India Food Service Market Size, Share, Trends and Forecast by Sector, Systems, Type of Restaurants, and Region, 2025-2033

India Food Service Market 2024, Size and Trends:

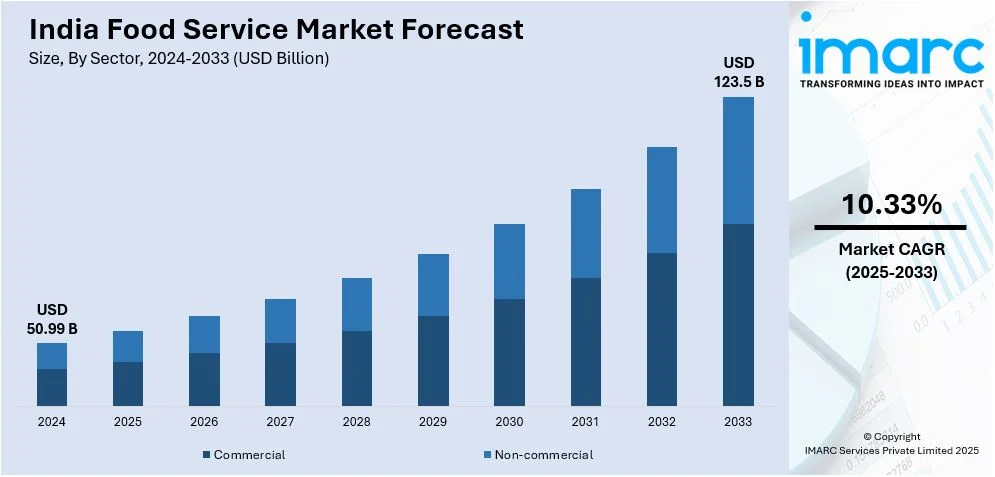

The India food service market size was valued at USD 50.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 123.5 Billion by 2033, exhibiting a CAGR of 10.33% from 2025-2033. The India food service market share is fueled by urbanization, higher disposable incomes, a rising inclination for eating out, the growth of quick-service restaurants (QSRs), and the impact of global food trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.99 Billion |

|

Market Forecast in 2033

|

USD 123.5 Billion |

| Market Growth Rate (2025-2033) | 10.33% |

The Indian food service market growth is witnessing substantial expansion, propelled by a combination of socioeconomic and cultural influences. Rapid urban growth and the rise of nuclear families in cities have resulted in more hectic lifestyles, driving an increase in the need for convenient dining choices away from home. According to industry reports, 600 million individuals are expected to reside in urban areas by 2036. This change is additionally backed by rising disposable incomes, especially within the millennial and Gen Z groups, who are more willing to invest in varied food experiences. The increasing impact of Western culture, along with globalization, has brought diverse international cuisines, driving India food service market demand.

To get more information on this market, Request Sample

Moreover, the increasing presence of organized retail and dining chains, along with assertive marketing tactics and loyalty initiatives, has greatly improved consumer involvement. Trends in health and wellness significantly influence the India food service market outlook, as rising consumer interest in healthier and organic food choices compels food service providers to refresh their menus. Additionally, government programs like "Make in India" and supportive regulations for the food processing and hospitality industries have attracted investments, enhancing market growth. The pandemic also accelerated a move towards cloud kitchens and contactless dining, further expanding the market. In general, the food service market in India is flourishing because of a vibrant mix of changing consumer preferences, technological progress, and favorable economic policies, establishing it as a key growth driver for the nation's hospitality industry.

India Food Service Market Trends:

Rising demand for experiential dining

In India, consumers are progressively looking for distinctive and unforgettable dining experiences, leading to a trend in experiential dining concepts. Dining establishments are integrating themed decor, live performances, chef-designed menus, and hands-on meal preparation to boost customer involvement. Social media has heightened this trend, as diners frequently select locations for their visual and experiential attraction to post on platforms such as Instagram. The emphasis on atmosphere and tailored service especially attracts the younger and urban crowd, who value entertainment and leisure in addition to their dining experiences. Both fine dining restaurants and casual eateries are embracing this trend to remain competitive, thereby transforming the India foodservice market trends.

Emergence of cloud kitchens

Cloud kitchens, also popularly referred to as ghost kitchens or virtual kitchens, are considered to be an emerging trend which is changing India's food service industry. According to the IMARC Group, India cloud kitchen market is expected to reach US$ 2,948 Million by 2032. In a cloud kitchen, dine-in facilities are missing, allowing owners to dedicate entirely to online orders and reduce their overheads since there are no physical restaurants involved. This phenomenon has seen food delivery platforms Swiggy and Zomato significantly fuel growth in this category. The Cloud Kitchen caters to the ever-evolving demand for convenience and affordability, hence extremely popular among working professionals and urban households. Furthermore, this type of kitchen allows businesses to experiment with a variety of cuisines and brands under a single operational setup to maximize profitability, thereby creating a positive India foodservice market outlook.

Focus on regional and indigenous cuisines

As consumers cultivate a deeper appreciation for their culinary traditions, there is an increasing demand for regional and indigenous cuisines throughout India’s food service industry. Restaurateurs are progressively integrating traditional recipes, local produce, and cooking methods to deliver genuine regional experiences. This trend is especially noticeable in the increase of specialty restaurants that emphasize states such as Kerala, Rajasthan, Bengal, and the Northeast. These venues appeal to both local and international patrons seeking culturally enriching dining experiences. Moreover, the "vocal for local" initiative has boosted enthusiasm for local cuisines, as chefs and entrepreneurs highlight obscure dishes from rural and tribal populations. This emphasis on native cuisines not only appeals to the nostalgia and cultural pride of Indian consumers but also enriches the food service market, further strengthening the India food service market share.

India Food Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India food service market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector, systems, and type of restaurants.

Analysis by Sector:

- Commercial

- Non-commercial

Commercial dominates the market, holding 77.8% of the market share, on account of growing demand from businesses, offices, and institutions such as hotels, restaurants, QSRs, and catering services. It benefits through a large and diverse consumers comprising professionals, workers, and tourists searching for convenience, quick meals, and affordable dines. Commercial food service establishments have experienced growth due to rapid urbanization, higher disposable incomes, and a shift toward dining out. Furthermore, growth in delivery platforms and cloud kitchens has continued to propel the commercial segment's leadership in the market.

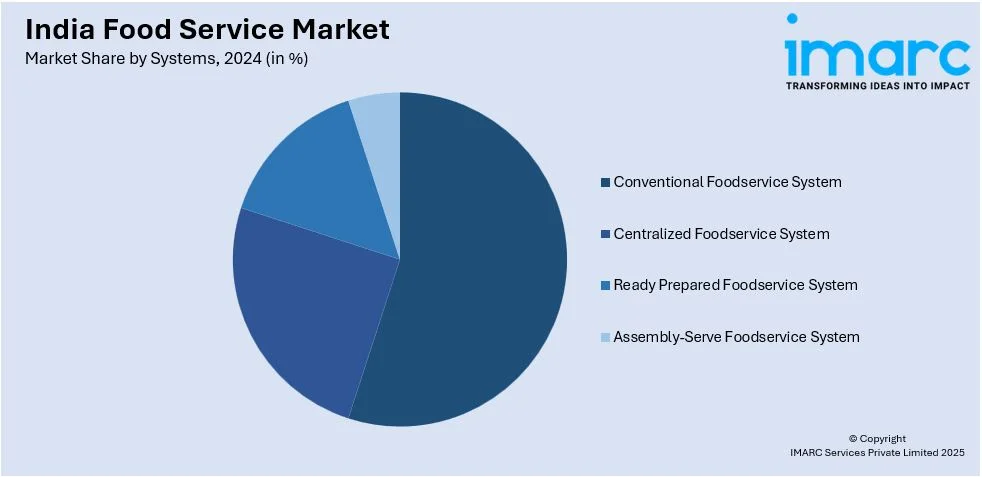

Analysis by Systems:

- Conventional Foodservice System

- Centralized Foodservice System

- Ready Prepared Foodservice System

- Assembly-Serve Foodservice System

Conventional food service system holds the largest, holding 44.4% of the India foodservice market share on account of its extensive use in different sectors, such as restaurants, cafeterias, and catering providers. This system provides adaptability in menu creation, enabling the preparation of fresh food customized to suit customer tastes. It offers improved management of food quality, portion sizes, and expenses, making it a favored option for companies looking to uphold a customized dining experience. Moreover, the system accommodates conventional cooking techniques and onsite food preparation, guaranteeing uniform flavor and quality that attracts consumers. Its versatility across various cuisines and operational levels further reinforces its market supremacy.

Analysis by Type of Restaurants:

- Fast Food Restaurants

- Full-Service Restaurants

- Limited Service Restaurants

- Special Food Services Restaurants

Full-service restaurants lead the Indian food service market with over 49.8% of market shares by systems as they can deliver an all-encompassing dining experience, blending top-notch food, tailored service, and a pleasant atmosphere. These venues serve a broad range of people, such as families, business professionals, and social events, making them a popular option for various occasions. Increasing disposable incomes and urbanization have additionally driven consumer demand for sit-down meals that provide convenience and luxury. Moreover, full-service restaurants gain from their flexibility, offering various cuisines and dining experiences that attract India’s culturally rich and food-oriented populace, thereby securing ongoing expansion.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and Central India represent the maximum number of shares, with 44.9% of market shareson account of various factors such as high urbanization, considerable disposable incomes, and a broad, diverse consumer population. Cities such as Mumbai, Pune, Ahmedabad, and Indore serve as economic centers with a vibrant middle class and a significant presence of both national and global dining establishments. Moreover, these areas enjoy strong infrastructure, increasing retail networks, and rising tourism, all of which enhance the need for a variety of dining choices. The existence of large corporate offices and a youthful, employed demographic boosts the demand for fast-food and casual dining venues in these locations.

Competitive Landscape:

Major participants in the India food service market are implementing various strategic initiatives to stimulate growth and address changing consumer preferences. Numerous individuals are concentrating on increasing their presence in tier-2 and tier-3 cities, capitalizing on the expanding middle-class population in these areas. Players are significantly investing in technology, including sophisticated point-of-sale systems, cloud kitchens, and food delivery applications, to improve convenience and customer satisfaction. To meet the rising demand for healthier choices, numerous chains are updating their menus to feature organic, low-calorie, and plant-based options, in line with global food movements. Moreover, collaborations with food delivery services such as Swiggy and Zomato enable food service providers to connect with a broader audience and enhance efficiency.

The report provides a comprehensive analysis of the competitive landscape in the India food service market with detailed profiles of all major companies.

Latest News and Developments:

- 22 February 2024: Prime Minister Modi has set the ambitious target of making GCMMF, the owner of the Amul brand, the number one dairy company in the world. India's dairy sector is growing at a faster rate than the global average, with Amul currently ranking as the eighth largest dairy company worldwide.

- 8 January 2025: Swiggy has launched the Snacc app for 10-15 minutes of food delivery, offering fast food, in Bengaluru. The rapid food delivery segment has seen increased competition with the entry of new services from established companies like Zomato and startups like Blinkit and Zepto Cafe.

- 10 November 2024: Zomato's new Food Rescue feature allows users to purchase canceled orders at a discounted price, reducing food wastage and benefiting both customers and restaurants. The feature is limited to customers within a 3 km radius of the delivery partner, with a short window of time to claim the canceled order to ensure freshness.

- 4 September 2024: McDonald's India has collaborated with CSIR-CFTRI to introduce burgers with a multi-millet bun, sourced directly from farmers, to offer improved nutritional value and a unique dining experience. The collaboration marks the first-ever initiative in the QSR space to combine CSIR-CFTRI's expertise with McDonald's focus on developing nutritious food options, demonstrating their commitment to leading in this area.

- 10 April 2023: Barista Coffee aims to reach 500 stores in the next two years, with a strategic expansion plan across the country. The recent opening of the 350th outlet in Udaipur reflects the company's focus on connecting with a larger community and expanding into tourist destinations.

- 28 February 2023: Rebel Foods has acquired the master franchise rights to expand Wendy's presence in India through both traditional restaurants and cloud kitchens, demonstrating a strategic commitment to hyper-scale the brand.

India Food Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Commercial, Non-Commercial |

| Systems Covered | Conventional Foodservice System, Centralized foodservice System, Ready Prepared Foodservice System, Assembly-Serve Foodservice System |

| Type of Restaurants Covered |

Fast Food Restaurants, Full-Service Restaurants, Limited Service Restaurants, Special Food Services Restaurants |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India food service market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India food service market was valued at USD 50.99 Billion in 2024.

IMARC estimates the India food service market to exhibit a CAGR of 10.33% during 2025-2033, reaching a value of USD 123.5 Billion by 2033.

The India food service market is driven by rising inflating income levels, rapid urbanization, growing consumer preference for dining out, expanding quick-service restaurants, and increasing influence of digital platforms and delivery services.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, wherein West and Central India currently dominates the market, driven by rapid urbanization, higher disposable incomes, diverse dining preferences, and the presence of metropolitan hubs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)