India Foam Market Size, Share, Trends and Forecast by Category, Type, Application, and Region, 2025-2033

Market Overview:

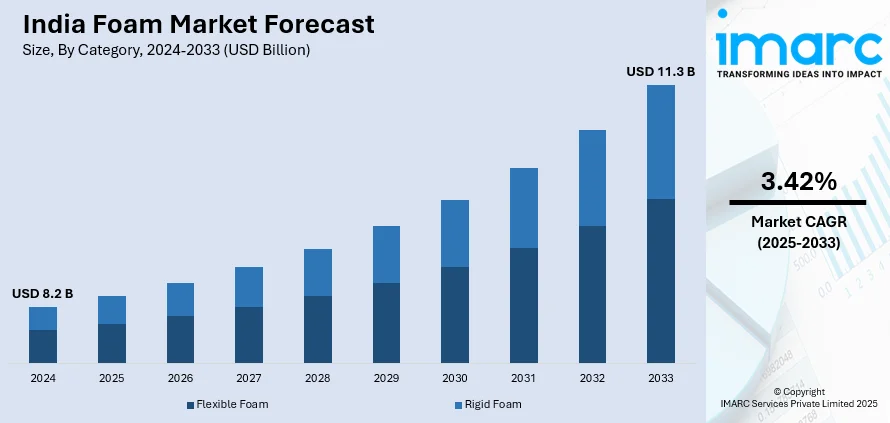

The India foam market size reached USD 8.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. The growing demand for foam-based furniture, including sofas, chairs, mattresses, and cushions among the masses, the widespread product adoption in apparel for padding, shaping, and creating garments with a soft, lightweight feel, and the development of specialty foams are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.2 Billion |

|

Market Forecast in 2033

|

USD 11.3 Billion |

|

Market Growth Rate 2025-2033

|

3.42% |

Foam is a complex, multi-phase system typically composed of gas bubbles dispersed in a liquid or solid medium. It's a unique material as it possesses both liquid and solid properties, showcasing elasticity, viscosity, and density. The most familiar forms of foam are found in everyday objects, such as soaps, beers, bread, and polyurethane foams used in mattresses or insulation. The structure of foam is characterized by a network of interconnected bubbles or cells, where the walls of these cells determine the foam's properties. If these walls are thin and fragile, such as in soap foam, the foam will be liquid-like and temporary. Conversely, if the walls are thick and durable, as in plastic foams, the structure is more permanent and behaves similarly to a solid. Foams play crucial roles in a wide array of fields, including food technology, firefighting, environmental protection, and even space exploration.

To get more information on this market, Request Sample

The foam industry in India has been witnessing robust growth, driven by factors such as urbanization, rising disposable income, and changing consumer lifestyles. As more consumers move to urban centers and seek modern living solutions, there has been an increased demand for foam-based furniture, including sofas, chairs, mattresses, and cushions. Along with this, in footwear manufacturing, foam-based insoles and midsoles are widely used to enhance the wearer's comfort and reduce the impact on the feet during walking or running. Additionally, foam materials are utilized in apparel for padding, shaping, and creating garments with a soft, lightweight feel, which is acting as another growth-inducing factor. With consumers becoming more conscious of the importance of a good night's sleep and overall well-being, the demand for high-quality foam mattresses and bedding products has risen. Foam's ability to provide support, conform to body contours, and offer pressure relief has made it a popular choice among Indian consumers seeking improved sleep experiences. Moreover, the development of specialty foams with unique properties, such as flame retardancy, antimicrobial properties, and improved durability is creating a positive market outlook.

India Foam Market Trends/Drivers:

Expanding Automotive Sector

One of the primary market drivers for the foam industry in India is the rapid expansion of the automotive sector. India has emerged as a major player in the automotive market, with both domestic consumption and export of vehicles on the rise. As the automotive industry grows, there is a substantial demand for various foam products to cater to different automotive applications. Additionally, automobile manufacturers use foam materials extensively in car interiors, including seats, headrests, armrests, door panels, and dashboards. In addition, the rising focus on passenger comfort and safety has further boosted the demand for high-quality foams with enhanced properties such as better cushioning, durability, and fire resistance. Moreover, the government's emphasis on electric mobility has led to a rise in demand for electric vehicles (EVs).

Flourishing Packaging and Consumer Goods Market

The packaging industry in India has experienced exponential growth, primarily fueled by the expansion of the e-commerce sector and changing consumer preferences. Foam packaging materials, such as expanded polystyrene (EPS) and polyurethane foam, are widely used for protecting delicate items during shipping and transportation. As more consumers opt for online shopping, the demand for foam packaging solutions has skyrocketed. In addition, the foam industry has adapted to the need for sustainable packaging by developing biodegradable and recyclable foam alternatives, aligning with the growing environmental consciousness of consumers and businesses. Apart from this, the foam industry has found applications in various consumer goods, including electronics, appliances, footwear, and sports equipment. Foam cushioning provides superior protection during transit and enhances the overall user experience, thus driving its adoption across these sectors.

India Foam Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India foam market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on category, type and application.

Breakup by Category:

- Flexible Foam

- Rigid Foam

Flexible foam represents the most widely used category

The report has provided a detailed breakup and analysis of the market based on the category. This includes flexible foam and rigid foam. According to the report, flexible foam represented the largest segment.

The flexible foam category in the India foam industry is primarily driven by the expanding automotive sector resulting in a growing demand for flexible foam materials in car interiors, providing enhanced comfort and safety features. Additionally, the flourishing furniture industry has driven the adoption of flexible foam for manufacturing sofas, mattresses, and cushions, due to its versatility and affordability. In addition, the construction and infrastructure have led to increased usage of flexible foam for thermal and acoustic insulation in buildings. Moreover, the rising popularity of online shopping and the growing e-commerce sector has contributed to the demand for flexible foam in packaging applications, protecting delicate items during transit. Also, flexible foam offers manufacturers the ability to customize the foam's properties, such as density, firmness, and resilience, to meet specific application requirements. This adaptability has led to the development of innovative products that cater to diverse industries and customer preferences.

Breakup by Type:

- Polyurethane

- Polystyrene

- Polyolefin

- Phenolic

- PET

- Others

Polyurethane account for the majority of the market share

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes polyurethane, polystyrene, polyolefin, phenolic, PET, and others. According to the report, polyurethane accounted for the largest market share.

The polyurethane type is a significant driver in the India foam industry due to its versatility and wide-ranging applications. Additionally, the automotive sector's rapid expansion has led to a rise in demand for polyurethane foams used in car seat cushions, armrests, and interior components, as it offers superior comfort and durability. In addition to this, the construction industry's growth has influenced the use of polyurethane foam for thermal insulation and sealing applications, meeting the rising demand for energy-efficient buildings. Apart from this, the furniture industry relies heavily on polyurethane foam to produce comfortable and stylish upholstery products, such as sofas and chairs. Furthermore, the healthcare sector has embraced polyurethane foam for medical devices, mattresses, and orthopedic supports, benefiting from its cushioning and pressure-relieving properties.

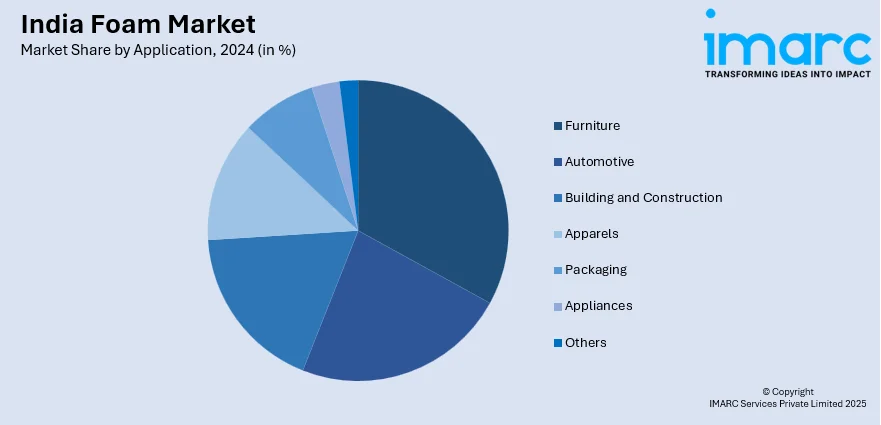

Breakup by Application:

- Furniture

- Automotive

- Building and Construction

- Apparels

- Packaging

- Appliances

- Others

Furniture represents the most widely used category

The report has provided a detailed breakup and analysis of the market based on the category. This includes furniture, automotive, building and construction, apparels, packaging, appliances, and others. According to the report, furniture accounted for the largest market share.

The furniture application segment serves as a key market driver in the India foam industry, propelled by several factors. Firstly, the steady rise in disposable incomes and urbanization has led to increased consumer spending on furniture, driving demand for foam-based products, including sofas, chairs, and mattresses. Secondly, changing consumer lifestyles and preferences have fueled the demand for aesthetically pleasing and comfortable furniture, with foam materials providing the necessary cushioning and support. Additionally, the industry's focus on sustainability has driven the adoption of eco-friendly foam options, meeting the growing demand for environmentally conscious furniture choices. Furthermore, the emergence of the e-commerce sector has widened the market reach, making foam-based furniture more accessible to a larger consumer base. These market drivers collectively contribute to the growth and innovation within the furniture application segment, making it a significant driving force in the India foam industry.

Breakup by Region:

- South India

- North India

- West and Central India

- East and North East-India

South India exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East and North-East India. According to the report, South India was the largest market for India foam market.

The foam industry in South India is driven by the region's expanding automotive sector leading to an increased demand for foam products used in car interiors, providing better comfort and aesthetics to consumers. Additionally, the rapid growth of the construction and infrastructure industry in South India has resulted in higher requirements for foam materials for thermal insulation and acoustic solutions in buildings and commercial spaces. In addition, the growing furniture market in the region has further boosted the demand for foam products in manufacturing comfortable and stylish upholstery items. Furthermore, the region's focus on sustainability and eco-friendly practices has encouraged the adoption of bio-based and recyclable foam materials, driving innovation and growth within the foam industry. The region is home to several research and development centers and educational institutions that focus on polymer sciences and material engineering. This intellectual capital fosters innovation and technological advancements in foam production, leading to the development of high-quality and specialized foam products that cater to specific industry needs.

Competitive Landscape:

The key players in the market are continuously investing in research and development to innovate and develop new foam materials with enhanced properties. They are creating foams that are more eco-friendly, durable, fire-resistant, and provide better comfort and support for various applications. Along with this, companies in the foam industry are diversifying their product offerings to cater to different market segments. They are producing a wide range of foam products, including flexible polyurethane foam, rigid polyurethane foam, expanded polystyrene (EPS), polyethylene foam to meet the specific requirements of different industries, such as automotive, furniture, construction, packaging, and healthcare. In addition, manufacturers are committed to maintaining stringent quality standards and obtaining relevant certifications to ensure their foam products meet industry regulations and customer expectations, further impacting the market. Furthermore, the growing investments in upgrading their manufacturing equipment and processes to improve efficiency and product quality is contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the India foam market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alpha Foam Ltd.

- Ankit Polymers

- Goldcoin Foam Pvt. Ltd.

- IRE-TEX Premier India Pvt. Ltd.

- Jumax Foam Pvt Ltd

- M.H. Polymers Pvt. Ltd.

- Premratan Concast Pvt Ltd. (PyareLal Group Of Industries)

- Royal EPE Foam Private Limited

- Sarva Foam Industries Pvt. Ltd

- Sheela Foam Limited

- Tirupati Foam Limited

India Foam Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Categories Covered | Flexible Foam, Rigid Foam |

| Types Covered | Polyurethane, Polystyrene, Polyolefin, Phenolic, PET, Others |

| Applications Covered | Furniture, Automotive, Building and Construction, Apparels, Packaging, Appliances, Others |

| Regions Covered | South India, North India, West and Central India, East and North East-India |

| Companies Covered | Alpha Foam Ltd., Ankit Polymers, Goldcoin Foam Pvt. Ltd., IRE-TEX Premier India Pvt. Ltd., Jumax Foam Pvt Ltd, M.H. Polymers Pvt. Ltd., Premratan Concast Pvt Ltd. (PyareLal Group Of Industries), Royal EPE Foam Private Limited, Sarva Foam Industries Pvt. Ltd, Sheela Foam Limited, Tirupati Foam Limited etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India foam market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India foam market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India foam industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India foam market was valued at USD 8.2 Billion in 2024.

We expect the India foam market to exhibit a CAGR of 3.42% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations resulting in the temporary closure of numerous end-use industries for foam across the nation.

The rising demand for foam in the furnishing sector for manufacturing various home furnishing products, such as foam-based mattresses, pillowcases, bed linens, etc., that offer superior comfort through even distribution of pressure and body weight, is primarily driving the India foam market.

Based on the category, the India foam market can be divided into flexible foam and rigid foam. Currently, flexible foam accounts for the largest market share.

Based on the type, the India foam market has been segmented into polyurethane, polystyrene, polyolefin, phenolic, PET, and others. Among these, polyurethane currently exhibits a clear dominance in the market.

Based on the application, the India foam market can be bifurcated into furniture, automotive, building and construction, apparels, packaging, appliances, and others. Currently, the furniture industry holds the majority of the total market share.

On a regional level, the market has been classified into South India, North India, West and Central India, and East and North East-India, where South India currently dominates the India foam market.

Some of the major players in the India foam market include Alpha Foam Ltd., Ankit Polymers, Goldcoin Foam Pvt. Ltd., IRE-TEX Premier India Pvt. Ltd., Jumax Foam Pvt Ltd, M.H. Polymers Pvt. Ltd., Premratan Concast Pvt Ltd. (PyareLal Group Of Industries), Royal EPE Foam Private Limited, Sarva Foam Industries Pvt. Ltd, Sheela Foam Limited, and Tirupati Foam Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)