India Feminine Hygiene Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Market Overview:

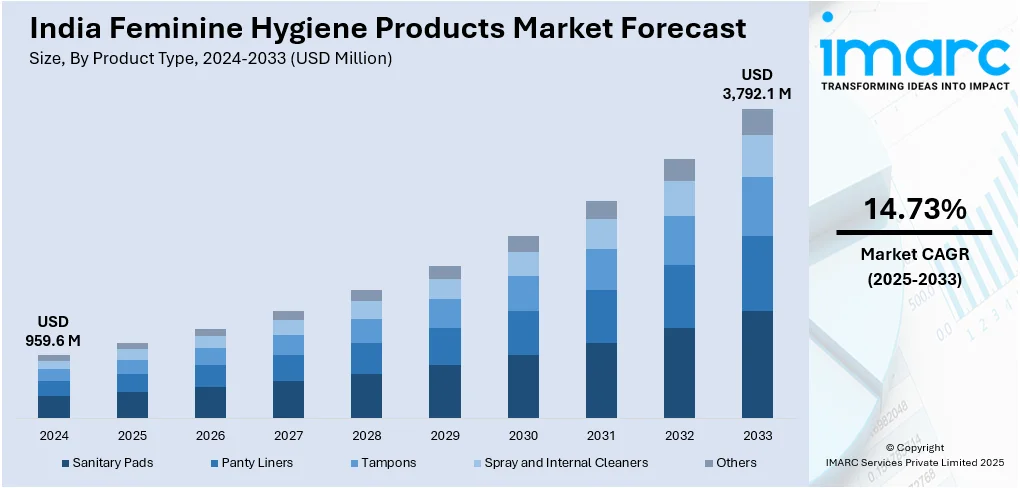

The India feminine hygiene products market size reached USD 959.6 Million in 2024. The market is expected to reach USD 3,792.1 Million by 2033, exhibiting a growth rate (CAGR) of 14.73% during 2025-2033. The market growth is attributed to the rise of e-commerce platforms, which has made feminine hygiene products more accessible, especially in regions with limited physical retail infrastructure, evolving societal norms and increased awareness regarding women's health, surge in disposable income and the growing focus on personal hygiene, changing lifestyle patterns and the rising prevalence of gynecological issues, advent of innovative and eco-friendly product formulations, strategic marketing campaigns and educational initiatives, and integration of technology in product development.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of product type, the market has been divided into sanitary pads, panty liners, tampons, spray and internal cleaners, and others.

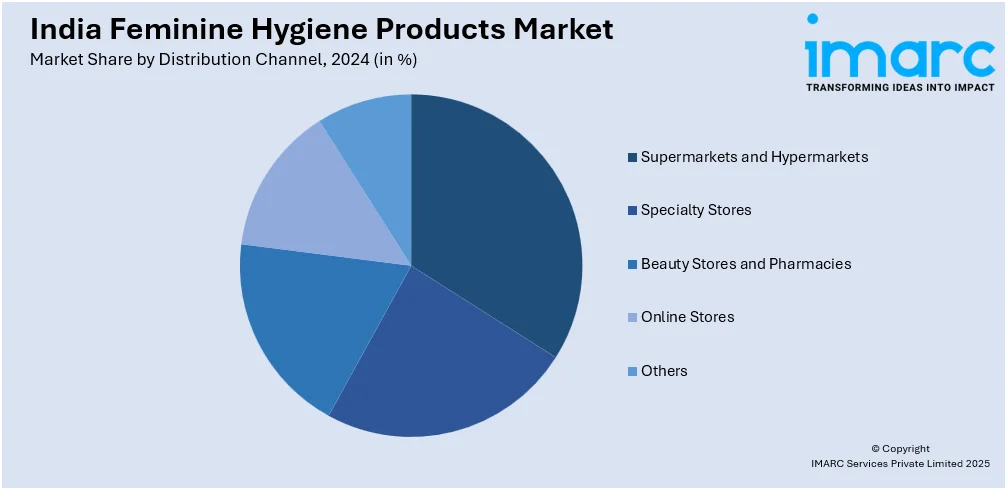

- On the basis of distribution channel, the market has been divided into supermarkets and hypermarkets, specialty stores, beauty stores and pharmacies, online stores, and others.

Market Size and Forecast:

- 2024 Market Size: USD 959.6 Million

- 2033 Projected Market Size: USD 3,792.1 Million

- CAGR (2025-2033): 14.73%

Feminine hygiene products are essential personal care items designed to maintain cleanliness and comfort for women during menstruation. These products include sanitary pads, tampons, menstrual cups, and panty liners. Sanitary pads, made of absorbent materials, provide a barrier between the body and clothing to absorb menstrual flow. Tampons are inserted into the vagina to absorb blood, while menstrual cups are reusable, silicone, or rubber cups that collect menstrual fluid. Panty liners offer additional protection against spotting between periods. Proper use of these products helps prevent discomfort and leakage and ensures hygiene during the menstrual cycle. While various options cater to individual preferences, the overarching goal of feminine hygiene products is to empower women to manage their menstrual health with confidence and discretion. Regular disposal and adherence to usage guidelines are essential for maintaining overall reproductive health.

To get more information on this market, Request Sample

The feminine hygiene products market in India is witnessing substantial growth, primarily due to evolving societal norms and increased awareness regarding women's health. Moreover, the surge in disposable income and the growing focus on personal hygiene contribute significantly to the market's expansion. In addition to these factors, changing lifestyle patterns and the rising prevalence of gynecological issues propel the India feminine hygiene products market share. Furthermore, the advent of innovative and eco-friendly product formulations responds to the increasing consumer preference for sustainable options. Additionally, strategic marketing campaigns and educational initiatives have played a pivotal role in destigmatizing discussions around women's health, fostering a more open dialogue, and driving market acceptance. The integration of technology in product development, such as advanced materials and smart solutions, further augments the market's appeal. Consequently, a confluence of societal shifts, economic dynamics, and technological advancements acts as key drivers propelling the regional feminine hygiene products market towards sustained growth.

India Feminine Hygiene Products Market Trends:

Preference for Reusable and Sustainable Choices

Indian consumers are increasingly making the switch towards environmentally friendly women's sanitary products as concerns about plastic waste and environmental health increase. Disposable pads are ubiquitous in the market, but growing concerns about non-biodegradable waste have generated interest in biodegradable pads, menstrual cups, and reusable cloth pads. Menstrual cups, for example, are picking up speed among urban, educated women due to their long life span, cost-effectiveness over the long term, and lightening of the carbon footprint. Younger consumers are more eco-aware and willing to experiment with alternatives that fit their conscience, which is augmenting the India feminine hygiene products market growth. Manufacturers are taking note by creating pads made from organic cotton, bamboo fibers, or biodegradable packaging materials. While adoption continues to be slow in rural India, awareness initiatives and focused campaigns are slowly making the products acceptable. This transition is not just a product innovation trend but also an increasing congruence of personal hygiene decisions with overall sustainability objectives.

E-Commerce Growth and Broader Market Reach

Online retailing has emerged as a key growth driver for female hygiene products in India. Internet sites offer convenience, anonymity, and access to a range of products that are not necessarily available in high street shops. For a lot of women, particularly those living in small towns, shopping online eliminates the social embarrassment typically associated with purchasing pads or tampons in a shop. Subscription schemes and blind delivery have added comfort, while special offers and product comparisons render internet shopping more appealing. Existing brands are collaborating with e-commerce sites, while new brands are leveraging direct-to-consumer websites to access customers in wider locations. Outside urban hubs, increasing digital infrastructure and improved logistics are assisting in reaching semi-urban and rural customers. This wider reach enables brands to cut out conventional supply chain constraints and directly connect with consumers. The growth of e-commerce is not merely about distribution; it also provides businesses with access to rich consumer data that drives product innovation.

Some of the other trends are,

- Smart Feminine Hygiene Items with IoT Integration: Intelligent pads and tampons with sensors are in the process of being created to monitor flow rates and menstrual wellness metrics in real time. They interface with mobile apps to offer cycle tracking, anomaly notifications, and customized health information. The trend is indicative of a movement towards merging wellness technology and daily hygiene items.

- AI-Driven Menstrual Wellness Platforms: AI platforms scan cycle history, symptoms, and lifestyle data to provide personalized suggestions. Users are predicted period start, fertile windows, and potential health complications. Personalization increases user interaction and enhances menstrual wellness awareness, which further enhances India feminine hygiene products market outlook.

- Menstrual Waste Management Innovations: Low-cost incinerators and specialized disposal units are being introduced to address environmental and hygiene issues. These innovations target safe, odorless, and discreet waste handling. They are gaining especially important ground in schools, workplaces, and rural settings.

- Pad Recycling Technologies and Composting Programs: New technologies are developing to recycle spent pads into energy or raw materials, alleviating landfill pressure. Compostable sanitary products enable safe disposal by biodegrading. The initiatives meet sustainability objectives and decrease long-term waste burden.

- Corporate Extended Producer Responsibility (EPR) Programs: Feminine care brands are being nudged to own up to the end-of-life management of their products. Companies are testing collection drives, recycling partnerships, and education campaigns. EPR policies compel manufacturers to integrate sustainability into product life cycles.

- Menstrual Health Clinics and Gynecologist Partnerships: Partnerships with healthcare professionals are widening to inform women on product choices and safe use, as there is an increased India feminine hygiene products demand. Clinics have workshops, counseling, and demonstrations to enhance comfort and confidence. This alignment ensures medical advice supplements commercial product promotion.

- Insurance Coverage for Menstrual Hygiene Products: Health insurance programs are starting to consider coverage of menstrual products, partly or fully, as an essential healthcare cost. Inclusion in government or corporate schemes may enhance the affordability for the poorer segments of society. This action demonstrates increased awareness of menstrual hygiene as a core health right.

Growth, Opportunities, and Challenges in the India Feminine Hygiene Products Market:

- Growth Drivers: The market is driven by increasing awareness about menstrual health and hygiene among women across all age groups. Government initiatives and NGO campaigns promoting menstrual health education are significantly expanding the feminine hygiene products market size in India. Rising disposable income levels and changing lifestyle patterns are also fueling demand for premium and specialized feminine hygiene products.

- Market Opportunities: The market demand presents significant opportunities in rural and semi-urban markets where penetration rates remain low. E-commerce platforms offer untapped potential for reaching underserved markets and providing discreet purchasing options. Innovation in sustainable and technologically advanced products creates opportunities for premium market segments and brand differentiation.

- Market Challenges: According to the India feminine hygiene products market forecast, cultural taboos and societal stigma associated with menstruation continue to hinder market penetration in specific regions. High price sensitivity, especially among rural consumers, restricts the uptake of premium products. Furthermore, insufficient infrastructure for distribution and disposal in remote areas presents a considerable operational challenge for manufacturers.

India Feminine Hygiene Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Sanitary Pads

- Panty Liners

- Tampons

- Spray and Internal Cleaners

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sanitary pads, panty liners, tampons, spray and internal cleaners, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Beauty Stores and Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, beauty stores and pharmacies, online stores, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2025, Sirona and M3M India launched India's first menstrual hygiene vending machines across 15 M3M commercial spaces, strategically placed outside women's washrooms. These machines provide easy access to menstrual hygiene products, including cups, period panties, sanitary pads, panty liners, toilet seat covers, and stain-removing wipes. This initiative marks a significant step in enhancing public health infrastructure and promoting dignity and equality for women in public spaces.

- In August 2025, Rajkot-based startup Nishkaam Innovations developed biodegradable sanitary napkins made from agricultural stubble. This innovation addresses environmental pollution caused by crop residue burning and offers a sustainable alternative to conventional plastic-based sanitary products. The startup, recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) and incubated at the Marwadi University Centre of Innovation, Incubation and Research (MUIIR Centre), is also known for its product UriMate, a portable female urination device aimed at promoting public hygiene.

- In July 2025, Vestige launched the DewGarden Fly sanitary napkin, designed to empower women to live with confidence and comfort throughout the month. The product features advanced leak-lock technology, ensuring enhanced protection and dryness. This launch underscores Vestige's commitment to providing innovative solutions that support women's health and well-being.

- In October 2024, Sofy introduced its new Anti-Bacteria range, featuring a six-layer deep absorption system and an Herbal Shield designed to enhance period hygiene and prevent leakage. Additionally, Sofy launched the SOFY CLUB app, an innovative period tracking application that offers personalized cycle predictions, mood tracking, and tailored product recommendations. This dual initiative aims to empower women with improved hygiene solutions and digital tools for better menstrual health management.

India Feminine Hygiene Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Beauty Stores and Pharmacies, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India feminine hygiene products market performed so far and how will it perform in the coming years?

- What is the breakup of the India feminine hygiene products market on the basis of product type?

- What is the breakup of the India feminine hygiene products market on the basis of distribution channel?

- What are the various stages in the value chain of the India feminine hygiene products market?

- What are the key driving factors and challenges in the India feminine hygiene products?

- What is the structure of the India feminine hygiene products market and who are the key players?

- What is the degree of competition in the India feminine hygiene products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India feminine hygiene products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India feminine hygiene products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India feminine hygiene products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)