India Ethanol Market Size, Share, Trends and Forecast by Type, Raw Material, Purity, Application, and Region, 2026-2034

India Ethanol Market Overview:

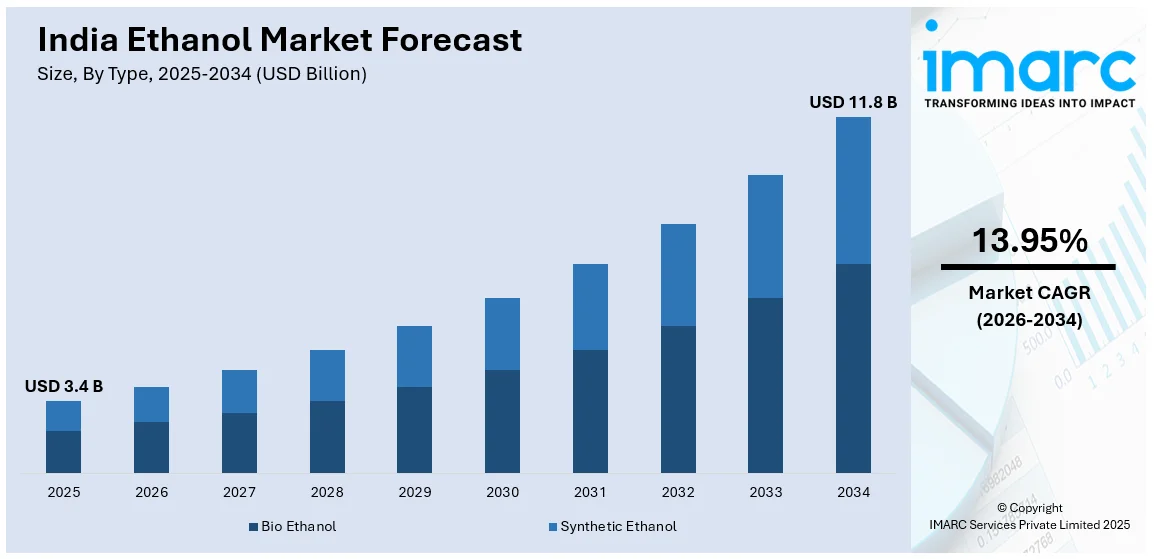

The India ethanol market size reached USD 3.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.95% during 2026-2034. Rising ethanol blending mandates, government incentives, increased sugarcane production, expanding biofuel infrastructure, demand for cleaner fuels, investments in ethanol plants, rising automotive sector adoption, favorable policies, technological advancements, and growing industrial applications are driving the growth of India's ethanol market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 11.8 Billion |

| Market Growth Rate (2026-2034) | 13.95% |

India Ethanol Market Trends:

Advancement of Ethanol Blending Targets

With a 20% blend (E20) in mind by 2025–2026, India is stepping up its efforts to improve ethanol blending in gasoline. The goals of this program are to promote the agriculture industry, lower carbon emissions, and increase energy security. Significant success has been made with the Ethanol Blending Programme (EBP); in July 2024, blending levels rose from 1.5% in 2014 to 15.80%. This increase has reduced CO₂ emissions by 544 lakh metric tons and resulting in significant foreign exchange savings of ₹1.06 lakh billion. India's ethanol production capacity has inflated to 1,685 crore liters per year in order to fulfill the E20 objective, and by 2025, it is expected to reach 1,700 crore liters. Escalated consumption of grain-based ethanol (700 crore liters) and sugar-based ethanol (400 crore liters) are the main drivers of this expansion. The government's proactive policies, including financial incentives and infrastructure development, are pivotal in achieving these ambitious blending targets.

To get more information on this market Request Sample

Diversification of Feedstock for Ethanol Production

In order to support the growing demand for ethanol, India is diversifying its feedstock beyond conventional sugarcane sources. This involves the use of excess grains like rice and maize, as well as farm residues. In 2024, around 3.5 million tons of maize were used in making 1.35 billion liters of ethanol, four times the increase compared to the previous year. This change has turned India from a net exporter to a net importer of maize, with the imports being around 1 million tons in 2024. The government has also allowed sugarcane juice and syrup for ethanol manufacturing since November 2024, improving flexibility for sugar mills. These steps are intended to reconcile the twin goals of meeting E20 blending targets and food security, while also giving farmers an alternative source of income. To further promote ethanol production, India is also investing in second-generation ethanol units that use lignocellulosic biomass, such as rice straw and wheat straw. The nation ordered three new second-generation ethanol plants in early 2025, having a combined production capacity of 350 million liters annually. In addition, oil marketing firms have expanded procurement deals for ethanol, which involves securing long-term contracts with distilleries to guarantee a steady supply for the E20 program.

India Ethanol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, raw material, purity, and application.

Type Insights:

- Bio Ethanol

- Synthetic Ethanol

The report has provided a detailed breakup and analysis of the market based on the type. This includes bio ethanol and synthetic ethanol.

Raw Material Insights:

- Sugar and Molasses

- Cassava

- Rice

- Algal Biomass

- Ethylene

- Lignocellulosic Biomass

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes sugar and molasses, cassava, rice, algal biomass, ethylene, and lignocellulosic biomass.

Purity Insights:

- Denatured

- Undenatured

The report has provided a detailed breakup and analysis of the market based on the purity. This includes denatured and undenatured.

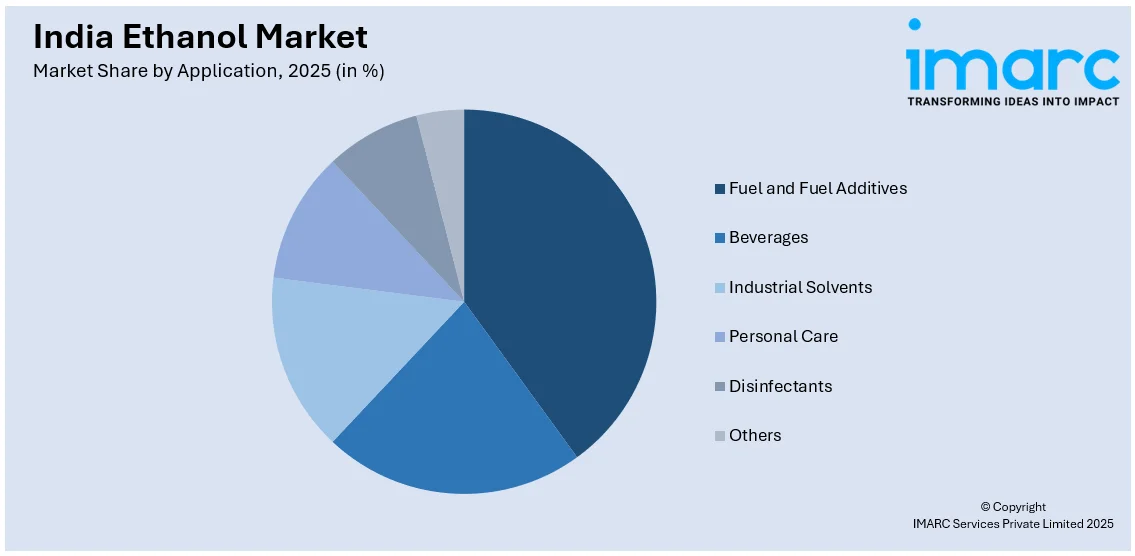

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel and Fuel Additives

- Beverages

- Industrial Solvents

- Personal Care

- Disinfectants

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fuel and fuel additives, beverages, industrial solvents, personal care, disinfectants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethanol Market News:

- January 2025: Advanta Seeds and Baidyanath Biofuels Private Ltd announced a strategic partnership to advance India's ethanol production. The partnership aims to contribute to India's National Biofuels Policy goal of achieving 20% ethanol blending with petrol by 2025-26.

- December 2024: Godavari Biorefineries Limited (GBL), the largest biofuels company in India, proposed investing $15.6 million in a 200 KLPD ethanol distillery based on corn and grains in order to increase its output. The choice aligns with GBL's mission to support India's green energy transition and climate-related risk resilience.

India Ethanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bio Ethanol, Synthetic Ethanol |

| Raw Materials Covered | Sugar and Molasses, Cassava, Rice, Algal Biomass, Ethylene, Lignocellulosic Biomass |

| Purities Covered | Denatured, Undenatured |

| Applications Covered | Fuel and Fuel Additives, Beverages, Industrial Solvents, Personal Care, Disinfectants, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethanol market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethanol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ethanol market was valued at USD 3.4 Billion in 2025.

The India ethanol market is projected to exhibit a CAGR of 13.95% during 2026-2034, reaching a value of USD 11.8 Billion by 2034.

India’s ethanol market is driven by government support for fuel blending, efforts to reduce oil dependence, and promotion of cleaner energy. Use of diverse agricultural feedstocks, rural development goals, rising fuel demand, and investment in production and distribution infrastructure also contribute to the market’s strong and sustained growth momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)