India Freeze Dried Fruits Market Size, Share, Trends and Forecast by Nature, Product Type, Form, Fruit Type, Distribution Channel, End User, and Region, 2025-2033

India Freeze Dried Fruits Market Overview:

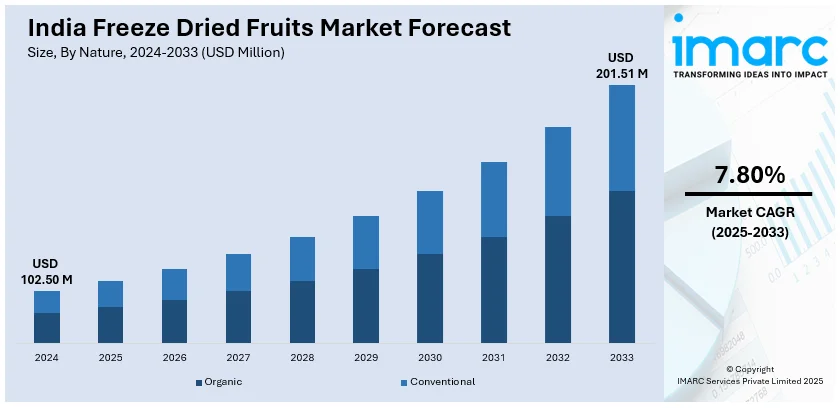

The India freeze dried fruits market size reached USD 102.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 201.51 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is expanding due to rising demand for healthy snacks, increasing consumer preference for long shelf-life products, and growing awareness of nutrient retention in freeze-drying technology. Factors such as urbanization, expanding e-commerce distribution, premiumization of food products, and rising disposable incomes are further propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 102.50 Million |

| Market Forecast in 2033 | USD 201.51 Million |

| Market Growth Rate (2025-2033) | 7.80% |

India Freeze Dried Fruits Market Trends:

Rising Demand for Nutrient-Rich, Shelf-Stable Snacks

Health-conscious consumers are increasingly shifting toward freeze-dried fruits as a nutritious alternative to conventional snacks. This trend is particularly strong among urban consumers, fitness enthusiasts, and working professionals seeking convenient, on-the-go snacks without added sugars or preservatives. For instance, in June 2024, the Moon Store expanded its freeze-dried fruit range to include mango and strawberry, offering a nutritious, preservative-free snacking option with a two-year shelf life. These ready-to-eat fruit cubes provide essential vitamins, antioxidants, and fiber, supporting immunity, digestion, and skin health. The versatile snacks can be enjoyed on-the-go, in cereals, yogurt, or smoothies. Additionally, the demand for organic and clean-label products is influencing brands to offer additive-free, non-GMO, and sustainably sourced freeze-dried fruit options. The convenience of lightweight packaging and extended shelf life makes these products attractive for travelers, athletes, and meal-prep consumers. As awareness of functional foods and superfoods increases, freeze-dried berries, tropical fruits, and citrus fruits are gaining traction in premium health-focused food categories.

To get more information on this market, Request Sample

Expansion in E-Commerce and Premium Retail Channels

The growing digital penetration in India has significantly expanded the availability of freeze-dried fruits through e-commerce platforms. For instance, as per the data by the Ministry of Communication, Government of India (GoI), India witnessed significant rise in digital penetration, with over 954.40 million internet subscribers in 2024, representing a large portion of the population. Online marketplaces, direct-to-consumer (DTC) brands, and quick commerce are making these products accessible to a wider audience. Premium retail chains and modern supermarkets are also showcasing freeze-dried fruit assortments in health food aisles, targeting affluent consumers and international product adopters. Additionally, the market is witnessing increased investments in branding, influencer marketing, and digital campaigns to educate consumers about the benefits of freeze-dried fruit over conventional dried fruit or dehydrated snacks. Subscription-based models and customizable bulk purchasing are further fueling consumer retention and brand loyalty. This omnichannel retail strategy is strengthening market penetration and driving category expansion in India.

Integration of Freeze-Dried Fruits in Functional and Packaged Foods

The incorporation of freeze-dried fruits into breakfast cereals, smoothie powders, yogurt, confectionery, and bakery products is becoming a major growth driver. Food manufacturers and beverage brands are leveraging the vibrant color, intense flavor, and extended shelf life of freeze-dried fruit powders and pieces in nutrient-dense formulations. For instance, in August 2024, the Indian Institute of Horticultural Research (IIHR) developed a cost-effective freeze-dried dragon fruit powder, enhancing affordability and accessibility. This innovation retains the fruit’s nutrients, flavor, and shelf life, making it ideal for health-conscious consumers and the food industry. The powder offers versatility in beverages, bakery products, and functional foods, aligning with India’s growing demand for nutrient-rich, natural food ingredients. The rising functional foods and plant-based diet trends are further encouraging the use of freeze-dried fruits in protein bars, meal replacements, and dairy-free products. The demand for natural food colorants and clean-label ingredients is pushing R&D investments in freeze-dried fruit-based functional blends. As consumers seek fortified foods with antioxidants, vitamins, and fiber, brands are innovating with value-added freeze-dried fruit formulations, positioning them as a premium and health-conscious food ingredient in India.

India Freeze Dried Fruits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on nature, product type, form, fruit type, distribution channel, and end user.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have been provided in the report. This includes organic and conventional.

Product Type Insights:

- Whole

- Diced

- Powdered/Granulated

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes whole, diced, and powdered/granulated.

Form Insights:

- Powders and Granules

- Chunks and Pieces

- Flakes

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powders and granules, chunks and pieces, and flakes.

Fruit Type Insights:

- Berries

- Strawberry

- Raspberry

- Blueberry

- Cranberry

- Others

- Exotic and Tropical Fruits

- Mango

- Papaya

- Apply

- Guava

- Banana

- Cantaloupe

- Orchard and Citrus Fruits

- Kiwi

- Pear

- Peach

- Lemon

- Orange

- Grapefruits

- Others

A detailed breakup and analysis of the market based on the fruit type have also been provided in the report. This includes berries (strawberry, raspberry, blueberry, cranberry, others), exotic and tropical fruits (mango, papaya, apple, guava, banana, cantaloupe), and orchard and citrus fruits (kiwi, pear, peach, lemon, orange, grapefruit) and others.

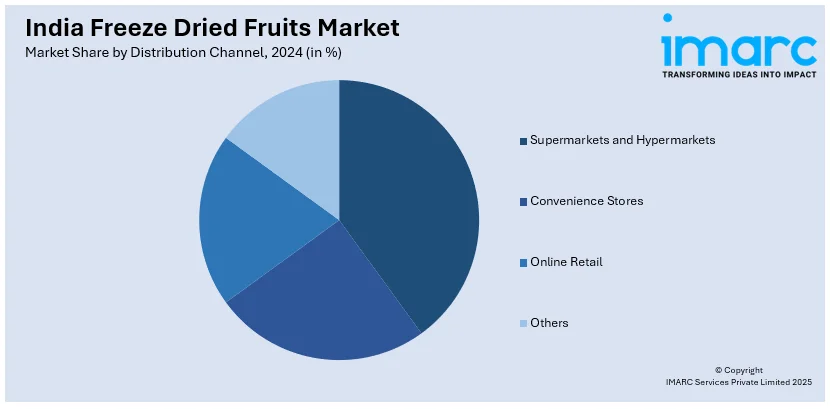

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online retail, and others.

End User Insights:

- Food and Beverage Products

- Breakfast Cereals

- Dairy Products

- Bakery and Confectionery

- Nutritional Bars and Supplements

- Powdered Beverages

- Snacks

- Retail

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage products (breakfast cereals, dairy products, bakery and confectionery, nutritional bars and supplements, powdered beverages, and snacks) and retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Freeze Dried Fruits Market News:

- In December 2024, Sahyadri Farms, India’s largest climate-smart horticulture platform, raised ₹390 crore from responsAbility, GEF Capital, and existing investors. The funds will expand climate-resilient crops and enhance processing capacities for freeze-dried, aseptic, IQF, and juice concentrates.

India Freeze Dried Fruits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Nature Covered | Organic, Conventional |

| Product Types Covered | Whole, Diced, Powdered/Granulated |

| Forms Covered | Powders and Granules, Chunks And Pieces, Flakes |

| Fruit Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India freeze dried fruits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India freeze dried fruits market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India freeze dried fruits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India freeze-dried fruits market was valued at USD 102.50 Million in 2024.

The India freeze-dried fruits market is projected to exhibit a CAGR of 7.80% during 2025-2033, reaching a value of USD 201.51 Million by 2033.

The freeze-dried fruits market in India is driven by rising health awareness, demand for convenient snacks, and growing use in cereals, smoothies, and bakery products. E-commerce growth, urbanization, and higher disposable incomes support market expansion. Technological advances and government initiatives also boost local production and supply chain efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)