India Fermentation Chemicals Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Fermentation Chemicals Market Overview:

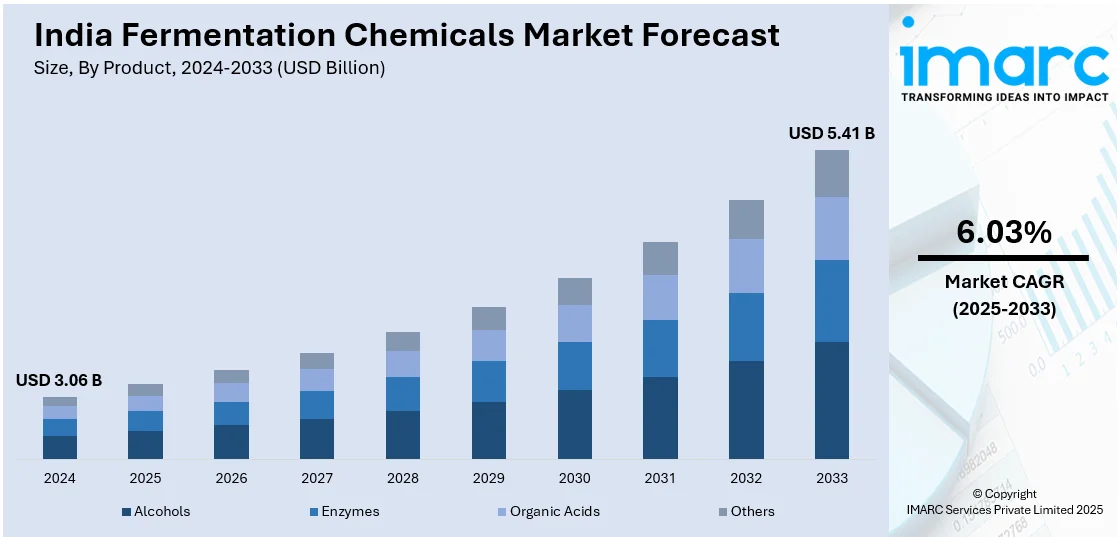

The India fermentation chemicals market size reached USD 3.06 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.41 Billion by 2033, exhibiting a growth rate (CAGR) of 6.03% during 2025-2033. The India fermentation chemicals market share is expanding due to the rising demand for bio-based chemicals, the growing pharmaceutical sector, and increasing adoption in food processing. Additionally, government initiatives promoting sustainability are driving innovation and industrial adoption across multiple sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.06 Billion |

| Market Forecast in 2033 | USD 5.41 Billion |

| Market Growth Rate 2025-2033 | 6.03% |

India Fermentation Chemicals Market Trends:

Expanding Pharmaceutical Sector

The burgeoning pharmaceutical sector is a key driver strengthening the India fermentation chemicals market growth, supported by rising healthcare needs, increasing disease prevalence, and the escalating demand for effective medications. With India’s pharmaceutical market estimated at USD 50 billion for FY 2023-24, comprising USD 23.5 billion from domestic consumption and USD 26.5 billion from exports, fermentation-derived chemicals are playing a crucial role in drug production. Fermentation is essential in manufacturing antibiotics, vaccines, amino acids, and enzymes, ensuring cost-effective and sustainable pharmaceutical solutions. Antibiotics like penicillin and erythromycin are primarily produced through microbial fermentation, making it a fundamental process for pharmaceutical companies. Additionally, fermentation-derived enzymes are widely used in drug formulations and biopharmaceutical production, improving drug stability and efficacy. The increasing adoption of probiotics in dietary supplements and gut health solutions is further fueling the India fermentation chemicals market growth. Government initiatives, growing investments in research and development (R&D), and the expansion of biopharmaceutical manufacturing are accelerating market growth. With India being a major global supplier of generic drugs, fermentation chemicals are witnessing rising demand for large-scale drug synthesis. Furthermore, the shift toward biologics, including monoclonal antibodies and biosimilars, is enhancing the adoption of fermentation technologies, ensuring long-term market expansion.

To get more information on this market, Request Sample

Growing Demand for Biobased Chemicals

Industries are moving more towards sustainable and green alternatives because of growing environmental issues and government policies encouraging green chemicals. Fermentation-based chemicals like organic acids, enzymes, and biopolymers are good alternatives to petroleum-based chemicals in many industries such as pharmaceuticals, food and beverages (F&B), and agriculture. Following this trend, Godavari Biorefineries Limited (GBL) commissioned a specialty biochemical facility at its Sakarwadi plant in Maharashtra, India, in May 2024. The multi-product plant manufactures bio-based chemicals like biobutanol, bio-based ethers, and esters for application in coatings, resins, cosmetics, pharmaceuticals, food and fragrances. Such programs underpin the increasing use of fermentation-based chemicals in the pharmaceutical industry, where they are used extensively in the production of antibiotics and in the formulation of drugs, cutting the use of synthetic chemicals. In the food and beverage (F&B) industry, natural preservatives, flavor enhancers, and probiotics produced by fermentation are increasingly finding acceptance due to the growing demand for clean-label products. The agricultural industry is also observing greater deployment of bio-based pesticides and fertilizers, reducing the environmental cost of synthetic chemicals. Technical progress through biotechnology, genetic engineering, and microbial fermentation are further enhancing production efficiency, favorably affecting the India fermentation chemicals market outlook.

India Fermentation Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Alcohols

- Enzymes

- Organic Acids

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes alcohols, enzymes, organic acids, and others.

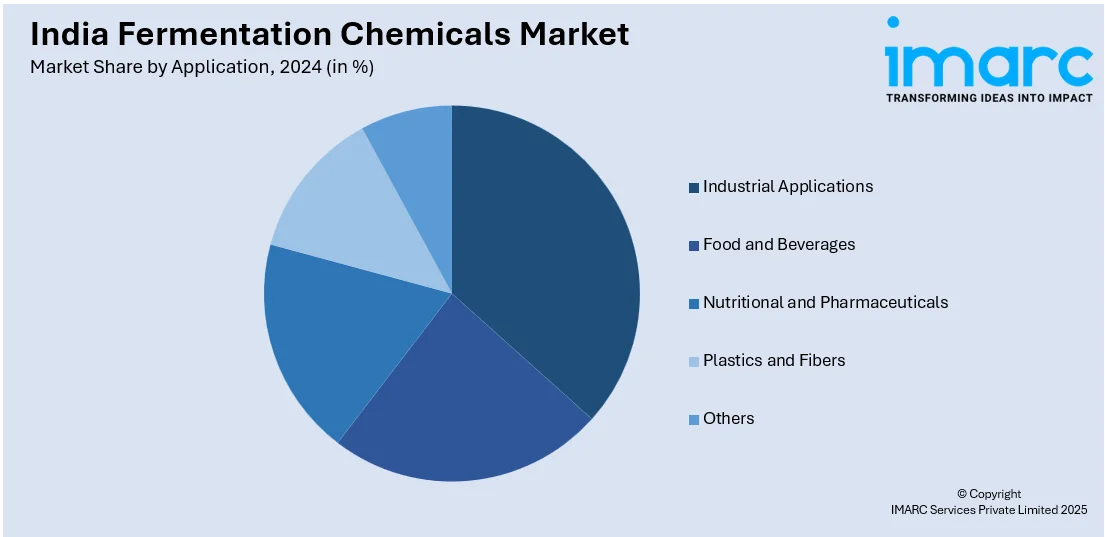

Application Insights:

- Industrial Applications

- Food and Beverages

- Nutritional and Pharmaceuticals

- Plastics and Fibers

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial applications, food and beverages, nutritional and pharmaceuticals, plastics and fibers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fermentation Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Alcohols, Enzymes, Organic Acids, Others |

| Applications Covered | Industrial Applications, Food and Beverages, Nutritional and Pharmaceuticals, Plastics and Fibers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fermentation chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the India fermentation chemicals market on the basis of product?

- What is the breakup of the India fermentation chemicals market on the basis of application?

- What are the various stages in the value chain of the India fermentation chemicals market?

- What are the key driving factors and challenges in the India fermentation chemicals market?

- What is the structure of the India fermentation chemicals market and who are the key players?

- What is the degree of competition in the India fermentation chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fermentation chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fermentation chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fermentation chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)