India Ferroalloy Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Ferroalloy Market Size and Share:

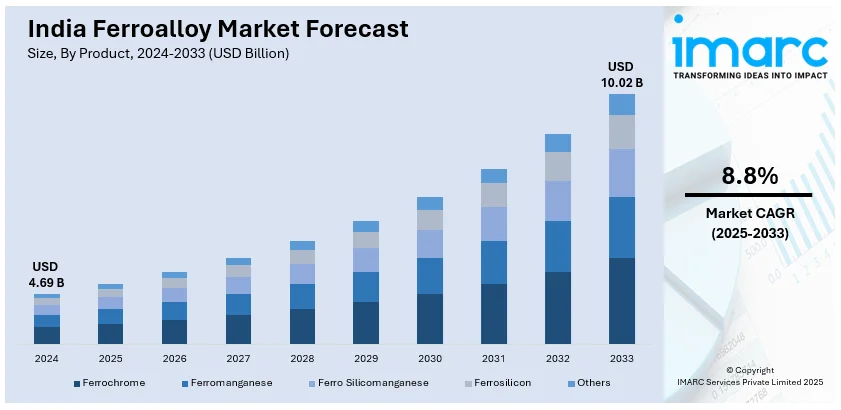

The India ferroalloy market size reached USD 4.69 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.02 Billion by 2033, exhibiting a growth rate (CAGR) of 8.8% during 2025-2033. The rising steel production, government initiatives, infrastructure growth, and increasing demand from the automotive and construction sectors are the factors propelling the growth of the market. Abundant raw material availability, export opportunities, and technological advancements in production processes further support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.69 Billion |

| Market Forecast in 2033 | USD 10.02 Billion |

| Market Growth Rate (2025-2033) | 8.8% |

India Ferroalloy Market Trends:

Growing Focus on Environmental Transparency

The ferroalloy sector in India is increasingly adopting environmental impact assessment tools to enhance sustainability practices. Producers are prioritizing third-party verified declarations that provide detailed insights into carbon footprint, resource consumption, and lifecycle impact. This shift enables buyers to make informed sourcing decisions while aligning with stricter regulatory frameworks and global sustainability goals. The move toward publishing comprehensive environmental impact reports reflects a broader industry effort to reduce emissions, improve resource efficiency, and meet customer demand for greener materials. With sustainability now a competitive factor, companies are integrating eco-friendly measures into production processes, reinforcing their commitment to responsible manufacturing. This development signals a transformation in ferroalloy production, emphasizing accountability and aligning with global decarbonization initiatives. For example, in November 2024, Tata Steel's Ferro Alloys and Minerals Division published an Environmental Product Declaration (EPD) for ferrochrome, becoming the first in India's ferrochrome industry to do so. This EPD provides transparent, third-party verified data on the product's environmental impact, aiding customers in making sustainable choices. The initiative aligns with Tata Steel's commitment to environmental transparency and leadership in the industry.

To get more information on this market, Request Sample

Strengthening Collaboration in Ferroalloy Production

India's ferroalloy industry is experiencing an increased push for industry-wide collaboration to overcome operational difficulties and assure long-term success. Rising electricity prices and restricted mineral availability have prompted talks about regulatory assistance, technology breakthroughs, and supply chain optimization. Industry executives emphasize the need of government action and strategic alliances to improve production efficiency and global competitiveness. With ferroalloys playing an important role in steel production, stakeholders are actively looking at options including renewable energy integration and resource diversification. The growing engagement of experts and stakeholders in industry forums demonstrates a collaborative effort to address inefficiencies and build a more resilient ecosystem. This strategy is projected to increase efficiency, assure consistent raw material supply, and promote long-term growth in ferroalloy production. For instance, in September 2024, the Indian Ferro Alloys and Producers' Association (IFAPA) hosted the 4th International Ferro Alloys Conference, attracting over 550 delegates and featuring insights from more than 30 industry experts. The event underscored ferroalloys' essential role in India's steel industry and addressed challenges such as high-power tariffs and ore shortages. Industry leaders called for collaborative efforts to overcome these obstacles and promote sustainable growth in the sector.

India Ferroalloy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ferrochrome, ferromanganese, ferro silicomanganese, ferrosilicon, and others.

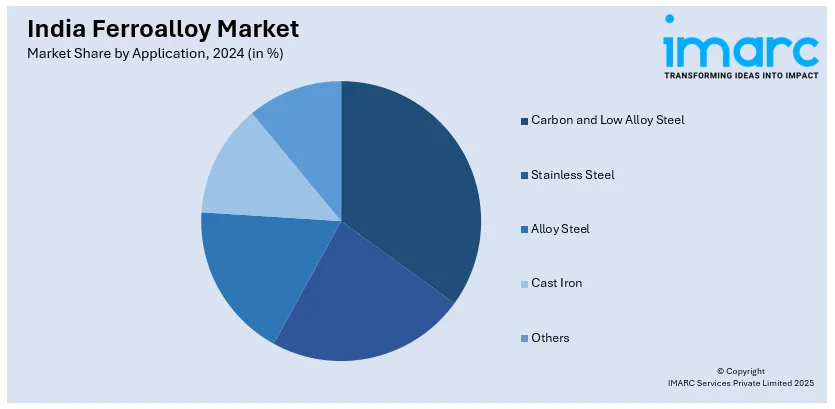

Application Insights:

- Carbon and Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes carbon and low alloy steel, stainless steel, alloy steel, cast iron, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ferroalloy Market News:

- In January 2025, Saoner MLA announced plans to establish a ferroalloy plant in Gumgaon, leveraging MOIL's manganese reserves. This initiative aims to boost industrial development and create employment opportunities for local youth in the Saoner-Kalmeshwar region.

- In December 2024, Indian Metals & Ferro Alloys (IMFA) partnered with JSW Green Energy to source 70 MW of renewable energy for its smelting operations. IMFA would invest INR 832.6 Million (~USD 9.8 Million) in a wind-solar hybrid project, combining 50 MW solar and 100 MW wind capacity. A 25-year power purchase agreement would be established, aligning with IMFA's sustainability goals.

India Ferroalloy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon, Others |

| Applications Covered | Carbon and Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ferroalloy market performed so far and how will it perform in the coming years?

- What is the breakup of the India ferroalloy market on the basis of product?

- What is the breakup of the India ferroalloy market on the basis of application?

- What are the various stages in the value chain of the India ferroalloy market?

- What are the key driving factors and challenges in the India ferroalloy market?

- What is the structure of the India ferroalloy market and who are the key players?

- What is the degree of competition in the India ferroalloy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ferroalloy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ferroalloy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ferroalloy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)