India Ethyl Acetate Market Size, Share, Trends and Forecast by Application, End Use Industry, and Region, 2025-2033

India Ethyl Acetate Market Size and Share:

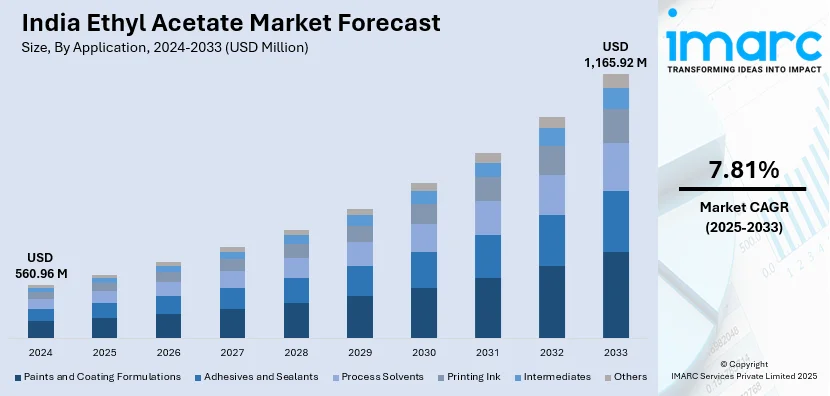

The India ethyl acetate market size reached USD 560.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,165.92 Million by 2033, exhibiting a growth rate (CAGR) of 7.81% during 2025-2033. The increasing demand from the paints and coatings, adhesives, and packaging industries are some of the factors propelling the growth of the market. Growth in pharmaceuticals and food and beverage sectors further supports consumption. Additionally, expanding industrial production, favorable government policies, and rising exports contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 560.96 Million |

| Market Forecast in 2033 | USD 1,165.92 Million |

| Market Growth Rate 2025-2033 | 7.81% |

India Ethyl Acetate Market Trends:

Digital Platforms Driving Efficiency

The ethyl acetate market in India is shifting toward digitization, with new platforms developing to ease procurement and financial administration for small and medium-sized businesses. These technologies improve access to raw materials, optimize supply chains, and provide data-driven insights for better decision-making. By lowering operational obstacles and increasing transparency, digital adoption promotes growth and market competitiveness. Chemical manufacturers and buyers can respond quickly to demand swings because of more flexible financing alternatives and real-time market data. This technology breakthrough not only improves productivity but also promotes sustainable business practices throughout the sector. As digital integration progresses, market accessibility and operational resilience could increase even further. For example, in March 2023, OfBusiness launched an exclusive app to support MSMEs in streamlining their procurement processes. The platform could benefit small and medium enterprises in the chemical sector, including those dealing with ethyl acetate. By offering improved access to raw materials and better financial management, the app may contribute to greater efficiency and growth in the Indian ethyl acetate market.

To get more information on this market, Request Sample

Expanding Domestic Production

India’s ethyl acetate sector is experiencing a boost in domestic manufacturing capacity as companies scale operations to meet growing demand. With new facilities reaching significant production milestones, the market is seeing enhanced supply stability and reduced reliance on imports. Expansions are not only increasing output but also diversifying product portfolios, supporting various industries such as pharmaceuticals, coatings, and adhesives. This growth aligns with the broader push for self-reliance in chemical manufacturing, fostering job creation and regional economic development. As production hubs strengthen their presence, competitive pricing and improved accessibility are likely to benefit downstream users, contributing to the sector's overall expansion. For instance, in March 2023, Sagar Chemicals Private Limited (SCPL) successfully completed the first year of operations at its ethyl acetate manufacturing facility in Kanpur, Uttar Pradesh. The plant has an annual capacity of 24,000 metric tonnes. SCPL The company plans to expand its operations and product portfolio, aiming to contribute significantly to the growth of the Indian chemical industry.

India Ethyl Acetate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application and end use industry.

Application Insights:

- Paints and Coating Formulations

- Adhesives and Sealants

- Process Solvents

- Printing Ink

- Intermediates

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coating formulations, adhesives and sealants, process solvents, printing ink, intermediates, and others.

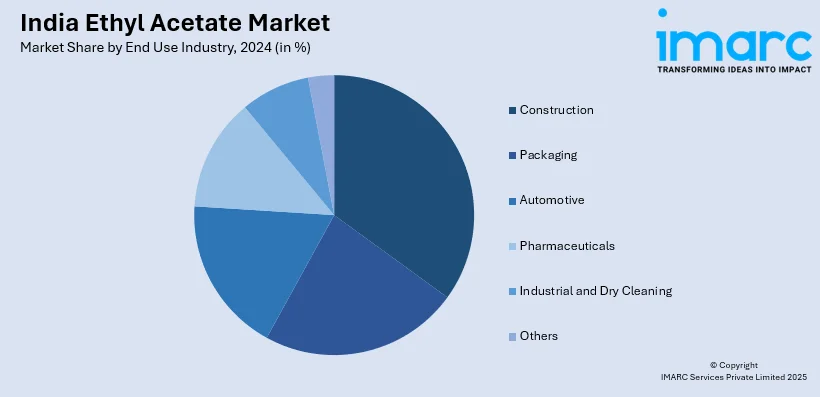

End Use Industry Insights:

- Construction

- Packaging

- Automotive

- Pharmaceuticals

- Industrial and Dry Cleaning

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction, packaging, automotive, pharmaceuticals, industrial and dry cleaning, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethyl Acetate Market News:

- In November 2024, INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) signed a memorandum of understanding to explore constructing a 600-kilotonne-per-year acetic acid plant in Bharuch, Gujarat. Acetic acid is a key precursor in ethyl acetate production. This initiative aims to bolster the domestic acetic acid supply, potentially enhancing ethyl acetate manufacturing in India.

- In October 2024, Laxmi Organic Industries Limited approved a capital expenditure of INR 181.9 Crore to enhance its production capacities. The company plans to invest INR 90.5 Crore to expand its ethyl acetate production by 70 kilotons per annum (KTA) at its Lote facility in Maharashtra, addressing increased customer demand. Additionally, INR 91.4 crore would be allocated to establish a new 70 KTA n-butyl acetate plant in Dahej, Gujarat.

India Ethyl Acetate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Paints and Coating Formulations, Adhesives and Sealants, Process Solvents, Printing Ink, Intermediates, Others |

| End Use Industries Covered | Construction, Packaging, Automotive, Pharmaceuticals, Industrial and Dry Cleaning, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethyl acetate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethyl acetate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethyl acetate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ethyl acetate market was valued at USD 560.96 Million in 2024.

The India ethyl acetate market is projected to exhibit a CAGR of 7.81% during 2025-2033, reaching a value of USD 1,165.92 Million by 2033.

The India ethyl acetate market is driven by expanding paint, coatings, and adhesive industries, fueled by construction and automotive growth. Rising demand from pharmaceuticals and cosmetics sectors also boosts production. Additionally, India’s cost-efficient manufacturing, supportive government policies, and increasing exports strengthen market competitiveness and supply chain resilience.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)