India Fraud Detection and Prevention Market Size, Share, Trends and Forecast by Component, Application, Organization Size, Vertical, and Region, 2025-2033

Market Overview:

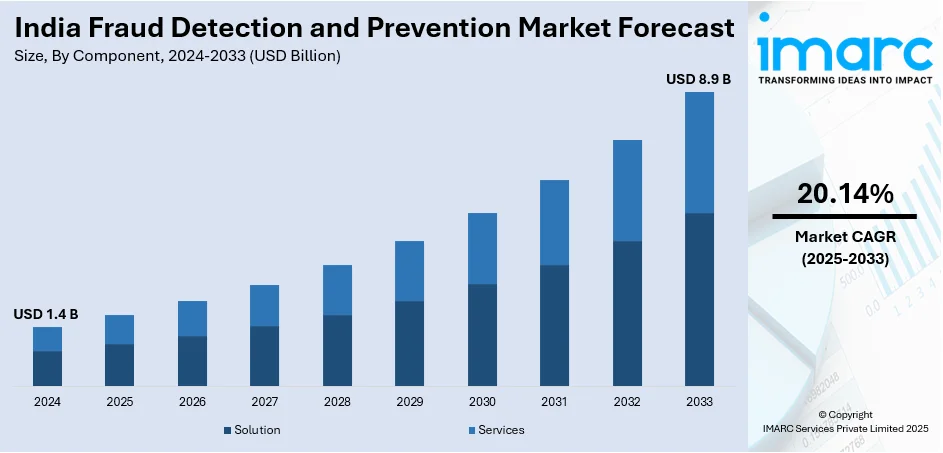

India fraud detection and prevention market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.9 Billion by 2033, exhibiting a growth rate (CAGR) of 20.14% during 2025-2033. The rising number of fraudulent activities, on account of the widespread adoption of online platforms for banking, e-commerce, and other financial services, is propelling the need for advanced solutions for detection and prevention, which is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 8.9 Billion |

| Market Growth Rate (2025-2033) | 20.14% |

Fraud detection and prevention encompass a range of automated solutions that empower organizations to identify and take necessary actions to prevent fraudulent activities. These approaches heavily leverage statistical data analysis methods and artificial intelligence (AI) to expedite the detection of fraud and swiftly process transactions. Integration with cutting-edge technologies enhances these solutions, enabling the retrieval of unlawfully acquired resources and mitigating the impact of scams. Consequently, these tools find extensive application in various organizations, enhancing operational efficiency and ensuring the security of financial and network systems.

To get more information on this market, Request Sample

India Fraud Detection and Prevention Market Trends:

The India fraud detection and prevention market have witnessed significant growth and evolution in recent years, driven by the increasing digitalization of financial transactions and the need for robust security measures. One of the key factors is the rapid adoption of artificial intelligence (AI) and machine learning (ML) technologies. Moreover, regulatory initiatives and compliance requirements have heightened the demand for sophisticated fraud prevention solutions in India. Financial institutions are increasingly investing in comprehensive fraud detection systems to ensure compliance with regulatory frameworks and protect their customers' sensitive information. Besides this, the India fraud detection and prevention market also benefit from the integration of biometric authentication and multi-factor authentication methods. These technologies add an additional layer of security, making it more challenging for fraudsters to exploit vulnerabilities in the system. Furthermore, there is a growing emphasis on real-time fraud detection capabilities, which is acting as another significant growth-inducing factor. The integration of adaptive analytics, anomaly detection, and behavioral analysis further strengthens the fraud prevention landscape in India. In conclusion, the India fraud detection and prevention market is dynamic and responsive to the evolving landscape of digital transactions. Apart from this, with various technological advancements, regulatory compliance, and a proactive approach to security, the market across the country is poised for sustained growth in the foreseeable future.

India Fraud Detection and Prevention Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, application, organization size, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

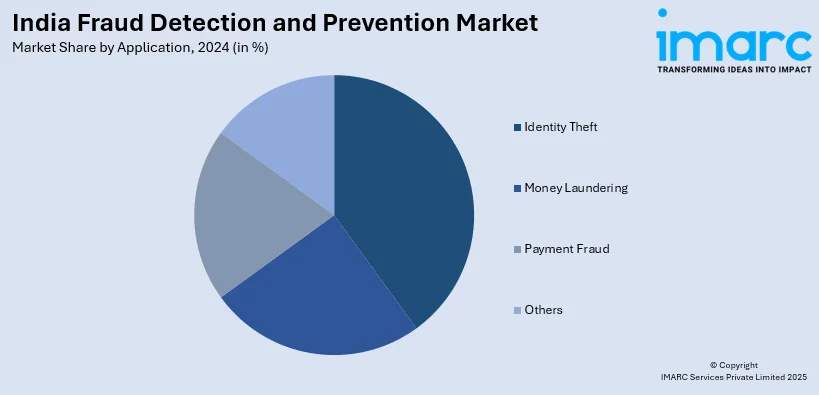

Application Insights:

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

A detailed breakup and analysis of the market based on application have also been provided in the report. This includes identity theft, money laundering, payment fraud, and others.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on vertical have also been provided in the report. This includes BFSI, government and defense, healthcare, IT and telecom, manufacturing, retail and e-commerce, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include the North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fraud Detection and Prevention Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Applications Covered | Identity Theft, Money Laundering, Payment Fraud, Others |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare, IT and Telecom, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fraud detection and prevention market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fraud detection and prevention market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fraud detection and prevention industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fraud detection and prevention market in India was valued at USD 1.4 Billion in 2024.

The India fraud detection and prevention market is projected to exhibit a CAGR of 20.14% during 2025-2033, reaching a value of USD 8.9 Billion by 2033.

Key drivers include rising digital transactions, increased cyber threats, and regulatory requirements for financial transparency. Rapid adoption of AI and machine learning in banking and e-commerce sectors enhances fraud monitoring. Businesses are also investing in real-time risk management systems to strengthen operational security.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)