India Freight Forwarding Market Size, Share, Trends and Forecast by Mode of Transport, Customer Type, Service, Application, and Region, 2025-2033

India Freight Forwarding Market Overview:

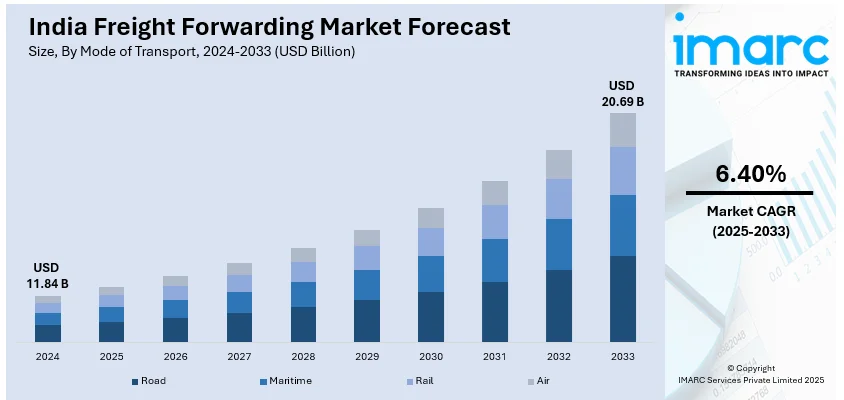

The India freight forwarding market size reached USD 11.84 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.69 Billion by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The market is expanding due to rising e-commerce demand, trade globalization, multimodal logistics adoption, and government infrastructure initiatives. Growth in manufacturing exports, digitalization in supply chains, increasing cold chain logistics, and demand for cost-effective transportation solutions further fuel market development, ensuring efficiency and scalability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.84 Billion |

| Market Forecast in 2033 | USD 20.69 Billion |

| Market Growth Rate (2025-2033) | 6.40% |

India Freight Forwarding Market Trends:

Digitalization and AI-Driven Supply Chain Optimization

India's freight forwarding sector is growing swiftly, fueled by e-commerce, which is expected to reach USD 350 Billion by 2030. Companies are enhancing global trade by adopting advanced technology for seamless logistics, customs handling, and efficient shipping. The industry is undergoing digital transformation, leveraging AI, blockchain, and IoT to enable real-time tracking, predictive analytics, and automated documentation. AI-driven route optimization and demand forecasting improve supply chain efficiency, while blockchain enhances data security. Digital freight platforms streamline bookings, making logistics more transparent and cost-effective.

To get more information on this market, Request Sample

Expansion of Multimodal Logistics and Warehousing Infrastructure

With growing domestic and international trade, India is witnessing a major shift towards multimodal logistics, integrating road, rail, air, and sea transport for cost-effective and time-efficient freight movement. Investments in dedicated freight corridors (DFCs), inland waterways, and modern warehousing facilities are enhancing connectivity and reducing transit times. The rise of third-party logistics (3PL) and fourth-party logistics (4PL) providers has streamlined supply chain operations by offering end-to-end freight management services. Government initiatives are also supporting the market growth. For instance, in December 2024, the Indian government launched the Jalvahak scheme to promote cargo movement via inland waterways, covering National Waterways 1, 2, and 16. The scheme offers up to 35% reimbursement on operating costs for cargo transported over 300 km and is valid for three years. Implemented by the Inland Waterways Authority of India (IWAI) and Inland & Coastal Shipping Ltd (ICSL), it aims to shift 800 million tonne-kilometres of cargo and attract ₹95.4 crore investment by 2027, decongesting roads and railways while enhancing sustainable freight transport. By incentivizing long-haul waterway cargo movement, the scheme supports freight forwarders, shipping firms, and trade bodies, strengthening India’s logistics and supply chain ecosystem.

Structural Transformation

India’s freight forwarding market is undergoing a structural transformation, driven by government initiatives to enhance domestic shipping capabilities and reduce reliance on foreign carriers. For instance, the establishment of Bharat Container Line, with 100 containerships under public-private participation, reflects a strategic push by the government to strengthen local shipping infrastructure. Supported by India’s USD 3 Billion maritime development fund, this move is expected to improve trade efficiency, lower logistics costs, and enhance supply chain resilience. Increased investment in port modernization, multimodal connectivity, and digital integration is fostering greater transparency and operational efficiency. These developments position India as a rising global logistics hub, benefiting exporters and freight forwarders by offering cost-effective, streamlined shipping solutions while reinforcing the country’s role in international trade.

India Freight Forwarding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on mode of transport, customer type, service, and application.

Mode of Transport Insights:

- Road

- Maritime

- Rail

- Air

A detailed breakup and analysis of the market based on the mode of transport have been provided in the report. This includes road, maritime, rail, and air.

Customer Type Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes B2B and B2C.

Service Insights:

- Transportation and Warehousing

- Value Added Services

- Packaging

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation and warehousing, value added services, packaging, and others.

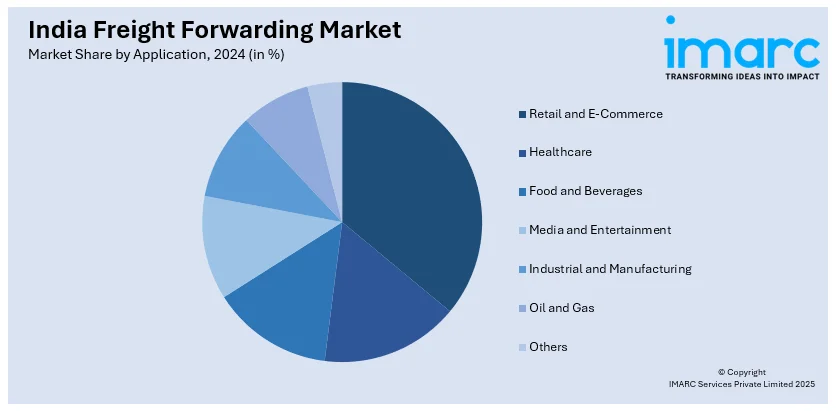

Application Insights:

- Retail and E-Commerce

- Healthcare

- Food and Beverages

- Media and Entertainment

- Industrial and Manufacturing

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail and e-commerce, healthcare, food and beverages, media and entertainment, industrial and manufacturing, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Freight Forwarding Market News:

- In January 2025, Yusen Logistics India signed a long-term lease with Macrotech Developers for a 200,000 sq ft built-to-suit warehouse at Palava Industrial and Logistics Park (LILP) near Mumbai. The five-year lease strengthens Yusen's national logistics network, supporting industries like e-commerce, automotive, and retail.

- In September 2024, Krishko Logistics rebranded and launched a new identity as part of its growth strategy. The Chennai-based freight forwarding company has expanded in air and ocean freight, customs brokerage, and supply chain management. It specializes in diplomatic cargo and perishable goods, including live shrimp seed exports. Krishko has integrated in-house customs brokerage services and weekly consolidation shipping. It is also investing in sustainability initiatives, including contributions to the "Plant A Billion Tree" campaign.

India Freight Forwarding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transports Covered | Road, Maritime, Rail, Air |

| Customer Types Covered | B2B, B2C |

| Services Covered | Transportation and Warehousing, Value Added Services, Packaging, Others |

| Applications Covered | Retail and E-Commerce, Healthcare, Food and Beverages, Media and Entertainment, Industrial and Manufacturing, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India freight forwarding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India freight forwarding market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India freight forwarding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India freight forwarding market was valued at USD 11.84 Billion in 2024.

The India freight forwarding market is projected to exhibit a CAGR of 6.40% during 2025-2033, reaching a value of USD 20.69 Billion by 2033.

The key factors driving the India freight forwarding market include the rise in e-commerce demand, trade globalization, adoption of multimodal logistics, and government infrastructure initiatives. These drivers, along with digitalization in supply chains and increased cold chain logistics, ensure efficient and scalable market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)