India Flooring Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Market Overview:

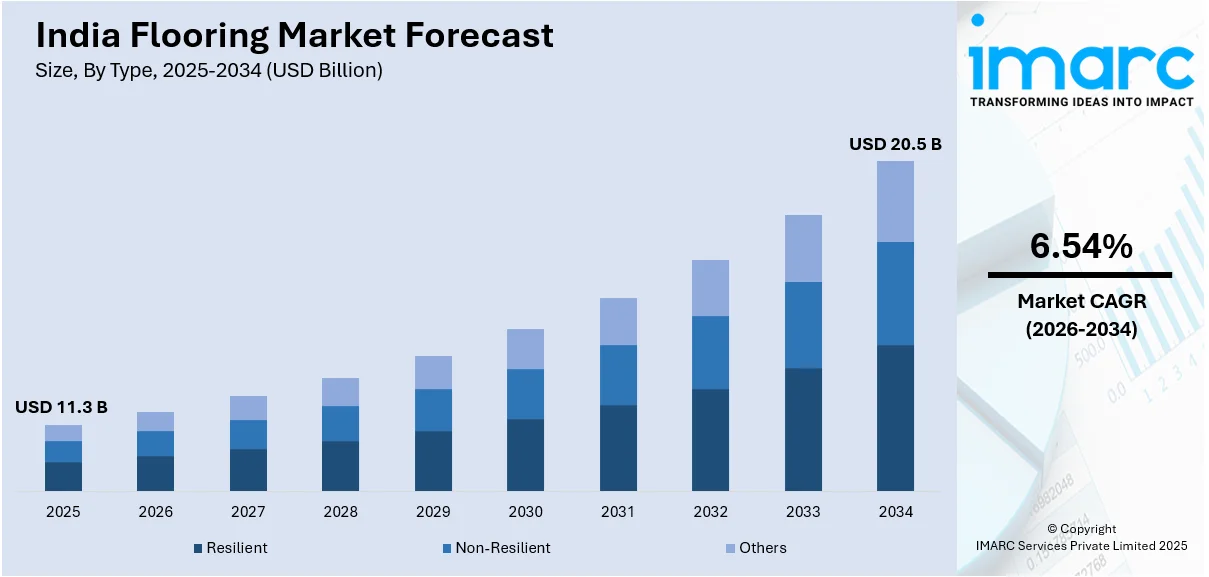

India flooring market size reached USD 11.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.54% during 2026-2034. The rising investments by individuals in the aesthetics and functionality of their living and working spaces are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.3 Billion |

| Market Forecast in 2034 | USD 20.5 Billion |

| Market Growth Rate (2026-2034) | 6.54% |

Flooring pertains to the finished material layer applied to cover a floor structure, creating a smooth and level surface. Common types of layers encompass vinyl sheets, ceramic tiles, rubber, natural stone, wood, carpets, and rugs. The choice of materials depends on considerations like noise insulation, ease of cleaning, comfort, durability, and cost. The demand for flooring in India has surged due to extensive renovations and new construction projects, driving the need for diverse flooring solutions.

To get more information of this market Request Sample

India Flooring Market Trends:

The flooring market in India is experiencing robust growth, propelled by a confluence of factors including rapid urbanization, increasing disposable income, and a surge in construction and renovation activities. Vinyl sheets, ceramic tiles, natural stone, wood, rubber, and carpets are prevalent choices in the Indian flooring market. Besides this, with the rising focus on aesthetics and functionality in interior spaces, consumers are increasingly opting for a variety of flooring solutions that meet both visual and practical requirements, which is acting as another significant growth-inducing factor. Moreover, the government's initiatives to boost affordable housing and infrastructure development further contribute to the flourishing flooring market. As cities expand and modernize, the demand for high-quality, aesthetically pleasing, and durable flooring solutions has increased significantly, thereby positively influencing the market growth in India. Apart from this, the real estate sector's growth, coupled with a burgeoning middle-class population, has heightened the demand for innovative and sustainable flooring materials. The flooring market has also witnessed a shift towards eco-friendly and sustainable options, reflecting the growing awareness of environmental impact among consumers. Furthermore, leading manufacturers are responding to this trend by introducing flooring solutions that prioritize environmental sustainability, aligning with India's broader efforts toward green and responsible construction practices. Overall, evolving consumer preferences, the inflating disposable income levels of individuals, urban development trends, and the ongoing surge in construction activities throughout the country are anticipated to fuel the market growth over the forecasted period.

India Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Resilient

- Non-Resilient

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes resilient, non-resilient, and others.

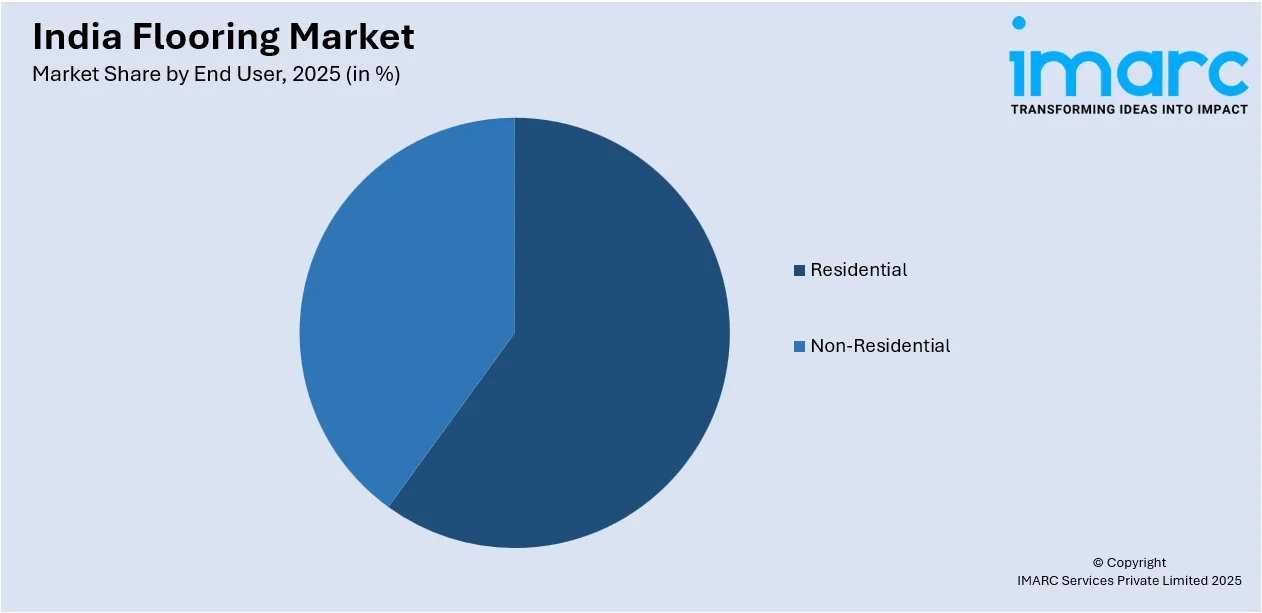

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-Residential |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flooring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India flooring market was valued at USD 11.3 Billion in 2025.

The flooring market in India is projected to exhibit a CAGR of 6.54% during 2026-2034, reaching a value of USD 20.5 Billion by 2034.

The flooring market in India is driven by rapid urbanization, growing construction activities, and rising demand in residential, commercial, and industrial sectors. Increased preference for durable, low-maintenance, and aesthetic flooring solutions, along with government initiatives like Smart Cities and Housing for All, also support market growth. Technological advancements further enhance product appeal and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)