India Faulted Circuit Indicator Market Size, Share, Trends and Forecast by Type, Network, Application, and Region, 2025-2033

India Faulted Circuit Indicator Market Overview:

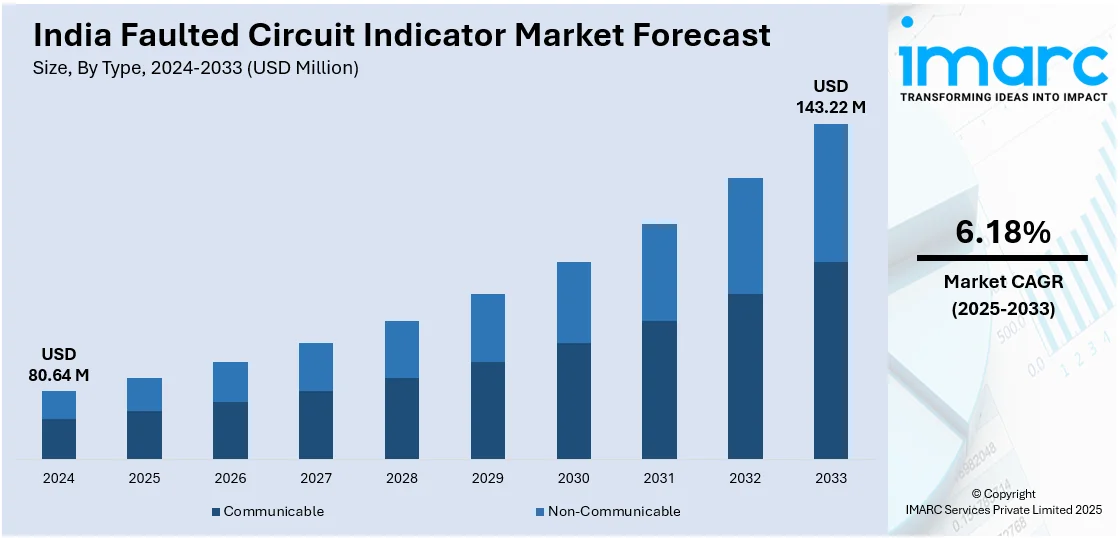

The India faulted circuit indicator market size reached USD 80.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 143.22 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The India faulted circuit indicator market is driven by expanding rural electrification, rapid urban infrastructure development, increasing focus on grid reliability, government initiatives for smart grid implementation, and propelling demand for real-time fault detection solutions that enhance operational efficiency, reduce downtime, and ensure safety across extensively complex power distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.64 Million |

| Market Forecast in 2033 | USD 143.22 Million |

| Market Growth Rate 2025-2033 | 6.18% |

India Faulted Circuit Indicator Market Trends:

Expanding Rural Electrification and Grid Modernization Initiatives

One of the strongest drivers of the faulted circuit indicator market in India is India's large thrust toward rural electrification and grid modernization. With different government programs like the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Saubhagya Scheme, there has been a major surge in the electrification of rural and far-flung areas. These initiatives have not only improved the coverage of power infrastructure but also made the distribution network more complex. When rural grids expand, guaranteeing reliability and reducing outages become increasingly important. Faulted circuit Indicators (FCIs) are critical devices in this regard because they allow utilities to identify, isolate, and clear faults sooner, dramatically enhancing service continuity and lowering downtime. Additionally, the modernization of India's power grid, including the transition from conventional to smart grids, demands intelligent monitoring solutions. FCIs are essential in ensuring this "smartness" by offering real-time fault detection and remote diagnostics. This integration minimizes manual inspection efforts, increases grid transparency, and is aligned with India's vision of digitizing infrastructure for improved efficiency and reduced losses.

To get more information on this market, Request Sample

Industrial Growth and Surge in Urban Infrastructure Projects

One other key market driver is the fast rate of industrialization and urban infrastructure growth. India's cities are growing at a record rate, driven by economic liberalization, foreign investment, and initiatives such as Smart Cities Mission, Make in India, and Atmanirbhar Bharat. These projects are promoting the development of industrial estates, IT parks, metro rail corridors, and business complexes—all of which require high-strength and un-interrupted electrical distribution networks. Under such congested and high-load conditions, electrical faults may result in severe safety risks, economic loss, and plant downtime. FCIs provide a vital means of identifying locations of faults with speed and minimizing system outages in complex urban power grids. The devices are especially critical in underground and substation networks, typical of urban settings but difficult to manually inspect.

India Faulted Circuit Indicator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, network, and application.

Type Insights:

- Communicable

- Non-Communicable

The report has provided a detailed breakup and analysis of the market based on the type. This includes communicable and non-communicable.

Network Insights:

- Overhead

- Underground

A detailed breakup and analysis of the market based on the network have also been provided in the report. This includes overhead and underground.

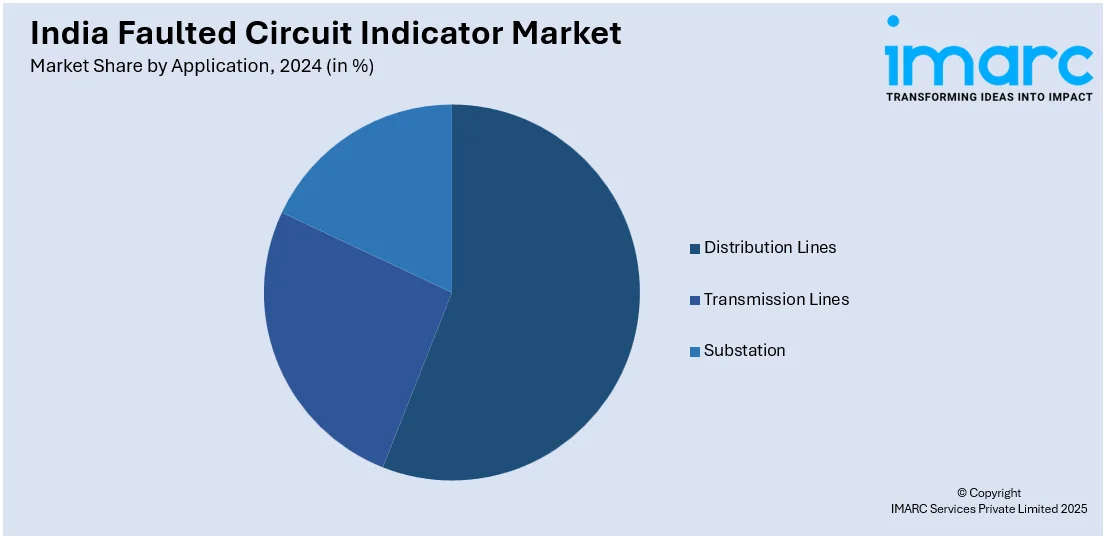

Application Insights:

- Distribution Lines

- Transmission Lines

- Substation

The report has provided a detailed breakup and analysis of the market based on the application. This includes distribution lines, transmission lines, and substation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Faulted Circuit Indicator Market News:

- February 2024: ABB announced a strategic agreement to acquire SEAM Group, a leading provider of energized asset management and advisory services for clients in the industrial and commercial building sectors. This acquisition is set to enhance ABB’s Electrification Service portfolio by adding specialized expertise in preventive, predictive, and corrective maintenance, as well as in renewable energy systems, electrical safety, and asset management consulting.

- August 2023: Elektro-Mechanik EM GmbH launched the Type BL7 external blinking lamp, featuring red and green LEDs for clear directional fault indication. Its durable, weather-resistant design ensures reliable performance in harsh environments. This innovation supports faster fault detection.

India Faulted Circuit Indicator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Communicable, Non-Communicable |

| Networks Covered | Overhead, Underground |

| Applications Covered | Distribution Lines, Transmission Lines, Substation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India faulted circuit indicator market performed so far and how will it perform in the coming years?

- What is the breakup of the India faulted circuit indicator market on the basis of type?

- What is the breakup of the India faulted circuit indicator market on the basis of network?

- What is the breakup of the India faulted circuit indicator market on the basis of application?

- What are the various stages in the value chain of the India faulted circuit indicator market?

- What are the key driving factors and challenges in the India faulted circuit indicator market?

- What is the structure of the India faulted circuit indicator market and who are the key players?

- What is the degree of competition in the India faulted circuit indicator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India faulted circuit indicator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India faulted circuit indicator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India faulted circuit indicator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)