India Foot and Ankle Devices Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Foot and Ankle Devices Market Overview:

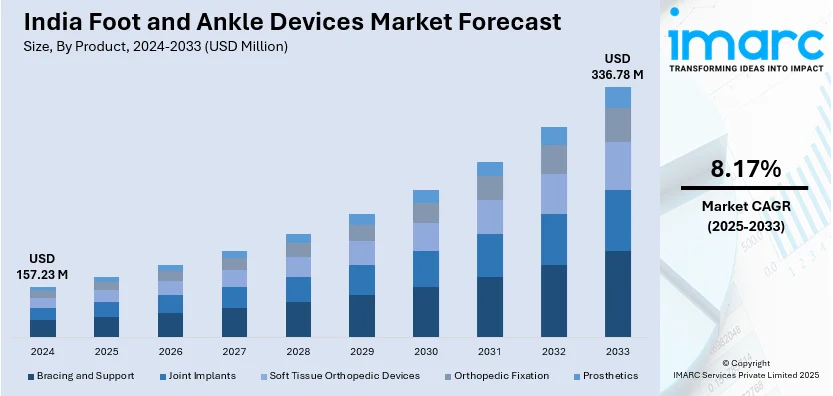

The India foot and ankle devices market size reached USD 157.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 336.78 Million by 2033, exhibiting a growth rate (CAGR) of 8.17% during 2025-2033. The rising sports injuries, increasing cases of arthritis and diabetes-related foot complications, advancements in orthopedic implants, escalating awareness about minimally invasive surgeries (MIS), and government initiatives to improve orthopedic care are aiding in market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 157.23 Million |

| Market Forecast in 2033 | USD 336.78 Million |

| Market Growth Rate 2025-2033 | 8.17% |

India Foot and Ankle Devices Market Trends:

Increasing Adoption of 3D-Printed Orthopedic Implants

One of the major trends influencing the India foot and ankle devices market is the growing use of 3D-printed orthopedic implants. 3D printing technology enables patient-specific implants, which improves surgery results and reduces recuperation time. Traditional foot and ankle implants are frequently available in standard sizes, however, 3D printing allows for the creation of personalized implants that are matched to a patient's anatomy. This decreases issues such as implant rejection and misalignment, resulting in improved post-operative outcomes. Furthermore, continued developments in local manufacturing and government programs encouraging the Make in India initiative are driving down costs. The cost of patient-specific implants has dropped by approximately 30% over the previous five years, making them more affordable. In addition, India is seeing an increase in foot and ankle procedures owing to rising sports injuries, arthritis, and diabetic foot issues. The frequency of ankle replacement procedures in India is predicted to increase by 15% every year, further pushing demand for sophisticated implants.

To get more information on this market, Request Sample

Rising Popularity of Minimally Invasive Surgeries (MIS) for Foot and Ankle Conditions

Minimally invasive surgery (MIS) techniques are transforming the foot and ankle devices market in India by offering reduced pain, minimal scarring, and faster recovery times compared to traditional open surgeries. Arthroscopic surgeries for foot and ankle conditions, such as ligament repairs, ankle fractures, and bunion corrections, have gained significant traction. The use of arthroscopic procedures in India has increased by 25% between 2023 and 2025, reflecting a shift toward less invasive interventions. Furthermore, with India's elderly population expected to reach 192 million by 2030, age-related foot and ankle disorders, such as osteoarthritis and fractures, are increasing. Minimally invasive techniques, which need fewer hospital stays and decrease infection risks, are becoming the preferred treatment option. In addition, the advancement of robotic-assisted MIS procedures and improved imaging equipment is increasing the popularity of minimally invasive foot and ankle operations. These developments are transforming India's foot and ankle device industry, enhancing patient outcomes and propelling market growth.

India Foot and Ankle Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Bracing and Support

- Joint Implants

- Soft Tissue Orthopedic Devices

- Orthopedic Fixation

- Prosthetics

The report has provided a detailed breakup and analysis of the market based on the product. This includes bracing and support, joint implants, soft tissue orthopedic devices, orthopedic fixation, and prosthetics.

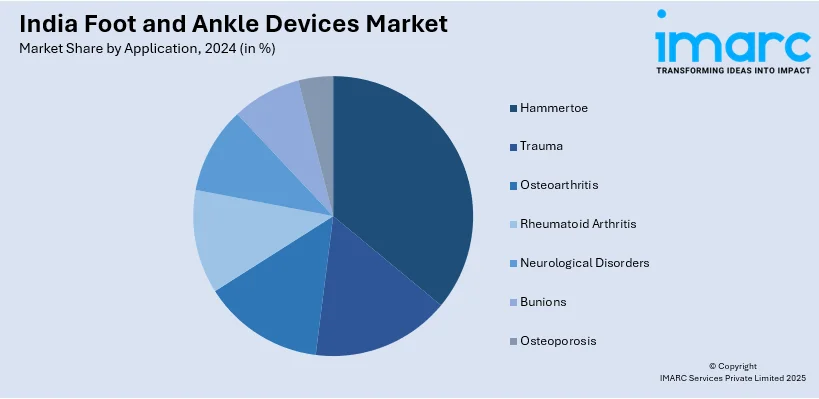

Application Insights:

- Hammertoe

- Trauma

- Osteoarthritis

- Rheumatoid Arthritis

- Neurological Disorders

- Bunions

- Osteoporosis

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hammertoe, trauma, osteoarthritis, rheumatoid arthritis, neurological disorders, bunions, and osteoporosis.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Foot and Ankle Devices Market News:

- December 2024: Gurvinder Singh, a 41-year-old mechanical engineer, developed the 'Phoenix Foot' to help amputee military personnel who experience discomfort using artificial limbs. The product, developed with the assistance of doctors and experts at the Artificial Limb Centre (ALC) in Pune, provides natural ankle movements with shock-absorption capability, assisting in knee and hip relief even during long physical work.

- November 2024: The Bengaluru Science and Technology (BeST) cluster at IISc expanded its digital podiatry clinic (D-PoC) model to improve early screening of diabetic foot disorders. The D-PoC aims to assist doctors in screening patients' feet and predicting their likelihood of developing diabetic foot complications, such as ulcers and peripheral neuropathy.

India Foot and Ankle Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bracing and Support, Joint Implants, Soft Tissue Orthopedic Devices, Orthopedic Fixation, Prosthetics |

| Applications Covered | Hammertoe, Trauma, Osteoarthritis, Rheumatoid Arthritis, Neurological Disorders, Bunions, Osteoporosis |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India foot and ankle devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India foot and ankle devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India foot and ankle devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India foot and ankle devices market was valued at USD 157.23 Million in 2024.

The India foot and ankle devices market is projected to exhibit a CAGR of 8.17% during 2025-2033, reaching a value of USD 336.78 Million by 2033.

The India foot and ankle devices market is driven by increasing diabetic foot issues, sports and trauma injuries, and age-related orthopedic conditions. Demand is rising for minimally invasive procedures, advanced solutions such as 3D-printed implants and smart orthotics, and improved healthcare infrastructure, awareness, and access.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)