India Facility Management Market Size, Share, Trends and Forecast by Solution, Service, Deployment Type, Organization Size, Vertical, and Region, 2026-2034

India Facility Management Market Summary:

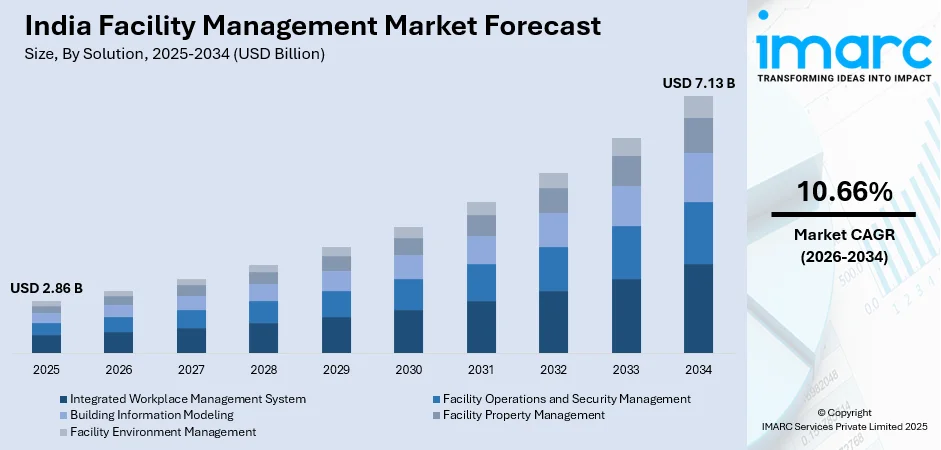

The India facility management market size was valued at USD 2.86 Billion in 2025 and is projected to reach USD 7.13 Billion by 2034, growing at a compound annual growth rate of 10.66% from 2026-2034.

The India facility management market is experiencing robust expansion driven by rapid urbanization, infrastructure development, and growing corporate demand for integrated services. Government initiatives such as the Smart Cities Mission and Gati Shakti are accelerating adoption of tech-enabled facility solutions across public and private sectors. Rising investments in commercial real estate, IT parks, and industrial corridors are creating sustained demand for professional facility management services.

Key Takeaways and Insights:

- By Solution: Facility operations and security management dominate the market with a share of 34% in 2025, owing to heightened focus on workplace safety, asset protection, and regulatory compliance across commercial and industrial facilities. Growing adoption of integrated security systems and IoT-enabled monitoring is strengthening this segment's leadership position.

- By Service: Deployment and integration lead the market with a share of 30% in 2025. This dominance is driven by enterprises seeking seamless implementation of facility management solutions across multi-site operations. The rising complexity of building systems and need for unified platforms are fueling demand for professional deployment services.

- By Deployment Type: Cloud-based exhibits a clear dominance in the market with 58% share in 2025, reflecting strong organizational preference for flexible, scalable solutions that enable real-time monitoring and remote facility management. Cost-effectiveness and enhanced data accessibility are accelerating cloud adoption across enterprises.

- By Organization Size: Large enterprises represent the leading segment with 54% share in 2025. These organizations drive demand through extensive multi-location portfolios requiring standardized service delivery, compliance management, and technology-driven operational efficiency.

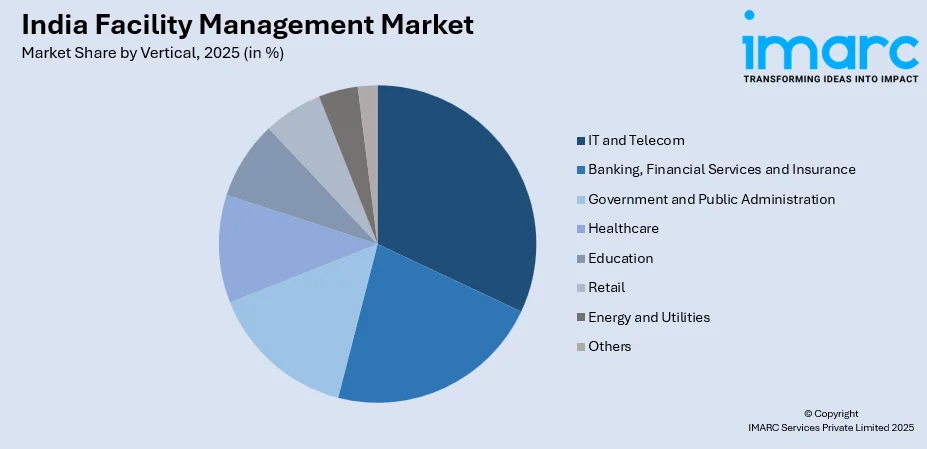

- By Vertical: IT and telecom hold the biggest share at 22% in 2025, driven by India's position as a global technology hub. Massive IT parks, data centers, and Global Capability Centres across Bengaluru, Hyderabad, and Chennai require sophisticated facility management services for mission-critical operations.

- By Region: South India is the largest region with 34% share in 2025, driven by concentration of IT corridors, manufacturing hubs, and commercial real estate in Bengaluru, Chennai, and Hyderabad. State government incentives and infrastructure investments continue strengthening regional market leadership.

- Key Players: Key players drive the India facility management market by expanding service portfolios, integrating advanced technologies like IoT and AI, and strengthening nationwide distribution networks. Their investments in sustainable practices, workforce training, and strategic acquisitions boost operational capabilities and market reach.

To get more information on this market Request Sample

The India facility management market is witnessing transformative growth as organizations increasingly recognize the strategic value of professional facility services. Digital transformation is reshaping service delivery, with IoT sensors, AI-powered analytics, and cloud-based platforms becoming standard offerings. The integration of predictive maintenance capabilities is enabling facilities to reduce operational costs while improving asset performance and occupant experience. With INR 1.64 lakh crore invested, 94% of India's Smart Cities Mission were finished by June 2025, according to government data. This will significantly increase demand for structured facilities management services throughout urban infrastructure. The commercial real estate sector is experiencing strong growth, with office leasing across India's major cities reaching record levels. Global Capability Centres are driving a substantial portion of office leasing activity, particularly in southern cities, generating sustained demand for integrated hard and soft FM services including space optimization, HVAC maintenance, and workplace experience management. The market is transitioning toward outcome-based contracting models where clients demand measurable KPIs on energy efficiency, response times, and compliance metrics.

India Facility Management Market Trends:

Accelerated Adoption of Smart Building Technologies

The integration of IoT sensors, AI-driven analytics, and automation platforms is fundamentally reshaping facility management operations across India. Organizations are deploying connected building management systems that enable real-time monitoring of energy consumption, HVAC performance, and security parameters. Leading technology companies are unveiling smart campuses showcasing integrated building management systems that automate energy, security, and comfort controls across commercial portfolios. This technological transformation is enabling predictive maintenance approaches that reduce operational costs and improve asset uptime.

Shift Toward Integrated Facility Management Services

Enterprises are increasingly consolidating multiple facility services under single contracts for improved efficiency and cost optimization. This shift toward integrated facility management is driven by demand for unified accountability, standardized service delivery, and reduced vendor management complexity. Businesses are seeking providers offering comprehensive solutions combining housekeeping, security, maintenance, and waste management services. The trend is particularly pronounced in IT parks, healthcare facilities, and large manufacturing units where operational continuity demands seamless coordination across service categories.

Growing Emphasis on Sustainability and Green Building Practices

Sustainability is becoming central to facility management strategies as organizations pursue energy efficiency, waste reduction, and carbon footprint minimization. Government energy efficiency schemes are prompting facility managers to integrate energy auditing and management systems. Green building certifications from recognized bodies are increasingly influencing service specifications, with numerous green building projects being implemented across India. Facility management providers are adopting eco-friendly practices and energy-efficient solutions to meet evolving client ESG requirements and regulatory mandates.

Market Outlook 2026-2034:

The India facility management market outlook remains positive, supported by sustained infrastructure investments, expanding commercial real estate activity, and digital transformation across industries. Government initiatives including Smart Cities Mission, Gati Shakti, and Make in India are creating substantial opportunities for structured facility management services across logistics parks, manufacturing units, and Special Economic Zones. The market generated a revenue of USD 2.86 Billion in 2025 and is projected to reach a revenue of USD 7.13 Billion by 2034, growing at a compound annual growth rate of 10.66% from 2026-2034. The expansion of Global Capability Centres, rising healthcare infrastructure investments, and increasing adoption of technology-enabled service models will continue driving market growth. Cloud-based deployment and outcome-focused contracting models are expected to gain further traction as organizations prioritize operational efficiency and measurable performance outcomes.

India Facility Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Solution |

Facility Operations and Security Management |

34% |

|

Service |

Deployment and Integration |

30% |

|

Deployment Type |

Cloud-based |

58% |

|

Organization Size |

Large Enterprises |

54% |

|

Vertical |

IT and Telecom |

22% |

|

Region |

South India |

34% |

Solution Insights:

- Integrated Workplace Management System

- Facility Operations and Security Management

- Building Information Modeling

- Facility Property Management

- Facility Environment Management

Facility operations and security management dominates with a market share of 34% of the total India facility management market in 2025.

Facility operations and security management has emerged as the leading solution segment due to heightened organizational focus on workplace safety, asset protection, and regulatory compliance. The segment encompasses integrated security systems, access control mechanisms, surveillance technologies, and operational monitoring platforms that ensure business continuity. Growing concerns about data security, physical asset protection, and occupant safety are driving enterprises across IT parks, financial institutions, and manufacturing facilities to invest substantially in comprehensive operations and security management solutions.

The proliferation of smart security technologies including AI-powered video analytics, biometric access systems, and IoT-enabled monitoring is transforming service delivery in this segment. In January 2025, KISL secured a major facility management contract at Aurangabad Airport to provide mechanized housekeeping services along with landside security services at Chhatrapati Shivaji Maharaj International Airport, demonstrating the integrated nature of modern operations and security management. Organizations operating in the country are increasingly seeking unified platforms that combine physical security, cyber-physical systems, and operational analytics to ensure comprehensive facility protection.

Service Insights:

- Deployment and Integration

- Auditing and Quality Assessment

- Support and Maintenance

- Consulting

- Service Level Agreement Management

Deployment and integration lead with a share of 30% of the total India facility management market in 2025.

Deployment and integration services have captured the largest share of the service segment as enterprises increasingly require professional implementation of complex facility management systems across multi-site operations. The growing adoption of integrated workplace management systems, building automation platforms, and IoT-enabled monitoring solutions demands specialized expertise for seamless deployment. Organizations are prioritizing vendors capable of ensuring smooth technology integration with existing infrastructure while minimizing operational disruptions during implementation phases.

The complexity of modern facility management ecosystems, encompassing HVAC controls, energy management systems, security platforms, and analytics dashboards, necessitates comprehensive deployment services. In October 2024, CBRE South Asia partnered with NetApp to oversee its expansive 1.07 Million Square Feet office footprint in India, encompassing the Bengaluru campus alongside sales offices in Mumbai and New Delhi, highlighting the scale of integrated deployment services demanded by large enterprises. Service providers are investing in technical capabilities and training to deliver end-to-end deployment solutions that ensure interoperability and optimal system performance.

Deployment Type Insights:

- On-premises

- Cloud-based

Cloud-based exhibits a clear dominance with a 58% share of the total India facility management market in 2025.

Cloud-based deployment has emerged as the dominant approach due to its flexibility, scalability, and cost-effectiveness compared to traditional on-premises solutions. Organizations benefit from real-time data accessibility, remote facility management capabilities, and reduced infrastructure investments. The cloud model enables centralized control of multi-location facilities while facilitating seamless integration with IoT sensors, mobile applications, and analytics platforms. Enterprises are increasingly recognizing that cloud deployment accelerates digital transformation and enhances operational agility.

The shift toward cloud-based facility management is supported by India's expanding digital infrastructure and improving internet connectivity across commercial centers. Cloud-based platforms are increasingly becoming the preferred choice for new facility management software installations, reflecting the fundamental shift away from legacy on-premises systems. This deployment model aligns with organizational preferences for subscription-based services that reduce capital expenditure while ensuring access to the latest technological capabilities. In January 2025, SILA Group launched tech-driven facility management solutions centered on IoT sensors and AI analytics delivered through cloud platforms to enable predictive maintenance across commercial portfolios. This deployment model aligns with organizational preferences for subscription-based services that reduce capital expenditure while ensuring access to latest technological capabilities.

Organization Size Insights:

- Small and Medium Size Enterprises

- Large Enterprises

Large enterprises represent the leading segment with a 54% share of the total India facility management market in 2025.

Large enterprises dominate the India facility management market driven by their extensive facility portfolios requiring standardized service delivery across multiple locations. These organizations manage substantial built environments including corporate headquarters, manufacturing plants, data centers, and regional offices that demand professional facility management services. Large enterprises prioritize integrated solutions offering comprehensive coverage of hard and soft services with measurable performance outcomes and compliance assurance across their operations. The scale of operations necessitates sophisticated vendor management frameworks and centralized oversight mechanisms.

The complexity of managing large-scale facilities with diverse functional requirements drives demand for sophisticated facility management solutions. Large enterprises in sectors like IT, BFSI, and manufacturing require vendors capable of delivering consistent service quality while adapting to site-specific requirements. Global Capability Centres expanding across major Indian cities are demanding specialized facility management services for space optimization, HVAC maintenance, security, and workplace experience management. The trend toward outcome-based contracting is particularly pronounced among large enterprises seeking quantifiable returns on facility management investments. These organizations increasingly expect service providers to demonstrate technological capabilities, ESG compliance, and proven track records in managing complex multi-site portfolios with stringent service level agreements.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Banking, Financial Services and Insurance

- IT and Telecom

- Government and Public Administration

- Healthcare

- Education

- Retail

- Energy and Utilities

- Others

IT and telecom hold the largest share at 22% of the total India facility management market in 2025.

The IT and telecom sector leads vertical-wise market share driven by India's position as a global technology hub housing extensive IT parks, data centers, and corporate campuses. This sector demands sophisticated facility management services to maintain mission-critical infrastructure ensuring business continuity, regulatory compliance, and optimal working environments. The concentration of technology companies in major cities creates sustained demand for integrated hard and soft services including MEP maintenance, HVAC optimization, security management, and workplace experience services.

The expansion of Global Capability Centres and continued growth of domestic IT companies are accelerating facility management demand in this vertical. Technology companies and GCCs are dominating commercial real estate transactions in major cities, highlighting the sector's prominence and associated facility management requirements. IT facilities require specialized services for critical systems including uninterrupted power supply, precision cooling, fire suppression, and round-the-clock security. The vertical's emphasis on sustainability and employee experience is driving adoption of smart building technologies and green facility management practices. Service providers catering to this sector must demonstrate expertise in managing complex technical environments while meeting stringent uptime and compliance requirements.

Regional Insights:

- North India

- West and Central India

- South India

- East India

South India is the largest region with 34% share of the total India facility management market in 2025.

South India dominates regional market share anchored by the concentration of IT corridors, manufacturing hubs, and commercial real estate developments in Bengaluru, Chennai, and Hyderabad. These cities collectively account for a significant portion of India's annual office space absorption, creating substantial demand for professional facility management services. The region benefits from state government policies actively supporting digitized facility management for public infrastructure and strong presence of multinational corporations requiring global-standard service delivery. The southern states have established themselves as preferred destinations for technology companies and Global Capability Centres seeking quality infrastructure and talent availability.

The southern region's leadership is reinforced by continuous infrastructure investments and expansion of technology parks. Karnataka's policies support smart facility management adoption, while Tamil Nadu's Smart City projects are expanding outsourced facility management contracts for civic services. Telangana continues attracting major corporations through business-friendly policies and infrastructure development. The availability of skilled workforce, progressive regulatory environment, and robust infrastructure ecosystem position South India for sustained market leadership. Early adoption of technology-enabled services, strong vendor ecosystems, and established relationships between facility management providers and major corporate clients further strengthen the region's competitive advantage in the national market.

Market Dynamics:

Growth Drivers:

Why is the India Facility Management Market Growing?

Rapid Urbanization and Infrastructure Development

India's accelerating urbanization is fundamentally driving facility management demand as cities expand and new commercial and residential developments proliferate. The growing urban population is creating unprecedented requirements for professional property maintenance and management services across residential, commercial, and public infrastructure. The growth trajectory is supported by substantial government investments in urban infrastructure, with major allocations for development of smart cities, housing projects, and metro rail systems under the National Infrastructure Pipeline. These large-scale infrastructure initiatives require structured facility management services from commissioning through operational phases. The expansion of Grade-A offices and warehouses in major cities demands integrated hard and soft services from initial occupancy, establishing long-term revenue streams for service providers. Urban centers are expected to contribute significantly to India's GDP, underscoring the critical role of optimized facility management in supporting economic growth and maintaining quality built environments.

Government Smart City and Digital Infrastructure Initiatives

Government initiatives are creating substantial opportunities for technology-enabled facility management across public and private assets. The Smart Cities Mission has achieved significant progress with numerous projects completed, implementing Integrated Command and Control Centres across designated smart cities. These initiatives demand advanced facility management solutions incorporating real-time monitoring, energy management, and predictive maintenance capabilities. New smart city projects approved under the National Industrial Corridor Development Programme are expected to attract substantial investments from large industries and enterprises. The Gati Shakti initiative and Make in India programs are fueling expansion in logistics parks, manufacturing units, and Special Economic Zones, all requiring structured facility management services. These policy frameworks establish favorable conditions for technology adoption and professional service delivery across urban infrastructure, creating sustained demand for organized facility management providers.

Expansion of Commercial Real Estate and Technology Sector

The robust growth of India's commercial real estate sector is generating sustained demand for professional facility management services across offices, retail spaces, and industrial facilities. Office leasing activity across India's major cities has reached record levels, driven substantially by Global Capability Centres and technology companies establishing operations in India. The IT sector continues expanding, with major technology companies establishing campuses requiring sophisticated facility management for critical infrastructure. Major cities including Bengaluru, Hyderabad, and Chennai are witnessing strong office absorption driven by technology and BFSI sectors. This commercial expansion creates demand for comprehensive facility services including HVAC maintenance, security management, cleaning services, and workplace experience optimization. The concentration of multinational corporations and their requirements for global-standard service delivery is elevating professionalism and technological sophistication across the facility management industry.

Market Restraints:

What Challenges the India Facility Management Market is Facing?

Skilled Labor Shortage and Workforce Challenges

The facility management industry faces persistent challenges in recruiting and retaining skilled technicians, particularly in tier-2 and tier-3 cities. Only a small percentage of India's workforce has received formal skill training compared to developed nations, creating capability gaps in technical maintenance, building automation, and specialized services. The younger workforce is increasingly gravitating toward gig-based employment, reducing interest in traditional facility management roles. This shortage impacts service quality, delays response times, and constrains geographic expansion for providers seeking to serve emerging markets.

Price-Sensitive Market and Margin Pressures

Intense competition and cost-conscious clients create pricing pressures that challenge profitability and service quality. Many organizations prioritize lowest-cost bids over value-based proposals, leading to underpriced contracts that compromise service delivery standards. Rising operational costs including labor, energy, equipment maintenance, and technology adoption strain profit margins, making it difficult for providers to invest in workforce development, technology upgrades, and service innovation while maintaining competitive pricing structures.

Fragmented Regulatory Landscape and Compliance Complexity

The absence of unified regulatory frameworks for facility management services creates compliance complexity across different states and municipal jurisdictions. Varying labor laws, environmental regulations, and building codes increase operational complexity for providers serving multi-state clients. The lack of standardized quality certifications and service benchmarks hinders market development and makes it challenging for clients to evaluate and compare service providers objectively. This regulatory fragmentation slows technology adoption and constrains market consolidation.

Competitive Landscape:

The India facility management market is highly competitive with both domestic and international players vying for market share through service innovation, technology integration, and geographic expansion. Major players are pursuing consolidation strategies, acquiring niche specialists to strengthen integrated service capabilities. Competition intensifies around technology-enabled offerings, with providers investing in IoT platforms, AI-powered analytics, and mobile workforce management tools. Strategic partnerships between facility management companies and PropTech firms are proliferating, enabling unified solutions combining sensor data, building information modeling, and augmented reality work instructions. Large enterprises are increasingly preferring providers demonstrating ESG compliance, outcome-based contracting capabilities, and digital transformation expertise. Regional players leverage local market knowledge and relationships while national and global providers compete through scale economies and standardized service delivery frameworks.

India Facility Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Integrated Workplace Management System, Facility Operations and Security Management, Building Information Modeling, Facility Property Management, Facility Environment Management |

| Services Covered | Deployment and Integration, Auditing and Quality Assessment, Support and Maintenance, Consulting, Service Level Agreement Management |

| Deployment Types Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium Size Enterprises, Large Enterprises |

| Verticals Covered | Banking, Financial Services and Insurance, IT and Telecom, Government and Public Administration, Healthcare, Education, Retail, Energy and Utilities, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India facility management market size was valued at USD 2.86 Billion in 2025.

The India facility management market is expected to grow at a compound annual growth rate of 10.66% from 2026-2034 to reach USD 7.13 Billion by 2034.

Facility operations and security management dominated the market with a share of 34%, driven by heightened organizational focus on workplace safety, asset protection, and regulatory compliance across commercial and industrial facilities.

Key factors driving the India facility management market include rapid urbanization, expanding commercial real estate sector, government smart city initiatives, growing IT and telecom sector, increasing adoption of IoT and AI technologies, and rising demand for integrated facility management services.

Major challenges include skilled labor shortages particularly in tier-2 and tier-3 cities, pricing pressures from cost-conscious clients, fragmented regulatory landscape, slow technology adoption in smaller markets, and resistance to value-based contracting models.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)