India Foundry and Casting Market Size, Share, Trends and Forecast by Casting Type, Manufacturing Process, End Use Industry, and Region, 2026-2034

India Foundry and Casting Market Overview:

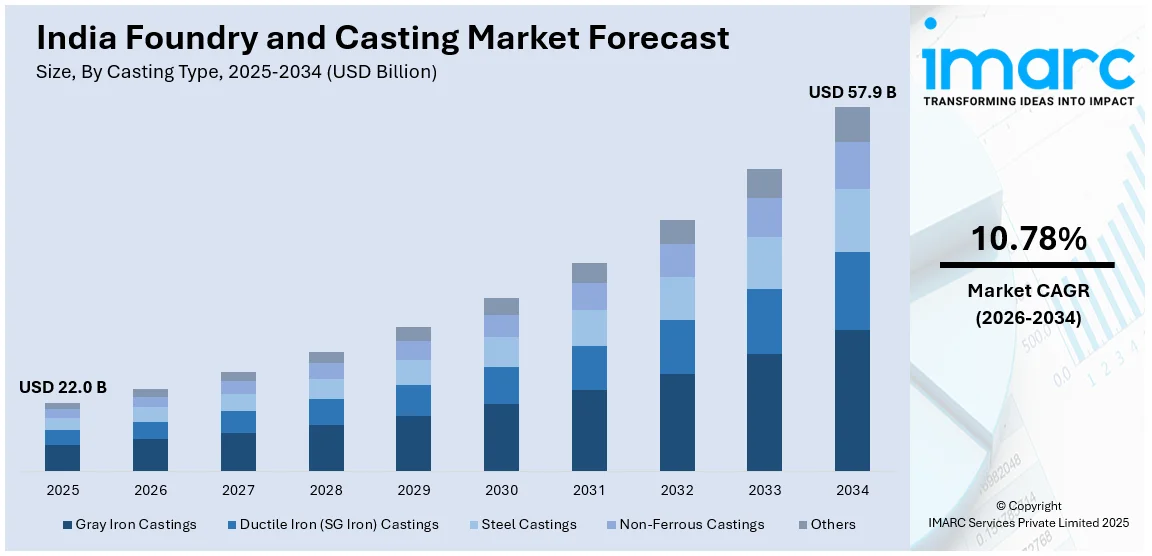

The India foundry and casting market size reached USD 22.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 57.9 Billion by 2034, exhibiting a growth rate (CAGR) of 10.78% during 2026-2034. The market is fueled by growing infrastructure development, expansion in the automotive industry, accelerating demand for machinery parts, government policies such as "Make in India," technological advancements in manufacturing, and growing exports. Industrialization, urbanization, and investment in renewable energy projects also increase market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22.0 Billion |

| Market Forecast in 2034 | USD 57.9 Billion |

| Market Growth Rate 2026-2034 | 10.78% |

India Foundry and Casting Market Trends:

Technological Advancements in Casting Processes

Indian foundry and casting sector is going through rapid technology transformation with automation, simulation tools, and sophisticated robotics being applied. Computer-aided design (CAD) and computer-aided manufacturing (CAM) systems make processes more efficient by reducing defects and increasing accuracy in casting. Furthermore, application of 3D printing technology to form patterns and mold production helps reduce product development time. Adoption of advanced melting and molding technology enhances efficiency as well as saves material wastage. These technologies result in enhanced quality, faster production, and enhanced competitiveness in both local and international markets. With the momentum for intelligent manufacturing with Industry 4.0 on the go, Indian foundries are embracing data analytics and predictive maintenance tools, making processes even more streamlined and reducing downtime. For instance, in July 2024, SMG Group acquired Hunter Foundry Machinery Corporation, a leading global manufacturer specializing in matchplate moulding machines, mould handling equipment, and sand casting technology.

To get more information on this market Request Sample

Growth in Automotive and Construction Sectors

The expansion of the automotive and construction industries remains a major growth driver for India’s foundry and casting market. Rising vehicle production, driven by increased consumer demand and the shift towards electric vehicles (EVs), has accelerated the need for high-quality cast components. Automotive manufacturers rely heavily on cast parts such as engine blocks, transmission housings, and brake components. Simultaneously, infrastructure projects, including highways, railways, airports, and housing developments, are fueling demand for structural and machinery castings. Government programs like the National Infrastructure Pipeline (NIP) and Pradhan Mantri Awas Yojana (PMAY) are further stimulating the construction sector. This heightened demand ensures continued growth opportunities for foundries specializing in iron, steel, and non-ferrous metal castings. For instance, as per industry reports, India produces 12 million MT of castings annually and is projected to reach a market value of USD 25 Billion by 2025, with growth primarily fueled by demand from the automotive and construction sectors. The focus on Lost Foam Casting (LFC), used for 30% of die-cast components, aligns with the automotive industry's move toward lighter, more fuel-efficient vehicles.

India Foundry and Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on casting type, manufacturing process, and end use industry.

Casting Type Insights:

- Gray Iron Castings

- Ductile Iron (SG Iron) Castings

- Steel Castings

- Non-Ferrous Castings

- Others

The report has provided a detailed breakup and analysis of the market based on the casting type. This includes gray iron castings, ductile iron (SG Iron) castings, steel castings, non-ferrous castings, and others.

Manufacturing Process Insights:

- Sand Casting

- Investment Casting

- Die Casting

- Centrifugal Casting

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes sand casting, investment casting, die casting, centrifugal casting, and others.

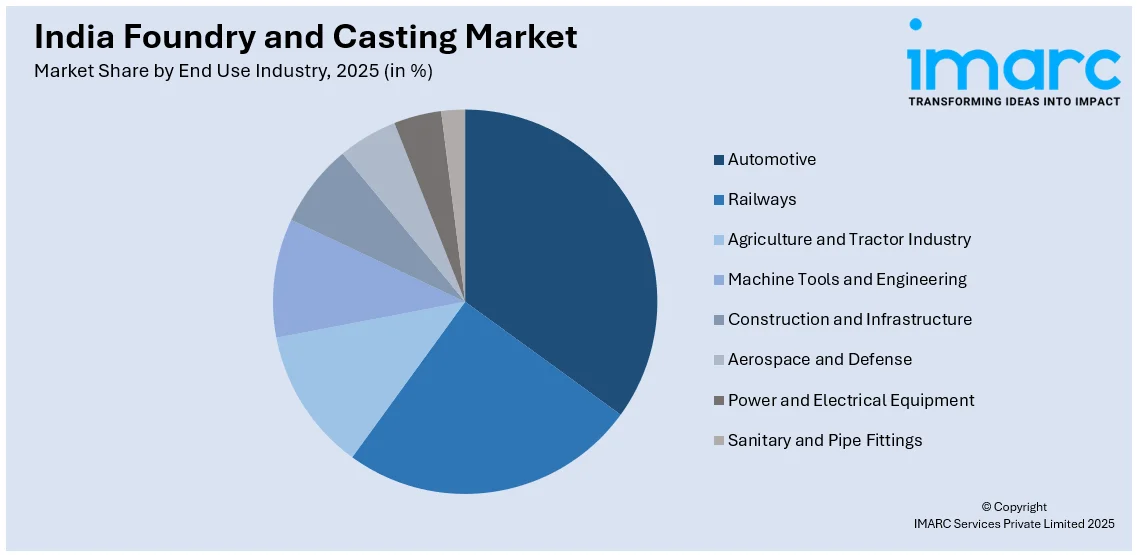

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Railways

- Agriculture and Tractor Industry

- Machine Tools and Engineering

- Construction and Infrastructure

- Aerospace and Defense

- Power and Electrical Equipment

- Sanitary and Pipe Fittings

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, railways, agriculture and tractor industry, machine tools and engineering, construction and infrastructure, aerospace and defense, power and electrical equipment, and sanitary and pipe fittings.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Foundry and Casting Market News:

- In July 2024, Meson Valves India Limited acquired a majority stake in Milindpra Castings Private Limited for ₹70,330. This acquisition enhances Meson’s presence in the metal casting sector.

- In December 2024, JS Auto Cast Foundry, a subsidiary of Bharat Forge, announced plans to invest ₹67.5 crore to expand its Perundurai unit near Erode, Tamil Nadu. The expansion will increase its annual production capacity of grey and SG iron castings by over 60%, from 72,000 tonnes to 116,000 tonnes. This move is expected to strengthen the company’s market position and meet rising demand in the casting sector.

India Foundry and Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Casting Types Covered | Gray Iron Castings, Ductile Iron (SG Iron) Castings, Steel Castings, Non-Ferrous Castings, Others |

| Manufacturing Processes Covered | Sand Casting, Investment Casting, Die Casting, Centrifugal Casting, Others |

| End Use Industries Covered | Automotive, Railways, Agriculture and Tractor Industry, Machine Tools and Engineering, Construction and Infrastructure, Aerospace and Defense, Power and Electrical Equipment, Sanitary and Pipe Fittings |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India foundry and casting market performed so far and how will it perform in the coming years?

- What is the breakup of the India foundry and casting market on the basis of casting type?

- What is the breakup of the India foundry and casting market on the basis of manufacturing process?

- What is the breakup of the India foundry and casting market on the basis of end use industry?

- What are the various stages in the value chain of the India foundry and casting market?

- What are the key driving factors and challenges in the India foundry and casting market?

- What is the structure of the India foundry and casting market and who are the key players?

- What is the degree of competition in the India foundry and casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India foundry and casting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India foundry and casting market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India foundry and casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)