India Food Certification Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Food Certification Market Size and Share:

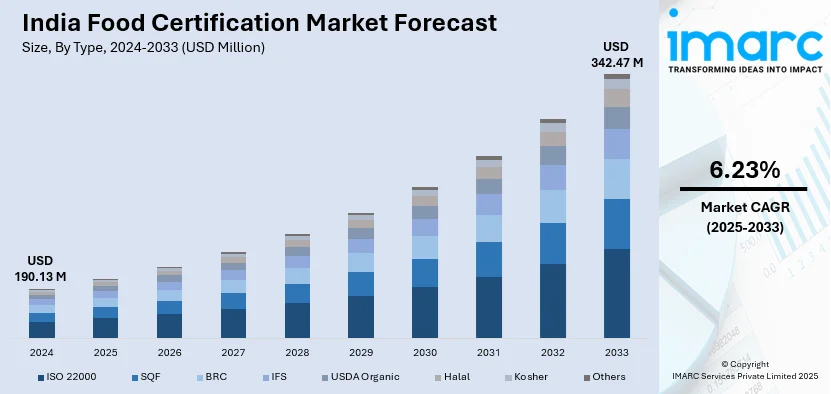

The India food certification market size reached USD 190.13 Million in 2024. The market is expected to reach USD 342.47 Million by 2033, exhibiting a growth rate (CAGR) of 6.23% during 2025-2033. The market growth is attributed to rising consumer awareness about food safety, increasing demand for quality standards, regulatory frameworks, growing export opportunities, and the expansion of organized retail and food processing sectors.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into ISO 22000, SQF, BRC, IFS, USDA organic, halal, kosher, and others.

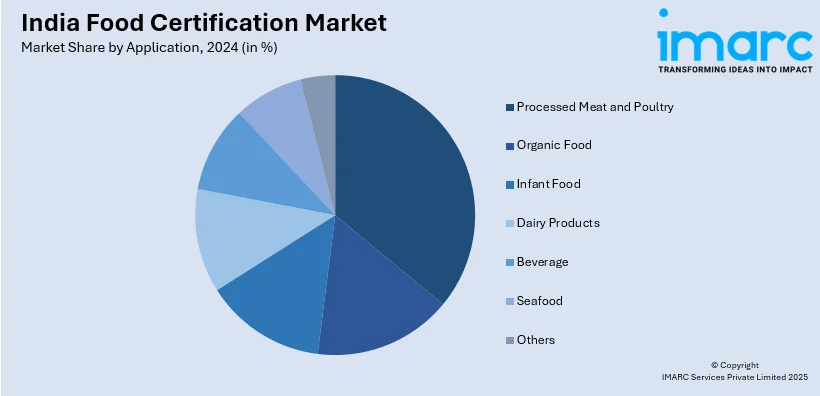

- On the basis of application, the market has been divided into processed meat and poultry, organic food, infant food, dairy products, beverage, seafood, and others.

Market Size and Forecast:

- 2024 Market Size: USD 190.13 Million

- 2033 Projected Market Size: USD 342.47 Million

- CAGR (2025-2033): 6.23%

India Food Certification Market Trends:

Strengthened Food Safety Regulations

The government has substantially strengthened food safety rules to ensure the supply of safe and nutritious food. Standards for food manufacturing, storage, distribution, and sale are defined by a designated regulating authority. Compliance is constantly checked by routine inspections, audits, and sampling. Surveillance efforts are carried out nationally, with an emphasis on detecting suspected adulteration in essential food goods. Furthermore, regional governments employ local enforcement measures, allowing for more personalized approaches to food safety hazards based on regional consumption trends and emergent issues. This integrated strategy promotes both consumer safety and the overall objective of preserving food quality across the country. This, in turn, significantly augments the India food certification market share. For example, in March 2025, the government of India enacted the Food Safety and Standards (FSS) Act 2006, establishing the FSSAI to set standards for food safety. The FSSAI regulates food manufacture, storage, distribution, and sale to ensure safe consumption. It monitors compliance through inspections, audits, and sampling. In FY2023-2024, FSSAI introduced the National Annual Surveillance Plan and conducted pan-India surveillance on staple foods, while states/UTs implemented local enforcement and surveillance measures.

To get more information on this market, Request Sample

Streamlined Food Safety Certification Process

Recent changes in India's food safety regulations have simplified the certification process for food products. Under the updated rules, food businesses are now required to obtain certification only from the food safety authority, removing the need for additional certifications from other bodies. This streamlining reduces regulatory complexity and promotes ease of doing business for food companies. The India food certification market growth is propelled by eliminating redundant certifications, businesses can focus on meeting safety standards more efficiently, reducing costs and time delays. This adjustment not only simplifies the certification process but also encourages faster market entry and broader industry growth. The move is expected to strengthen food safety measures while fostering a more business-friendly environment within the sector. For instance, in February 2024, the government of India approved amendments to food safety regulations, streamlining the certification process for food products. Following these amendments, only FSSAI certification would be required, eliminating the need for additional certifications from the Bureau of Indian Standards (BIS) or AGMARK. This move aims to enhance ease of doing business under the "One Nation, One Regulator" framework, reducing complexity for food businesses.

Digital Integration and Technology Adoption

The Indian food certification industry is undergoing a significant transformation with the integration of digital technologies and the adoption of cutting-edge technology. Furthermore, online platforms are transforming the certification process by enabling online applications, facilitating real-time tracking, and implementing automated compliance tracking systems. Besides this, the use of blockchain technology is being increasingly adopted to provide traceability and transparency along the food supply chain, which builds consumer confidence in certified food products. India food certification market outlook reveals huge growth prospects with artificial intelligence and machine learning algorithms being used for predictive analysis of food safety hazards and automated evaluation of quality. Also, mobile apps are promoting simpler access to certification data for both consumers and enterprises. Cloud-based systems are facilitating smooth data sharing amongst regulatory bodies, certification agencies, and food producers, establishing a more effective and transparent certification system that minimizes processing time and enhances general market accessibility.

Growth, Opportunities, and Challenges in the India Food Certification Industry:

- Growth Drivers: The expanding organized retail sector and increasing consumer awareness about food safety are driving significant market growth. Government initiatives promoting food exports and strengthening regulatory frameworks are creating favorable conditions for certification service providers. The rising demand for organic and specialty food products is generating substantial opportunities for specialized certification services.

- Market Opportunities: Emerging opportunities exist in rural market penetration as small-scale food producers increasingly seek certification to access premium markets. Digital transformation initiatives present significant potential for developing cost-effective, technology-enabled certification solutions. The growing export potential to international markets offers substantial revenue opportunities for certification bodies specializing in global standards.

- Market Challenges: High certification costs remain a significant barrier for small and medium enterprises, limiting market accessibility. According to India food certification market forecast, the complexity of multiple regulatory requirements and lack of standardization across different certification bodies are expected to create operational challenges. Limited awareness about certification benefits among rural food producers continues to restrict market expansion in untapped regions.

India Food Certification Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- ISO 22000

- SQF

- BRC

- IFS

- USDA Organic

- Halal

- Kosher

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ISO 22000, SQF, BRC, IFS, USDA organic, halal, kosher, and others.

Application Insights:

- Processed Meat and Poultry

- Organic Food

- Infant Food

- Dairy Products

- Beverage

- Seafood

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes processed meat and poultry, organic food, infant food, dairy products, beverage, seafood, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Certification Market News:

- In September 2025, the Food Safety and Standards Authority of India (FSSAI) announced the formation of a panel to overhaul the country’s regulations for organic food in order to better align with updated international guidelines. The revision will include updating the National Programme for Organic Production (NPOP) of 2014, covering aspects such as organic agricultural products, certifications, and use of the “India Organic” label.

- In March 2025, the Bureau of Indian Standards (BIS) established standards on respiratory protection, fall prevention, and fire safety to ensure the overall occupational health and safety of workers. These standards were implemented to enhance workplace safety, addressing critical hazards in various industries. The initiative aimed at improving worker protection through specific guidelines, ensuring compliance with safety measures, and reducing risks associated with respiratory issues, falls, and fire-related incidents.

- In March 2025, The Food Safety and Standards Authority of India (FSSAI) has proposed updated regulations for vegan food imports, mandating that every consignment be supported by an official certificate issued by a recognized authority in the country of origin. This certification must confirm that the products comply with India’s vegan food standards. The initiative is part of FSSAI’s wider strategy to tighten regulatory oversight and reinforce consumer confidence in plant-based products entering the Indian market.

- In February 2025, Tetra Pak became the first company in India's food and beverage packaging industry to introduce packaging with 5% certified recycled polymers. Starting April 1, 2025, the new packaging complies with the Plastic Waste Management (Amendment) Rules 2022. The materials are certified by ISCC PLUS, ensuring high environmental standards. This initiative supports the transition toward more sustainable packaging solutions and is part of Tetra Pak's broader efforts to reduce reliance on virgin plastics.

- In January 2025, the Indian Government, through the Directorate General of Foreign Trade (DGFT), issued Public Notice No. 39/2024-25, establishing new procedures for the export of certified organic products. Under the revised framework, organic products must be produced, processed, packed, and labelled in compliance with the National Programme for Organic Production (NPOP) standards and accompanied by a Transaction Certificate (TC) from a Certification Body accredited by the National Accreditation Body (NAB) under NPOP.

India Food Certification Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | ISO 22000, SQF, BRC, IFS, USDA Organic, Halal, Kosher, Others |

| Applications Covered | Processed Meat and Poultry, Organic Food, Infant Food, Dairy Products, Beverage, Seafood, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food certification market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food certification market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food certification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food certification market in India was valued at USD 190.13 Million in 2024.

The India food certification market is projected to exhibit a CAGR of 6.23% during 2025-2033, reaching a value of USD 342.47 Million by 2033.

Heightened consumer concern over food safety, quality, and traceability is prompting greater demand for certified products. Regulatory tightening and export-driven compliance are reinforcing certification needs. Additionally, growing awareness about health, sustainability, and ethical sourcing is driving businesses to seek recognized certifications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)