India Flexible Heater Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Flexible Heater Market Overview:

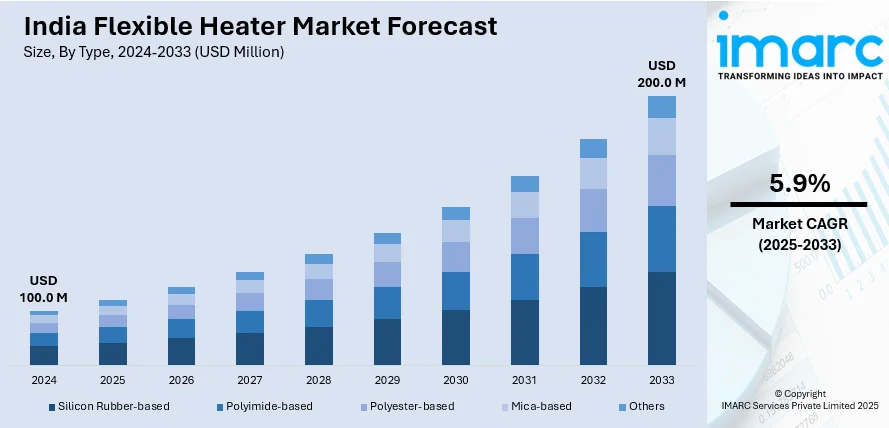

The India flexible heater market size reached USD 100.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The market is driven by growing demand from electric vehicles (EVs), expanding medical device manufacturing, and rising industrial automation. Increased adoption of EVs necessitates efficient battery thermal management, while advancements in healthcare equipment and electronics manufacturing further accelerate the need for compact, adaptable, and energy-efficient heating solutions across various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 100.0 Million |

| Market Forecast in 2033 | USD 200.0 Million |

| Market Growth Rate 2025-2033 | 5.9% |

India Flexible Heater Market Trends:

Rising Demand from Electric Vehicles and Battery Applications

The hike in electric vehicle (EV) adoption in India is fueling demand for flexible heaters, particularly in battery thermal management systems. Flexible heaters are used to maintain optimal battery temperatures, ensuring efficiency and safety during charging and discharging cycles. As government incentives and infrastructure investments accelerate EV production and adoption, the need for lightweight, efficient heating solutions is rising. Additionally, the shift toward lithium-ion battery manufacturing within the country further bolsters this trend. Flexible polyimide and silicone rubber heaters are increasingly integrated into battery packs and charging systems to prevent cold-weather inefficiencies. Their adaptability to complex shapes and compact spaces makes them ideal for electric mobility solutions, strengthening their relevance in India’s EV ecosystem.

To get more information on this market, Request Sample

Growth in Medical Device Manufacturing and Healthcare Sector

India's growing medical device sector is fueling the need for flexible heaters, which are a necessity in diagnostic and therapeutic devices like blood analyzers, respiratory care devices, surgical equipment, and patient warming systems. With India focusing on medical technology self-reliance, the need for precise thermal solutions is increasing. Flexible heaters provide consistent heating, space efficiency, and accurate temperature control, hence being reliable to be employed in medical devices. Government Production Linked Incentive (PLI) program with INR 3,420 crore budget encourages indigenous production and is giving a 5% bonus on enhanced medical devices sales. The program is attracting massive investment, encouraging domestic manufacturing, and growing the market for heating products. Additionally, higher demand for handheld and miniature-sized medical equipment is further contributing to the employment of flexible heaters in India's medical sector.

Industrial Automation and Electronics Manufacturing Expansion

India’s rapid strides in industrial automation and electronics manufacturing are contributing to heightened usage of flexible heaters across various segments. These heaters support manufacturing operations such as 3D printing, semiconductor processing, and equipment dehumidification. With the government promoting the "Make in India" initiative and incentivizing electronics production, flexible heaters are becoming critical components in thermal control solutions across manufacturing plants. Their ability to conform to irregular surfaces and provide efficient spot heating makes them ideal for applications in circuit boards, enclosures, and sensor systems. Additionally, flexible heaters are increasingly integrated into consumer electronics like wearables and displays, aligning with the growing domestic electronics assembly sector. This industrial momentum is positioning flexible heaters as essential elements in India’s evolving manufacturing landscape.

India Flexible Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Silicon Rubber-based

- Polyimide-based

- Polyester-based

- Mica-based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes silicon rubber-based, polyimide-based, polyester-based, mica-based, and others.

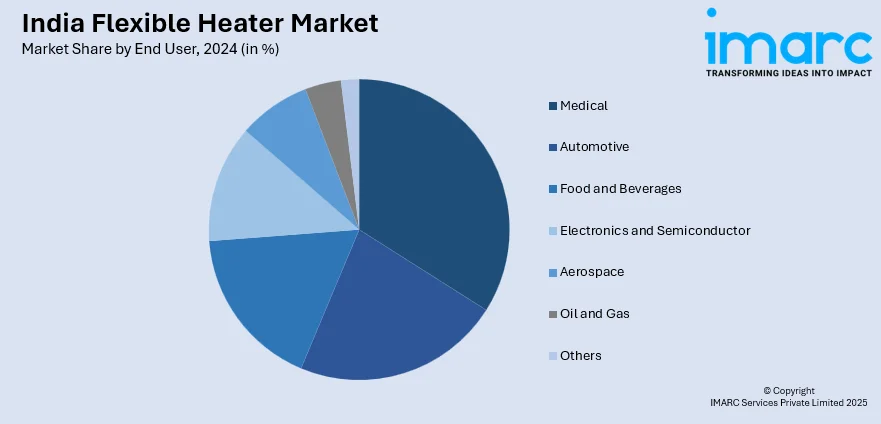

End User Insights:

- Medical

- Automotive

- Food and Beverages

- Electronics and Semiconductor

- Aerospace

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes medical, automotive, food and beverages, electronics and semiconductor, aerospace, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Flexible Heater Market News:

- In January 2025, Loomia and AFFOA unveiled the Gentoo Flexible Heater, a TPU-based resistive heating element engineered for ultra-cold conditions, functioning effectively at -60°C. Designed for seamless textile integration, it offers comfort, stretchability, and durability, even after 20 wash cycles. This innovation supports high-performance apparel for extreme environments. Part of AFFOA’s PAFF programme, the collaboration aims to accelerate advanced textile technologies for both civilian and military applications in harsh climates.

- In September 2024, At Boiler India 2024, Thermax showcased advanced clean air, energy, and heating solutions, including the Greenpac biograte boiler, Greenbloc thermic fluid heater, and Thermeon 2.0 solid fuel-fired boiler. Highlighting its new universal biograte combustion technology for enhanced biomass fuel flexibility, the company also presented biogas and carbon capture solutions. Emphasizing digital and service innovations, Thermax reinforced its commitment to sustainable energy transition across industries at the Navi Mumbai-based expo.

India Flexible Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Silicon Rubber-based, Polyimide-based, Polyester-based, Mica-based, Others |

| End Users Covered | Medical, Automotive, Food and Beverages, Electronics and Semiconductor, Aerospace, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India flexible heater market performed so far and how will it perform in the coming years?

- What is the breakup of the India flexible heater market on the basis of type?

- What is the breakup of the India flexible heater market on the basis of end user?

- What is the breakup of the India flexible heater market on the basis of region?

- What are the various stages in the value chain of the India flexible heater market?

- What are the key driving factors and challenges in the India flexible heater market?

- What is the structure of the India flexible heater market and who are the key players?

- What is the degree of competition in the India flexible heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India flexible heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India flexible heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India flexible heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)