India Fabric Wash and Care Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

India Fabric Wash and Care Market Overview:

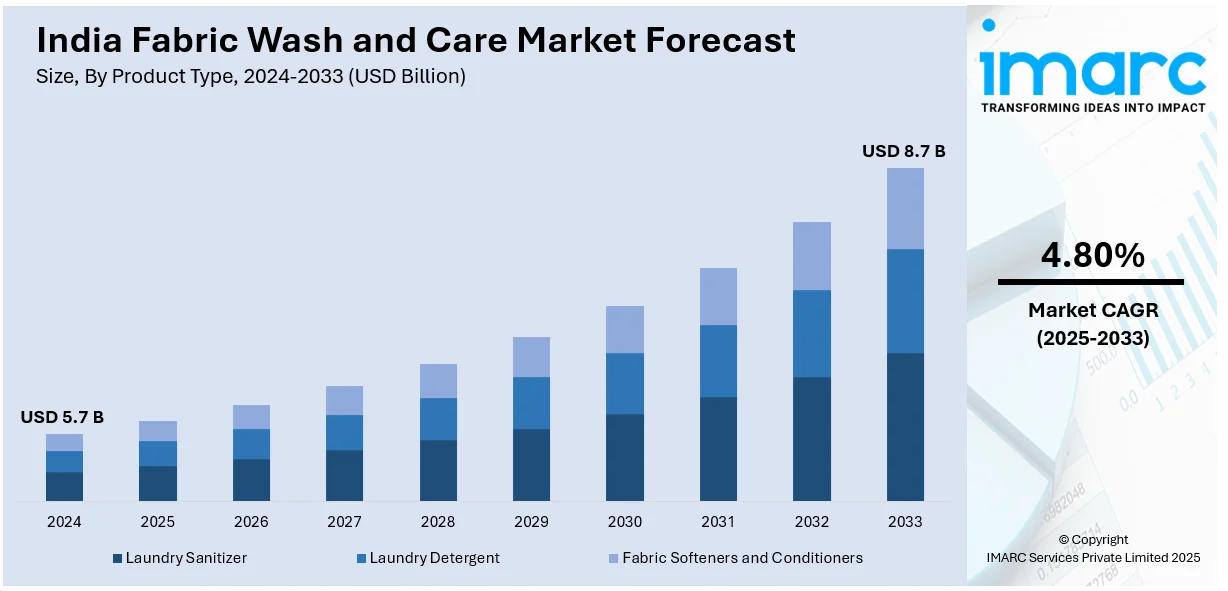

The India fabric wash and care market size reached USD 5.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by expanding urbanization, rising disposable incomes, increasing washing machine adoption, eco-friendly detergent innovations, premium fabric care demand, government textile sector support, and evolving consumer preferences toward hygiene, convenience, and sustainability, fostering strong development in detergent, fabric softener, and specialty wash product segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

India Fabric Wash and Care Market Trends:

Rising Hygiene Awareness

The India fabric wash and care market is being driven by the increasing awareness of hygiene, as consumers become more conscious of the need for cleaner, germ-free clothing. People now understand that fabrics can harbor bacteria, allergens, and pollutants, leading to a growing demand for antibacterial detergents, fabric sanitizers, and deep-cleaning laundry solutions. As hygiene becomes a priority in daily life, consumers are shifting from traditional washing methods to specialized fabric care products that offer not just stain removal but also protection against germs and odors. Brands are introducing hygiene-focused detergents with antibacterial and antifungal properties, catering to both urban and rural households. Marketing campaigns and product innovations by key players are further educating consumers about the benefits of maintaining fabric hygiene. With this rising awareness, the demand for advanced, multi-functional fabric care solutions is expected to grow steadily in India’s expanding market.

To get more information on this market, Request Sample

Growing Demand for Eco-Friendly and Sustainable Products

Indian consumers are becoming more concerned about environmental sustainability when making buying decisions, resulting in increased demand for green fabric wash and care products. This can be seen with consumers looking for biodegradable detergents, chemical-free fabric softeners, and recyclable packaging products. These demands are indicative of a larger social trend towards shrinking ecological footprints and responsible consumption. The reaction of the textile industry to this consumer trend is embracing sustainable practices, for example, the use of effluent treatment processes to recycle wastewater, thus reducing environmental footprint. These efforts not only appeal to the green consumer but also establish new industry standards for environmental stewardship. The growing availability of green fabric care products has also accelerated this trend. Companies are pushing the boundaries to provide products that are consistent with environmental concerns without sacrificing on effectiveness or quality. This consistency between consumer values and product portfolios has created a market scenario in which sustainable fabric care products are emerging as mainstream options for Indian homes.

India Fabric Wash and Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Laundry Sanitizer

- Laundry Detergent

- Fabric Softeners and Conditioners

The report has provided a detailed breakup and analysis of the market based on the product type. This includes laundry sanitizer, laundry detergent, and fabric softeners and conditioners.

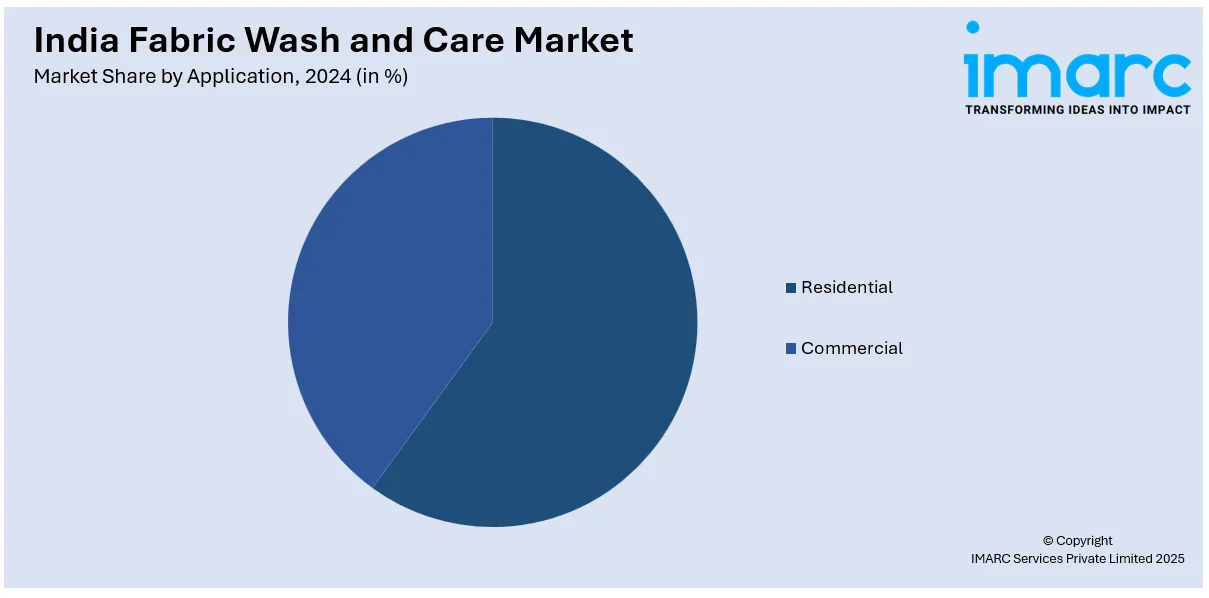

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channels Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fabric Wash and Care Market News:

- April 2024: Unilever's Wonder Wash, launched under the Dirt Is Good brand, is a liquid laundry detergent designed for 15-minute short cycles, addressing the growing consumer demand for speed and convenience in laundry routines. The product's expansion to 20 markets within 20 months of its initial launch reflects its rapid adoption and the significant market opportunity in the short-cycle laundry segment, projected to be worth €2 billion by 2026.

- July 2022: Unilever introduced its most sustainable laundry capsules, engineered for optimal performance in cold, short wash cycles, enabling consumers to reduce energy consumption by up to 60% per use. These capsules feature biodegradable active ingredients, with 65% sourced from plant-based materials, and are packaged in plastic-free, recyclable cardboard.

India Fabric Wash and Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Laundry Sanitizer, Laundry Detergent, Fabric Softeners and Conditioners |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fabric wash and care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fabric wash and care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fabric wash and care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fabric wash and care market in India was valued at USD 5.7 Billion in 2024.

The India fabric wash and care market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 8.7 Billion by 2033.

The key growth drivers of India’s fabric wash and care market include rising consumer focus on hygiene and fabric longevity, increased demand for premium and eco-friendly products due to higher disposable incomes, and rapid expansion of e-commerce, making innovative laundry solutions more accessible across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)