India Food Pathogen Testing Market Size, Share, Trends and Forecast by Type, Food Type, Technology, and Region, 2025-2033

India Food Pathogen Testing Market Overview:

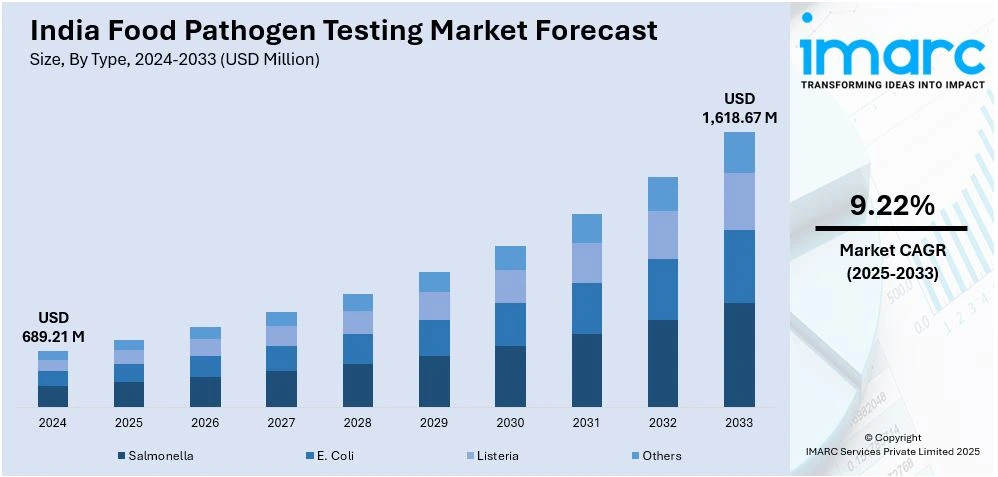

The India food pathogen testing market size reached USD 689.21 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,618.67 Million by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. The market is driven by rising foodborne illness cases, stringent food safety regulations, growing processed food demand, increasing consumer awareness, ongoing advancements in testing technologies, expanding food exports, and the presence of global food safety certification requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 689.21 Million |

| Market Forecast in 2033 | USD 1,618.67 Million |

| Market Growth Rate 2025-2033 | 9.22% |

India Food Pathogen Testing Market Trends:

Growing Adoption of Rapid and Advanced Testing Technologies

The rising adoption of advanced testing technologies, including polymerase chain reaction (PCR), immunoassays, and biosensors, is boosting the India food pathogen testing market share. These modern methods deliver rapidly accurate results better than traditional culture-based techniques which helps food producers identify contaminants faster. Moreover, the rising requirements of the Food Safety and Standards Authority of India (FSSAI) and consumer interest in clean-label and minimal processing drive businesses to implement high-throughput automated testing systems. For instance, the Food Safety and Standards Authority of India (FSSAI) launched the RAFT portal, a digital platform designed to streamline the approval process for rapid food testing kits. This initiative aims to expedite the deployment of advanced testing technologies, including PCR and immunoassays, enhancing the efficiency of food pathogen detection across the country. Besides this, real-time monitoring tools used in food production facilities are increasing in number because they help stop contamination before it starts. Also, the demand for exporting food internationally is expanding the requirement for fast pathogen detection methods to meet global food safety requirements. Furthermore, the rising consumer expectation of food transparency and traceability is encouraging food producers to implement cutting-edge technologies to ensure product safety while defending their brand reputation, thereby enhancing the India food pathogen testing market outlook.

To get more information on this market, Request Sample

Rising Demand for Outsourced Food Testing Services

The growing demand for outsourced food pathogen testing services in India is driven by stricter food safety regulations and manufacturers' need to lower costs, significantly boosting the country's food pathogen testing market growth. In line with this, small and medium-sized enterprises (SMEs), along with many other organizations, often lack internal facilities and specialized knowledge to perform complete pathogen testing. To address this gap, the Union Food Processing Minister announced plans to set up 100 food testing laboratories and 50 food irradiation centers to enhance processing levels and ensure product quality across India. This initiative aims to support manufacturers, especially SMEs, by providing accessible testing facilities. Concurrently, third-party food testing laboratories are expanding rapidly because they provide accredited bacterial testing solutions for Salmonella, Listeria, and E. coli. In confluence with this, the focus from regulatory bodies such as FSSAI and the Agricultural and Processed Food Products Export Development Authority (APEDA) on certified testing labs is also driving the increasing trend of outsourcing. Furthermore, the global food companies doing business in India choose independent testing services to fulfill their domestic regulations and international standards. As a result, the growth of e-commerce food platforms and cloud kitchens created more demand for third-party testing because online food businesses need to fulfill strict safety guidelines to protect consumer trust and prevent legal problems.

India Food Pathogen Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, food type and technology.

Type Insights:

- Salmonella

- E. Coli

- Listeria

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes salmonella, E.coli, listeria, and others.

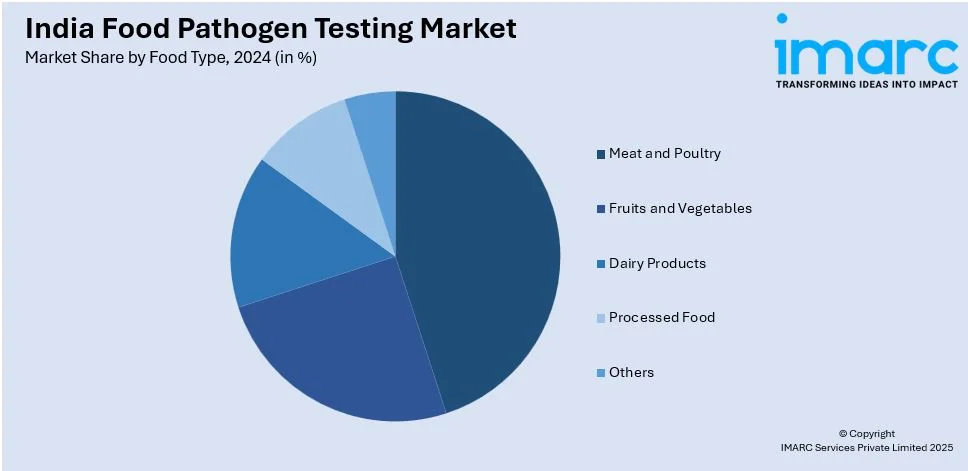

Food Type Insights:

- Meat and Poultry

- Fruits and Vegetables

- Dairy Products

- Processed Food

- Others

A detailed breakup and analysis of the market based on the food type have also been provided in the report. This includes meat and poultry, fruits and vegetables, dairy products, processed food, and others.

Technology Insights:

- Rapid Technology

- Traditional Technology

The report has provided a detailed breakup and analysis of the market based on the technology. This includes rapid technology and traditional technology.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Pathogen Testing Market News:

- In February 2024, EpiLogic partnered with Tentamus India to enhance fungicide resistance monitoring. Using advanced detection techniques, the collaboration improves treatment effectiveness, reduces pathogen contamination risks, and strengthens food safety, ensuring safer production and boosting consumer confidence in food quality.

- In February 2024, PM Modi inaugurated a microbiology lab and 17 Food Safety on Wheels vehicles in Assam. It is developed by FSSAI, to enhance food testing, training, and public awareness, further improving pathogen detection and food safety infrastructure across the state.

India Food Pathogen Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Salmonella, E.Coli, Listeria, Others |

| Food Types Covered | Meat and Poultry, Fruits and Vegetables, Dairy Products, Processed Food, Others |

| Technologies Covered | Rapid Technology, Traditional Technology |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food pathogen testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food pathogen testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food pathogen testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India food pathogen testing market was valued at USD 689.21 Million in 2024.

The India food pathogen testing market is projected to exhibit a CAGR of 9.22% during 2025-2033, reaching a value of USD 1,618.67 Million by 2033.

The India food pathogen testing market is driven by rising food safety concerns, stringent government regulations, and increasing outbreaks of foodborne illnesses. Growing processed food industry, consumer awareness, and demand for quality assurance also fuel growth. Technological advancements in testing methods further support market expansion across manufacturing and food service sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)