India Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033

India Food Packaging Market Size and Share:

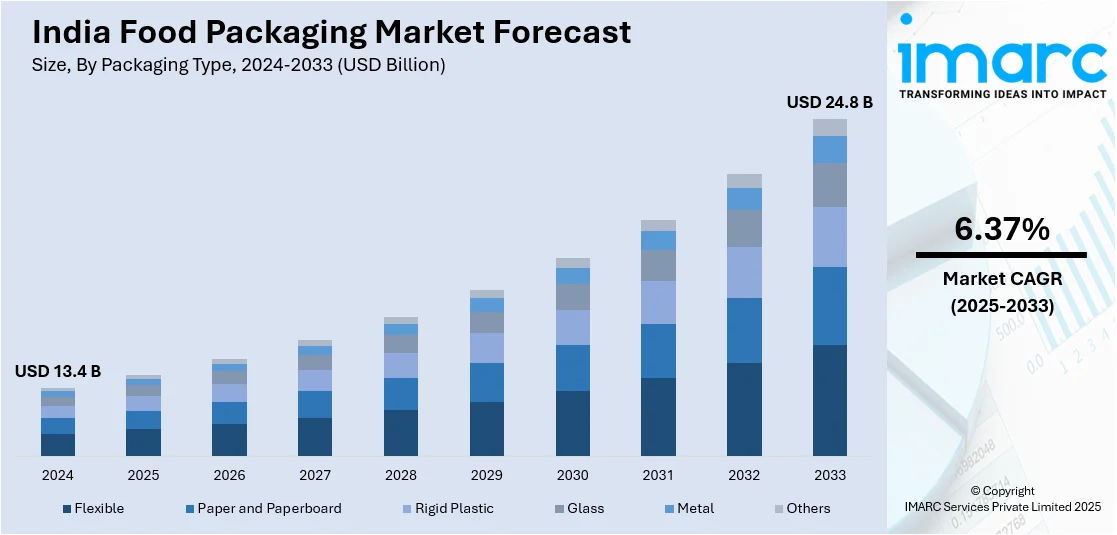

The India Food Packaging market size reached USD 13.4 Billion in 2024. The market is expected to reach USD 24.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The market growth is attributed to the considerable rise of online retailing and e-commerce. Additionally, the steady rise in demand for packaging materials ensuring the safe transportation and delivery of food products is prompting the development of protective and secure packaging solutions.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of packaging type, the market has been divided into flexible, paper and paperboard, rigid plastic, glass, metal, and others.

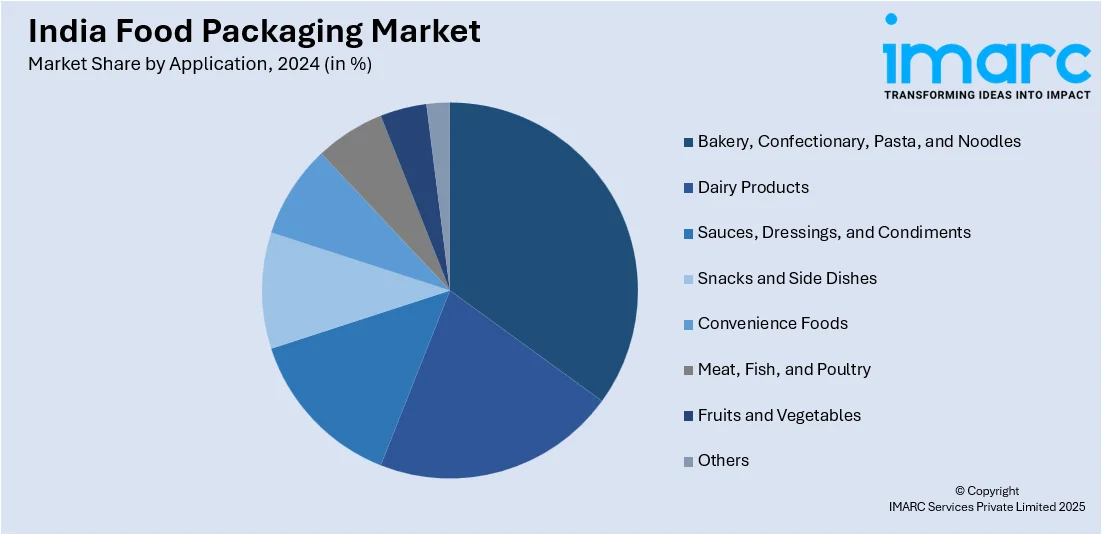

- On the basis of application, the market has been divided into bakery, confectionary, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others.

Market Size and Forecast:

- Base Year Market Size (2024): USD 13.4 Billion

- Forecast Year Market Size (2033): USD 24.8 Billion

- CAGR (2025-2033): 6.37%

Food packaging is a crucial aspect of the food industry that involves the design, production, and use of containers and materials to protect, preserve, and distribute food products. The primary goals of food packaging are to ensure the safety and quality of the food, extend its shelf life, and provide information to consumers. Packaging serves as a barrier against external elements like air, moisture, and contaminants, preventing spoilage and maintaining freshness. Additionally, it facilitates transportation, storage, and handling while also serving as a means of marketing and branding. Modern food packaging employs a variety of materials, including plastics, paper, metal, and glass, each chosen based on its compatibility with the food product and environmental considerations. Sustainable and eco-friendly packaging options are gaining prominence to address environmental concerns in the food industry.

To get more information on this market, Request Sample

The food packaging market in India is experiencing robust growth, driven by various factors that collectively underscore its significance in the economy. Firstly, heightened consumer awareness regarding food safety and hygiene has propelled the demand for advanced packaging solutions. Consequently, stringent regulations governing food safety have prompted manufacturers to invest in innovative packaging technologies to meet compliance standards. Moreover, the escalating demand for convenience foods, coupled with changing lifestyles, has fueled the need for packaging that not only ensures product freshness but also offers ease of use. In addition to these factors, the increasing prevalence of e-commerce has significantly contributed to the expansion of the food packaging market. The surge in online grocery shopping has necessitated packaging solutions that are not only protective but also visually appealing, as packaging serves as a virtual storefront in the digital realm. Furthermore, sustainability concerns have emerged as a prominent driver, with eco-conscious consumers demanding environmentally friendly packaging materials and solutions. In response, manufacturers are increasingly adopting recyclable and biodegradable materials to align with evolving consumer preferences and address the growing importance of corporate social responsibility. In summary, the food packaging market in India is intricately connected to evolving consumer behaviors, regulatory landscapes, technological advancements, and environmental considerations, making it a dynamic and rapidly evolving industry.

India Food Packaging Market Trends:

Smart Packaging Technologies and Innovations

Smart packaging technologies are transforming the India food packaging landscape since they do incorporate advanced features for improving product safety, traceability, and also consumer engagement. These revolutionary solutions show temperature, detect freshness, use QR codes, and tag with RFID to give real-time details about product quality and authenticity. Smart packaging is adopted as consumers want food safety assurances and transparency more often. Indian manufacturers are incorporating intelligent packaging systems that can detect spoilage, monitor storage conditions, and provide interactive experiences through mobile applications. These technologies not only extend shelf life but also reduce food waste by providing accurate information about product freshness. The India food packaging market share in smart packaging is expanding rapidly as companies recognize the competitive advantage of offering technologically advanced solutions. Major food brands are investing in smart packaging to differentiate their products and build consumer trust, while packaging manufacturers are developing cost-effective smart solutions tailored to the Indian market's price-sensitive requirements.

The Rise of Flexible Packaging Solutions

Flexible packaging emerged as being a dominant trend within the India food packaging market. It is more versatile than, cost-effective than, and sustainable than customary rigid packaging formats. This packaging style has pouches, bags, wraps, and films for conforming to product shapes, thus lowering material use and transport costs. Lightweight with durable packaging is important for flexible packaging's growth. Indian consumers increasingly prefer flexible packaging due to its convenience features such as resealable closures, easy-open mechanisms, and portion control capabilities. The e-commerce boom has further accelerated flexible packaging adoption as online retailers require packaging solutions that minimize shipping costs and reduce environmental impact. Manufacturers are investing in advanced flexible packaging technologies including barrier films, multilayer structures, and biodegradable materials to meet evolving market demands. The India food packaging market growth in flexible packaging is supported by domestic production capabilities and improving printing technologies that enable attractive graphics and branding, making it an increasingly preferred choice across various food categories.

Growth, Opportunities, Challenges and Government Initiatives in the India Food Packaging Market:

- Growth Drivers of the India Food Packaging Market: The market is primarily driven by the rapid expansion of e-commerce and online food delivery platforms, which require robust packaging solutions for safe product transportation. Rising consumer awareness about food safety and hygiene standards has intensified demand for advanced packaging technologies that ensure product integrity. The growing preference for convenience foods and ready-to-eat products, driven by changing lifestyles and urbanization, continues to fuel the expansion of the food packaging industry in India.

- Market Opportunities in the India Food Packaging Market: Significant opportunities exist in developing sustainable and eco-friendly packaging solutions as environmental consciousness increases among consumers and regulatory bodies. The India Food Packaging Market Share expansion into rural markets presents untapped potential, driven by improving distribution networks and rising disposable incomes. Innovation in smart packaging technologies, including QR codes, freshness indicators, and temperature sensors, offers substantial growth prospects for market players.

- Market Challenges in the India Food Packaging Market: The India food packaging market analysis reveals key challenges including rising raw material costs and supply chain disruptions that impact profit margins. Stringent government regulations regarding plastic usage and waste management create compliance complexities for manufacturers. Intense competition from established players and price sensitivity in the industry pose significant barriers for new market entrants.

- Government Schemes and Policy Support: Government schemes are playing a pivotal role in supporting the India Food Packaging Market through comprehensive policy frameworks and financial incentives. The Pradhan Mantri Kisan Sampada Yojana (PMKSY) has allocated significant funds for developing food processing infrastructure, including packaging facilities, cold chain networks, and quality testing laboratories. The Production Linked Incentive (PLI) scheme specifically targets food processing industries with attractive incentives for setting up modern packaging units and adopting advanced technologies.

India Food Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on packaging type and application.

Packaging Type Insights:

- Flexible

- Paper and Paperboard

- Rigid Plastic

- Glass

- Metal

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes flexible, paper and paperboard, rigid plastic, glass, metal, and others.

Application Insights:

- Bakery, Confectionary, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionary, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In May 2025, the Food Safety and Standards Authority of India (FSSAI) issued updated rules for food packaging, as these rules allow particular kinds of recycled plastics for food packaging if strict safety standards are satisfied. Key changes include new migration limits, approved recycling methods, and enhanced traceability and labeling requirements.

- In April 2025, he Food Safety and Standards Authority of India (FSSAI) did then reclassify food-grade packaging materials. Inspection checklists changed them from “non-critical” to “critical” highlighting packaging's key role in preventing contamination and ensuring food safety. This update aligns with FSSAI's focus on strengthening food safety regulations, as outlined in the Food Safety and Standards (Packaging) Regulations 2018.

- In October 2024, Fi India & ProPak India 2024 set new benchmarks for innovation in food packaging and processing, attracting over 340 exhibitors and 17,000 professionals. The event highlighted advancements in sustainable packaging, including bioplastics and recyclable materials, and discussed emerging technologies like nanotechnology and enzyme engineering, aimed at enhancing food safety, shelf life, and nutritional value.

- In March 2024, UFlex Limited, India’s largest flexible packaging company, showcased its innovative food-grade packaging solutions at Aahar 2024, an international food and hospitality fair held in New Delhi. The company presented its latest range of flexible packaging pouches and WPP bags designed to enhance product freshness, extend shelf life, and improve convenience, revolutionizing the food packaging sector in India.

India Food Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible, Paper and Paperboard, Rigid Plastic, Glass, Metal, Others |

| Applications Covered | Bakery, Confectionary, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India food packaging market was valued at USD 13.4 Billion in 2024.

The India food packaging market is projected to exhibit a CAGR of 6.37% during 2025-2033, reaching a value of USD 24.8 Billion by 2033.

Several key factors are contributing to the growth of the food packaging market in India, including the rising demand for convenient, ready-to-eat meals, an increase in food processing activities, and a growing consumer inclination toward packaged and processed food items. Furthermore, a strong emphasis on food safety regulations, advancements in eco-friendly packaging solutions, and the expansion of e-commerce platforms are also driving market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)