India Fly Ash Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Fly Ash Market Overview:

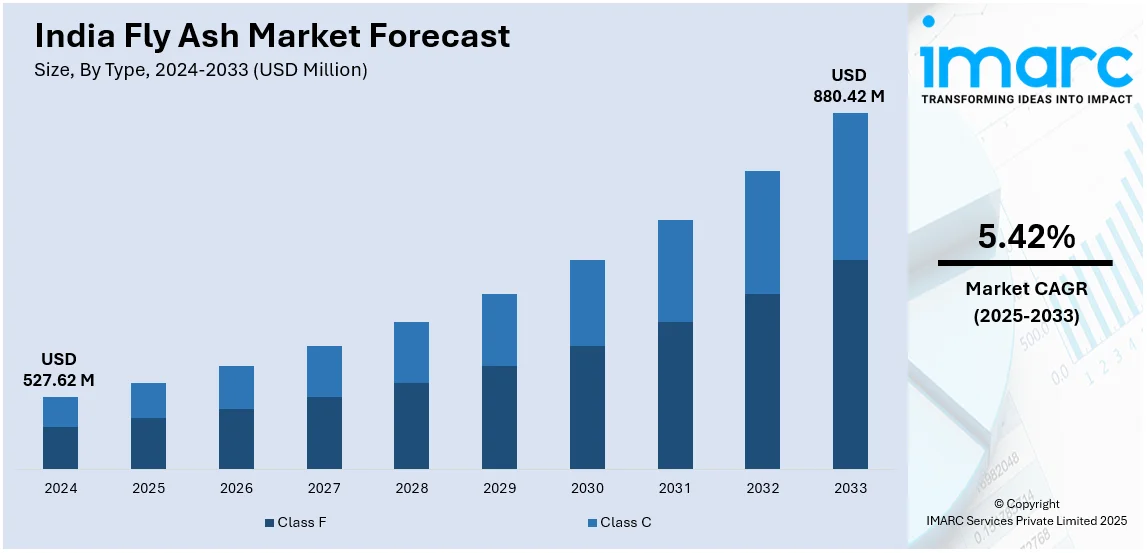

The India fly ash market size reached USD 527.62 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 880.42 Million by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. Increasing infrastructure development, growing demand for fly ash bricks, government initiatives promoting sustainable construction, rising cement production, stringent environmental regulations on waste management, cost-effectiveness of fly ash as a raw material, expansion of thermal power plants, and increasing adoption of fly ash in road construction and concrete manufacturing are expanding India fly ash market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 527.62 Million |

| Market Forecast in 2033 | USD 880.42 Million |

| Market Growth Rate 2025-2033 | 5.42% |

India Fly Ash Market Trends:

Rising Demand for Fly Ash in the Construction Industry

The India fly ash market growth is driven by the increasing infrastructure development and urbanization. For instance, according to a 2025 industry research, India's urban population is expected to reach 600 million by 2036, and 75% of the country's GDP will come from urban areas.As the government puts emphasis on sustainable building, fly ash is finding greater use as a cement substitute in concrete, lowering carbon footprints and the cost of construction. Large-scale infrastructure development such as highways, bridges, and smart cities is propelling demand. Fly ash applications in road building, brick production, and embankment filling is also gaining momentum. BIS has also permitted increased content of fly ash in cement, strengthening market expansion even further. It is also part of India's sustainability and waste management push.

To get more information on this market, Request Sample

Government Policies and Environmental Regulations Bolstering Adoption

Stringent environmental regulations and policies promoting fly ash utilization are propelling market expansion in India. The Ministry of Environment, Forest and Climate Change (MoEFCC) mandates 100% utilization of fly ash by thermal power plants, encouraging industries to incorporate it in various applications. Cement manufacturers, ready-mix concrete plants, and road developers are increasingly adopting fly ash due to its eco-friendly properties. Additionally, incentives for fly ash-based products and research on high-volume fly ash concrete are expanding market opportunities. As sustainability gains prominence, industries are shifting towards fly ash-based materials to meet environmental compliance and reduce their carbon footprint, which in turn is positively impacting India fly ash market outlook. For instance, in a major step toward sustainable development, the Prime Minister dedicated and lay the foundation stone for NTPC power projects worth over INR 30,000 Crores on March 3, 2024. The Fly Ash Based Light Weight Aggregate Plant, which was built at an investment of INR 51 Crores, was inaugurated at the Sipat Super Thermal Power Station in Bilaspur, Chhattisgarh. The facility promotes the use of fly ash in bulk and environmental preservation by turning fly ash into aggregates using pelletizing and sintering technology.

India Fly Ash Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Class F

- Class C

The report has provided a detailed breakup and analysis of the market based on the type. This includes class F and class C.

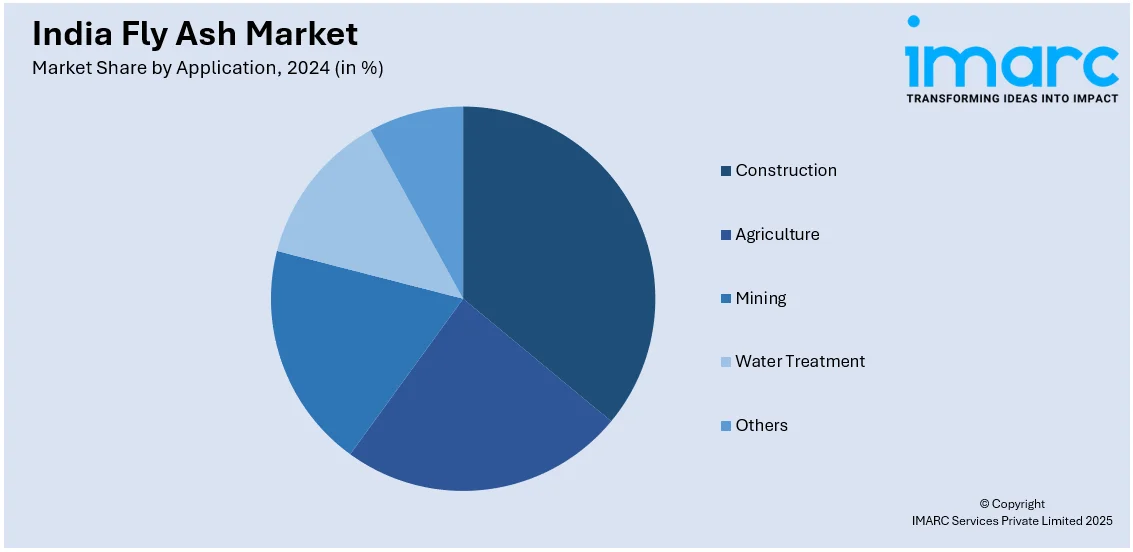

Application Insights:

- Construction

- Bricks and Blocks

- Road Construction

- Portland Cement and Concrete

- Agriculture

- Mining

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction (bricks and blocks, road construction, and Portland cement and concrete), agriculture, mining, water treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fly Ash Market News:

- On May 11, 2024, Bharat Aluminium Company Limited (BALCO) and Shree Cement Limited signed a Memorandum of Understanding (MoU) for the supply of 90,000 metric tons of fly ash for the production of low-carbon cement. By reusing fly ash, a byproduct of thermal power generation, this partnership seeks to advance sustainable practices and a circular economy.Approximately 500 kg of carbon emissions, 3.2 million GJ of energy, and 250 liters of water per ton can be saved by using fly ash in the cement making process.

India Fly Ash Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Class F, Class C |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fly ash market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fly ash market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fly ash industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fly ash market in India was valued at USD 527.62 Million in 2024.

The India fly ash market is projected to exhibit a CAGR of 5.42% during 2025-2033, reaching a value of USD 880.42 Million by 2033.

Rising infrastructure development, urbanization, government mandates for fly ash use, cost savings in construction, expansion of thermal power plants, and incentives for fly ash-based products are driving demand. Fly ash is increasingly used in bricks, roads, cement, and concrete to meet sustainability goals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)