India Ferrite Magnet Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

India Ferrite Magnet Market Size and Share:

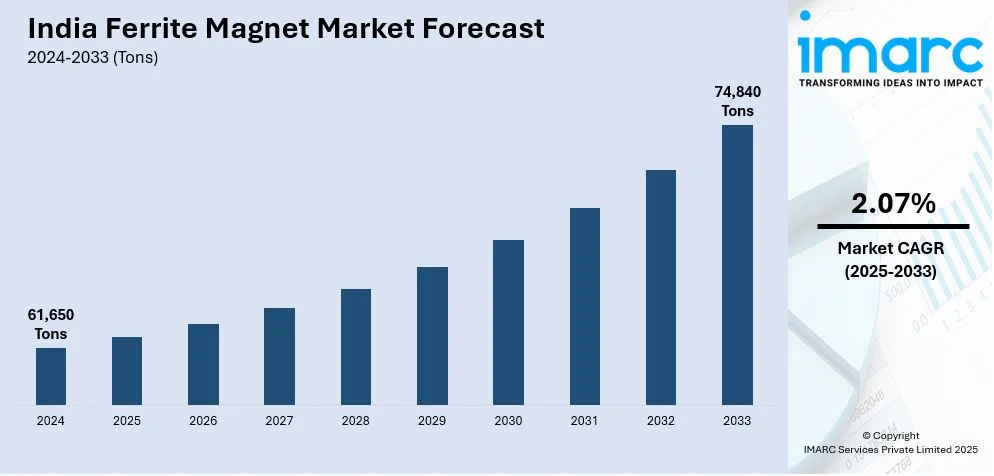

The India ferrite magnet market size was valued at 61,650 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 74,840 Tons by 2033, exhibiting a CAGR of 2.07% from 2025-2033. The market share is expanding owing to the increasing demand for energy-efficient products, proliferation of consumer electronics, such as smartphones, televisions, and home appliances, and heightened implementation of favorable government initiatives to support the production of products domestically.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

61,650 Tons |

|

Market Forecast in 2033

|

74,840 Tons |

| Market Growth Rate (2025-2033) | 2.07% |

One of the crucial drivers of the ferrite magnet industry in India is the heightened requirement for energy-saving products. As people and producers focus on conserving energy, ferrite magnets are becoming an indispensable product in operating efficient electrical and electronic appliances. Ferrite magnets are used in several energy-saving applications like electric motors, Transformers, and air conditioners, where low energy consumption by ferrite magnets contributes to decreased overall operational expenditure. The pressure from the government towards sustainability and energy efficiency is also encouraging manufacturers to use energy-efficient components. For instance, in the automotive sector, there is a growing demand for electric vehicles (EVs), and EV motors and other powertrain parts require ferrite magnets because they are efficient and reliable, thereby driving the India ferrite market demand.

To get more information on this market, Request Sample

Moreover, India's electronics industry is witnessing advancements, driven by an increment in mobile phone adoption and a growing use of home appliances. Ferrite magnets are essential parts in various electronic devices like loud speakers, smartphones, televisions, and computer hard drives. With India emerging as a worldwide center for manufacturing electronic products, the requirement for ferrite magnets is anticipated to increase accordingly. The automotive industry in India, especially with the growth of EVs, is a major contributor to this demand for ferrite magnets. Ferrite magnets are utilized in the motors of electric vehicles, hybrid cars, and other automotive functions like power steering and braking systems.

India Ferrite Magnet Market Trends:

Rising Demand for Energy-Efficient Products

The increasing need for energy-saving products is a major influence on the ferrite magnet market in India. As individuals and companies focus more on minimizing energy usage and expenses, ferrite magnets are being utilized more frequently in various applications that support energy efficiency. For example, ferrite magnets are frequently used in electric motors, transformers, and compressors, which all serve essential functions in energy-efficient devices. The Indian government has launched various initiatives, including the Perform, Achieve, and Trade (PAT) program, that promote energy efficiency in industrial sectors. Moreover, the growth of electric vehicles (EVs) in India enhances the need for energy-efficient parts such as ferrite magnets, which are utilized in the motors of EVs and hybrid vehicles. according to the India ferrite market research report, as these trends persist, the need for ferrite magnets will rise, further propelling market growth. According to the forecasts from the IMARC Group, the Indian EV market is anticipated to hit USD 164,420.4 Million by 2033.

Expansion of Electronics and Automotive Sectors

India's electronics and automotive industries are experiencing swift innovation, with ferrite magnets being essential in both fields. In the electronics industry, the rise of consumer devices like smartphones, TVs, and household appliances has heightened the need for ferrite magnets utilized in speakers, hard drives, and other essential elements. The Indian government's promotion of electric mobility, backed by policies, is anticipated to boost the demand for ferrite magnets in this field. For example, the PM E-DRIVE Scheme was unveiled on 29th September 2024 to promote electric transportation and reduce dependence on fossil fuels in the country. The proposal includes spending ₹10,900 crore over a period of two years, from 01.04.2024 to 31.03.2026. The Electric Mobility Promotion Scheme (EMPS) 2024, which runs for a period of 06 months from 01.04.2024 to 30.09.2024, is part of the PM E-DRIVE initiative. This initiative aims to boost the sales of e-2W, e-3W, e-Trucks, e-Ambulances, and e-buses.

Government Initiatives and Policies Supporting Domestic Manufacturing

Government policies aimed at boosting domestic manufacturing and reducing reliance on imports are also contributing to the India ferrite magnet market growth. The "Make in India" program, aimed at developing domestic production of components and lowering reliance on international markets, has played a crucial role in persuading local producers to expand the production capacity for ferrite magnets. Moreover, different fiscal benefits and subsidies provided by the Government of India, particularly in renewable energy, automotive, and electronics sectors, are boosting demand for ferrite magnets. The government's emphasis on renewable energy and energy-efficient technologies, including wind turbines, also fuels the demand for ferrite magnets. In 2024, India added 3.4 GW of wind capacity, with Gujarat (1,250 MW), Karnataka (1,135 MW), and Tamil Nadu (980 MW) being the top additions. These states accounted for 98% of the new installations of wind capacity, highlighting their continued dominance in wind power generation.

India Ferrite Magnet Industry Segmentation:

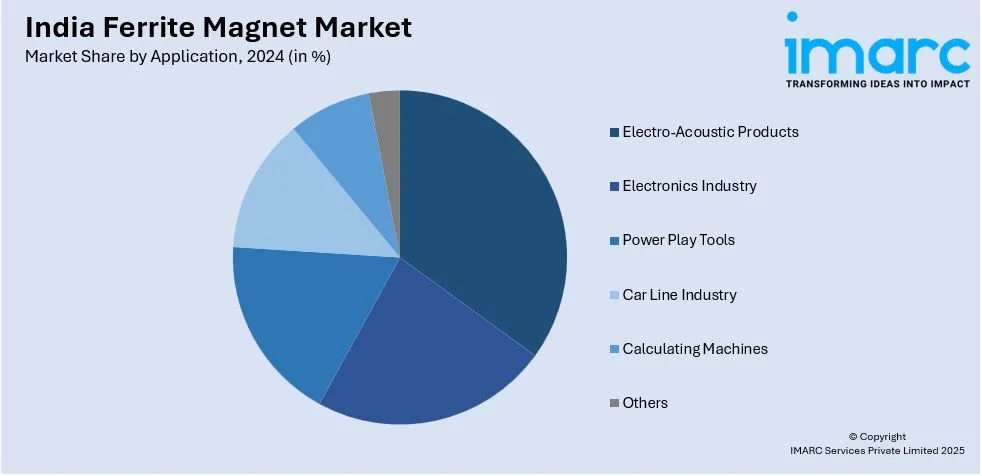

IMARC Group provides an analysis of the key trends in each segment of the India ferrite magnet market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Electro-Acoustic Products

- Electronics Industry

- Power Play Tools

- Car Line Industry

- Calculating Machines

- Others

Electro-acoustic products represent the largest segment. Ferrite magnets find widespread application in electro-acoustic devices because of their affordability, stability, and magnetic characteristics, which are uniquely adapted to the requirements of acoustic applications. Ferrite magnets form an essential part of devices that transform electric signals into sound waves, including speakers, microphones, and headphones, thereby offering a favorable India ferrite market outlook. Ferrite magnets are incorporated in the voice coil assembly within loudspeakers. The ferrite magnet produced magnetic field is what interacts with the electrical current flowing through the coil to induce the movement of the diaphragm, which in turn creates sound. This mechanism enables efficient electrical energy to mechanical movement conversion, translating to high-quality performance audio. Consumer-grade audio products particularly prefer ferrite magnets due to the equilibrium between cost and performance they provide.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and central India has the largest market share. The region account for a considerable share of the ferrite magnet market, fueled by the diversified array of industries such as electronics, automobiles, and home appliances. Maharashtra, Gujarat, and Madhya Pradesh are prominent states in this region with major clusters of manufacturing units that produce loudspeakers, motor parts, and other household goods. The automotive industry of Maharashtra, Pune, and Aurangabad contributes to the need for ferrite magnets in electric vehicle motors and associated uses. Pune is rated as the automotive hub of India with over 4000 units of manufacturing and ancillary located in the Pimpri-Chinchwad region. Furthermore, the expansion of Gujarat's electronics and renewable energy industries leads to the use of ferrite magnets in the likes of solar power systems and windmills. The area also has robust industrial infrastructure, which serves as a manufacturing and export-oriented hub. Demand for ferrite magnets will increase as the manufacturing base of the region develops.

Competitive Landscape:

One of the major tactics being used by market participants is innovation in technology and product design. Ferrite magnets are a fairly mature product, yet there is still vast potential for improvement along the lines of performance, durability, and cost-effectiveness. In order to remain competitive, Indian manufacturers are concentrating on optimizing the magnetic characteristics of ferrite magnets using sophisticated material science methods. In addition, industry leaders are making investments in the creation of ferrite magnets with improved resistance to environmental factors, including corrosion and heat. In industries such as renewable energy, where magnets are subjected to harsh weather conditions, enhanced durability can go a long way in prolonging the life of components. This emphasis on innovation not only fulfills the increasing demands for higher-quality and more energy-efficient products but also gives manufacturers a competitive advantage in the international market, where the demand for high-performance ferrite magnets is increasing.

The report provides a comprehensive analysis of the competitive landscape in the India ferrite magnet market with detailed profiles of all major companies.

India Ferrite Magnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Electro-Acoustic Products, Electronics Industry, Power Play Tools, Car Line Industry, Calculating Machines, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ferrite magnet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India ferrite magnet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ferrite magnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ferrite magnet market was valued at 61,650 Tons in 2024.

The growth of the India ferrite magnet market is driven by increasing demand for energy-efficient products, the proliferation of consumer electronics, such as smartphones and televisions, and the implementation of favorable government policies supporting domestic manufacturing and electric vehicle adoption.

The India ferrite magnet market is projected to exhibit a CAGR of 2.07% during 2025-2033, reaching a value of 74,840 Tons by 2033.

The electro-acoustic products segment accounted for the largest market share, as ferrite magnets are widely used in loudspeakers, microphones, and headphones due to their cost-effectiveness and reliable magnetic properties

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)