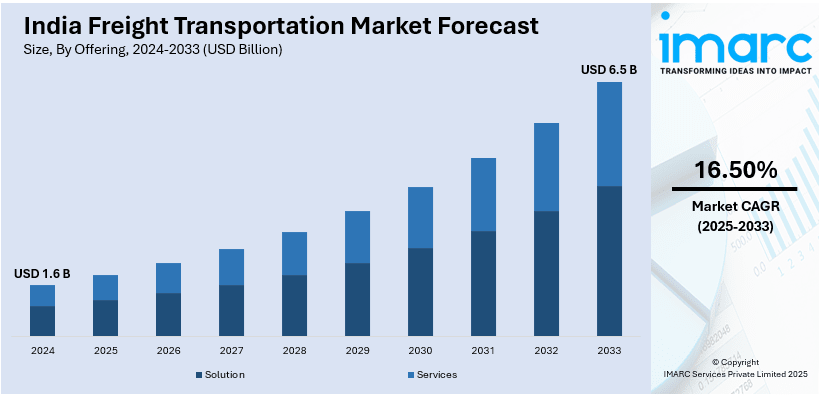

The India freight transportation market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.5 Billion by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033. The expanding e-commerce, government infrastructure projects, multimodal logistics adoption, and rising demand for efficient supply chains are propelling the India freight transportation market growth. Investments in road, rail, air, and maritime networks, along with digitalization and policy reforms, are enhancing operational efficiency and market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Market Growth Rate 2025-2033 | 16.50% |

India Freight Transportation Market Trends:

Rising Adoption of Digital Logistics Solutions

India freight transportation market share is expanding due to the significant shift toward digitalization, with logistics companies increasingly adopting advanced technologies such as AI, IoT, and blockchain. For instance, as per 2025 industry reports, India's swift digital transformation, which is being fueled by the country's strong economic growth and massive internet penetration, establishes it as a global leader in innovation. The article highlights how supply chain resilience and customer experiences may be improved through the integration of artificial intelligence (AI), highlighting the significance of data trust and sustainability in preserving competitiveness. Although precise figures are not given, the report predicts that these technical developments will greatly strengthen India's position in the global economy. These technologies enhance real-time tracking, route optimization, and fleet management, reducing transit delays and costs. The Indian government’s push for digitization through initiatives like e-way bills and the Unified Logistics Interface Platform (ULIP) is further driving this transformation. Moreover, startups and established players are investing in cloud-based freight management solutions to streamline operations. This trend is expected to improve efficiency, transparency, and cost-effectiveness across the freight transportation sector, making logistics smarter and more responsive.

To get more information on this market, Request Sample

Growth in Multimodal Transportation Infrastructure

The Indian freight transportation sector is experiencing rapid growth in multimodal logistics, integrating road, rail, air, and waterways for seamless cargo movement. The government's focus on projects like the Bharatmala and Sagarmala initiatives, as well as the expansion of Dedicated Freight Corridors (DFCs), is boosting multimodal connectivity. On August 2024, Indian Railways announced that its total freight loading for the fiscal year 2024–2025 was 653.22 million tonnes (MT), up from 634.68 MT in the same period the year before. The total amount of freight loaded in August 2024 was 126.97 MT. With 333.40 MT moved up to August 2024—more than the 266.71 MT transported by the same month in the previous fiscal year—coal transportation performed a major role. Investments in inland waterways and rail freight corridors are aimed at reducing logistics costs and transit times. Companies are increasingly adopting multimodal solutions to improve operational efficiency and sustainability. With growing demand for efficient freight movement, this trend is set to play a crucial role in India’s logistics sector expansion, which in turn is positively impacting India freight transportation market outlook.

India Freight Transportation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on offering, transport, and end use.

Offering Insights:

- Solution

- Freight Transportation Cost Management

- Freight Mobility Solution

- Freight Security and Monitoring System

- Freight Information Management System

- Fleet Tracking & Maintenance Solution

- Freight Operational Management Solutions

- Freight 3PL Solution

- Warehouse Management System

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solution (freight transportation cost management, freight mobility solution, freight security and monitoring system, freight information management system, fleet tracking & maintenance solution, freight operational management solutions, freight 3PL solution, and warehouse management system) and services.

Transport Insights:

- Roadways

- Railways

- Waterways

- Airways

A detailed breakup and analysis of the market based on the transport have also been provided in the report. This includes roadways, railways, waterways and airways.

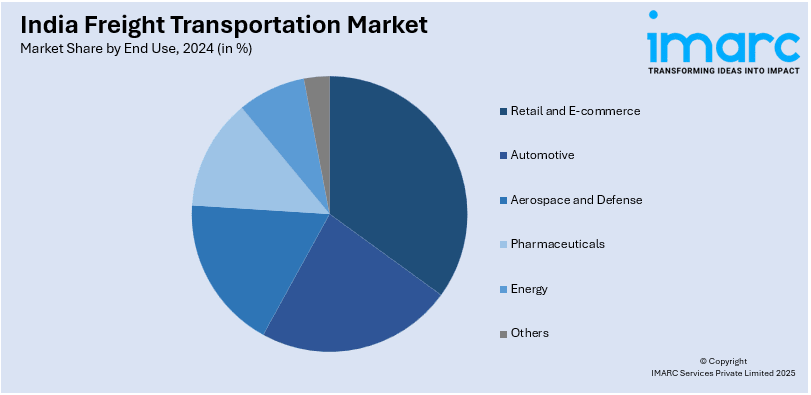

End Use Insights:

- Retail and E-commerce

- Automotive

- Aerospace and Defense

- Pharmaceuticals

- Energy

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes retail and e-commerce, automotive, aerospace and defense, pharmaceuticals, energy, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Freight Transportation Market News:

- 19 April 2024: Maersk has upgraded its ME2 service by adding port calls to Rotterdam, Felixstowe, and Bremerhaven, reducing transit times between Mumbai and North Europe by five to seven days. This enhancement benefits Indian exporters, particularly in the lifestyle and retail sectors, by providing faster access to key European markets.

India Freight Transportation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Transports Covered | Roadways, Railways, Waterways, Airway |

| End Uses Covered | Retail and E-commerce, Automotive, Aerospace and Defense, Pharmaceuticals, Energy, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India freight transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India freight transportation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India freight transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight transportation market in India was valued at USD 1.6 Billion in 2024.

The India freight transportation market is projected to exhibit a CAGR of 16.50% during 2025-2033, reaching a value of USD 6.5 Billion by 2033.

India’s freight transportation market benefits from booming e-commerce, industrial output, better highways, new logistics hubs, and dedicated freight routes. Policy support pushes modern warehousing and multimodal networks. Digital tools like fleet tracking and route planning improve delivery times. Growing cities and changing consumer habits add steady demand for goods movement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)