India Fire & Safety Equipment Market Size, Share, Trends and Forecast by Solution, Application, and Region, 2025-2033

India Fire & Safety Equipment Market Overview:

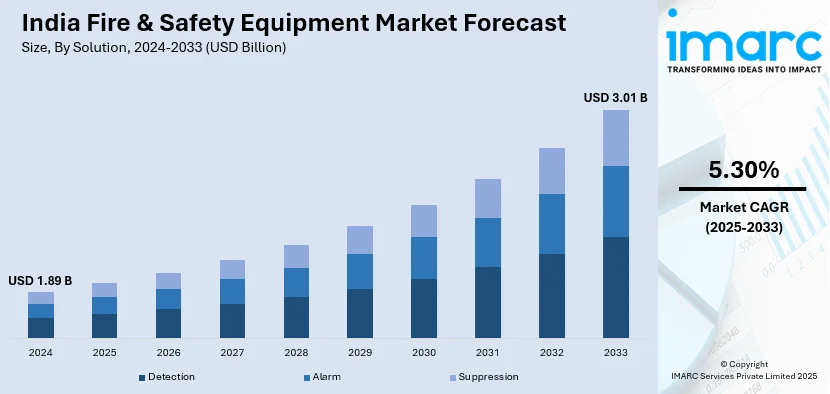

The India fire & safety equipment market size reached USD 1.89 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.01 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. Stringent government regulations, increased infrastructure development, rising fire incidents in residential and commercial spaces, heightened awareness of workplace safety, and advancements in fire detection and suppression technologies are fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.89 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Market Growth Rate 2025-2033 | 5.30% |

India Fire & Safety Equipment Market Trends:

Integration of Advanced Technologies in Fire Safety Equipment

The Indian fire safety equipment market is undergoing a technological transformation with the integration of IoT, AI, and smart sensors, significantly improving fire detection and suppression capabilities. IoT-enabled fire alarms now provide real-time alerts to emergency services and occupants, reducing response times and enhancing safety. In 2023, Johnson Controls partnered with an Indian real estate developer to implement integrated fire protection solutions for a smart city initiative, a collaboration projected to generate INR 500 crore in revenue over the next five years. AI-driven fire suppression systems are also gaining traction, utilizing sensor data to predict and mitigate potential fire hazards proactively. It is anticipated that more than 50,000 buildings in India will have AI and IoT-based fire protection systems installed by 2028, greatly enhancing operational effectiveness and safety. Furthermore, the integration of fire safety systems with Building Management Systems (BMS) is improving the infrastructure for fire protection in both residential and commercial areas by simplifying centralized monitoring and control. In addition to improving fire safety protocols, these developments support India's Smart Cities Mission, which encourages market growth and strengthens the nation's dedication to technical improvements in disaster relief and fire prevention.

To get more information on this market, Request Sample

Infrastructure Development and Government Initiatives

The rapid urbanization, industrial expansion, and large-scale infrastructure projects in India are driving the demand for advanced fire safety solutions. The commercial real estate sector is experiencing significant growth, with an influx of USD 2.77 billion in investments in 2024, fueling the development of office spaces, shopping malls, and hotels. Government regulations mandating fire protection systems in public, industrial, and residential buildings further contribute to market expansion. The Indian government’s Smart Cities Mission and national safety policies prioritize integrating modern fire safety technologies into urban infrastructure. Under the Pradhan Mantri Awas Yojana Urban 2.0, INR 10 lakh crore was allocated in 2024 for affordable housing projects, incorporating fire safety as a key component. Additionally, INR 1,44,237 crore was invested in infrastructure development under the Smart Cities Mission, ensuring enhanced fire protection systems in urban areas. Beyond real estate, industries such as manufacturing, oil & gas, and commercial enterprises are increasingly adopting fire safety measures due to stricter building codes and rising safety awareness. Public campaigns on fire safety further drive the adoption of protective measures across sectors. These factors collectively contribute to the growing market for fire safety equipment in India, fostering significant industry expansion.

India Fire & Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on solution and application.

Solution Insights:

- Detection

- Alarm

- Suppression

The report has provided a detailed breakup and analysis of the market based on the solution. This includes detection, alarm, and suppression.

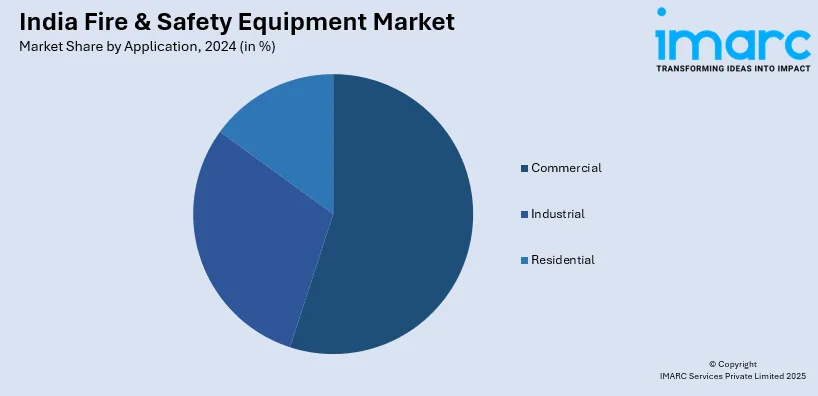

Application Insights:

- Commercial

- Industrial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fire & Safety Equipment Market News:

- November 2024: Sri Triveni Crafts, a Gurgaon-based fire safety equipment maker, introduced a new portable fire extinguisher built for electrical fires. The unique solution, which was created after significant study and testing, provides a cost-effective alternative to traditional fire extinguishing systems. The product boasts patent-protected technology, a user-friendly design, a 10-year shelf life, and extensive laboratory testing certification.

- September 2024: Edwards, a leading manufacturer of fire safety and detection systems, announced the local production of its Signature Optica Smoke Detectors in India. These smoke detectors are outfitted with cutting-edge technologies such as dual wavelengths, different angles, and advanced detecting algorithms that discriminate between harmless particles and dangerous threats.

- July 2024: HFI, a business unit of the Halma Safety Sector, launched Veiga, a novel fire alarm and detection system designed to improve fire prevention and protection in residential, commercial, and industrial settings in India. Veiga designs, tests, and manufactures all of its fire safety alarms and detection solutions in India, and they are certified to EN-54 and IS standards.

India Fire & Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Detection, Alarm, Suppression |

| Applications Covered | Commercial, Industrial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fire & safety equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fire & safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fire & safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fire & safety equipment market was valued at USD 1.89 Billion in 2024.

The India fire & safety equipment market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 3.01 Billion by 2033.

The India fire & safety equipment market is driven by increasing regulatory enforcement in construction, industrial, and commercial sectors. Rising urban infrastructure, growing awareness about workplace safety, and high-profile fire incidents have boosted demand. Additionally, adoption of advanced technologies like smart fire detection systems and mobile surveillance solutions is further reshaping market preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)