India Fermented Food and Beverage Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Fermented Food and Beverage Market Overview:

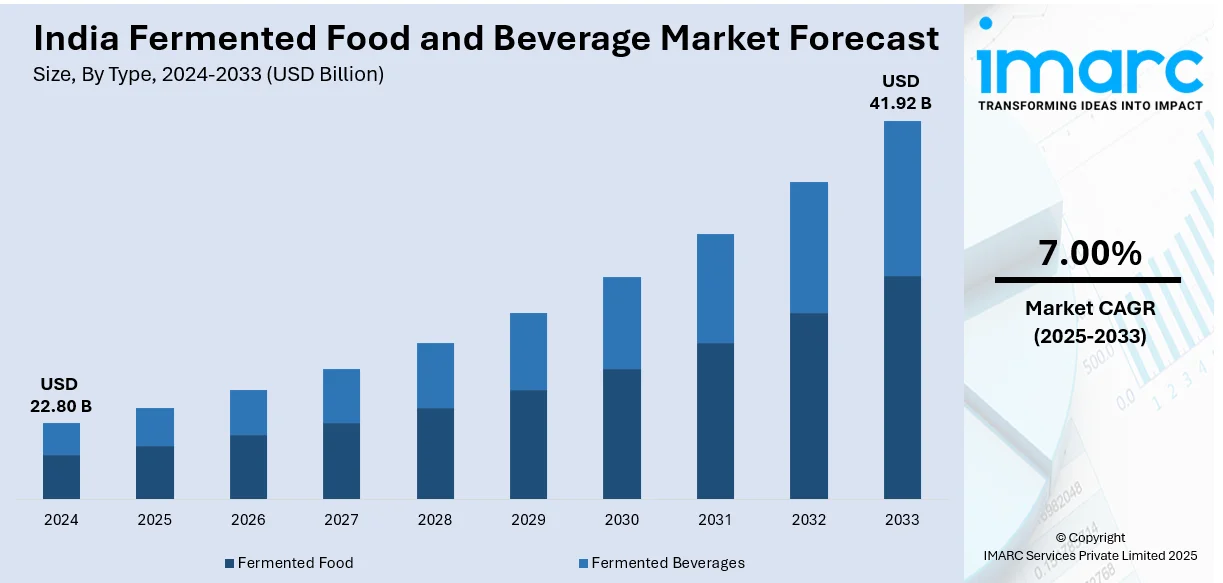

The India fermented food and beverage market size reached USD 22.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.92 Billion by 2033, exhibiting a growth rate (CAGR) of 7.00% during 2025-2033. The market is expanding due to rising health consciousness, increased demand for probiotic-rich products, urbanization-driven dietary shifts, and growing disposable incomes. Advancements in fermentation technology, expansion of functional foods, and increased awareness of gut health further support market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.80 Billion |

| Market Forecast in 2033 | USD 41.92 Billion |

| Market Growth Rate (2025-2033) | 7.00% |

India Fermented Food and Beverage Market Trends:

Expansion of Functional and Probiotic-Rich Fermented Products

The increasing consumer focus on gut health and immunity is driving demand for functional and probiotic-rich fermented foods and beverages in India. The market is witnessing a surge in innovative formulations such as fortified yogurts, kombucha, and plant-based fermented alternatives. For instance, in August 2024, Tata Consumer Products launched Tetley Kombucha, a fermented sparkling drink available in Ginger Lemon and Peach flavors. The drink contains prebiotic fiber for digestive health, marking Tetley’s expansion beyond traditional tea, and, in turn, catering to health-conscious consumers. The product features an imported Kombucha base, ensuring high quality. With India’s functional beverage market growing, Tetley Kombucha aims to offer a refreshing wellness experience, strengthening Tata’s presence in the premium beverage segment. Growing clinical research linking probiotics to digestive health, metabolic regulation, and mental well-being is encouraging brands to develop science-backed products. Additionally, government initiatives promoting fortified and functional foods under FSSAI regulations are boosting industry compliance and product standardization. With urban consumers actively seeking digestive wellness solutions, domestic and international brands are expanding their portfolios to include fermented superfoods, probiotic beverages, and dairy-free fermented options, reshaping the functional food segment in India.

To get more information on this market, Request Sample

Revival of Traditional Fermented Foods with Premium Positioning

There is a notable resurgence of traditional Indian fermented foods such as kanji, gundruk, pickled vegetables, and idli batter, now being marketed as premium, health-focused offerings. For instance, in January 2025, iD Fresh Foods expanded its batter portfolio with four new variants: protein idli dosa batter, ragi millet idli dosa batter, multigrain idli dosa batter, and mallige idli batter. Initially launched in Bengaluru, Mumbai, Pune, Delhi, and Hyderabad via quick commerce platforms, the company plans a nationwide rollout. With increasing urbanization and nuclear families, there is rising demand for ready-to-eat and convenient versions of these age-old foods. Startups and established brands are leveraging clean-label ingredients, small-batch artisanal methods, and organic sourcing to enhance product appeal. Additionally, modern packaging solutions such as vacuum sealing and cold-chain logistics are extending shelf life while maintaining product authenticity. This shift aligns with consumer preferences for heritage foods with modern convenience, driving a new wave of innovation in retail-ready Indian fermented products, both domestically and in global ethnic food markets.

Technological Advancements in Fermentation and Sustainable Production

Advancements in precision fermentation, controlled microbial culture techniques, and bioprocess optimization are significantly impacting the Indian fermented food and beverage market. For instance, a study by the Indian Council of Medical Research (ICMR) found 6.8% pathogen prevalence in 1,227 traditional fermented food samples, highlighting contamination risks. The research, titled Ethnic Foods of Northeast India: Insight into the Light of Food Safety, emphasizes the need for balancing cultural heritage with safety regulations. Experts stress improving hygiene practices and microbial monitoring to maintain food safety while preserving traditional fermentation techniques. The findings urge regulatory frameworks and technological advancements to ensure safe, high-quality fermented products. Consequently, Ccmpanies are increasingly investing in AI-driven fermentation monitoring, automated microbial strain selection, and improved starter cultures to enhance product consistency, nutritional profile, and scalability. Additionally, sustainability initiatives such as waste valorization, upcycling of agricultural by-products, and water-efficient fermentation techniques are gaining traction. Brands are also exploring alternative fermentation substrates such as plant-based proteins and non-dairy alternatives, catering to lactose-intolerant and vegan consumers.

India Fermented Food and Beverage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Fermented Food

- Yogurt

- Tofu

- Tempeh

- Sauerkraut/Fermented Veggies and Pickles

- Cheese

- Others

- Fermented Beverages

- Yogurt Drinks/Smoothies

- Kombucha

- Kefir

- Others

A detailed breakup and analysis of the market based on the type have been provided in the report. This includes fermented food (yogurt, tofu, tempeh, sauerkraut/fermented veggies and pickles, cheese, and others) and fermented beverages (yogurt drinks/smoothies, kombucha, kefir, and others)

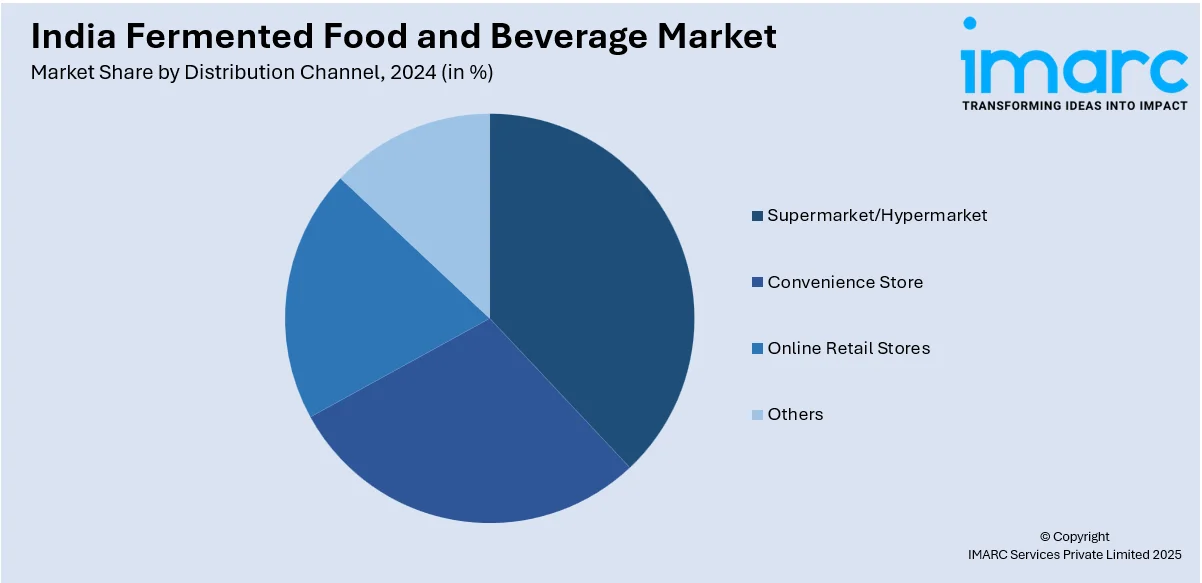

Distribution Channel Insights:

- Supermarket/Hypermarket

- Convenience Store

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, convenience store, online retail stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fermented Food and Beverage Market News:

- In January 2025, Brown Koji Boy, India’s first koji-based fermentary, and is redefining fermentation with innovative products like spiced chickpea miso, smoked tomato tamari, and stir-fry koji paste. The brand aims to enhance everyday Indian dishes using koji, a traditional Japanese mold known for umami-rich flavors. The brand caters to chefs and home cooks seeking unique, fermented condiments. This initiative reflects the growing interest in artisanal fermentation and the expanding market for gourmet, probiotic-rich foods in India.

- In November 2024, Bliss Body launched India’s first millet-fermented functional beverages, available in Pineapple, Mango, and Orange flavors. These sugar-free drinks promote gut health, diabetes management, stress relief, and enhanced immunity.

India Fermented Food and Beverage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Store, Online Retail Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fermented food and beverage market performed so far and how will it perform in the coming years?

- What is the breakup of the India fermented food and beverage market on the basis of type?

- What is the breakup of the India fermented food and beverage market on the basis of distribution channel?

- What are the various stages in the value chain of the India fermented food and beverage market?

- What are the key driving factors and challenges in the India fermented food and beverage market?

- What is the structure of the India fermented food and beverage market and who are the key players?

- What is the degree of competition in the India fermented food and beverage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fermented food and beverage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fermented food and beverage market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fermented food and beverage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)