India Epitaxial Wafer Market Size, Share, Trends and Forecast by Type, Wafer Size, Application, Industry Vertical, and Region, 2025-2033

India Epitaxial Wafer Market Overview:

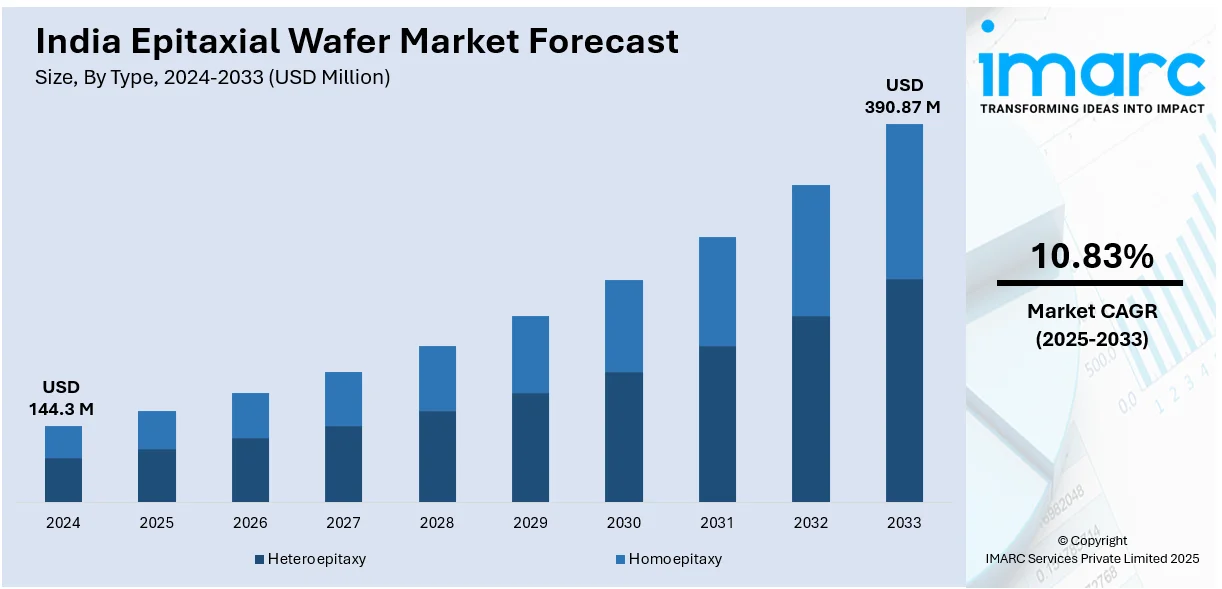

The India epitaxial wafer market size reached USD 144.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 390.87 Million by 2033, exhibiting a growth rate (CAGR) of 10.83% during 2025-2033. The rising demand for advanced semiconductors in consumer electronics, 5G technology, and electric vehicles are some of the factors propelling the growth of the market. Government initiatives, growing investments in wafer fabrication, and increasing adoption of AI, IoT, and photonics also fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 144.3 Million |

| Market Forecast in 2033 | USD 390.87 Million |

| Market Growth Rate 2025-2033 | 10.83% |

India Epitaxial Wafer Market Trends:

Expansion of Semiconductor Manufacturing

India's strong commitment to improving its semiconductor manufacturing skills is quickening, with new fabrication sites opening across the country. The clearance of Gujarat's latest semiconductor factory highlights the country's efforts to achieve chip production self-sufficiency. This advancement is likely to dramatically increase demand for epitaxial wafers, which are required for the fabrication of high-performance semiconductor devices. As India's semiconductor ecosystem grows, a growing dependence on epitaxial wafers will be required to fulfill the demands of sectors such as electric cars, 5G, and renewable energy. With significant infrastructural expenditures, India's semiconductor business is positioned for fast expansion, establishing the nation as a vital player in the global semiconductor supply chain and boosting local epitaxial wafer manufacturing. For example, in September 2024, India's Union Cabinet approved Kaynes Semicon’s proposal to establish a new semiconductor fabrication plant in Gujarat, marking the country’s fifth such facility. The project, with a USD 394 Million investment, aims to strengthen India's semiconductor ecosystem.

To get more information on this market, Request Sample

Growing Use of Silicon Carbide in Electric Vehicles

The integration of silicon carbide (SiC) epitaxial wafers in electric vehicle inverters is gaining momentum, driven by the need for enhanced efficiency and performance. SiC technology offers superior thermal conductivity, higher power density, and reduced energy loss, making it a preferred choice for next-generation EVs. With India’s electric vehicle sector expanding rapidly, the adoption of SiC-based semiconductors aligns with the country’s push for advanced manufacturing and sustainable mobility solutions. As automakers increasingly incorporate SiC wafers into power electronics, the demand for high-quality semiconductor materials is expected to surge. This shift supports India's semiconductor self-reliance and strengthens its position in global EV technology, fostering innovation and efficiency in the transportation sector. For instance, in March 2023, Resonac Corporation announced that its silicon carbide (SiC) epitaxial wafers were integrated into the inverters of the Lexus RZ electric vehicle. This development highlighted the rising importance of SiC technology in EVs, a sector growing rapidly in India. The adoption of SiC epitaxial wafers improves efficiency and performance in EVs, aligning with India's push for advanced semiconductor technologies.

India Epitaxial Wafer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, wafer size, application, and industry vertical.

Type Insights:

- Heteroepitaxy

- Homoepitaxy

The report has provided a detailed breakup and analysis of the market based on the type. This includes heteroepitaxy and homoepitaxy.

Wafer Size Insights:

- 2-4 Inch

- 5-8 Inch

- 9-12 Inch

- Others

A detailed breakup and analysis of the market based on the wafer size have also been provided in the report. This includes 2-4 inch, 5-8 inch, 9-12 inch, and others.

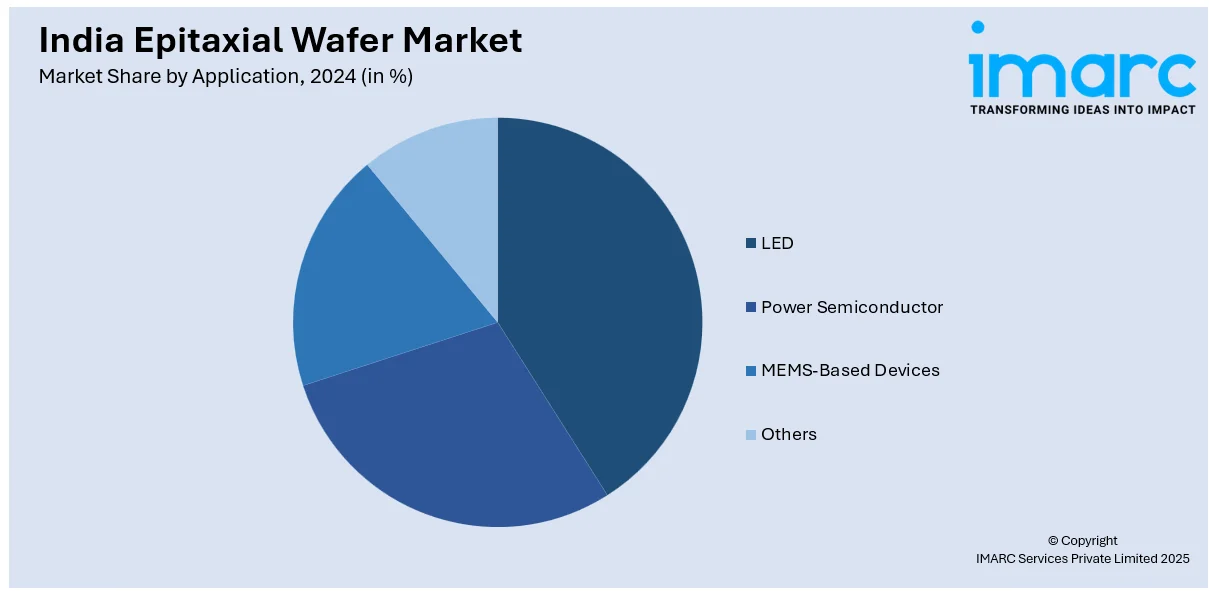

Application Insights:

- LED

- Power Semiconductor

- MEMS-Based Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes LED, power semiconductor, MEMS-based devices, and others.

Industry Vertical Insights:

- Consumer Electronics

- Automotive

- Healthcare

- Industrial

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes consumer electronics, automotive, healthcare, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Epitaxial Wafer Market News:

- In December 2024, NexWafe GmbH achieved a 24.4% efficiency rate with its EpiNex solar wafers on commercial M6 heterojunction cell lines, matching traditional Czochralski wafers. This breakthrough, coupled with reduced material waste and energy consumption, aligns with India's green energy goals. Reliance Industries' EUR 25 Million investment in NexWafe underscores India's commitment to advancing photovoltaic manufacturing.

- In September 2024, Coherent Corp. launched 200 mm silicon carbide (SiC) epitaxial wafers, enhancing thickness and doping uniformity standards. This advancement supports superior SiC power semiconductors, crucial for India's growing electric vehicle and renewable energy sectors.

India Epitaxial Wafer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends, Market Outlook, Industry Catalysts, Challenges, Segment-Wise Historical, Future Market Assessment:

|

| Types Covered | Heteroepitaxy, Homoepitaxy |

| Wafer Sizes Covered | 2-4 Inch, 5-8 Inch, 9-12 Inch, Others |

| Applications Covered | LED, Power Semiconductor, MEMS-Based Devices, Others |

| Industry Verticals Covered | Consumer Electronics, Automotive, Healthcare, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India epitaxial wafer market performed so far and how will it perform in the coming years?

- What is the breakup of the India epitaxial wafer market on the basis of type?

- What is the breakup of the India epitaxial wafer market on the basis of wafer size?

- What is the breakup of the India epitaxial wafer market on the basis of application?

- What is the breakup of the India epitaxial wafer market on the basis of industry vertical?

- What are the various stages in the value chain of the India epitaxial wafer market?

- What are the key driving factors and challenges in the India epitaxial wafer market?

- What is the structure of the India epitaxial wafer market and who are the key players?

- What is the degree of competition in the India epitaxial wafer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India epitaxial wafer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India epitaxial wafer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India epitaxial wafer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)