India Fish Farming Market Size, Share, Trends and Forecast by Environment, Fish Type, and Region, 2026-2034

India Fish Farming Market Size and Share:

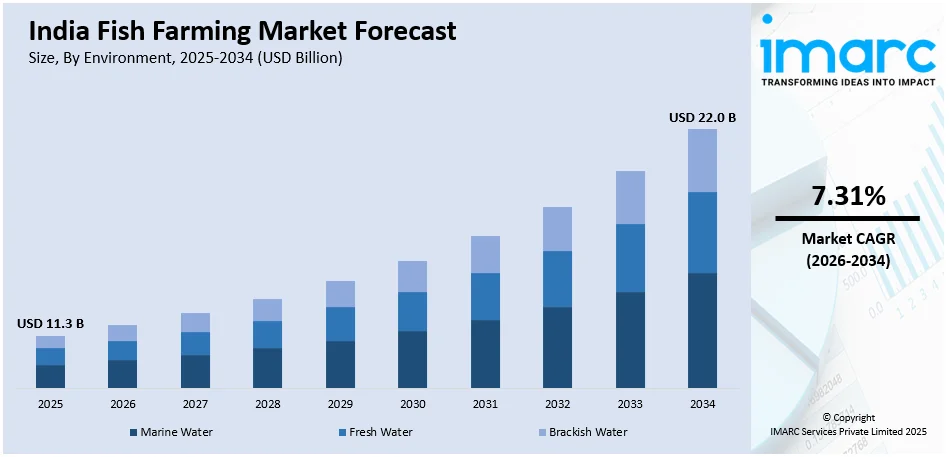

The India fish farming market size was valued at USD 11.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 22.0 Billion by 2034, exhibiting a CAGR of 7.31% from 2026-2034. The market is witnessing notable expansion, mainly bolstered by technological innovations, elevating seafood need, and robust government aid. Elevating utilization of sustainable practices and effective farming methods, combined with an escalating export landscape, are facilitating the expansion of the India fish farming market share. Marine farming and coastal aquaculture are crucial segments of development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.3 Billion |

| Market Forecast in 2034 | USD 22.0 Billion |

| Market Growth Rate (2026-2034) | 7.31% |

The India fish farming market demand is majorly influenced by the magnifying preference for seafood both internationally and domestically. Transforming dietary choices towards protein-abundant foods, significant elevation in disposable incomes, and rapid urbanization have resulted in a better utilization seafood products and fish. In addition, government initiatives such as subsidies, credit support, and infrastructure development under schemes like the Pradhan Mantri Matsya Sampada Yojana (PMMSY) have played a pivotal role in boosting the sector. Besides this, the expanding export potential of Indian seafood to global markets, particularly in Asia, North America, and the Middle East, further accelerates the India fish farming market demand. For instance, according to the Marine Products Export Development Authority, in the FY 2023-24, India achieved a record seafood export volume of 17,81,602 MT, valued at USD 7.38 billion. China and the U.S remain the leading importers of Indian seafood, with frozen shrimp continuing to be the top export item.

To get more information on this market Request Sample

Advancements in aquaculture technology and practices are also fueling the market’s growth. The adoption of sustainable farming techniques, including improved breeding, feed management, and disease control measures, has enhanced productivity and profitability. Furthermore, the increasing focus on coastal aquaculture, along with the use of automated monitoring systems, is contributing to efficient resource utilization and environmental sustainability. As the sector evolves, the demand for high-quality farmed fish continues to rise, benefiting both small-scale and commercial fish farming operations across the country. For instance, industry reports indicate that as of 2024, globally, India is the second biggest producer of farmed fishes and is actively implementing recirculating aquaculture systems (RAS) and biofloc technology (BFT).

India Fish Farming Market Trends:

Sustainable Aquaculture Practices

Sustainability is increasingly emerging as a critical trend in the India fish farming landscape, principally influenced by the accelerating requirement to significantly lower adverse impact on environment and facilitate superior productivity for long-term. Fish farms are rapidly shifting towards environmentally friendly approaches, including the effective water management systems, utilization of organic feed, and the incorporation of recirculating aquaculture systems (RAS). Such advancements aid in enhancing fish health, upgrading resource consumption, and reducing wastage, catering to the rising international requirement for responsibly sourced seafood. In addition to this, the government's robust focus on sustainable methodologies via initiatives such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY) is also propelling the India fish farming market share. For instance, as per the Press Bureau Information, in November 2024, the state government of Kerala announced the development of 100 climate-resilient coastal fishing villages under the PMMSY, with INR 2 crore allocated for each village to enhance infrastructure and foster sustainable livelihoods. The initiative aims to enhance climate resilience by establishing facilities such as fish drying platforms, processing hubs, and rescue operations. Additionally, it emphasizes the adoption of climate-conscious practices, including seaweed cultivation and sustainable fuel initiatives. The government also highlighted the adoption of drone technology to enhance monitoring within the aquaculture and fisheries sectors. Additionally, it unveiled an initiative to install transponders on 100,000 fishing vessels, enabling real-time tracking and weather alert capabilities. This effort is supported by a dedicated investment of INR 364 crores.

Technological Advancements in Fish Farming

India fish farming market forecast indicates that the incorporation of leading-edge technologies in fish farming is revolutionizing the sector dynamics in India. Automation, along with digital tools including Internet of Things (IoT) or artificial intelligence (AI) based monitoring systems, are actively being leveraged to track growth cycle of fish, enhance efficacy, and monitor water quality. Furthermore, advancements in feed formulations, breeding methods, and disease management are significantly improving productivity and lowering the costs of operations. Besides, such technological innovations not only boost elevated yields but also aid the growth of high-value species, mainly including tilapia and shrimp, in India’s aquaculture segment. For instance, as per industry reports, Aquaconnect, an India-based startup, developed AI-powered solution FarmMOJO that aid in elevation of farmer income by 5% to 10%, along with enhancing productivity, predicting diseases aquatic stock including shrimp, and lowering feed cost by 20%-30%. This startup currently serves more than 4200 farmers in Gujarat, Andhra Pradesh, and Tamil Nadu. Besides, by leveraging data intelligence, they facilitated direct connections between farmers and the marketplace, enabling them to sell over 1,000 MT of shrimp to international buyers.

Expansion of Marine Aquaculture

Marine aquaculture, especially along India’s vast coastline, is establishing itself as a principal trend in the fish farming industry. With notable proliferation of coastline, India is economically benefitting on the prospects for coastal as well as offshore fish farming. For instance, industry reports state that India's coastline has substantially expanded to 11,098 km in 2023-2024, up from 7,516 km in 1970. Moreover, species like shrimp, marine fish, and mollusks are being farmed in controlled marine environments, with increasing investment in marine infrastructure and technologies. This shift towards marine aquaculture is spurred by rising consumer demand for high-quality seafood, as well as the government's efforts to promote coastal aquaculture through various government initiatives, further boosting the India fish farming market growth.

India Fish Farming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India fish farming market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on environment and fish type.

Analysis by Environment:

- Marine Water

- Fresh Water

- Brackish Water

As per the India fish farming market trends, marine water fish farming represents a significant segment of the market. With a vast coastline, India’s marine aquaculture is thriving, particularly in the production of high-value species such as shrimp, grouper, and seabass. The marine environment offers favorable conditions for large-scale farming, contributing to the growth of the sector. Enhancements in breeding methodologies, nutritional formulations, and strategies for disease control have significantly improved overall efficiency and output. In addition, government support through subsidies and the promotion of sustainable practices has encouraged expansion. As a result, marine water aquaculture continues to hold a prominent position in India's fish farming industry.

Freshwater fish farming is highly prevalent in India’s aquaculture sector, with species like catfish, tilapia, and carp, being comprehensively grown. The nation’s surplus of freshwater resources, encompassing reservoirs, rivers, and ponds, offer a robust foundation for the expansion of this segment. Furthermore, freshwater fish farming is especially prevalent in rural regions, where it facilitates food security and aids livelihoods. In addition, innovations in sustainable farming approaches, breeding methods, water quality management have significantly improved productivity and India fish farming market outlook. With increasing consumer demand for fish protein and the government's push for aquaculture development, freshwater fish farming remains a core component of India’s fish farming market.

Brackish water aquaculture is a growing segment in India’s fish farming market, driven by the country's extensive coastal areas where both saline and freshwater mix. Brackish water farming is primarily focused on species like shrimp and mud crabs, which thrive in these conditions. The segment has seen rapid growth due to the increasing demand for high-value seafood products both domestically and for export. Furthermore, technological advancements in water management and disease control, along with favorable government policies, have enabled farmers to optimize yields. As a result, brackish water fish farming is emerging as a key contributor to India’s overall aquaculture industry.

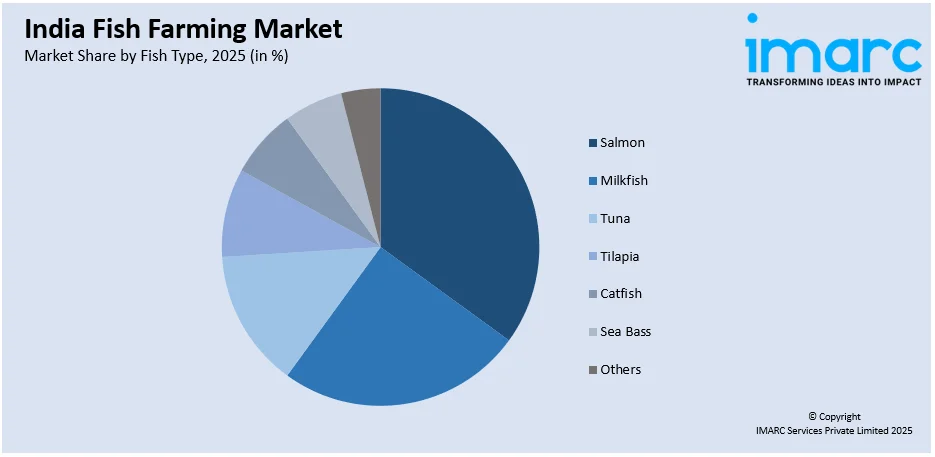

Analysis by Fish Type:

Access the comprehensive market breakdown Request Sample

- Salmon

- Milkfish

- Tuna

- Tilapia

- Catfish

- Sea Bass

- Others

Based on the India fish farming market outlook, salmon farming is notably gaining attention. This is driven by the growing domestic demand for high-quality seafood and an increasing preference for salmon due to its health benefits. India’s favorable climatic conditions, particularly in controlled aquaculture environments, are being explored for salmon cultivation. However, challenges such as high feed costs, water temperature management, and the need for specialized farming techniques limit its widespread adoption. Despite these challenges, salmon is emerging as a critical market in India’s expanding fish farming industry, with prospects for growth in premium seafood production.

Milkfish farming is a key component of India’s aquaculture sector, especially in coastal regions where brackish water resources are abundant. This species is highly valued for its fast growth rate and resilience in varying water conditions. Milkfish is primarily cultivated in extensive systems, making it an affordable and sustainable option for rural farmers. The fish is popular in Southeast Asian cuisine, and its increasing demand has led to growth in domestic production. Furthermore, with supportive government initiatives for aquaculture development and advances in farming techniques, milkfish farming is expected to expand, contributing significantly to India's fish farming market.

Tuna farming in India is witnessing steady growth, driven by both domestic consumption and international export potential. The country's vast maritime resources and strategic location make it well-suited for tuna farming, particularly in coastal regions. The demand for tuna, especially varieties like yellowfin and bluefin, is increasing due to their popularity in global markets, particularly in sushi and sashimi production. In addition, tuna farming requires high capital investment, advanced technology, and expertise. Furthermore, tuna is expected to remain an important segment within India’s fish farming market, particularly as export opportunities grow.

Tilapia farming plays a notable role in India’s freshwater aquaculture sector. Tilapia is prized for its rapid growth, adaptability to various water conditions, and resistance to disease, making it an ideal choice for farmers across the country. With a growing preference for low-cost, nutritious fish, tilapia’s popularity is on the rise both in domestic markets and for export. Advances in breeding practices and farming technologies have further increased yields, supporting market growth. Moreover, the government’s focus on promoting sustainable aquaculture practices also contributes to tilapia’s strong position in India’s fish farming market, ensuring continued growth in the coming years.

Catfish farming is another key segment within India’s fish farming market, particularly in freshwater systems. Known for its fast growth, low feed conversion ratio, and high market demand, catfish has become a favored species among farmers. The fish’s adaptability to a range of water conditions and its resilience to diseases further contribute to its popularity. Additionally, with a strong domestic demand for catfish, particularly in the foodservice and processing sectors, its market share is expected to expand. As India’s aquaculture industry continues to grow, catfish farming is anticipated to remain a critical component, supported by technological advancements and sustainable practices.

Sea bass farming is emerging as a prominent segment in India’s marine aquaculture industry, particularly along the coastal regions. The fish’s fast growth rate, high market value, and suitability for farming in controlled environments make it an attractive option for aquaculture businesses. Furthermore, sea bass is highly regarded in both domestic and international markets due to its delicate flavor and firm texture, making it popular in fine dining. With increasing demand for premium seafood products, sea bass farming is poised for growth. Moreover, ongoing research into breeding, feed, and farming practices will further drive the expansion of sea bass in India’s fish farming market.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

South India is a leading region in India’s fish farming market, benefiting from a long coastline and abundant freshwater resources. Coastal states like Tamil Nadu, Andhra Pradesh, and Kerala dominate the marine and brackish water aquaculture sectors, with the farming of shrimp, milkfish, and tilapia being particularly prominent. The region's favorable climatic conditions and growing demand for seafood contribute to its strong market position. Additionally, advancements in farming technologies and government support for sustainable aquaculture practices are driving the growth of fish farming in South India, reinforcing its critical role in the country’s overall fish production.

North India has seen steady growth in fish farming, primarily focusing on freshwater species such as tilapia, catfish, and carp. While the region is not as heavily dependent on coastal aquaculture, the availability of rivers, lakes, and reservoirs supports substantial inland fish farming. Additionally, states like Uttar Pradesh, Haryana, and Punjab contribute significantly to the market due to strong demand for affordable protein sources. Government initiatives aimed at boosting aquaculture productivity, coupled with improved farming techniques and better market access, are further enhancing the growth potential of North India’s fish farming sector, positioning it for long-term expansion.

West and Central India, with states like Maharashtra, Gujarat, and Madhya Pradesh, represent a growing segment of the fish farming market. Marine aquaculture thrives along the western coastline, particularly in Gujarat, where shrimp and sea bass farming are gaining prominence. Additionally, Central India’s freshwater farming activities, mainly focused on tilapia and catfish, are seeing significant expansion. Moreover, the region benefits from improved infrastructure, government incentives, and a well-established processing and export network, making it a key player in both domestic and international seafood markets. As such, West and Central India are critical to the overall growth of India’s fish farming industry.

East India is an emerging region for fish farming, with significant aquaculture activity in states like West Bengal, Odisha, and Assam. The region is known for its extensive freshwater farming, especially of species like catfish, tilapia, and carp. West Bengal, in particular, stands out for its large-scale freshwater fish farming and well-established fish markets. Despite challenges related to infrastructure and market access, East India’s fish farming market is gaining traction due to rising consumer demand for affordable and nutritious seafood. Ongoing investments in improving farming techniques and infrastructure will drive the region’s growth in the coming years.

Competitive Landscape:

The competitive landscape is exhibited by the robust establishment of large commercial operators as well as small-scale farmers. Industry giants mainly encompass cooperative models, local aquaculture firms, and multinational enterprises, that are currently emphasizing on variety of species like carp, shrimp, and tilapia. Besides this, competition is significantly elevating with rapid innovations in technology, eco-friendly farming methods, and advancements in booth feed management and breeding. Furthermore, increasing government programs offer a substantial boost to the industry, incentivizing new contenders. For instance, in November 2024, State for Fisheries, Animal Husbandry, Dairying, and Minority Affairs unveiled the Blue Pearl Fish Farmer Producer Company (FFPO) that is developed in partnership with ICAR-Central Institute of Fisheries Technology and NABARD. This company will target to empower local fish farmers and fuel the growth in fishery industry. In addition, the market is also witnessing increasing consolidation as larger players expand their operations to capture growing domestic and export demand.

The report provides a comprehensive analysis of the competitive landscape in the India fish farming market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, the State Government of Telangana announced the initiation of fish farming and sales practices study in Karnataka, with a robust emphasis on enhancing the state's aquaculture industry. This study is a tactical segment of the government's target to launch a new policy to bolster local aquaculture, improve production, and enhance market access for fish farmers.

- In November 2024, Punjab Agriculture and Farmers Welfare introduced a new fish market in Patiala. The market is developed with a significant investment of INR 4.5 Cr. This wholesale fish market will target to incentivize the fisheries sector along with paving new income prospects for local fish providers.

- In August 2024, the University of Engineering and Management signed an MoU with WorldFish to develop a ML and AI-based decision support system to aid the production of aquatic food. This system will acknowledge several parameters requisite to attain elevated levels of ecological and social sustainability, encompassing stable natural resource consumption, preservation of soil health, economic benefits, and ecosystem integrity.

- In July 2024, Captain Fresh, an India-based B2B seafood company, announced strategic acquisition of Koral, a Poland-based salmon provider. This tactical move highlights Captain Fresh's third crucial acquisition in 2024, with target to proliferate its foothold in the European seafood sector, especially in salmon category.

India Fish Farming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Marine Water, Fresh Water, Brackish Water |

| Fish Types Covered | Salmon, Milkfish, Tuna, Tilapia, Catfish, Sea Bass, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fish farming market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India fish farming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fish farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fish farming market was valued at USD 11.3 Billion in 2025.

The India fish farming market is estimated to reach USD 22.0 Billion by 2034, exhibiting a CAGR of 7.31% from 2026-2034.

The growth of the India fish farming market is driven by increasing demand for seafood, rising disposable incomes, government support through subsidies and policies, advancements in aquaculture technology, and a shift toward sustainable and efficient farming practices. Additionally, the export potential of seafood contributes significantly to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)