India Fiber Cement Market Size, Share, Trends and Forecast by Raw Material, Construction Type, End Use, and Region, 2025-2033

India Fiber Cement Market Overview:

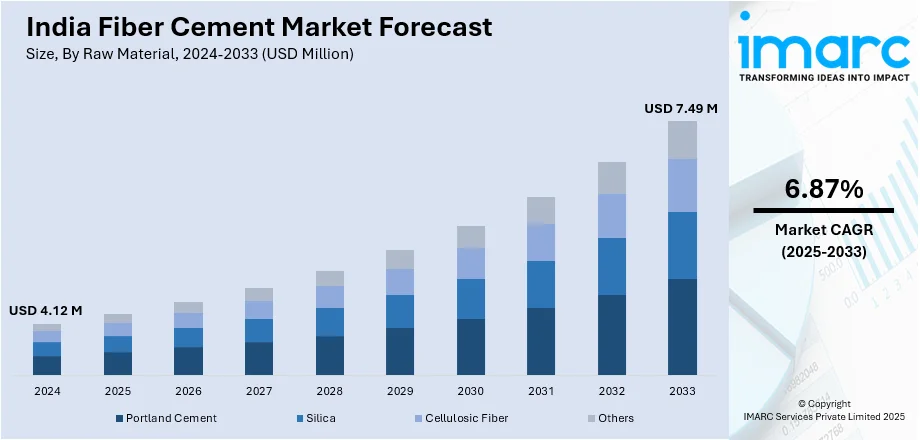

The India fiber cement market size reached USD 4.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7.49 Million by 2033, exhibiting a growth rate (CAGR) of 6.87% during 2025-2033. The India fiber cement market is expanding due to rapid urbanization, rising infrastructure projects, and increasing demand for durable, fire-resistant materials. Sustainable construction trends, prefabrication adoption, and eco-friendly innovations are driving growth. Moreover, government initiatives for affordable housing and smart cities further support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.12 Million |

| Market Forecast in 2033 | USD 7.49 Million |

| Market Growth Rate (2025-2033) | 6.87% |

India Fiber Cement Market Trends:

Rising Demand for Durable Construction Materials

The Indian fiber cement market is witnessing robust growth driven by growing construction activities in residential, commercial, and industrial areas. Moreover, urbanization and infrastructure developments are propelling the demand for products that are durable, fire-resistant, and resistant to harsh weather conditions. Architects and builders are opting for fiber cement over conventional materials such as wood and asbestos because it is more environmentally friendly and requires less maintenance. Moreover, affordable housing and smart city initiatives by the government are driving the application base of fiber cement broader. The demand is also being supported by increased home remodeling and renovation activities, wherein customers are choosing long-lasting and strong products. Novel product innovations, like high-performance fiber cement boards with better insulation and soundproofing properties, are increasing in popularity. Several manufacturers are also moving towards green production practices by minimizing carbon footprints and incorporating recycled materials. The use of prefabricated construction techniques is another trend driving demand, as fiber cement panels enable faster installation. Firms are launching new designs and textures to increase the aesthetic value of fiber cement products in contemporary architecture. With increasing awareness of sustainable building options, the market is likely to continue growing in the next few years, fueled by technological innovation and changing consumer demand.

To get more information on this market, Request Sample

Growth in Infrastructure and Industrial Applications

Applications of fiber cement are on the rise in mega-infrastructure projects, such as highways, railways, and business complexes. Its corrosion, pest, and moisture resistance make it perfect for industrial settings, where longevity is a primary issue. In addition, the building of warehouses, factory complexes, and office buildings is also driving market growth. Also, fiber cement cladding and roofing products are being adopted by real estate developers because of their appearance and economy. Rural housing schemes are also on the rise in the market as fiber cement is viewed as a cheap and long-lasting substitute for traditional materials. Moreover, companies are investing in research and development to launch lightweight, high-strength fiber cement sheets with enhanced performance. Factory automation is improving productivity, lowering expenses, and assuring uniform quality. Most of the manufacturers are increasing their output capacity to suffice the increasing need, especially from urban areas and developing countries. Furthermore, the trend for sustainable and eco-friendly buildings also affects the need for fiber cement products. Consumer consciousness and sectoral regulations are only improving, and the market is bound to grow gradually. Growing partnerships between construction companies and material providers are also slated to propel the industry's long-term development.

India Fiber Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-20333. Our report has categorized the market based on raw material, construction type, and end use.

Raw Material Insights:

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes Portland cement, silica, cellulosic fiber, and others.

Construction Type Insights:

- Siding

- Roofing

- Molding and Trim

- Others

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes siding, roofing, molding and trim, and others.

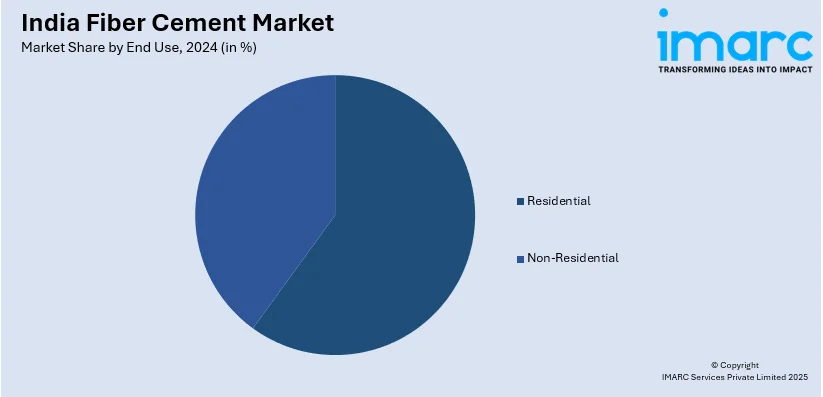

End Use Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and non-residential.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fiber Cement Market News:

- January 2025: Nuvoco Vistas Corp Ltd. launched Nuvoco Duraguard Microfiber Cement in Western Uttar Pradesh, advancing India's fiber cement market. This patented PPC variant with microfibers improves crack resistance and durability. Haryana-based production ensures faster supply, boosting regional market expansion and demand for fiber-reinforced cement solutions.

- March 2024: Everest Industries is set to launch a fiber cement boards and panels plant in Chamarajanagar, Karnataka, with a INR 187 Crore investment. The 72,000 MT fiber cement board capacity enhances eco-friendly construction.

India Fiber Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Covered | Portland Cement, Silica, Cellulosic Fiber, Others |

| Construction Type Covered | Siding, Roofing, Molding and Trim, Others |

| End Use Covered | Residential, Non-Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fiber cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fiber cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fiber cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fiber cement market was valued at USD 4.12 Million in 2024.

The fiber cement market in India is projected to exhibit a CAGR of 6.87% during 2025-2033, reaching a value of USD 7.49 Million by 2033.

The fiber cement market in India is driven by rapid urbanization and infrastructure expansion, increasing demand for affordable, durable, fire- and weather-resistant materials in residential and commercial construction. Technological advancements, green-building awareness, prefabrication use, and government initiatives like Smart Cities and affordable housing schemes further boost the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)