India Fleet Management Market Size, Share, Trends and Forecast by Component, Vehicle Type, End Use Sector, Technology, Deployment Type, and Region, 2025-2033

India Fleet Management Market Size and Share:

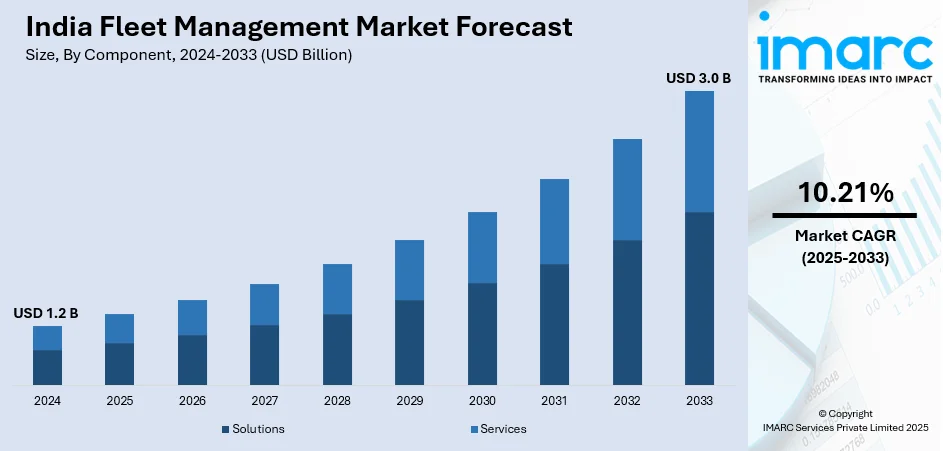

The India fleet management market size reached USD 1.2 Billion in 2024. The market is expected to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.21% during 2025-2033. The market growth can be attributed to the integration of telematics as well as Internet of Things (IoT) technologies, which allows for real-time tracking of vehicles, monitoring driver behavior, and collecting data on the vehicle health.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of component, the market has been divided into solutions and services.

- On the basis of vehicle type, the market has been divided into commercial vehicles, passenger cars, aircrafts, and watercrafts.

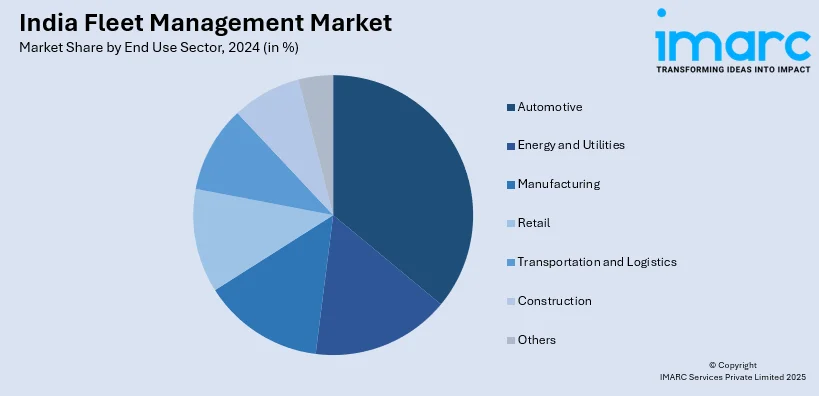

- On the basis of end use sector, the market has been divided into automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others.

- On the basis of technology, the market has been divided into GNSS and cellular systems.

- On the basis of deployment type, the market has been divided into cloud-based, on-premises, and hybrid.

Market Size and Forecast:

- Base Year Market Size (2024): USD 1.2 Billion

- Forecast Year Market Size (2033): USD 3.0 Billion

- CAGR (2025-2033): 10.21%

Fleet management refers to the comprehensive administration of a company's vehicle fleet. It involves a range of activities aimed at optimizing the efficiency, safety, and cost-effectiveness of a fleet of vehicles, typically including cars, trucks, and other specialized vehicles. Key components of fleet management encompass vehicle acquisition, maintenance, fuel management, driver management, and compliance with regulations. Modern fleet management systems often incorporate advanced technologies such as GPS tracking, telematics, and data analytics to monitor vehicle location, performance, and driver behavior in real-time. These tools enable companies to enhance route planning, minimize fuel consumption, improve safety, and streamline overall operations. Efficient fleet management contributes to increased productivity, reduced operational costs, and a more sustainable environmental impact, making it a crucial aspect of logistics and transportation management for businesses across various industries.

To get more information on this market, Request Sample

The fleet management market in India is experiencing robust growth, driven by several key factors. Firstly, the escalating demand for efficient and cost-effective transportation solutions has propelled the adoption of fleet management systems. Additionally, the integration of advanced technologies, such as GPS tracking and telematics, has enhanced real-time monitoring, contributing to improved operational efficiency. Moreover, the rising focus on sustainability and environmental conservation has fueled the deployment of fleet management solutions to optimize routes and reduce fuel consumption. This emphasis on eco-friendly practices is further supported by the implementation of electric and hybrid vehicles within fleets, aligning with regional efforts to mitigate carbon emissions. Furthermore, stringent regulatory mandates mandating the use of technology to ensure compliance with safety and emission standards have become pivotal drivers for the fleet management market. Furthermore, the evolution of cloud-based platforms and the IoT has revolutionized data management, offering seamless connectivity and accessibility to fleet-related information. This digital transformation not only enhances decision-making processes but also facilitates predictive maintenance, reducing downtime and overall operational costs. In essence, the confluence of technological advancements, environmental concerns, regulatory imperatives, and a growing need for operational efficiency collectively propels the dynamic expansion of the fleet management market in India.

India Fleet Management Market Trends:

Artificial Intelligence and Machine Learning Integration

The integration of artificial intelligence (AI) as well as machine learning (ML) technologies transforms the India fleet management landscape by enabling predictive analytics, automating decision-making, also improving operational intelligence. These very advanced technologies are being deployed in order to analyze huge amounts of fleet data, predict vehicle maintenance requirements, and then optimize route planning. These technologies improve driver behavior management too. Patterns in fuel consumption can be identified by AI-powered systems as well as potential breakdowns predicted plus optimal maintenance schedules suggested for reducing operational costs including downtime. The India fleet management market share in AI-enabled solutions is expanding rapidly as companies recognize the competitive advantage of data-driven fleet operations. Machine learning algorithms are being used to analyze driver behavior patterns, identify risky driving practices, and provide personalized coaching recommendations. Indian fleet operators are increasingly investing in AI-powered dashboard cameras, predictive maintenance systems, and intelligent route optimization software to enhance safety, efficiency, and profitability. Major technology providers are developing India-specific AI solutions that account for local traffic patterns, road conditions, and regulatory requirements, making these technologies more accessible and effective for domestic fleet operators.

Electric Vehicle Fleet Adoption and Green Fleet Initiatives

Government incentives along with environmental regulations with corporate sustainability goals drive the India fleet management market. Because of this, fleets are trending greatly toward electric and hybrid vehicles. Fleet operators increasingly adopt electric commercial vehicles given state-level EV incentives plus India's National Electric Mobility Mission Plan. For this shift, specialized fleet management solutions are required to monitor battery health as well as to optimize charging schedules.. The India fleet management market growth in electric vehicle segments is supported by expanding charging infrastructure and improving battery technology. Fleet management platforms are being enhanced with EV-specific features such as charge point location mapping, battery performance analytics, and energy cost optimization tools. Companies are implementing green fleet initiatives that combine electric vehicles with smart fleet management systems to achieve carbon neutrality goals and comply with emission regulations. The integration of renewable energy sources for fleet charging, combined with advanced fleet management analytics, is enabling organizations to create comprehensive sustainability strategies while maintaining operational efficiency and cost-effectiveness.

Growth, Opportunities, and Challenges in the India Fleet Management Market:

- Growth Drivers of the India Fleet Management Market: The India fleet management market outlook is positively influenced by the rapid expansion of e-commerce and last-mile delivery services, which require sophisticated fleet management solutions for efficient operations. Government initiatives promoting digitalization and the adoption of advanced transportation technologies are creating favorable conditions for market growth. Rising fuel costs and operational expenses are compelling fleet operators to invest in management systems that optimize routes, monitor fuel consumption, and enhance overall operational efficiency.

- Market Opportunities in the India Fleet Management Market: Significant opportunities exist in developing cost-effective fleet management solutions tailored for small and medium enterprises (SMEs) that represent a large portion of India's commercial vehicle market. The India fleet management market forecast indicates substantial growth potential in tier-2 and tier-3 cities where fleet digitization is still in early stages. Integration with emerging technologies such as 5G connectivity, blockchain for supply chain transparency, and advanced IoT sensors presents lucrative opportunities for market expansion.

- Market Challenges in the India Fleet Management Market: High initial implementation costs and lack of technical expertise among traditional fleet operators pose significant barriers to market adoption. Fragmented market structure with numerous small fleet operators makes it challenging to achieve widespread technology penetration and standardization. Data security concerns and regulatory compliance requirements create complexities in system deployment and management, particularly for multi-state fleet operations.

India Fleet Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, vehicle type, end use sector, technology, and deployment type.

Component Insights:

- Solutions

- Fleet Telematics

- Driver Information Management

- Vehicle Maintenance

- Safety and Compliance Management

- Others

- Services

- Installation and Integration Services

- After-Sales Support Services

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (fleet telematics, driver information management, vehicle maintenance, safety and compliance management, and others) and services (installation and integration services, after-sales support services, and consulting services).

Vehicle Type Insights:

- Commercial Vehicles

- Passenger Cars

- Aircrafts

- Watercrafts

A detailed breakup and analysis of the market based on vehicle type have also been provided in the report. This includes commercial vehicles, passenger cars, aircrafts, and watercrafts.

End Use Sector Insights:

- Automotive

- Energy and Utilities

- Manufacturing

- Retail

- Transportation and Logistics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others.

Technology Insights:

- GNSS

- Cellular Systems

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes GNSS and cellular systems.

Deployment Type Insights:

- Cloud-based

- On-premises

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based, on-premises, and hybrid.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include the North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, Carrum Mobility, part of the CarDekho Group, expanded its partnership with Uber by deploying over 250 SUVs under the Uber Black premium service in Delhi-NCR and Mumbai. As part of the rollout, Carrum introduced daily vehicle and driver inspections, tech-enabled performance monitoring, and structured driver training programs, reinforcing its position in fleet management while helping Uber strengthen its premium segment offerings.

- In January 2025, ZF launched its digital fleet management platform SCALAR in India at the Bharat Mobility Expo. The platform is positioned as the industry’s first comprehensive fleet orchestration solution tailored to the diverse requirements of Indian fleets, covering both cargo and passenger transport. SCALAR offers advanced features for real-time fleet optimization, including productivity enhancements, cost reduction, and improved safety and sustainability.

- In December 2024, Hitachi ZeroCarbon announced a partnership with COBUS Industries to integrate its BatteryManager solution into 100 e.COBUS Extended Range electric airport buses worldwide by 2025. The system provides real-time battery health and performance insights, enabling predictive maintenance, route optimization, and extended asset life, while supporting India’s broader decarbonization and fleet management goals as the country advances toward its 2070 carbon neutrality target.

- In March 2024, Tata Steel received its first fleet of eco-friendly commercial vehicles from Tata Motors, including LNG-powered tractor-trailers and tippers, as well as Ultra EV buses. This deployment marks a step toward reducing Scope 3 emissions in Tata Steel’s supply chain, cutting up to 0.74 kg CO₂/km with electric vehicles and 0.13 kg CO₂/km with LNG, while enhancing sustainability and safety across its logistics operations.

India Fleet Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Vehicle Types Covered | Commercial Vehicles, Passenger Cars, Aircrafts, Watercrafts |

| End Use Sectors Covered | Automotive, Energy and Utilities, Manufacturing, Retail, Transportation and Logistics, Construction, Others |

| Technologies Covered | GNSS, Cellular Systems |

| Deployment Types Covered | Cloud-based, On-premises, Hybrid |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fleet management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fleet management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fleet management industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fleet management market in India was valued at USD 1.2 Billion in 2024.

The India fleet management market is projected to exhibit a (CAGR) of 10.21% during 2025-2033, reaching a value of USD 3.0 Billion by 2033.

The market is expanding with increasing logistics and e-commerce activities necessitating operational efficiency and real-time monitoring. Steep fuel prices, governmental requirements for the installation of GPS, and demand for transparency of operations are major drivers. Digitalization, artificial intelligence (AI) deployment, and safety compliance are prompting fleet operators to implement sophisticated software for cost and performance optimization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)