India Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

India Eyewear Market Size and Trends:

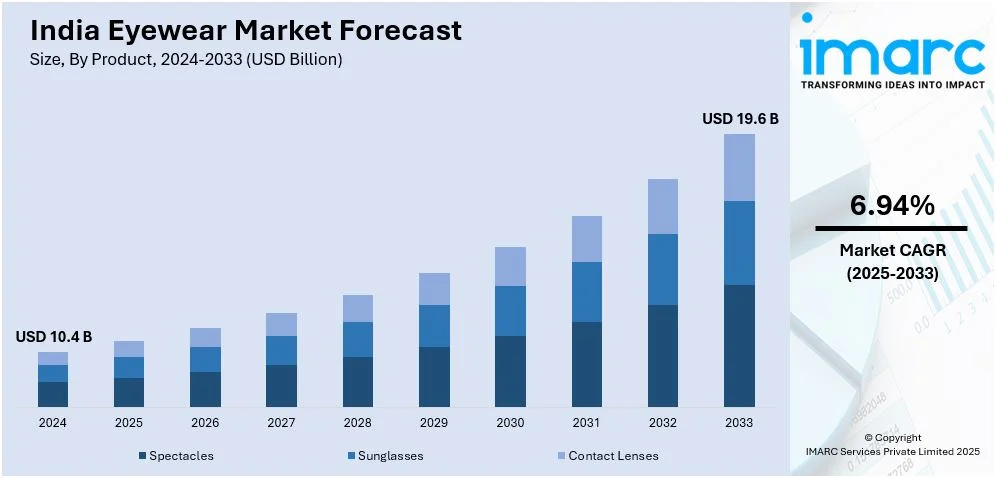

The India eyewear market size was valued at USD 10.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.6 Billion by 2033, exhibiting a CAGR of 6.94% from 2025-2033. The India eyewear market share is propelled by increasing disposable income and consumer spending, growing awareness about eye health and vision correction, rising fashion trends and demand for stylish eyewear, expansion of online retail and e-commerce platforms, and advancements in eyewear technology and product innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.4 Billion |

|

Market Forecast in 2033

|

USD 19.6 Billion |

| Market Growth Rate (2025-2033) | 6.94% |

The India eyewear market growth is primarily driven by the growing incidences of myopia, hypermetropia, and astigmatism that create the demand for corrective eyewear. Awareness regarding eye health among the masses also drives more customers toward professional eye care services and, therefore, opens a much broader prescription glasses market. The rise in e-commerce has also boosted growth through online eyewear stores offering glasses at reasonable costs, thus allowing an easy shopping experience for consumers from the comfort of their homes. According to industry reports, the Indian e-commerce market is projected to exhibit a CAGR of 18.7% during 2024-2028. Also, with the increase in digital device usage, there is an increase in digital eye strain, hence augmenting the sale of glasses, sunglasses, as well as protective eyewear solutions.

To get more information on this market, Request Sample

The India eyewear market demand is also driven by increased awareness about style-consciousness and changing lifestyles. There is more focus today on style through the wearability of glasses. Consumers demand more in terms of trendy sunglasses and frames. Higher demand is also projected to arise due to higher percentages of consumers indulging in purchases as urbanization rate and disposable income rise. As per Worldometers, 37.1% of the total population in India lives in urban areas in 2024. Besides this, increasing social media platforms, celebrity endorsements, and digital marketing are enhancing brand visibility and consumer interest. Technological advancements have also increased the demand for eyewear across various groups as lightweight materials and blue-light-blocking lenses become widely available.

India Eyewear Market Trends:

Increasing disposable income and fashion consciousness

With the growth of the Indian economy, there is a disposable income increase amongst its citizens, which is particularly notable in the urban sectors. Increased earnings have permitted more consumers to invest in quality eyewear, both for corrective purposes and as a fashion complement. Eyewear, which started off as strictly functional, has gradually become an important part of personal style, and mass-market consumers are now seeking fashionable and designer glasses. This shift in perception is supported by the increased influence of social media and celebrity culture, which encourages fashion-conscious consumers to purchase stylish eyewear.

Rising awareness about eye health and vision correction

The India eyewear market trends indicate that the increased incidence of vision problems in the country, due to a rapidly growing population afflicted with refractive errors and myopia, is driving up the demand for eyewear products in India. Moreover, the rising awareness among the masses regarding eye health and vision correction is a prime reason why individuals are visiting eye care centers for regular check-ups and corrective eyewear. Government and healthcare institutions also play an important role in the promotion of eye health by initiating awareness programs, which make the masses feel motivated to consult ophthalmologists about their vision problems. This increasing awareness has contributed directly to the growth of the eyewear market in India.

Growth of online retail and digital transformation

The rapid growth of e-commerce in India has greatly influenced the India eyewear market outlook, giving consumers easier access to the product. As per the IMARC Group, the India e-commerce market size is forecasted to exhibit a CAGR of 29.3% during 2024-2032. Online shops have dramatically changed the experience by making all brands of prescription glasses, sunglasses, and contact lenses available, which are delivered to the doorstep of consumers. Most eyewear brands have also embraced digital transformation by allowing customers to try styles virtually before buying the product. As a result, online eyewear stores are considered to be the best options with more appealing options, particularly among younger, technologically savvy shoppers. This shift toward online retail channels has expanded eyewear brands across India and increased overall sales.

India Eyewear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India eyewear market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, gender, and distribution channel.

Analysis by Product:

- Spectacles

- Sunglasses

- Contact Lenses

In the India eyewear market, the spectacles segment holds a large share owing to the sheer number of consumers who require eyeglasses for vision correction. The rise of refractive error cases and more awareness about good eye health have caused a surge in demand. On top of these factors, fashionable frames and popular brands have caused an increase in demand for more stylish spectacles.

The sunglasses segment is highly growth-oriented as people become increasingly conscious about protection from damaging UV rays. In addition to this, sunglasses are more of a fashion product nowadays, which has made them even more popular, with trends and branded ones getting huge demand. Rising outdoor activities, along with celebrity endorsements, which get propagated via social media platforms, also help fuel the Indian sunglasses market.

Contact lenses continue to see enormous growth as users seek relief and alternatives from classic spectacles. People find convenience and comfort in wearing them without any burden, such as traditional eyewear, particularly fashion-conscious and young consumers. Technological progress, such as unique colored lenses, along with more people paying attention to taking better care of their eyes, is also supporting this segment's growth.

Analysis by Gender:

- Men

- Women

- Unisex

The men’s segment in the India eyewear market is significant, driven by the increasing demand for functional and stylish eyewear. Men seek durability and practicality, with a growing interest in fashionable designs for both spectacles and sunglasses. The segment is also influenced by the rising adoption of eyewear as a fashion accessory, alongside the need for vision correction.

The eyewear market for women is growing rapidly with growing fashion consciousness among women. Stylish glasses, designer frames, and trendy sunglasses are highly in demand by women. Furthermore, women also require matching eyewear with their clothes. Therefore, different designs, colors, and shape requirements are the other factors contributing to this segment's growth, along with increasing awareness about eye health.

The unisex market is booming in India, which demands versatile, gender-neutral eyewear. There is a need for modern and minimalist designs suitable for both males and females. Its wide appeal, ease of use, and a broad range of styles that suit every preference contribute to the rising popularity of unisex eyewear.

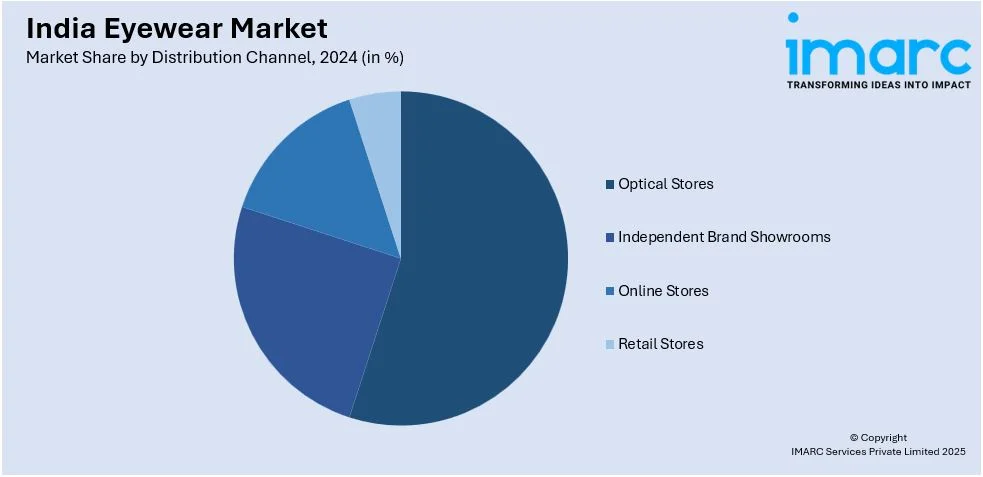

Analysis by Distribution Channel:

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Optical stores are a prominent distribution channel in India. Ranging from prescription glasses to sunglasses and contact lenses, optical stores have many types of eyewear options. The preference for going to optical stores lies in professional eye exams, proper fitting, and guidance for eyewear. Customers can also try frames in the store for a better buying decision.

Independent brand showrooms are becoming increasingly popular as a distribution channel, providing branded eyewear with exclusive collections. These showrooms target consumers seeking premium eyewear and high-quality products. The brand-centric approach enables consumers to experience the latest trends and styles, along with personalized services, which increases consumer loyalty and drives the growth of this segment in India.

Online stores are gradually increasing in the India eyewear market. Ease of home delivery is the major factor for using online stores. Nowadays, more consumers are buying eyeglasses from these e-commerce stores due to ease, price comparison, and discounts on their websites and applications. The availability of virtual try-on tools, as well as the free home trials offered by online stores, improve the overall buying experience, helping the market expand.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India occupies a major part of the market of eyewear in India with cities such as Delhi and Chandigarh housing large populations. Growing awareness about eye healthcare, coupled with improved disposable incomes, drives up the sale of prescription glasses and trendy sunglass shades alike as the increasingly style-conscious populace continues to create momentum for this space.

West and Central India, specifically Maharashtra, Gujarat, and Madhya Pradesh, have a huge demand for eyewear. Optical stores are increasing in major cities such as Mumbai and Pune, and so are e-commerce platforms. High-quality, branded eyewear has seen a rise in demand due to increased urbanization and the rising middle class, fueling the expansion of this market in the region.

South India offers prime locations and places such as Bangalore, Chennai, and Hyderabad. A growing middle class in South India and their health-conscious attitude have brought in an added demand for prescribed glasses, contact lenses, and sunglasses. The rapid growth of internet shopping and rising fashion consciousness within the population is increasing the market size within South India.

Competitive Landscape:

Key players in the India eyewear market are adopting various strategies to drive growth. Leading brands are expanding their retail presence across tier 2 and tier 3 cities, making eyewear more accessible. Additionally, they are leveraging e-commerce platforms to reach a wider audience, offering convenient online shopping experiences. Innovative products from most players focus on stylish, durable, and affordable eyewear to serve the growing fashionable consumer base. Partnering with eye care professionals and offering vision screening services also increases awareness about eye health. More options for customizations, including personal frames and lenses, are raising customer satisfaction and thereby fueling growth in the market.

The report provides a comprehensive analysis of the competitive landscape in the India eyewear market with detailed profiles of all major companies.

Latest News and Developments:

- 18 January 2025: Transe Vision Care, a renowned eye care services provider, has started a collaborative initiative with Netra Kumbh, a Mahakumbh flagship project, to serve the general public with excellent eye care services. As part of this partnership, a group of skilled optometrists from esteemed organizations such as LV Prasad Shankar Netralya has been brought together by Transe Vision Care to provide personalized glasses to numerous individuals.

- 10 October 2024: Leading smart wearable technology company Focally has launched Spectunes, a novel and innovative collection of smart eyewear that expertly combines handcrafted frames with affordability, style, and functionality. With a wide range of prices, Spectunes aims to transform the eyewear industry through its advanced solutions.

- 7 October 2024: Lenskart, the premier eyewear company in India, has launched its first physical location in Mussoorie, Uttarakhand. The new location, spanning 580 square feet, will provide the residents of the town with free eye exams in addition to stylish eyewear.

- 1 April 2024: Le Petit Lunetier, a new French eyewear brand, has been introduced in India by Lenskart as an exclusive partner. This launch is the first foreign addition to Lenskart’s portfolio and demonstrates the brand’s continued dedication to providing cutting-edge global brands and products to Indian consumers.

India Eyewear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spectacles, Sunglasses, Contact Lenses |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India eyewear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India eyewear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India eyewear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India eyewear market was valued at USD 10.4 Billion in 2024.

The rising prevalence of eye disorders, growth in the middle-class population, increasing urbanization and lifestyle changes, expanding availability of affordable eyewear, and influence of social media and celebrity endorsements are the primary factors driving the growth of the India eyewear market.

IMARC estimates the India eyewear market to exhibit a CAGR of 6.94% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)