India Ferrous Scrap Recycling Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Ferrous Scrap Recycling Market Overview:

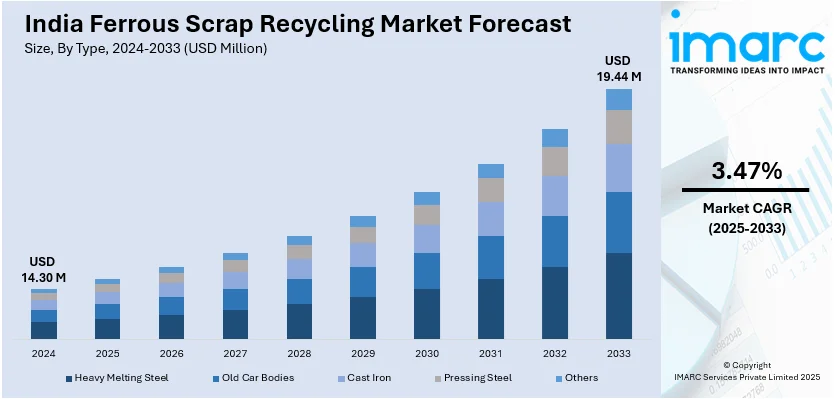

The India ferrous scrap recycling market size reached USD 14.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 19.44 Million by 2033, exhibiting a growth rate (CAGR) of 3.47% during 2025-2033. India's ferrous scrap recycling market is growing due to rising steel demand, urbanization, and industrial expansion. Government policies promote organized recycling, reducing import dependence. Advanced processing technologies improve efficiency, while sustainability goals drive increased scrap usage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.30 Million |

| Market Forecast in 2033 | USD 19.44 Million |

| Market Growth Rate (2025-2033) | 3.47% |

India Ferrous Scrap Recycling Market Trends:

Expansion of Organized Metal Scrap Recycling in India

In India, the market is witnessing significant growth due to rising demand for sustainable raw materials in steel production. The shift toward organized recycling is driven by government policies, increasing industrialization, and the push for decarbonization. Steel manufacturers are actively sourcing high-quality recycled scrap to reduce reliance on virgin iron ore, lowering production costs and carbon emissions. The transition from unorganized to structured recycling is gaining momentum, ensuring better efficiency and resource utilization. A key development in this sector was Mitsui & Co.’s investment in MTC Business Private Ltd. in June 2024. MTC, operating over 30 recycling facilities, is expanding metal scrap processing and vehicle recycling. This move strengthens the supply chain for steelmakers by ensuring a steady flow of processed scrap. Additionally, the investment promotes cleaner recycling methods, aligning with India's sustainability goals. As urbanization and infrastructure projects grow, the demand for steel continues to rise. Organized scrap recycling plays a crucial role in meeting this demand while minimizing environmental impact. Companies like MTC are contributing to a more structured recycling framework, reducing waste and enhancing the circular economy.

To get more information on this market, Request Sample

Rising Domestic Scrap Collection and Processing

The market is experiencing steady growth, driven by increased domestic scrap collection and processing efficiency. The country is gradually reducing its reliance on imported scrap by enhancing local recycling capabilities. With urbanization and industrial expansion, the construction and automotive sectors are generating substantial ferrous scrap, contributing to a more consistent supply. The introduction of advanced shredding and sorting technologies is improving scrap quality and recovery rates. Additionally, government policies, such as duty reductions on scrap imports and incentives for domestic recycling plants, are fostering industry growth. Steel manufacturers are increasingly using recycled scrap to reduce carbon emissions and production costs, aligning with global sustainability efforts. The shift from informal to formal recycling channels is improving efficiency, while digital platforms for scrap trading are enhancing transparency and price stability. Rising awareness of circular economy principles among businesses and consumers is further accelerating market adoption. However, infrastructure constraints and high logistics costs remain challenges. Investments in better collection networks and processing facilities will be critical for future market expansion. As domestic supply chains strengthen, India's ferrous scrap recycling industry is expected to play a more significant role in the global steel market, ensuring long-term sustainability and resource efficiency.

India Ferrous Scrap Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Heavy Melting Steel

- Old Car Bodies

- Cast Iron

- Pressing Steel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes heavy melting steel, old car bodies, cast iron, pressing steel, and others.

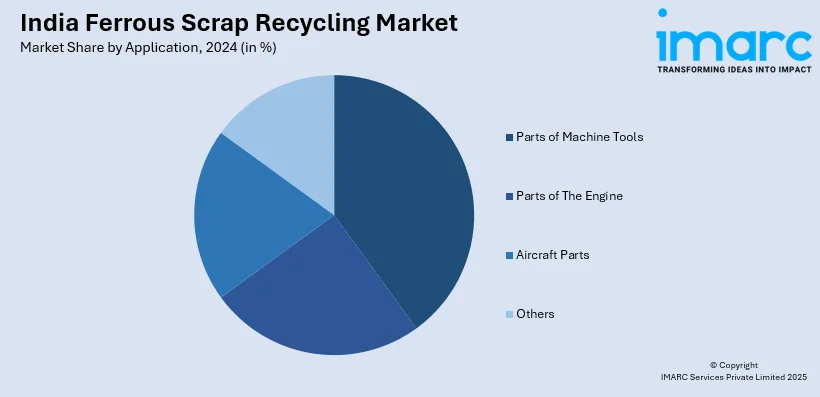

Application Insights:

- Parts of Machine Tools

- Parts of The Engine

- Aircraft Parts

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes parts of machine tools, parts of the engine, aircraft parts, and others.

End User Insights:

- Construction

- Automotive

- Shipbuilding

- Equipment Manufacturing

- Consumer Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, automotive, shipbuilding, equipment manufacturing, consumer appliances, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ferrous Scrap Recycling Market News:

- January 2025: Attero launched MetalMandi, an AI-powered platform to streamline India's ferrous scrap recycling market. Aiming to process 1,000 Tons daily by May 2025, it enhances transparency, eliminates intermediaries, and boosts efficiency, accelerating the formalization and growth of India's organized metal recycling sector.

- December 2024: The Ministry of Steel launched the Green Steel Mission with a INR 15,000 Crore budget, promoting ferrous scrap recycling for decarbonization. Policies like Steel Scrap Recycling Policy and zero BCD on ferrous scrap enhance domestic scrap availability, reducing imports and boosting sustainable steel production.

India Ferrous Scrap Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Heavy Melting Steel, Old Car Bodies, Cast Iron, Pressing Steel, Others |

| Application Covered | Parts of Machine Tools, Parts of The Engine, Aircraft Parts, Others |

| End User Covered | Construction, Automotive, Shipbuilding, Equipment Manufacturing, Consumer Appliances, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ferrous scrap recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ferrous scrap recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ferrous scrap recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ferrous scrap recycling market was valued at USD 14.30 Million in 2024.

The ferrous scrap recycling market in India is projected to exhibit a CAGR of 3.47% during 2025-2033, reaching a value of USD 19.44 Million by 2033.

The ferrous scrap recycling market in India is driven by rapid urbanization, expanding infrastructure and automotive sectors, and growth in steel production. Focus on sustainability, reduced energy costs, supportive government incentives like vehicle scrappage and production-linked policies, and adoption of advanced recycling technologies are also boosting market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)