India Enterprise Content Management Market Report by Component (Solution, Services), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Deployment Mode (On-premises, Cloud-based), End Use Industry (Telecom and IT, Banking Financial Services and Insurance (BFSI), Retail, Education, Manufacturing, Media and Entertainment, Government, Healthcare, and Others), and Region 2025-2033

Market Overview:

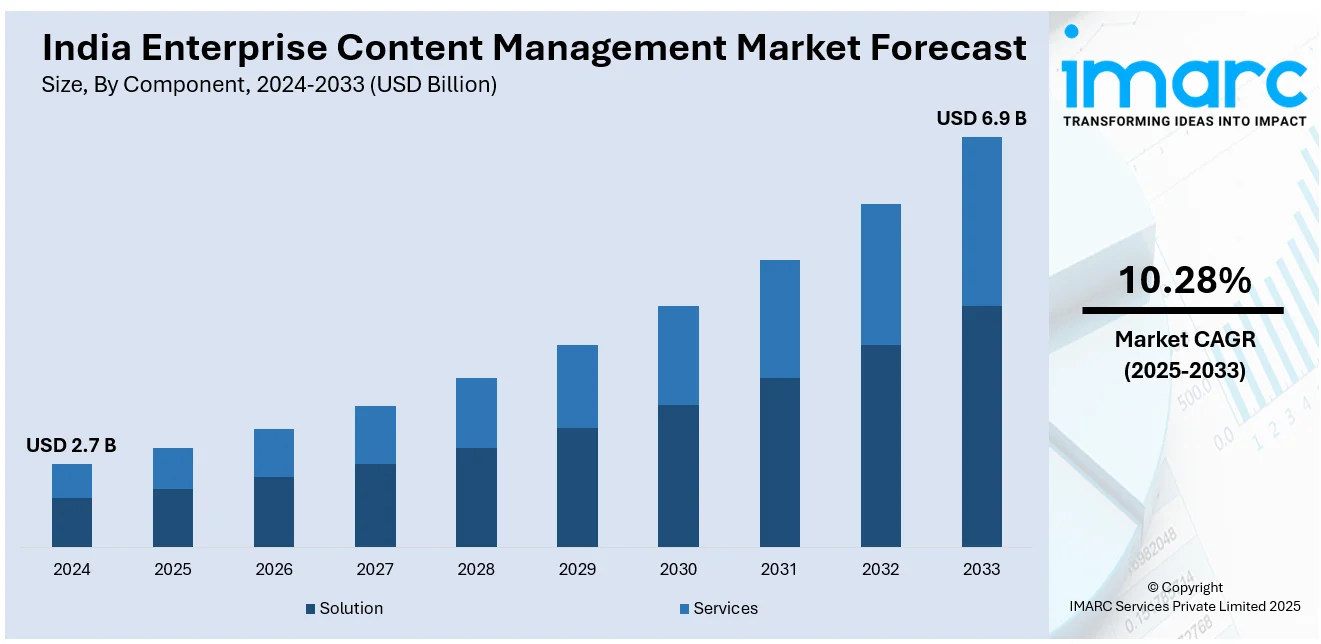

India enterprise content management market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.28% during 2025-2033. The rising number of organizations who are recognizing the importance of organizing, storing, and accessing digital content in a streamlined manner is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Market Growth Rate (2025-2033) | 10.28% |

Enterprise content management is a systematic approach to capturing, managing, storing, and delivering an organization's information in a way that enhances productivity, facilitates collaboration, and ensures compliance with regulatory requirements. It involves the integration of software, strategies, and processes to efficiently handle the entire lifecycle of digital and physical content within an enterprise. It encompasses a wide range of content types, including documents, emails, images, and multimedia files. The primary goals of enterprise content management are to streamline information workflows, improve access to critical data, and enhance the security and integrity of organizational content. This holistic approach not only improves operational efficiency but also enables organizations to make more informed decisions by ensuring that relevant and up-to-date information is readily accessible to authorized users. As businesses continue to grapple with the challenges of managing ever-growing volumes of digital content, enterprise content management solutions play a crucial role in optimizing information management processes, fostering collaboration, and maintaining compliance in an increasingly digital and data-driven business environment.

To get more information on this market, Request Sample

India Enterprise Content Management Market Trends:

The enterprise content management market in India is experiencing significant growth, driven by the increasing digitization of business processes and the need for efficient content management solutions. One key driver of the market in this country is the rising volume of digital data generated by businesses. Additionally, the increasing emphasis on compliance with regulatory standards and data security is propelling the adoption of enterprise content management systems, ensuring that organizations can handle sensitive information in a secure and compliant manner. Besides this, as businesses in India continue to invest in digital transformation initiatives, the enterprise content management market is poised for sustained growth. Furthermore, with the need for scalable and robust content management solutions becoming paramount, both domestic and international ECM vendors are actively participating in the Indian market, offering innovative and tailored solutions to meet the evolving demands of diverse industries. This, in turn, is expected to fuel the market growth across the country in the coming years.

India Enterprise Content Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, enterprise size, deployment mode, and end use industry.

Component Insights:

- Solution

- Document Management System (DMS)

- Web Content Management (WCM)

- Document-Centric Collaboration (DCC)

- Records Management

- Document Imaging

- Business Process Management (BPM)

- Others

- Services

- Professional

- Managed

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (document management system (DMS), web content management (WCM), document-centric collaboration (DCC), records management, document imaging, business process management (BPM), and others) and services (professional and managed).

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

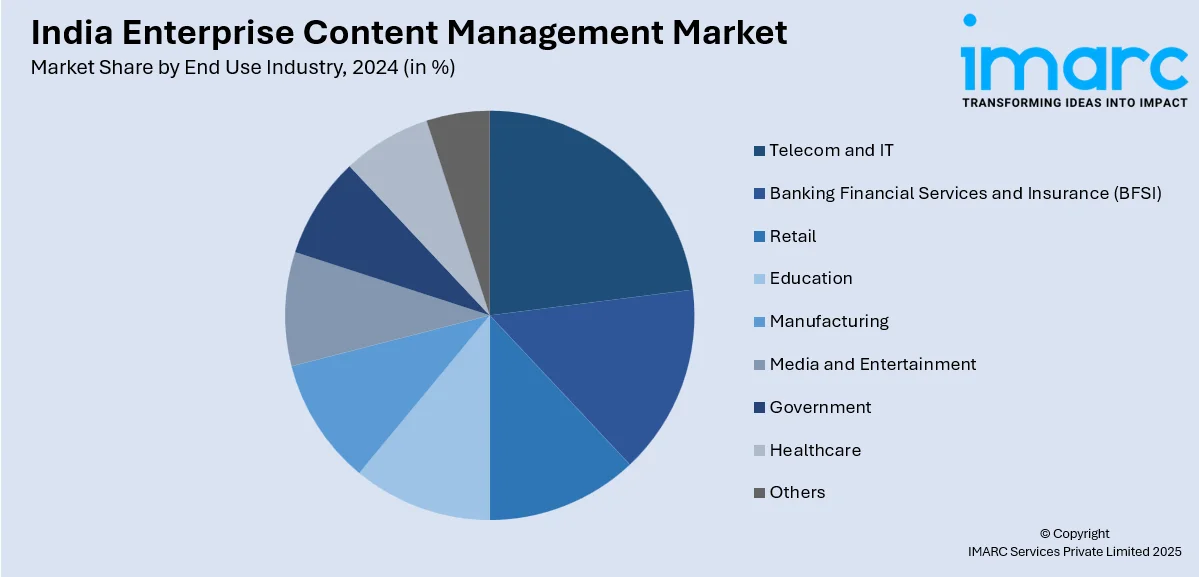

End Use Industry Insights:

- Telecom and IT

- Banking Financial Services and Insurance (BFSI)

- Retail

- Education

- Manufacturing

- Media and Entertainment

- Government

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes telecom and IT, banking financial services and insurance (BFSI), retail, education, manufacturing, media and entertainment, government, healthcare, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Content Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | Telecom and IT, Banking Financial Services and Insurance (BFSI), Retail, Education, Manufacturing, Media and Entertainment, Government, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India enterprise content management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India enterprise content management market?

- What is the breakup of the India enterprise content management market on the basis of component?

- What is the breakup of the India enterprise content management market on the basis of enterprise size?

- What is the breakup of the India enterprise content management market on the basis of deployment mode?

- What is the breakup of the India enterprise content management market on the basis of end use industry?

- What are the various stages in the value chain of the India enterprise content management market?

- What are the key driving factors and challenges in the India enterprise content management?

- What is the structure of the India enterprise content management market and who are the key players?

- What is the degree of competition in the India enterprise content management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise content management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise content management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise content management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)