India Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

India Fintech Market Size:

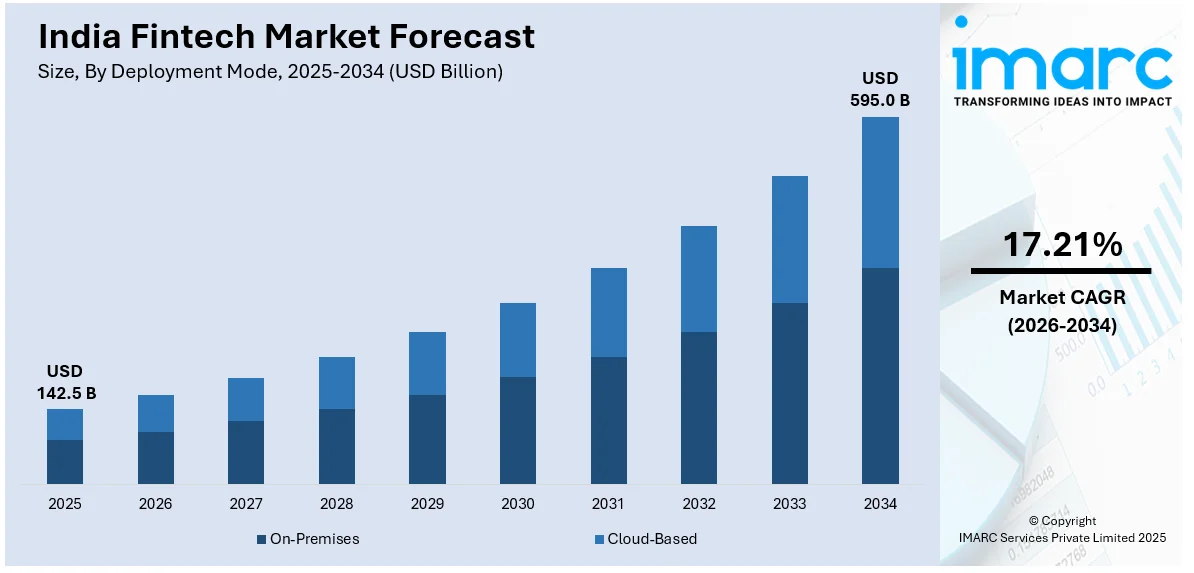

The India fintech market size reached USD 142.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 595.0 Billion by 2034, exhibiting a growth rate (CAGR) of 17.21% during 2026-2034. The market is experiencing steady growth driven by increasing smartphone and internet penetration facilitating access to digital financial services, the implementation of regulatory frameworks encouraging innovation and consumer protection across the globe, and continuous technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 142.5 Billion |

|

Market Forecast in 2034

|

USD 595.0 Billion |

| Market Growth Rate 2026-2034 | 17.21% |

India Fintech Market Analysis:

- Major Market Drivers: According to the India fintech market report, the market is majorly driven by technological upgrades and the availability of digital space on the back of the high penetration of smartphones and the internet amongst Indians. Government regulation encourages growth; therefore, this is also propelling the market.

- Key Market Trends: Mobile banking, digital wallets, and online lending platforms are growing correspondingly to the broader increase in consumer demand for fast and accessible financial services. The emergence of AI, blockchain, and big data analytics is allowing fintech to provide personalized solutions with greater safety.

- Geographical Trends: Urban areas with high internet penetration and tech-savvy populations are leading the fintech adoption curve in India.

- Competitive Landscape: According to the India fintech market overview, the competition is the highest in the fintech market of India, with numerous homegrown fintech startups and established financial institutions trying to capture market share.

- Challenges and Opportunities: The main challenges for the development of digital banking are compliance and regulatory requirements, cybersecurity risks, and the necessity of a secure digital infrastructure. However, major opportunities include serving the unbanked population and exploiting technology to create new financial products and experiences.

To get more information on this market Request Sample

India Fintech Market Trends:

Technological advancements and digital adoption

The escalating penetration of smartphones and internet is driving the India fintech market growth. Due to the accelerating number of mobile subscribers and Internet users, the digital context opens a wide range of opportunities for fintech innovations. Techs such as artificial intelligence (AI), blockchain, and big data analytics have been broadly adopted, allowing most fintech firms to deliver more personalized, efficient, and secure financial services. This change is especially visible in debit, mobile, electronic wallet, and peer-to-peer platforms which makes it more convenient and accessible for a wider audience from minority borrowers living in remote corners. This trend has been further empowered by the Indian government, which is advocating for a digital economy (for instance through Digital India or the unauthorized Payments Interface (UPI)) allowing financial services to become mainstream in daily activities.

Regulatory support and government initiatives

The Indian government and the regulatory bodies in India are playing a major role in creating the ecosystem that the fintech firms need to flourish. There is also a better regulatory environment emerging for a number of these products as main markets are stepping up and moving towards producing innovation and protection for consumers. The entirety of the financial industry has been a body of regulations set up by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) to lend to the industry overall, a greater degree of transparency, security, and efficiency. In addition, programs such as Pradhan Mantri Jan Dhan Yojana (PMJDY); are accelerating the move towards financial inclusion and letting millions of unbanked individuals come under the fold of a formal financial system. According to the India fintech market forecast, regulatory sandboxes allow fintech startups to trial new products and services under a more relaxed regulatory mindset, decreasing the number of breaches, consequently activating innovation, and driving the market as the India fintech industry growth improves.

Rising consumer demand and financial inclusion

The escalating demand for complex financial products and services in India is being fueled by a rising middle class and better literacy rates, according to experts in India. During this time of increased demand from consumers for more convenient, cost-effective, accessible financial solutions, there has been a corresponding growth in fintech adoption. Along with this, microfinance, peer-to-peer lending, and digital payment platforms, all facilitate a much greater potential for financial services on a wider scale, allowing more of the world to receive financial assistance and greater numbers of impoverished regions outside of cities. Consumers can take advantage of banking services that traditional banks are not able to reach. Apart from this, the COVID-19 pandemic has accelerated this shift, with more industries forced to pivot to accommodate work from home, digital transactions becoming essential to carry-on economic activities, financial inclusion gaps further exposed, and fintech used to bridge these gaps to support economic resilience. Thus, this is also expanding the India fintech market size.

India Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India fintech market report, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on deployment mode, technology, application, and end user.

Breakup by Deployment Mode:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Breakup by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

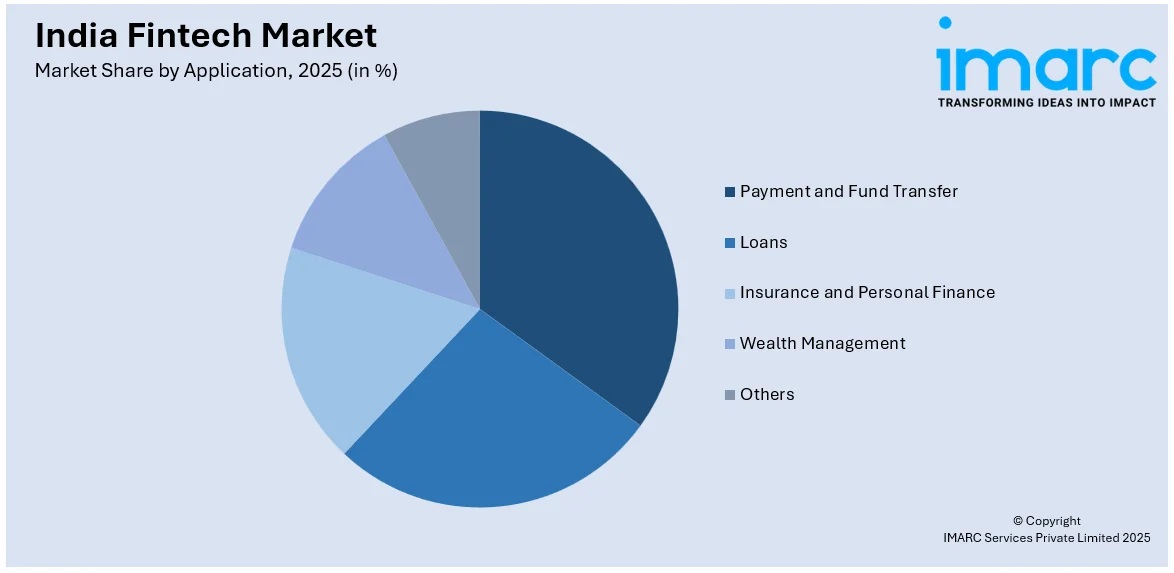

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

Breakup by End User:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Breakup by Region:

- North India

- South India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major markets in the country, which include North India, South India, West and Central India, and East India.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Key Indian companies holding the major India fintech market share are utilizing tech for new solutions and offerings more advanced use of AI and machine learning to make digital payment more secure and user-friendly such as Paytm, PhonePe, and GooglePay, among others. This is further encouraging traditional banks including ICICI and HDFC to partner with fintech startups to enable cloud banking and online lending seamlessly. Other companies such as Razorpay and Pine Labs are building a full stack of merchant services, journeying beyond payment gateways to offer Point of Sale solutions. Apart from this, companies in the insurtech and wealthtech space such as PolicyBazaar (insurtech) and Zerodha (wealthtech) have been leveraging digital platforms to make insurance and investment easy for their users. Moreover, the collective efforts entail progress toward expanding financial inclusion, ease of access to customers, and the overall growth of the fintech ecosystem in India.

India Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | North India, South India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fintech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fintech market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fintech industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in India was valued at USD 142.5 Billion in 2025.

The fintech market in India is projected to exhibit a CAGR of 17.21% during 2026-2034, reaching a value of USD 595.0 Billion by 2034.

Technological upgrades, the increasing penetration of smartphones and the internet, government regulation, and a growing digital financial ecosystem are major drivers. The rising adoption of AI, blockchain, and data analytics is significantly enhancing the personalization and security of financial services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)