India Fashion Retail Market Size, Share, Trends and Forecast by Product Type, Price, Distribution Channel, and Region, 2025-2033

India Fashion Retail Market Overview:

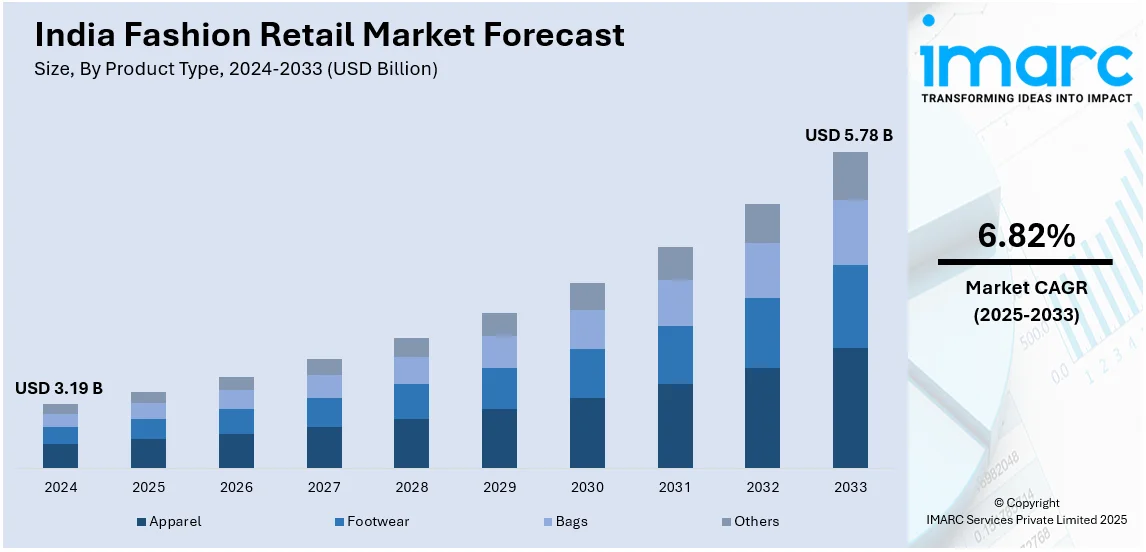

The India fashion retail market size reached USD 3.19 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.78 Billion by 2033, exhibiting a growth rate (CAGR) of 6.82% during 2025-2033. The market is driven by rising disposable incomes, rapid urbanization, and a young, fashion-conscious population. Increasing internet penetration and smartphone usage boost online shopping, while sustainability and ethical practices gain traction. Government initiatives like "Make in India" and the growth of D2C brands further propel the India fashion retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.19 Billion |

| Market Forecast in 2033 | USD 5.78 Billion |

| Market Growth Rate 2025-2033 | 6.82% |

India Fashion Retail Market Trends:

Rise of Sustainable and Ethical Fashion

The significant shift towards sustainable and ethical fashion is majorly driving the India fashion retail market growth. Millennials and Gen Z, in particular, are becoming increasingly aware of the environmental and social implications of their purchases. This trend is propelled by increasing awareness of problems such as climate change, waste generation, and unethical labor practices. Brands are countering by using eco-friendly materials including organic cotton, recycled fabrics, and biodegradable dyes in their lines. [More News] Many retailers are also adopting transparent supply chains and fair-trade practices to appeal to socially responsible shoppers they may have historically alienated. Local designers and start-ups are also taking the lead by designing out-of-the-box, sustainable garment lines to satisfy this appetite. From the government’s side, initiatives such as “Make in India” and encouragement of handloom and handicrafts only reinforce this. In association with the Ministry of Textiles, UNESCO showcased India's handloom and handicraft sectors at Bharat Tex 2025 in New Delhi. Attendance at the event included more than 5,000 exhibitors and 6,000 international buyers from 120 countries. It highlighted the need for sustainable practices, as well as the protection of traditional craftsmanship, while also seeking to enhance livelihoods through links such as the Rural Crafts and Cultural Hubs Project. The core discussions revolved around the need for R&D, financial support, and professional marketing to place India’s handloom sector in the global fashion retail arena. As sustainability becomes a key differentiator, it is expected to reshape the Indian fashion retail landscape in the coming years.

To get more information on this market, Request Sample

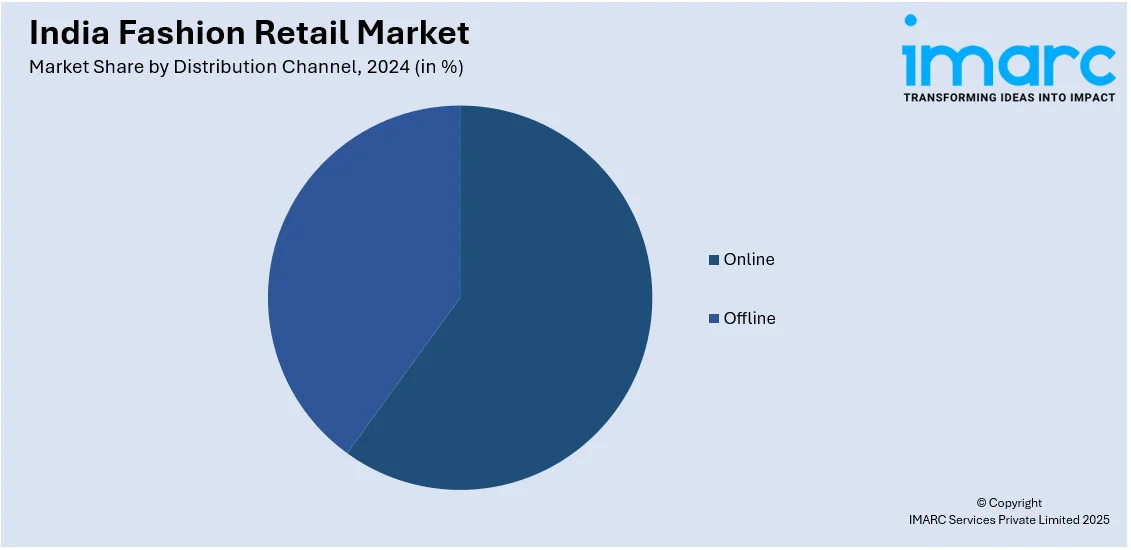

Growth of Online Fashion Retail and D2C Brands

The rise in online shopping, fueled by increasing internet penetration and smartphone usage is creating a positive India fashion retail market outlook. E-commerce platforms are dominating the space, offering a wide range of trendy and affordable options. A research report from the IMARC Group indicates that the e-commerce market in India achieved a size of USD 107.7 Billion in 2024. It is projected to expand to USD 650.4 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 19.70% from 2025 to 2033. With advancements in digital and social media marketing, direct-to-consumer (D2C) brands are becoming more popular and cater to their specific audience groups. These brands focus more on targeted market segments, such as athleisure, ethnic wear, and unisex, with bespoke experience and faster delivery. Virtual try-ons, easy returns, and cash-on-delivery have also made online buying for fashion much smoother. Additionally, with consumers opting for contactless shopping, the pandemic has fast-tracked the shift to digital platforms. Influencer marketing and social commerce will drive online fashion retail to unprecedented growth, establishing it as one of the key pillars fueling growth of the market.

India Fashion Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, price, and distribution channel.

Product Type Insights:

- Apparel

- Footwear

- Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes apparel, footwear, bags, and others.

Price Insights:

- Premium/Luxury Mid-Range

- Mass Market

A detailed breakup and analysis of the market based on the price have also been provided in the report. This includes premium/luxury mid-range, and mass market.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fashion Retail Market News:

- March 19, 2025: Mashroo expanded its retail presence in India with five new stores in Mumbai and Hyderabad, bringing the total number of stores to nine locations. The new locations will be in high-profile sites such as Mohammad Ali Road or Mira Road in Mumbai and Abids in Hyderabad. The expansion further complements the brand's strategy in India to address the growing demand for culturally aligned, modern fashion within the Indian retail space.

- August 23, 2024: UK-based fashion retailer ASOS made an official entry into the Indian market in association with Reliance Retail’s AJIO platform. The partnership starts with over 3,000 products but plans to scale that in a year to 20,000 products. The launch includes collections of ASOS Design, ASOS Luxe, and Miss Selfridge, followed by the growing appetite for international-looking trends in India. It reinforces AJIO's position as a serious fashion retail player in India, particularly aimed at younger, trend-focused consumers.

India Fashion Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Apparel, Footwear, Bags, Others |

| Prices Covered | Premium/Luxury Mid-Range, Mass Market |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fashion retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fashion retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fashion retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fashion retail market reached a size of USD 3.19 Billion in 2024.

The India fashion retail market is expected to reach USD 5.78 Billion by 2033, growing at a CAGR of 6.82% during 2025-2033.

Market growth is driven by increasing urbanization, rising disposable incomes, and a growing middle-class population with evolving fashion preferences. The surge in online retail and e-commerce platforms, along with the increasing influence of social media and digital marketing, is expanding access to global fashion trends. Furthermore, demand for fast fashion, lifestyle upgrades among younger consumers, and greater penetration of international brands in tier 2 and tier 3 cities are contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)