India Fecal Occult Testing Market Size, Share, Trends and Forecast by Test Type, End User, and Region, 2025-2033

India Fecal Occult Testing Market Overview:

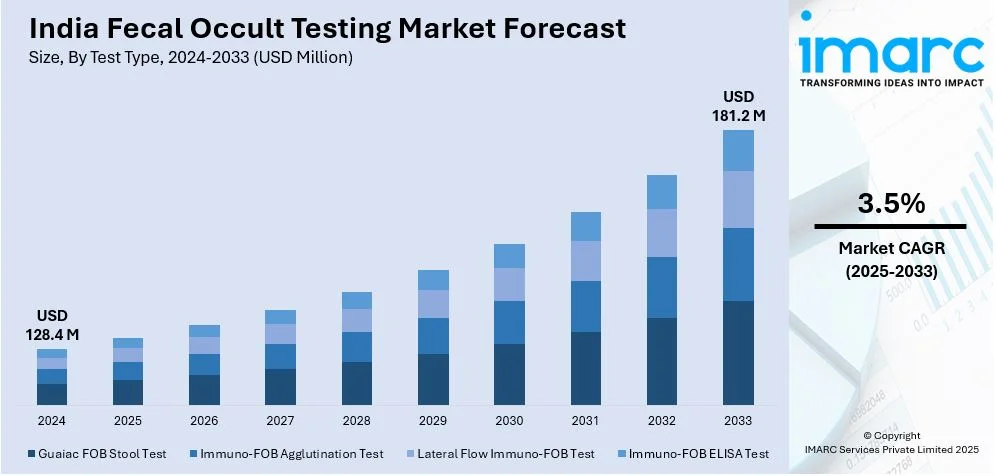

The India fecal occult testing market size reached USD 128.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 181.2 Million by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is driven by rising awareness of early colorectal cancer detection, increasing preference for non-invasive diagnostic methods, and government initiatives promoting preventive healthcare. The growing demand for home-based testing kits, fueled by convenience and the COVID-19 pandemic, alongside advancements in affordable and accurate testing solutions, further augments the India fecal occult testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 128.4 Million |

| Market Forecast in 2033 | USD 181.2 Million |

| Market Growth Rate 2025-2033 | 3.5% |

India Fecal Occult Testing Market Trends:

Increasing Adoption of Non-Invasive Diagnostic Methods

The significant shift toward non-invasive diagnostic methods is majorly driving the India fecal occult blood testing market growth. A 2024 survey revealed that 68% of junk food consumers have gastric-related issues, and 56% of families in India are facing digestive problems. In addition, functional gastrointestinal disorders affect about 40% of the global population. Early diagnosis, including fecal occult blood tests, is critical to preventing serious gastrointestinal conditions. As awareness and understanding of the importance of early detection for colorectal cancer and other gastrointestinal tract conditions increase, numerous individuals are opting for fecal occult blood tests (FOBT) over the invasive methods of traditional procedures such as colonoscopies. A major reason behind this transition is the convenience, cost-effectiveness, and low adverse events related to FOBT. Additionally, government programs and healthcare campaigns promoting preventive practices are also driving the growth in the uptake of these tests. This demand is also increasing due to the growing prevalence of lifestyle-related diseases, including diabetes and obesity, that are directly linked with the increased risk of colorectal cancer. In line with this trend, diagnostic companies are developing newer fecal occult blood test (FOBT) kits with improved sensitivity, specificity, and user-friendliness, enhancing access to this option for men and women across urban and rural populations.

To get more information on this market, Request Sample

Growing Emphasis on Home-Based Testing Kits

The rise in demand for home-based testing kits, fueled by the growing preference for self-monitoring and at-home healthcare solutions, is creating a positive India fecal occult testing market outlook. This trend grew to its full potential during the COVID-19 pandemic, as patients tried to limit hospital visits and reduce time spent in the healthcare environment. Home-based fecal occult blood test (FOBT) kits are an effective and non-invasive test for screening colorectal cancer present quietly and attract the attention of both the urban workforce and elderly communities. To cater to a wide base of customers, manufacturers are focusing on kits that are easy to use, reliable, and economical. Furthermore, the integration of digital health platforms, where users can upload test results for remote consultation, is enhancing the appeal of these kits. A research report released by the IMARC Group indicates that the digital health market in India is expected to demonstrate a compound annual growth rate (CAGR) of 19.80% from 2025 to 2033. Thus, this trend is expected to continue as healthcare infrastructure expands and telemedicine gains traction, making fecal occult testing more accessible and convenient for a larger segment of the population.

India Fecal Occult Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on test type and end user.

Test Type Insights:

- Guaiac FOB Stool Test

- Immuno-FOB Agglutination Test

- Lateral Flow Immuno-FOB Test

- Immuno-FOB ELISA Test

The report has provided a detailed breakup and analysis of the market based on the test type. This includes guaiac FOB stool test, immuno-FOB agglutination test, lateral flow immuno-FOB test, and immuno-FOB ELISA Test.

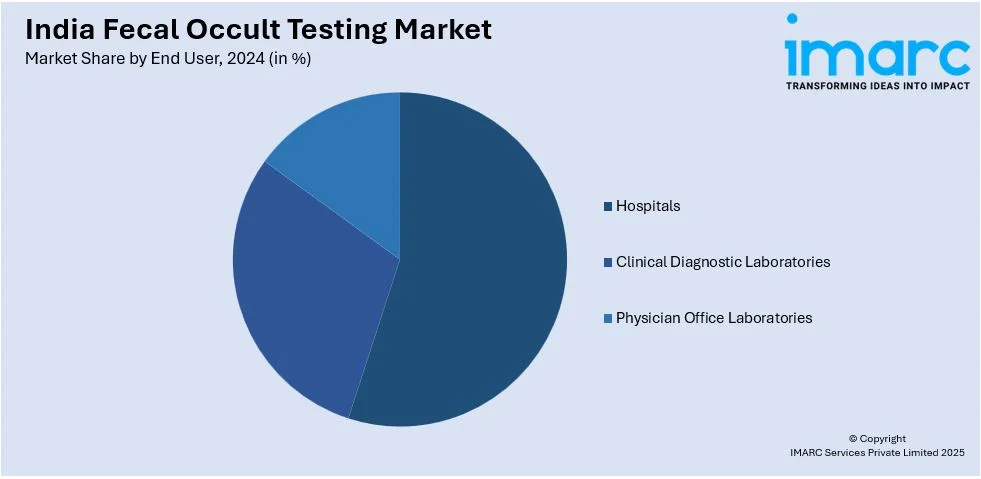

End User Insights:

- Hospitals

- Clinical Diagnostic Laboratories

- Physician Office Laboratories

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, clinical diagnostic laboratories, and physician office laboratories.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fecal Occult Testing Market News:

- October 29, 2024: Indian firm Agappe Diagnostics unveiled the first fully automated fecal analyzers, the Mispa F60 and Mispa F30 (semi-automated), that enhance the accuracy of gastrointestinal diagnostic tests. The Mispa F60 uses AI-powered imaging techniques in the pre-classification of parasites and non-parasite cellular components including tests such as fecal occult blood (FOB) for colorectal cancer. It offers automation of laboratory processes which help in reducing errors and aids in the early diagnosis of diseases in India.

India Fecal Occult Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Guaiac FOB Stool Test, Immuno-FOB Agglutination Test, Lateral Flow Immuno-FOB Test, Immuno-FOB ELISA Test |

| End Users Covered | Hospitals, Clinical Diagnostic Laboratories, Physician Office Laboratories |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fecal occult testing market performed so far and how will it perform in the coming years?

- What is the breakup of the India fecal occult testing market on the basis of test type?

- What is the breakup of the India fecal occult testing market on the basis of end user?

- What is the breakup of the India fecal occult testing market on the basis of region?

- What are the various stages in the value chain of the India fecal occult testing market?

- What are the key driving factors and challenges in the India fecal occult testing market?

- What is the structure of the India fecal occult testing market and who are the key players?

- What is the degree of competition in the India fecal occult testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fecal occult testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fecal occult testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fecal occult testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)