India Flooring Adhesive Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

India Flooring Adhesive Market Overview:

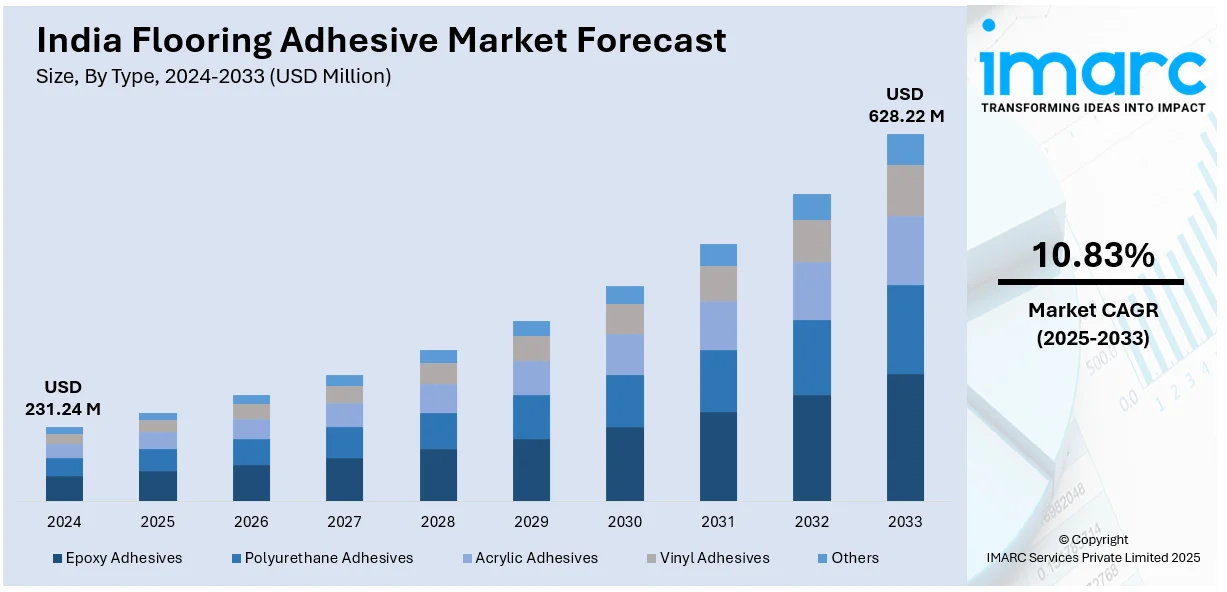

The India flooring adhesive market size reached USD 231.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 628.22 Million by 2033, exhibiting a growth rate (CAGR) of 10.83% during 2025-2033. The market is propelled by urbanization, infrastructure growth, and growing demand for high-performance adhesives in residential and commercial building. Luxury vinyl tiles (LVT) and wood flooring growth, growing demand for green adhesives, and government programs such as the Smart Cities Mission also drive the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 231.24 Million |

| Market Forecast in 2033 | USD 628.22 Million |

| Market Growth Rate 2025-2033 | 10.83% |

India Flooring Adhesive Market Trends:

Growth in Luxury Vinyl Tile (LVT) and Wooden Flooring

Growing demand for aesthetically pleasing and durable floor products, such as long-lasting floor products, is driving demand for engineered wood flooring and luxury vinyl tiles (LVT), significantly impacting the market in India for flooring adhesives. With urbanization increasing at a fast rate and disposable incomes rising, consumers are opting for quality floor products that require high-performance adhesives to ensure stability and durability in the long term. The fast-paced growth of commercial spaces, such as offices, hotels, and shopping malls, is further fueling interest in specialized adhesives with superior bonding, water resistance, and compatibility with varied substrates. This development is encouraging manufacturers to come up with innovative adhesive formulations adapted to flexible and durable flooring, to meet India's construction and interior design industries' ever-changing needs.

To get more information on this market, Request Sample

Rising Demand for Eco-Friendly Adhesives

India flooring adhesives market is moving towards eco-friendly, low-VOC products as a result of strict emission legislation and increasing focus on green certifications. Companies are focusing on waterborne and solvent-free products based on increasing consumer awareness of indoor air quality. New product development is focused on bio-based, non-toxic adhesives that meet LEED and IGBC standards, in line with the sustainability objectives of India. The usage of such adhesives is especially robust in urban residential and commercial construction, where sustainable materials are becoming more popular. India's focus on environmentally friendly building practices is evident, being ranked as third in the world for LEED certifications in 2024, with 370 projects certified for 8.5 million square meters. This trend is redefining competition, prompting major players to invest in high-performance, eco-friendly adhesive solutions to keep pace with changing industry needs.

Increasing Infrastructure Development and Smart Cities Projects

The demand for high-performance flooring adhesives is being driven by the India government's emphasis on infrastructure development, as evidenced by initiatives like the Smart Cities Mission. High-strength and durable adhesives that are capable of heavy foot traffic and can cope with environmental factors are necessary for massive residential, commercial, and industrial projects. Rapid expansion of the metro, airports, and the hospitality industry are also contributing to demand for superior flooring solutions. Adhesive producers are reacting with new, quick-curing, and affordable formulations suitable for mass applications. The increasing demand for tiles, laminates, and other engineered surfaces in such projects is also further driving market demand, and thus infrastructure development is a key driver for India flooring adhesive market.

India Flooring Adhesive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, technology, and application.

Type Insights:

- Epoxy Adhesives

- Polyurethane Adhesives

- Acrylic Adhesives

- Vinyl Adhesives

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes epoxy adhesives, polyurethane adhesives, acrylic adhesives, vinyl adhesives, and others.

Technology Insights:

- Water-Based

- Solvent-Based

- Hot Melt

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes water-based, solvent-based, and hot melt.

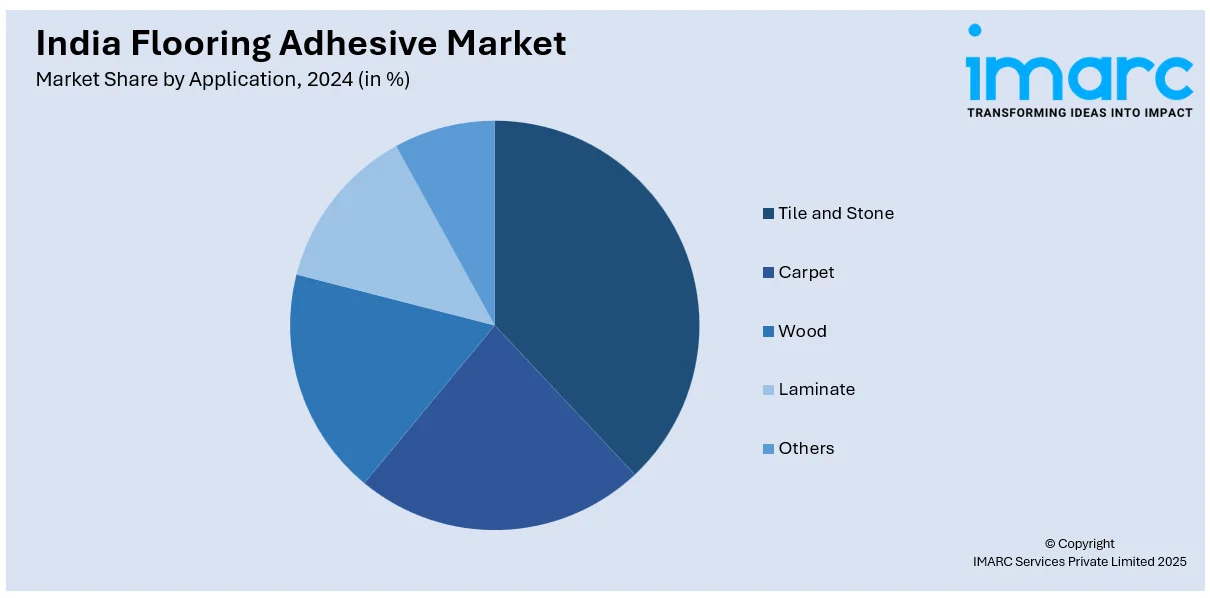

Application Insights:

- Tile and Stone

- Carpet

- Wood

- Laminate

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tile and stone, carpet, wood, laminate, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Flooring Adhesive Market News:

- In July 2024, Magicrete launched a new ad campaign promoting its tile adhesive range, featuring actor Sumeet Vyas. The campaign emphasizes the benefits of tile adhesives over traditional cement, showcasing their superior strength, durability, and ease of use. Through this initiative, Magicrete aims to raise awareness about modern tile installation solutions that ensure a flawless and long-lasting finish.

- In April 2024, Pidilite Industries Ltd. inaugurated a state-of-the-art manufacturing facility in Sandila, near Lucknow, to strengthen its Roff tile adhesive brand in North India. Spanning 11,000 square meters, the automated plant aims to modernize tile and stone fixing with specialized adhesives. Managing Director Bharat Puri emphasized the company's commitment to providing high-quality construction solutions and promoting adhesive-based tile fixing over traditional cement methods.

India Flooring Adhesive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Epoxy Adhesives, Polyurethane Adhesives, Acrylic Adhesives, Vinyl Adhesives, Others |

| Technologies Covered | Water-Based, Solvent-Based, Hot Melt |

| Applications Covered | Tile and Stone, Carpet, Wood, Laminate, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flooring adhesive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India flooring adhesive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flooring adhesive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flooring adhesive market in India was valued at USD 231.24 Million in 2024.

The India flooring adhesive market is projected to exhibit a CAGR of 10.83% during 2025-2033, reaching a value of USD 628.22 Million by 2033.

The India flooring adhesive market is driven by rapid urbanization, growth in residential and commercial construction, and increasing demand for durable, high-performance flooring solutions. Rising adoption of modern interior designs, expanding renovation activities, and advancements in adhesive formulations are further fueling market growth across various application segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)