India Forklift Trucks Market Size, Share, Trends and Forecast by Product Type, Technology, Class, Application, and Region, 2025-2033

India Forklift Trucks Market Overview:

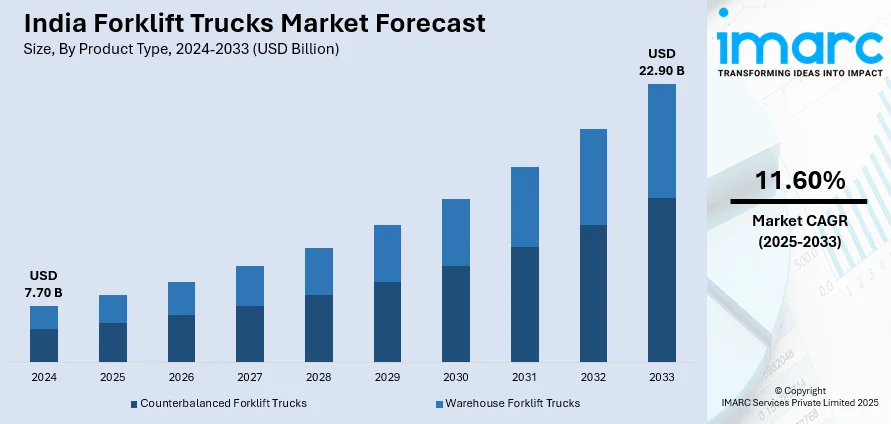

The India forklift trucks market size reached USD 7.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.90 Billion by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. The market is driven by the rapid growth of e-commerce, expanding warehousing and logistics infrastructure, and increasing industrialization. Additionally, the shift towards electric forklifts due to environmental regulations, cost efficiency, and advancements in automation and smart technologies are key factors propelling the India forklift trucks market share, catering to changing industry demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.70 Billion |

| Market Forecast in 2033 | USD 22.90 Billion |

| Market Growth Rate 2025-2033 | 11.60% |

India Forklift Trucks Market Trends:

Rising Demand for Electric Forklift Trucks

The significant shift towards electric forklift trucks, driven by the growing emphasis on sustainability and energy efficiency is majorly driving the India forklift trucks market growth. With more stringent environmental regulations and a growing number of companies aiming for sustainability targets, many businesses are replacing their traditional internal combustion engine (ICE) models with electric alternatives. The forklift benefits from lower operating costs, reduced carbon emissions, and quieter operation than internal combustion types, making electric forklifts suitable for use in indoor settings, such as warehouses, manufacturing plants, and e-commerce distribution centers. In addition, governmental programs that support clean energy and reward the use of green equipment are helping this trend grow by leaps and bounds. The rise of the e-commerce sector in India, coupled with the expansion of logistics and warehousing infrastructure, has also contributed to the rise in demand for electric forklifts. A research report from the IMARC Group indicates that the e-commerce market in India achieved a size of USD 107.7 Billion in 2024. It is projected to expand to USD 650.4 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 19.70% from 2025 to 2033. As battery technology continues to advance, offering longer life and faster charging, electric forklifts are expected to dominate the market in the coming years.

To get more information on this market, Request Sample

Integration of Automation and Smart Technologies

The growing integration of automation and smart technologies, driven by the need for enhanced operational efficiency and productivity is creating a positive India forklift trucks market outlook. Automated guided vehicles (AGVs) and forklifts equipped with IoT (Internet of Things) sensors are gaining traction, enabling real-time monitoring, predictive maintenance, and data-driven decision-making. These technologies help businesses optimize warehouse operations, reduce downtime, and improve safety. The adoption of Industry 4.0 practices in manufacturing and logistics is further fueling this trend. As artificial intelligence and machine learning account for 40% of total manufacturing spending by 2025, up from 20% in 2021, India's transition to Industry 4.0 is already underway. Moreover, the industrial automation market is expected to hit USD 29.43 Billion by 2029. The automotive, electronics, and pharmaceutical industries are turning into advanced technologies to drive greater efficiency, reduce downtime, and enhance productivity. With India's march towards smart manufacturing, the demand for intelligent forklift trucks is increasing in parallel with factories automating material handling processes and reducing operational costs through digitalization. Moreover, the increasing demand for customized forklift solutions tailored to specific industry requirements is propelling lifting equipment manufacturers to make significant investments and add advanced features, including AI-driven navigation and telematics. With the modernization of India's industrial and logistics sector, the demand for intelligent, automated forklifts is likely to grow, making a new mark on market dynamics and creating the bar of efficiency and performance.

India Forklift Trucks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, technology, class, and application.

Product Type Insights:

- Counterbalanced Forklift Trucks

- Warehouse Forklift Trucks

The report has provided a detailed breakup and analysis of the market based on the product type. This includes counterbalanced forklift trucks and warehouse forklift trucks.

Technology Insights:

- Electricity Powered

- Internal Combustion Engine Powered

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electricity powered and internal combustion engine powered.

Class Insights:

- Class I

- Class II

- Class III

- Class IV

- Class V

The report has provided a detailed breakup and analysis of the market based on the class. This includes class I, class II, class III, class IV, and class V.

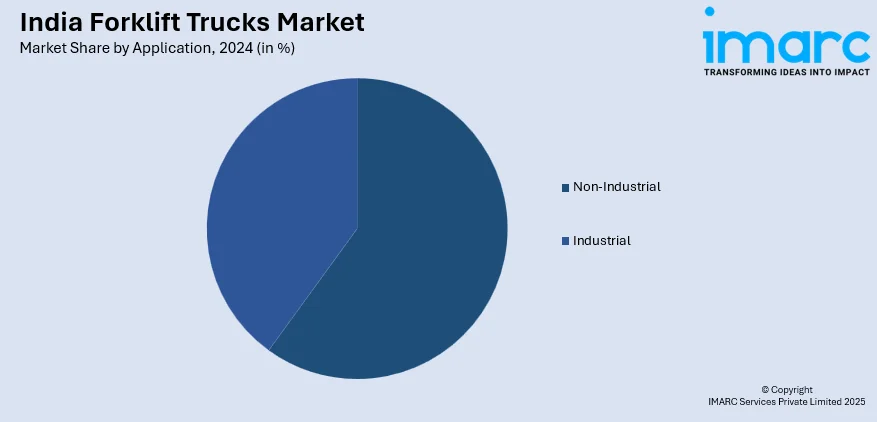

Application Insights:

- Non-Industrial

- Warehouse and Distribution Centers

- Construction Sites

- Dockyards

- Snow Plows

- Industrial

- Manufacturing

- Recycling Operations

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-industrial (warehouse and distribution centers, construction sites, dockyards, and snow plows), and industrial (manufacturing and recycling operations).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forklift Trucks Market News:

- August 23, 2024: Hikrobot launched the QF-1000 Forklift Latent Mobile Robot at the Automation Expo in Mumbai in 2024, catering to the growing demand for an intelligent forklift truck Market in India. Designed for pallet management in low-floor, narrow-aisle environments, the QF-1000 improves movement speed by 25% and meets all 360° safety requirements. As India accelerates its smart manufacturing initiatives, the demand for automated forklifts, such as the QF-1000, is expected to increase in tandem with the adoption of Industry 4.0.

- August 22, 2024: Godrej & Boyce launched India's first lithium-ion powered forklift trucks, designed and developed in India with an indigenous battery management system. These trucks are capable of racking up 5,000 charge cycles, more than quadruple the ability of now obsolete lead-acid batteries. 30% of these components are localized now, and the plan is to have it fully localized by next year. The new forklifts are designed to deliver up to 15% more runtime, 30% energy savings, and a fast charging time of just 2.5 hours. This is one of the enormous milestones being accomplished in the field of forklift trucks in India, bolstering India's stride towards its electrification and self-reliance machine-making mores.

India Forklift Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Counterbalanced Forklift Trucks, Warehouse Forklift Trucks |

| Technologies Covered | Electricity Powered, Internal Combustion Engine Powered |

| Classes Covered | Class I, Class II, Class III, Class IV, Class V |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forklift trucks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India forklift trucks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forklift trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forklift trucks market in India was valued at USD 7.70 Billion in 2024.

The India forklift trucks market is projected to exhibit a CAGR of 11.60% during 2025-2033, reaching a value of USD 22.90 Billion by 2033.

The India forklift trucks market is expanding due to rapid industrial growth, rising e-commerce and warehousing needs, and increased automation. Adoption spans logistics, manufacturing, and retail. Additionally, supportive policies, affordable financing options, and a growing focus on operational efficiency are further accelerating demand for these vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)